cheruiyotkb

@cheruiyotkb

~ NSE ~ Insurance ~ Personal Finance ~ Retirement Planning ~ SACCO ~ Unit Trusts ~

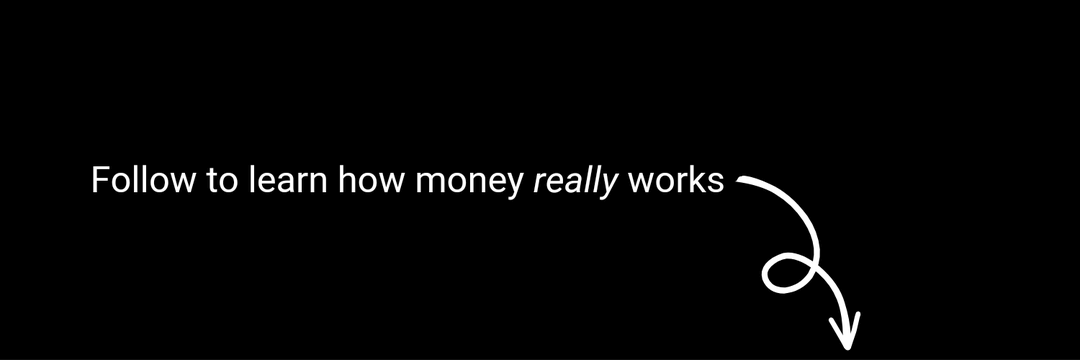

Sh 1M in MMF typically returns about Sh 10K per month.

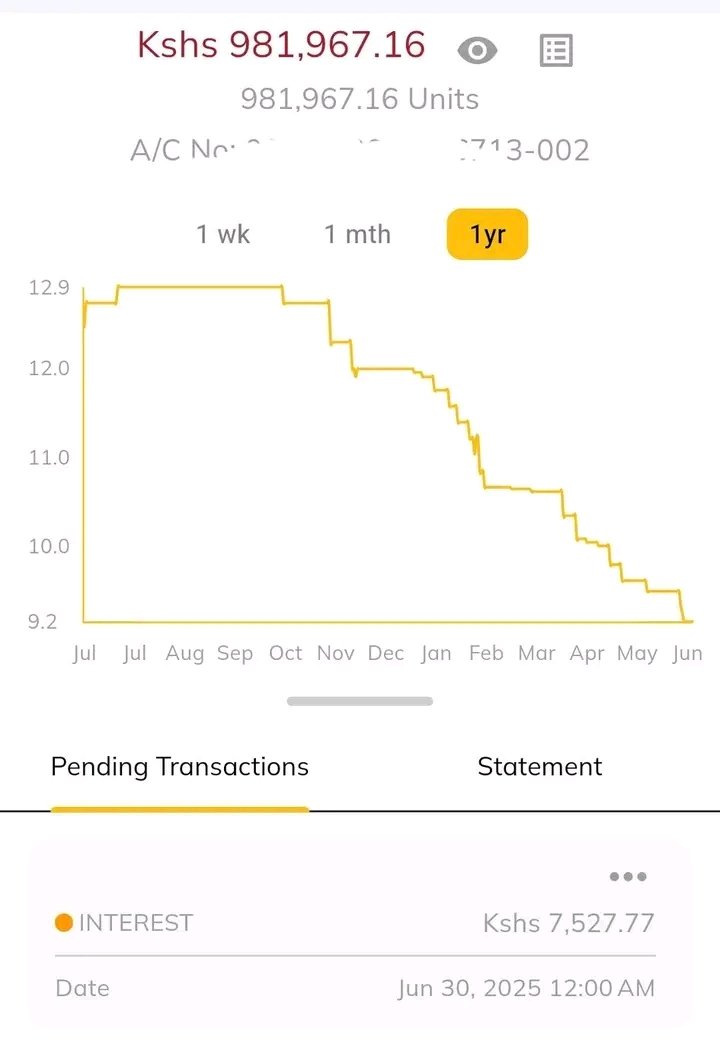

Your first Sh 200K invested in the stock market is the hardest. Hitting Sh 400K comes relatively faster. Then Sh 1M, then Sh 2M in a portfolio comprising stocks, SACCO deposits, MMF, and bonds. Adding real estate and smashing that Sh 10M mark someday is a reality. No matter…

At the heart of Africa’s inequality is a deep gap in ownership. According to a report by Oxfam International, the average income of the richest 1% in Africa has increased five times faster than that of the bottom 50% since 2020. In countries like South Africa, the top 1% hold…

Did a personal finance stress test 4 years ago and realized I needed to up my game. How long you can you maintain your living standards without working actively is a question that should drive anyone to have discipline.

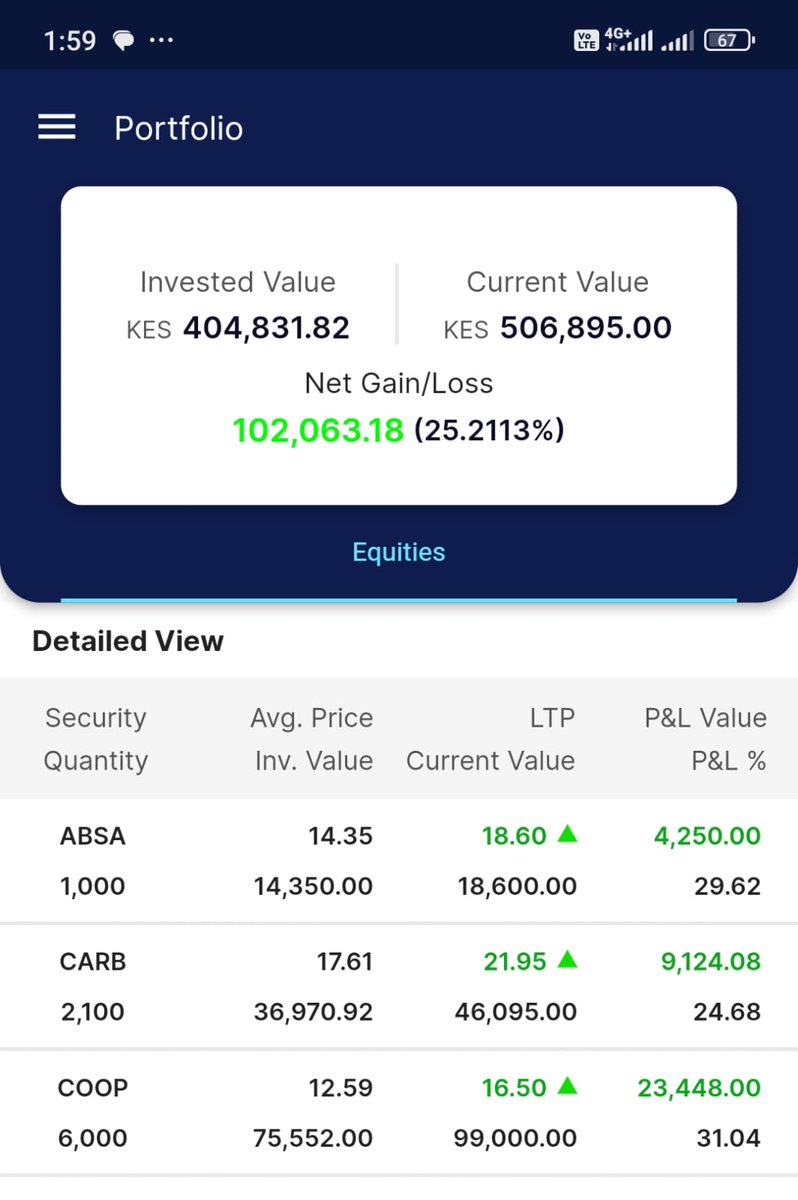

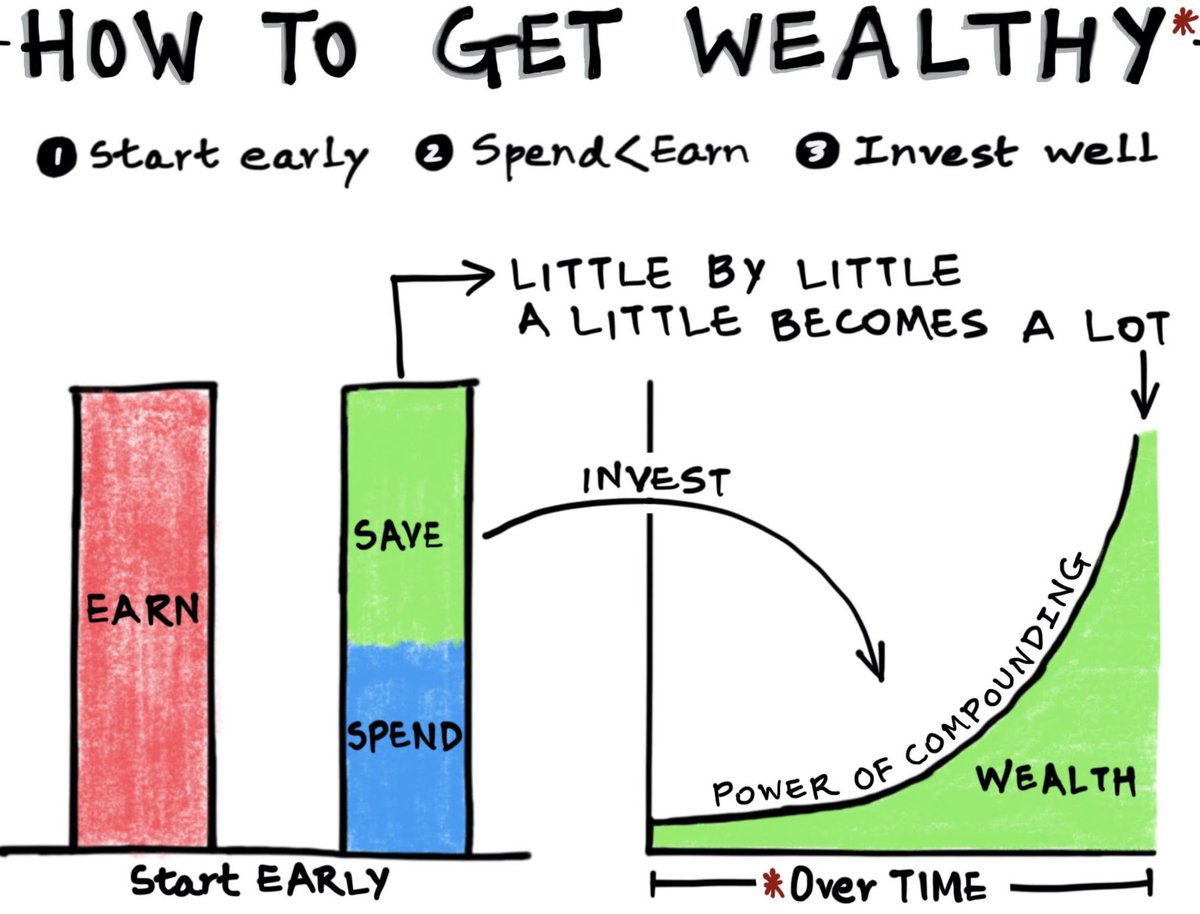

Payday week 💰 Here's what we do on paydays as we build wealth, one step at a time: • Money Market Fund top up • Fixed Income Fund top up • Knocking off debt • Purchasing stocks/bonds • Accumulate SACCO deposits We wash, rinse, and repeat next payday 🔄

Wealth building tips: 🚫 Avoid/eliminate bad debt 💰 Invest 20% of your income 🎯 Have a sinking fund for big buys 🚨 Always keep an emergency fund 📶 Focus on increasing your income ➕ Create multiple sources of income 📈 Buy assets that appreciate in value

Wealth means having assets which earn as you sleep. Once those assets earn more than it costs you to live, then wealth buys you freedom – freedom of choice: to be where you want to be, to work where you want to work and to spend your time how you want to spend it.

If you view your salary as a tool to buy cash flow assets like bonds, unit trusts, and dividend stocks; rather than just income, you can build sizeable wealth at your own pace and timeline. Nothing is as pleasant as having multiple sources of unlimited income. #PayDayWeek

Your salary is your active income. Your investments are your passive income sources. Your goal should be to slowly but steadily build the passive sources until they're bigger than the active. Consistently contribute to MMF, bond fund, SACCO deposits, dividend stocks, ETFs, etc.

No amount of budgeting will solve an income problem. Saving has a limit. Earning does not. Spend less time optimizing your expenses and more time building skills that multiply your income. #ShilingSaturday

"Africa has underutilized the opportunity of brand building..." ~Eva Muraya , CEO & Founder BSD Group #10XIsEasierThan2X #AbojaniSMENetworkingEvent @imbankke @cheruiyotkb

Brand building is all about : ✅Trust ✅Value ✅Familiarity ✅Favorability ~~Eva Muraya , CEO & Founder BSD Group #10XIsEasierThan2X #AbojaniSMENetworkingEvent @imbankke @cheruiyotkb @MihrThakar

HERE ARE 4 TYPES OF CASH YOU NEED TO KNOW ABOUT AS AN SME 1. Cash Generated 2. Cash Collected 3. Cash Outstanding 4. Cash Liabilities/Receivables Upcoming Abojani SME Networking event👇 @cheruiyotkb @MihrThakar @imbankke

Your true power comes from your ability to earn money in the future. However, don’t spend money you don’t have just yet. You work hard, so let your money work harder for you by consistently saving and investing in assets you understand better, at risks you can tolerate.