Danuka Peiris (DP)

@danukalive

Talking about #CSE Investing and developing stories

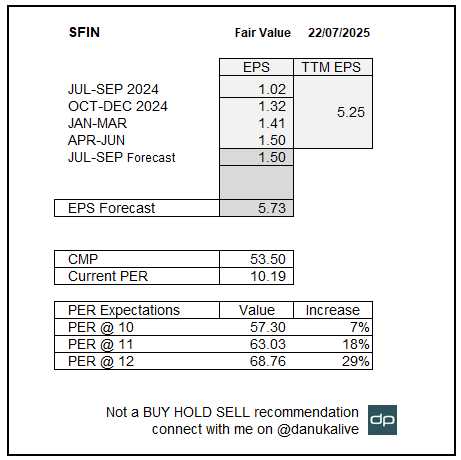

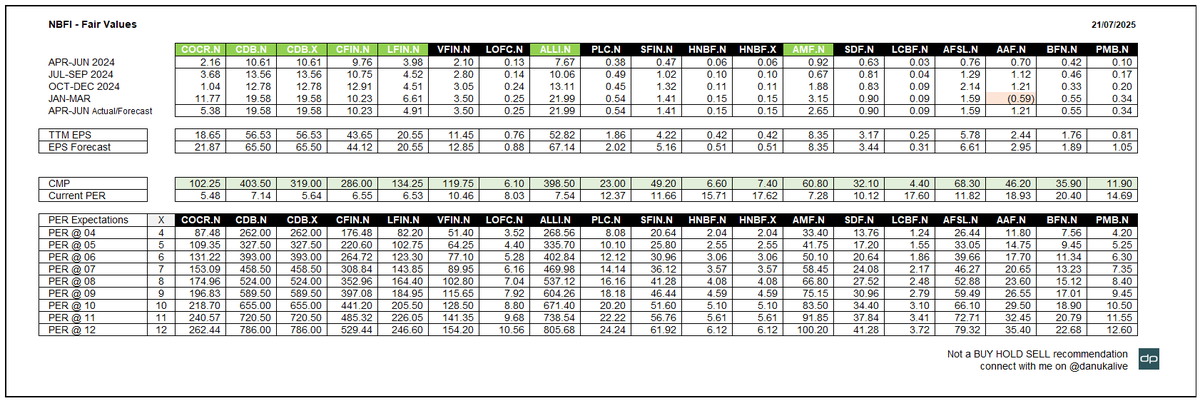

COCR (CMP 102.75) – Currently trading at a PER of 5.51, one of the lowest among NBFIs. In my opinion, although the company is showing book profits, investors remain cautious due to concerns over its financial reporting. Recently, the auditors restated the FY2024 profits, issuing…

Dr. Nandalal Weerasinghe, stated that no decision has been taken by the CBSL or the GOV to curtail vehicle imports. This announcement brings positive sentiment to several sectors of the economy, including banks, NBFIs, insurance companies, vehicle importers, and individuals or…

23rd July 1983 marked a crucial turning point in the onset of the 30-year war. Regardless of any prior reasons, the massacre of innocent Tamil civilians cannot be justified. President J.R. Jayewardene, Prime Minister R. Premadasa, cabinet ministers including Ranil Wickremesinghe,…

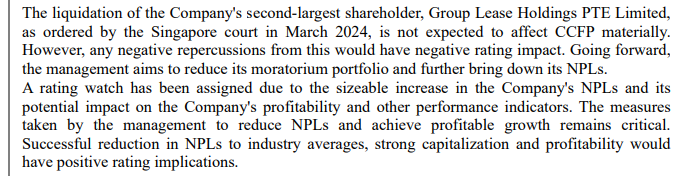

VFIN has done it again. They have continued their strong performance in the April–June Q. EPS improved by 69% YoY, while revenue increased by 24% and operating income rose by 28%. Maintaining similar results could drive the MP to LKR 150

The Monetary Policy Board decided to maintain the Overnight Policy Rate (OPR) at the current level of 7.75%

First Capital Research has speculated that there is a 60% probability of a policy rate cut by the Monetary Board during its review on 2025/07/22 to stimulate growth, among other factors

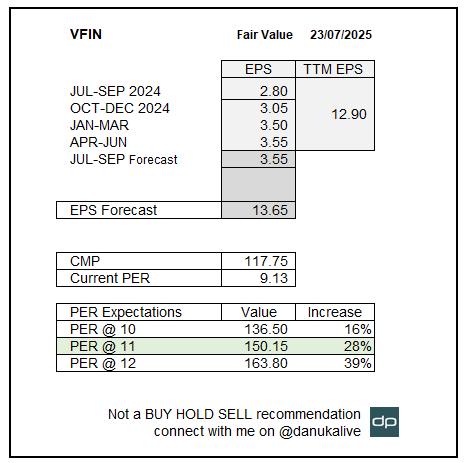

BOI Sri Lanka recorded FDI doubling to USD 507Mn in H1 2025, led by Singapore. 57 projects worth USD 569Mn were approved, with 700+ jobs created. Local investments rose 13% to USD 285Mn. Exports grew 8% to USD 3.75Bn

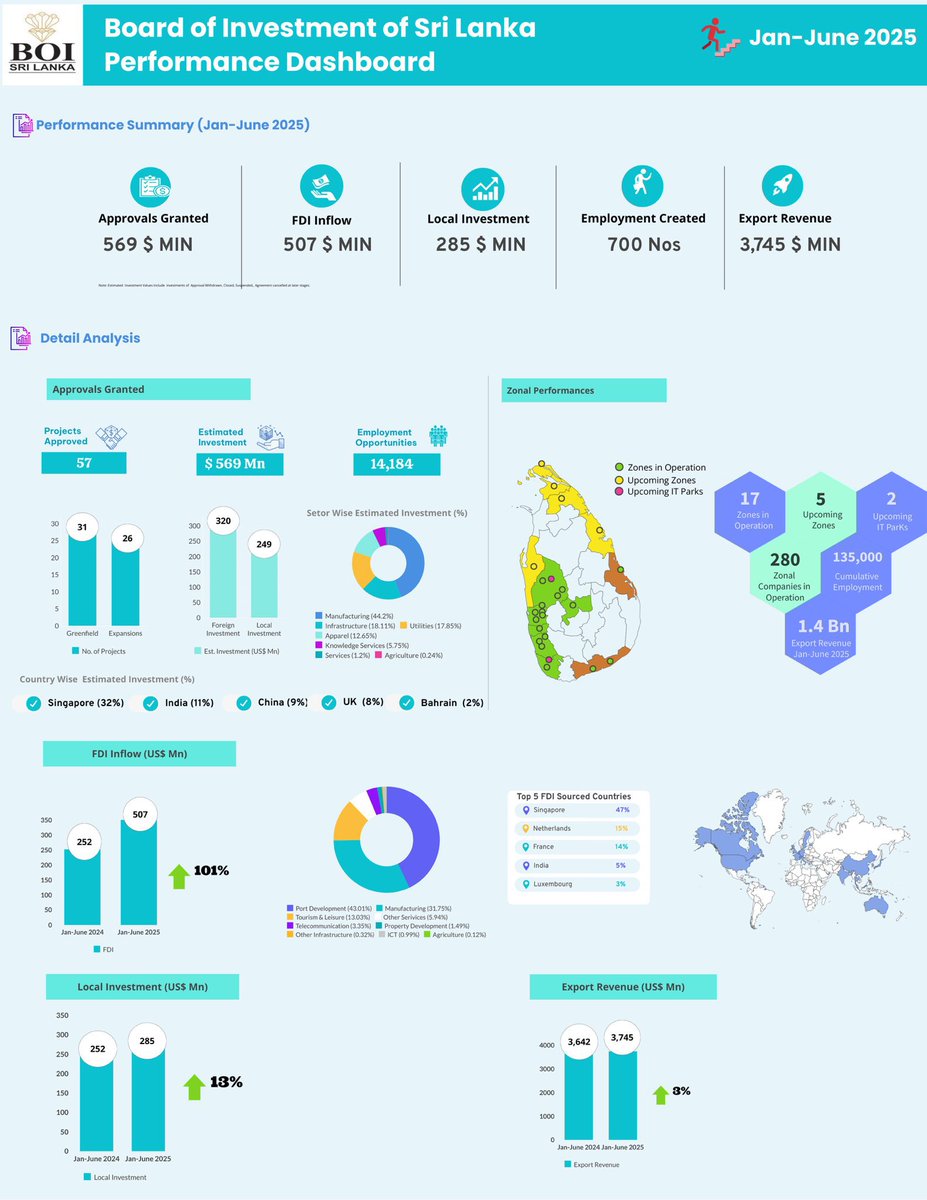

SFIN reported an EPS of 1.50 for April–June Q. Revenue grew 12% QoQ and 64% YoY, while Op profit rose 9% QoQ and 158% YoY. Continuous improvement in EPS could drive the MP above 68, valuing the stock at PER 12

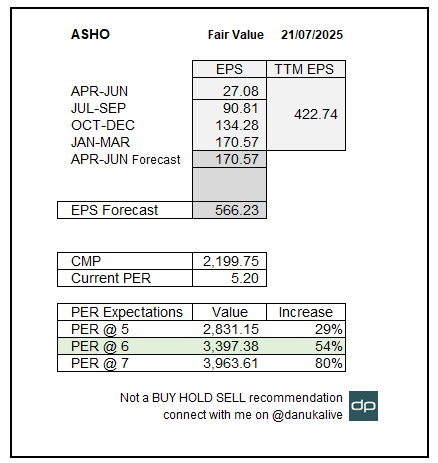

Lanka Ashok Leyland (ASHO) is set to introduce a new range of electric buses in Sri Lanka under the ‘SWITCH’ brand. According to the CEO, the government’s increasing emphasis on public sector electrification is anticipated to create favourable conditions for this initiative

ASHO gained 15% and stopped for the day at the 2535 mile post. They picked up some snacks at 2700 mile post and returned. Hopefully, 2535 is a good spot for an overnight stay before chasing the star of their journey

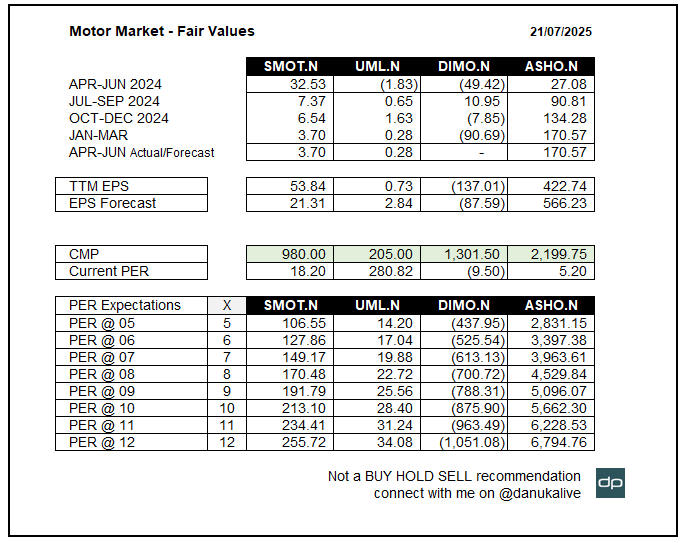

Motor Market - I have listed the entities directly involved in vehicle imports or assembling for sale in domestic market. However, JKH (BYD) and BIL have subsidiaries engaged in vehicle importing. ASHO is showing strong results, while SMOT and UML need to improve their earnings.…

NBFI update - The majority of counters have reached a PER of 10, but some entities with strong earnings are still trading at a discount. It’s worth reviewing and considering them

When entering a stock, what is the first thing you consider?

As per the recent CAL reports for the first half of 2025, ASHO accounts for 30% of new truck registrations and 35% of new bus registrations. DIMO (Tata) is the main challenger to ASHO in the truck segment with 26% registrations, while in the bus segment, Toyota (not listed) with…

First Capital Research has speculated that there is a 60% probability of a policy rate cut by the Monetary Board during its review on 2025/07/22 to stimulate growth, among other factors

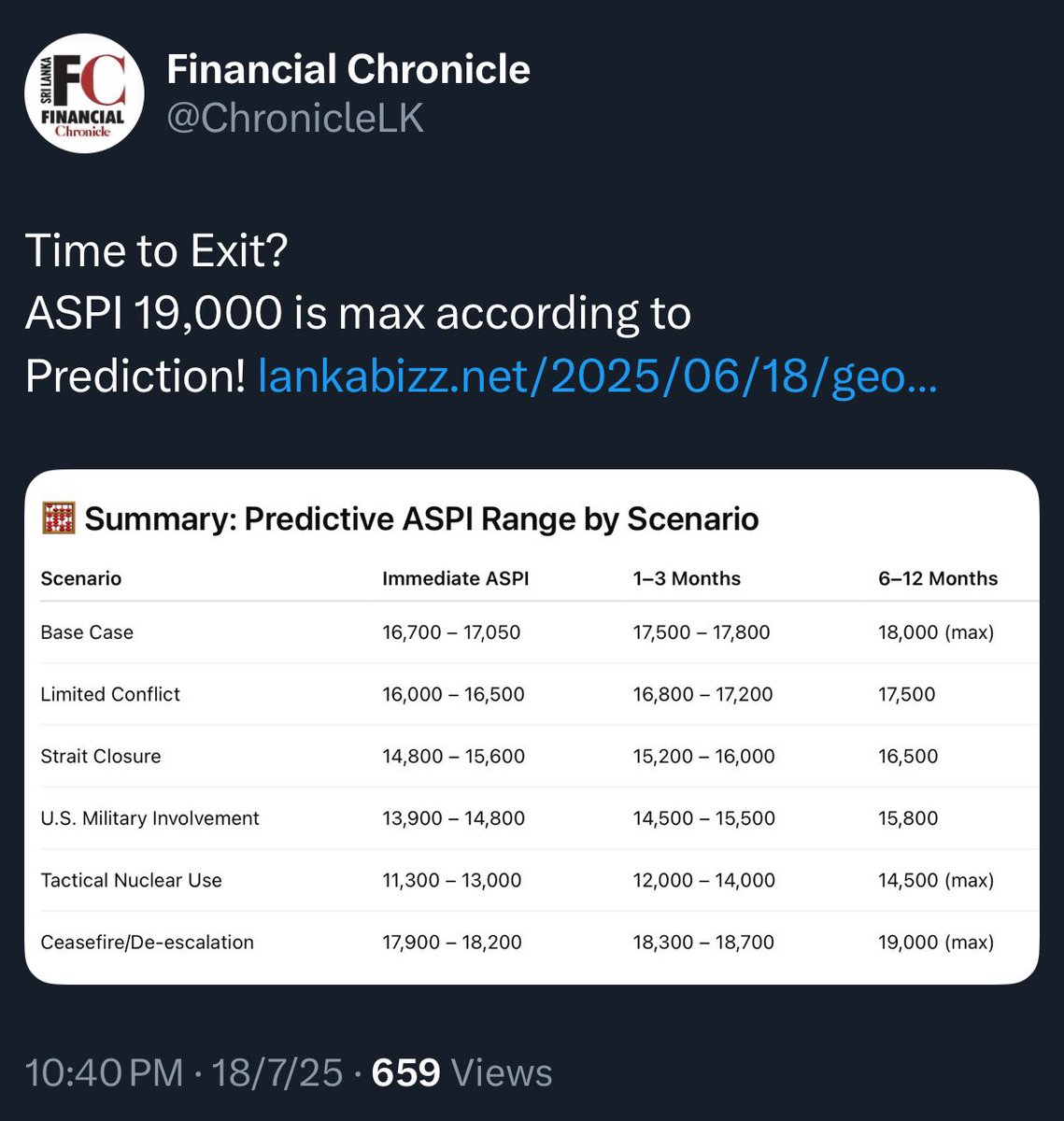

No, there’s no maximum limit for ASI. it can rise indefinitely as long as companies perform well and the country stays on track. However, you won’t see only bull runs - market corrections and pullbacks are inevitable to cool things down. This man once claimed a 15% tariff from…

Learn history and worship the ancient glory, But don’t forget to finish your education with an employable skill and an international language - Those mighty kings aren’t handing out jobs anymore. So, what exactly are we bringing to the global table ? වංශේ කබල් ගගා ඉමු, ඇතුලේ…

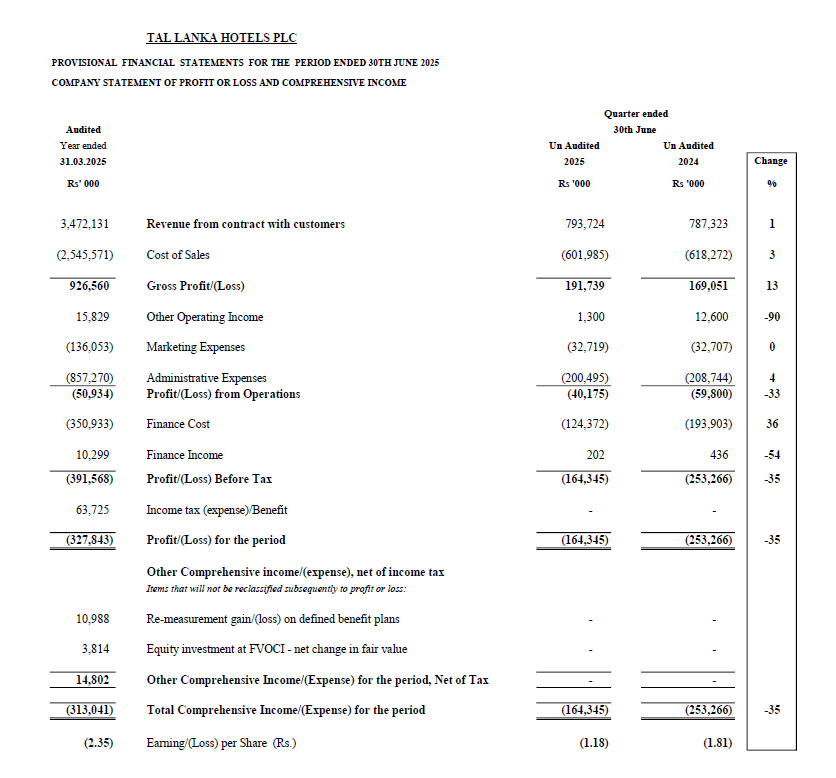

TAJ appreciated from 21.10 to 27.50 - an increase of over 30% in the last two days with the hotel sector rally. However, the APR-JUN Q results show a loss of 1.18, following a loss of 0.80 in the JAN-MAR Q. Lets see the reaction to the EPS !

ASI closed the week at 18,974, gaining 359 points with 3 green days and 2 red days. Trend remains bullish above 18800 with RSI above 77. Volume remained healthy throughout the week, supporting the uptrend. Financial results are slowly receiving for the APR-JUN Q.