bigz | drift

@bigz_Pubkey

building open source on Solana devnet | @DriftProtocol + @MetaDAOProject github enjoyer | all tweets are hilarious jokes

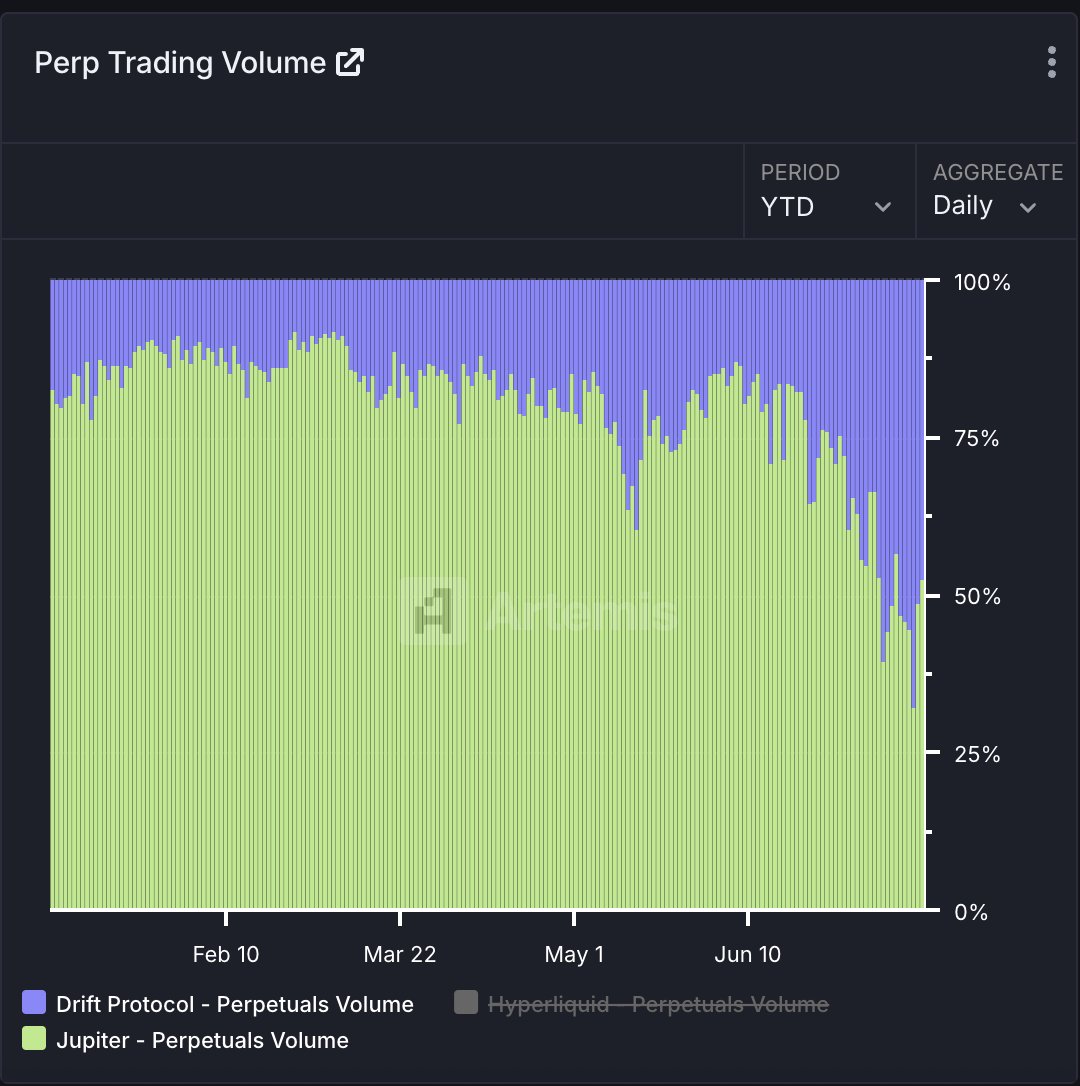

corr aint causation but checked artemis dashboard today for drift... 👀 0 fee trading -> more activity -> more borrowing demand? multikink interest rate curve keeping utilization relatively conservative / in check

classic reoccurring principle across all things risk/markets: be quick to prevent new risk but be smooth when shedding it

you are in crypto to get rich I am in crypto to get poor we are not the same

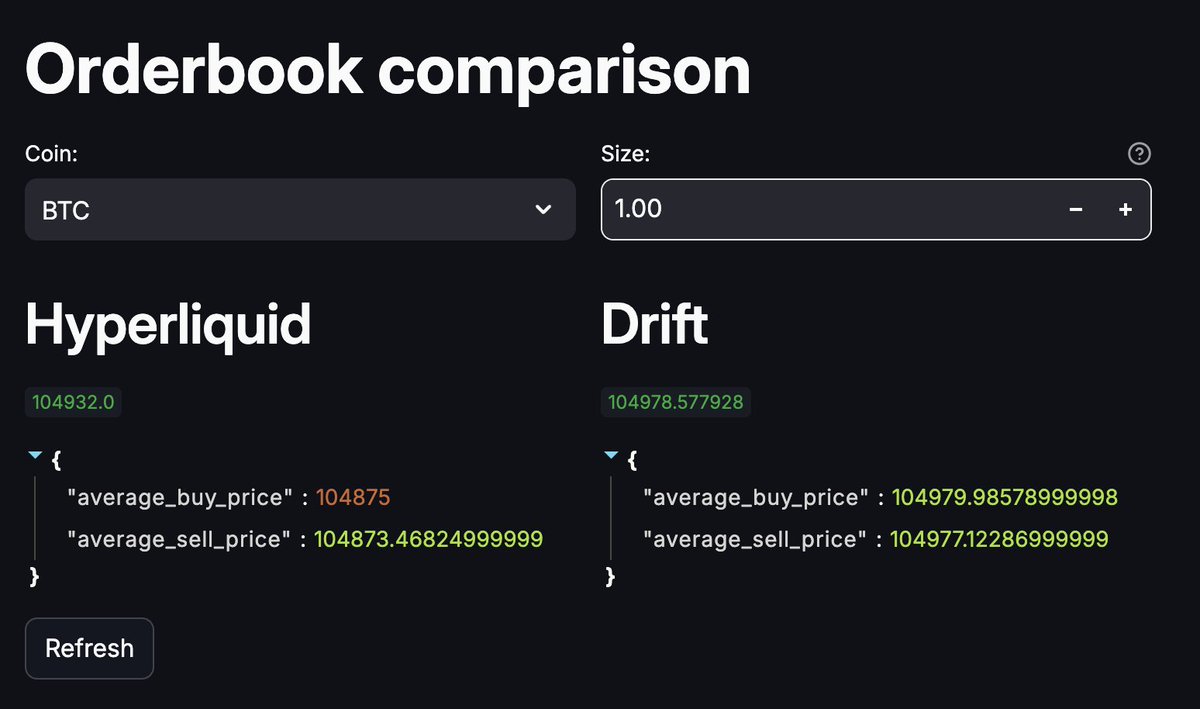

0 fee BTC trading with improving drift liquidity over months median fill now under 1 bps from oracle worst case 5 bps (which is a normal trading fee)

the zero fee revolution is now happening onchain 💫 no tx fees no taker fees

"single-anchor-test. sh" having an array of tests is blasphemy another day of misnomer creep

doing the "impossible" out here building an open source onchain market maker to process millions (soon billions) with the gang its not clob vs amm, but something subtler: a sustainable liquidity system crypto needs this first and then all else (crypto punk ideals etc) can…

Drift's fee schedule now super easy to find: a bit of stake or volume gets you even cheaper fee tiers - swing traders can just play the price and not worry about high taker fees - makers earn rebate at every level is there something out there more competitive?

theres no ayahuasca desert shortcut to figuring shit out, only need some stimmy free focus and good vibes

very deep drift books this past week as a result of optimized oracle cranks and amm liquidity logic the next big step toward commoditizing onchain liquidity is standardized oracle feeds cross venue because of differing oracles (~$50 gap), hyperliquid operates as a usdt-usdc…

had a dream last night that drift was extremelyliquid™️ and had the cheapest fees onchain

insufferably liquidity bull posting until morale improves lots of size on solana within 10bps, even for 100x junkies hyper drifting

its cool to POOL (Post Only Oracle Limit) protocol pays you to enter positions at fair value

7/7 on @DriftProtocol today. Most recent trade was +5.15% putting the total PnL on the day at +185.59%🔥 Really have to say, Post Oracle-Limit orders on Drift are incredibly OP.

The “dynamic” slippage selection is much better today than it was a few months ago. Always better to go with limit orders but when you need it, market orders in drift can be very effective.