John Smith.USD 🏴☠️

@cherrygarciafan

Family Office Manager, Macroeconomic Strategist, Investor, Speculator. I talk about Macro, not investment advice. Not selling anything.

$320T in global debt, 64% of it in USD. There’s currently only $18T on deposit in US banks. The US govt alone owes over $36T. How’s this possible? Global banks create money and are in charge of the monetary system. Stop worshipping M2 and the Fed.

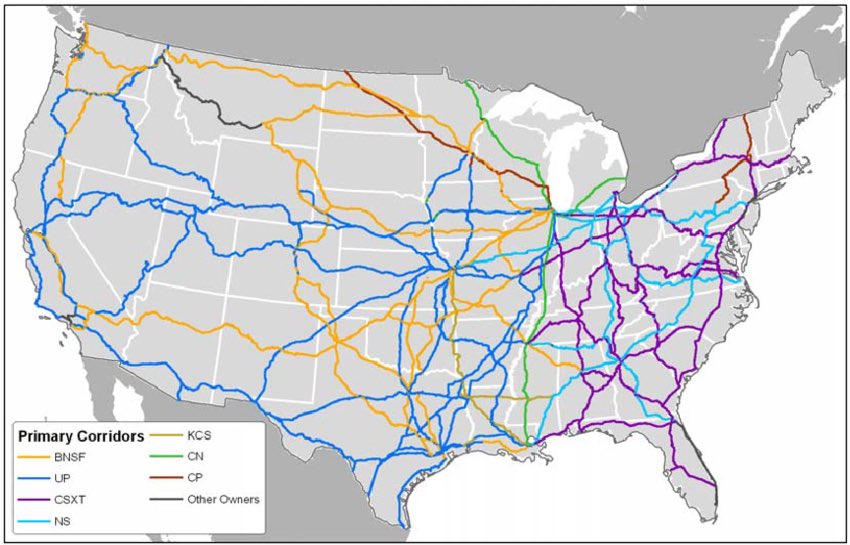

I’m keeping a close eye on the potential railroad merger talks in the US. UNP is considering buying NSC and BNSF (BRK) is considering buying CSX. I think BNSF is getting the better deal. What say you? Long BRK for the record.

Volume leads price folks. Yes, even in a specific zip code in Northern California.

Big picture: 2025 is on track to be one of the worst years for home sales in the past 30 years. (it may even turn out to be THE worst). June data came in even weaker than expected today. 3.93 million sales (annualized data) That's down from over 5 million pre-pandemic…

People aren’t struggling when grocery stores close in affluent suburbs. No, couldn’t be…

Who was it again that determines value? Thats right the buyers, same as the tariff situation. There is a limit to what people will spend. Stop listening to clowns that say otherwise.

US EXISTING HOME SALES CHANGE ACTUAL -2.7% (FORECAST -0.74%, PREVIOUS 0.8%) $MACRO

Any guesses where PPP loans stopped?

Ouch! Prices seem to have stabilised now though

“Too much money” aka inflation strikes again! This is a lack of money folks.

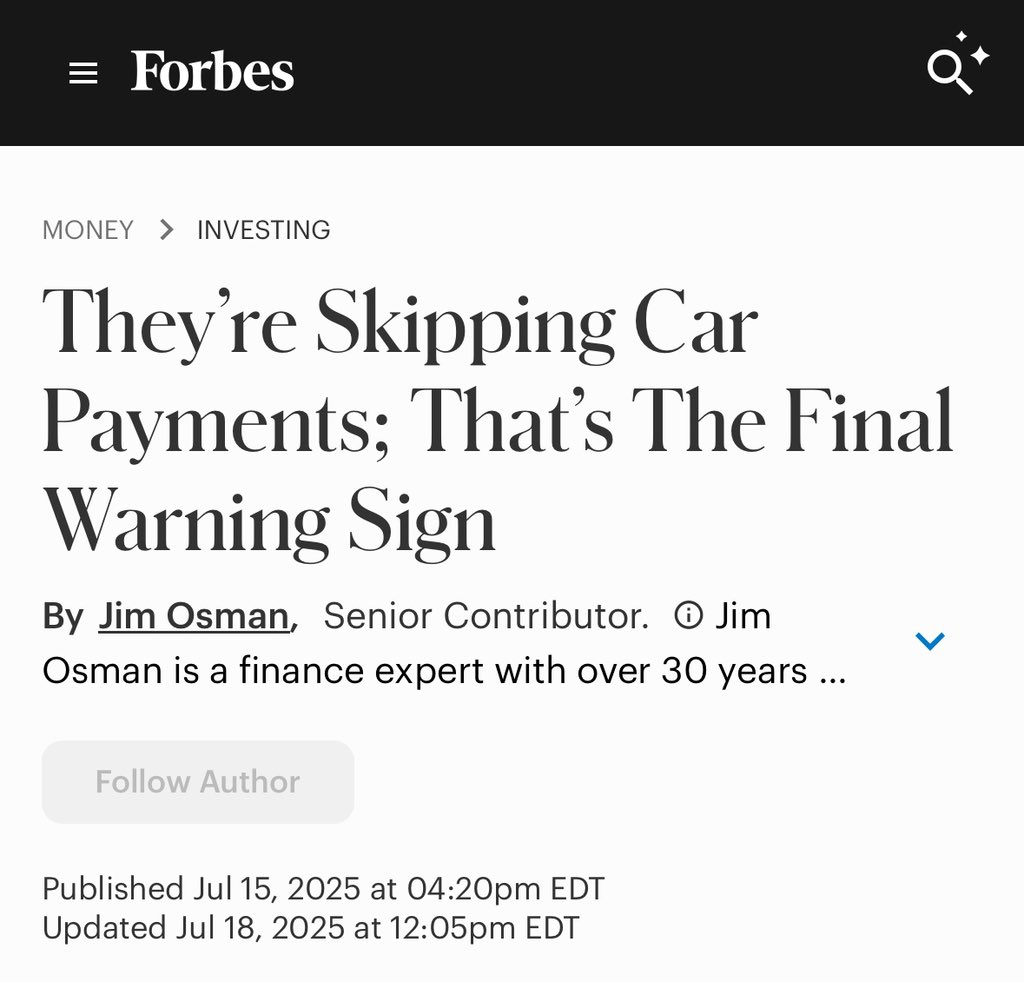

"Delinquencies, especially among subprime borrowers, are spiking," per Forbes.

The excrement is about to hit the fan.

JUST IN: Education Department halts student‑loan forgiveness under the Income‑Based Repayment plan—blocking forgiveness after 20–25 years with no end date, per WaPo

If tariffs can just be passed onto the consumer and they’ll continue to buy regardless of price, why are countries fighting them?

I was told tariffs would be passed onto the consumer and that they were inflationary.

Breaking: General Motors' profit shrank 35% last quarter after taking a $1.1 billion tariff hit on.wsj.com/4eXz66U

Whatever you do don’t pay attention to the real economy. Just focus on what the top 10% are doing. That was sarcasm btw.

It’s almost as if demographics is destiny.

St. Louis Public Schools proposal identifies more than 37 schools for closure #MacroEdge

Imagine that. Summary of the article is that boomers will be looking to downsize into smaller homes. Who buys all the McMansions?

“Notice the brackets below prior instances when the estimated risk premium was negative. Perhaps not surprisingly, the total return of the S&P 500 lagged Treasury bonds from 1929-1950, 1968-1987, and the 22-year stretch from 1998 to 2020 (3/23/98-3/23/20: 5.27% vs 5.32%…

Strangest economic boom I’ve ever seen

US trucking volumes have trended down to 2019 levels

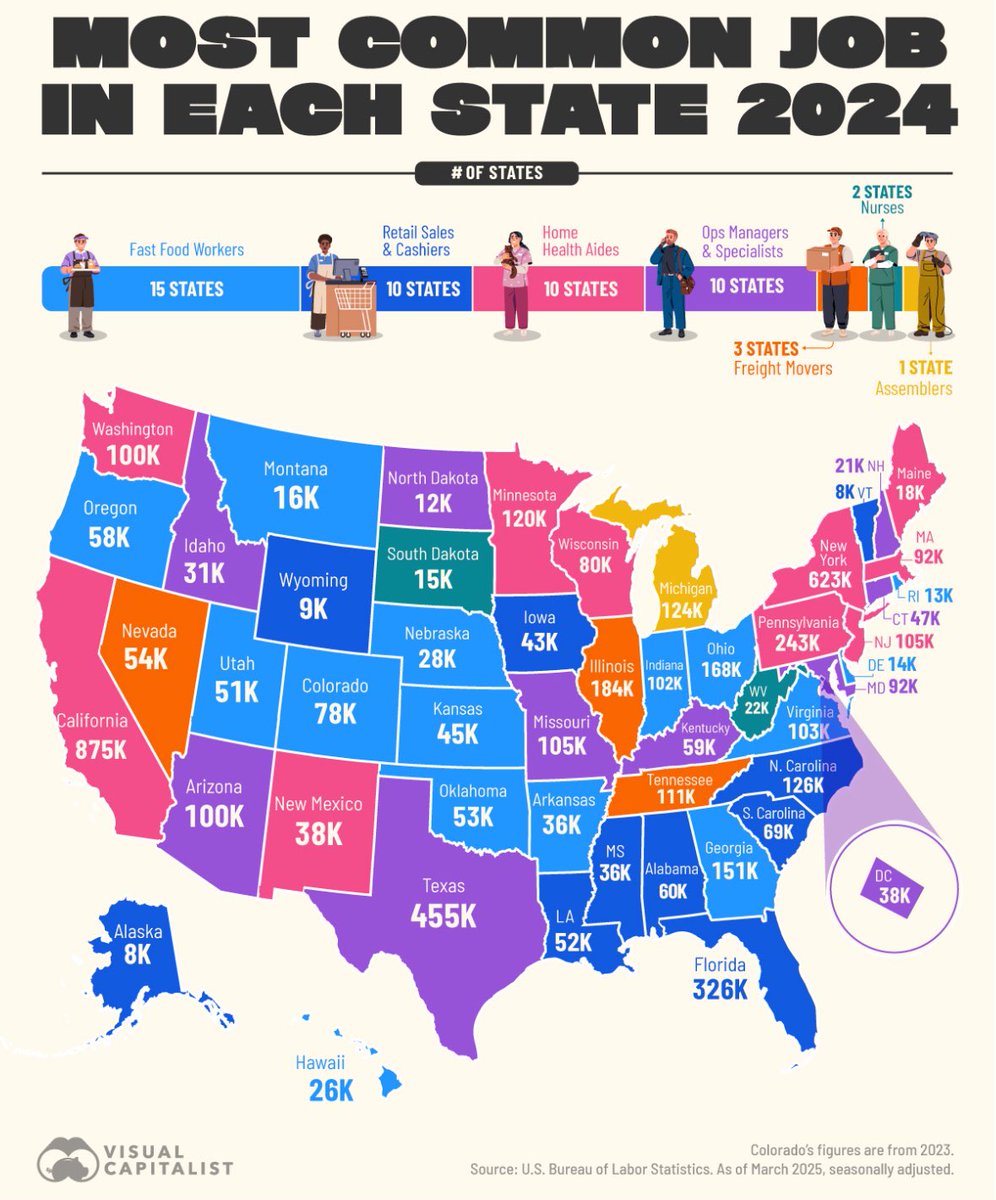

This is embarrassing. Only one state where the majority of people work in manufacturing. 15 states where the majority work in fast food, no wonder people are obese.

There’s been a lot of talk about how few Americans can afford to buy a house. I’m wondering who will have sufficient credit to buy one between student loans and BNPL.

If you think the numbers are bad now, wait until BNPL hits credit reports this fall. The last of the faux demand is finally coming to end. I’m looking forward to the sales in 2026 and beyond.

PPI Cooler Than Expected in June 👇🏼 PPI for final demand increased 2.3% year-over-year, a decrease from 2.7% in May and lower than the expected 2.5% increase. When consumers are tapped out, the cost of tariffs cannot be passed through to consumers. Margin compression is here.