Bespoke

@bespokeinvest

Bespoke Investment Group - Financial Markets Research. Learn more here: http://bespokepremium.com

Long-term investing isn't about timing. It's about time. WATCH:

Key Events Tomorrow (ET) 10:30 AM: EIA Natural Gas Inventories For more details, start a trial at bespokepremium.com.

Key Earnings Reports Tomorrow Before the Open: ADT $ADT American Airlines $AAL Blackstone $BX Dow $DOW Flex $FLEX Honeywell $HON L3Harris $LHX Mohawk $MHK Tractor Supply $TSCO Valero Energy $VLO After the Close: Edwards Lifesciences $EW Intel $INTC Newmont $NEM Weyerhaeuser $WY…

Q2 2025 Earnings Conference Call Recaps: DR Horton (DHI) bespokepremium.com/interactive/po… via @bespokeinvest

Q2 2025 Earnings Conference Call Recaps: GE Verona (GEV) bespokepremium.com/interactive/po… via @bespokeinvest

Q2 2025 Earnings Conference Call Recaps: Lamb Weston (LW) bespokepremium.com/interactive/po… via @bespokeinvest

Q2 2025 Earnings Conference Call Recaps: General Dynamics (GD) bespokepremium.com/interactive/po… via @bespokeinvest

Q2 2025 Earnings Conference Call Recaps: Capital One (COF) bespokepremium.com/interactive/po… via @bespokeinvest

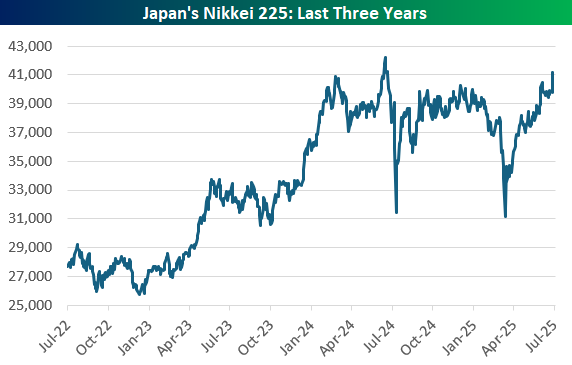

Japan's Nikkei 225 broke out to new 2025 highs today on a 3%+ gain. Not quite back to all-time highs. It has been a crazy year or so for the Nikkei, any good names for this chart pattern??

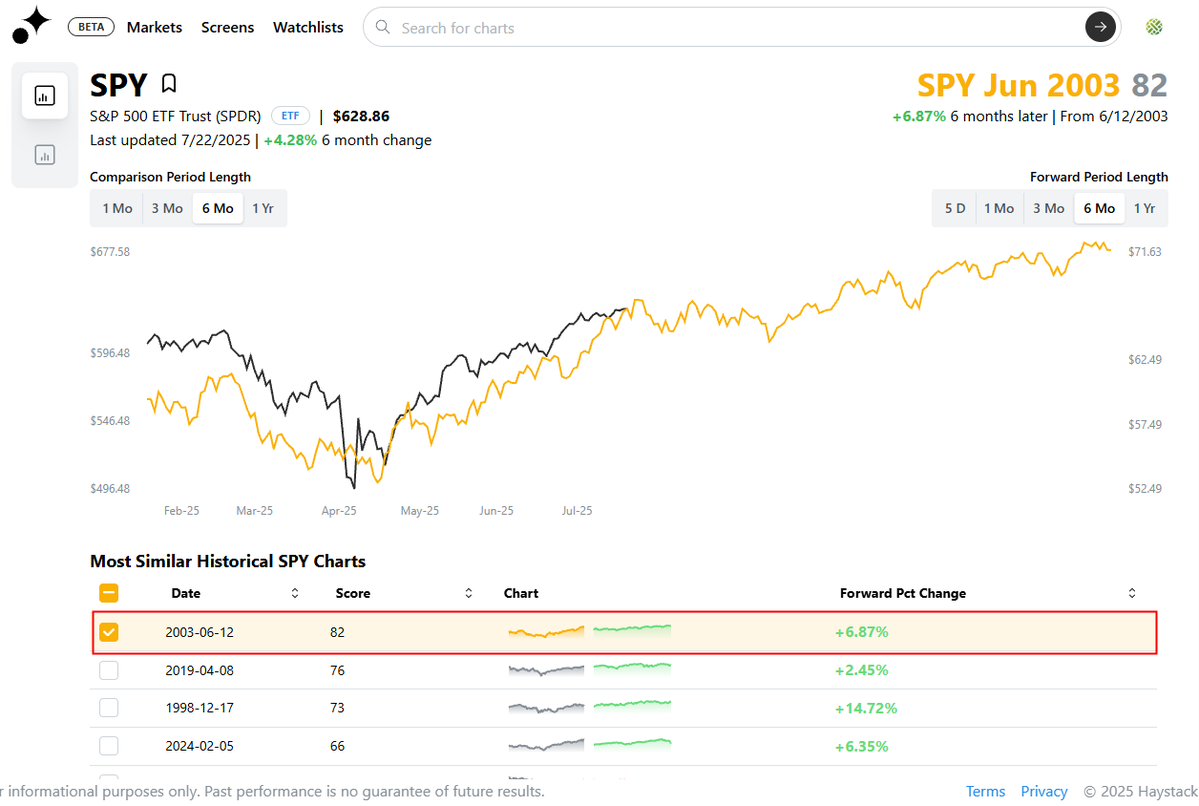

Interestingly, the first half of 2003 is now the most correlated period with the last six months for the S&P $SPY. That turned out to be the bottom of the Dot Com bust and the start of the '03-'07 bull market.

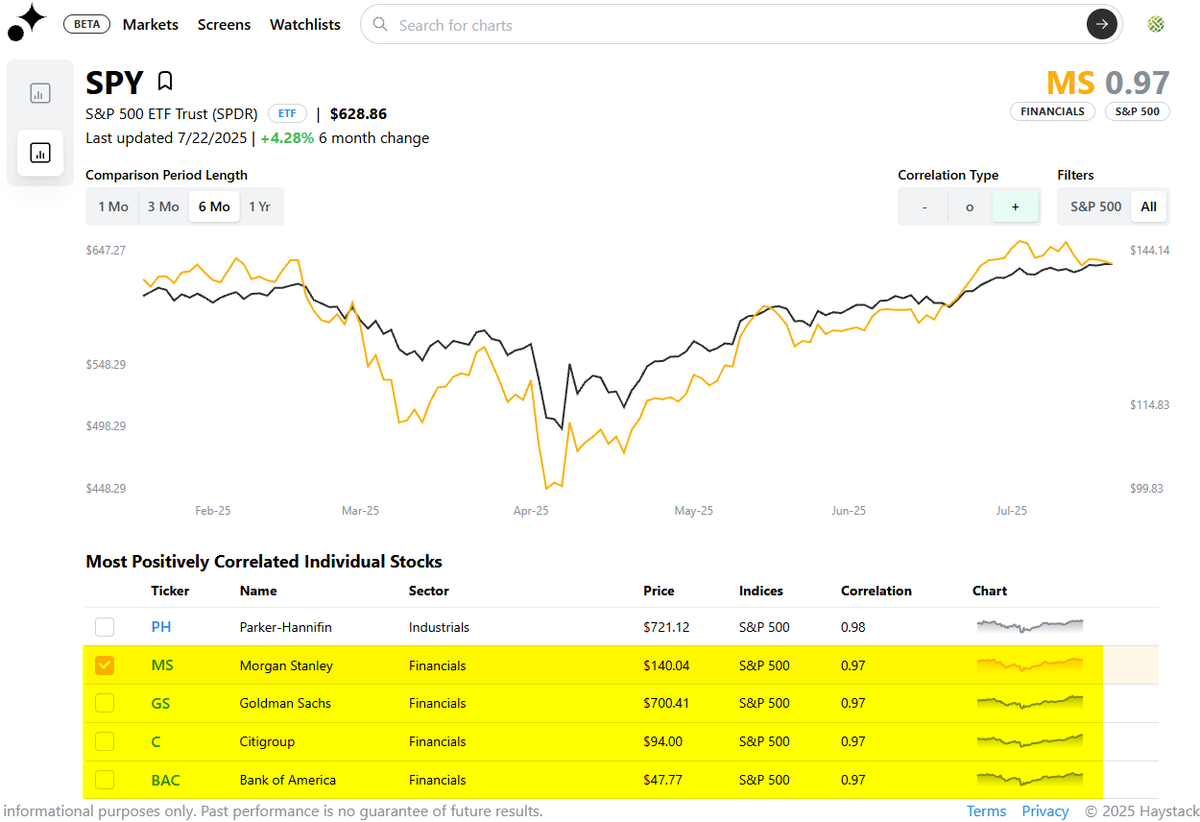

Interestingly, it's not the mega-cap Tech stocks that are the most correlated with $SPY, but rather the big banks and brokers. $MS, $GS, $C, and $BAC are four of the five most correlated S&P 500 stocks with $SPY over the last six months.

Mega-Cap Earnings + GOOGL Streaks open.substack.com/pub/bespokeinv…

Royal Caribbean $RCL is now up 100% (rounded up) since its April closing low. 👀👀

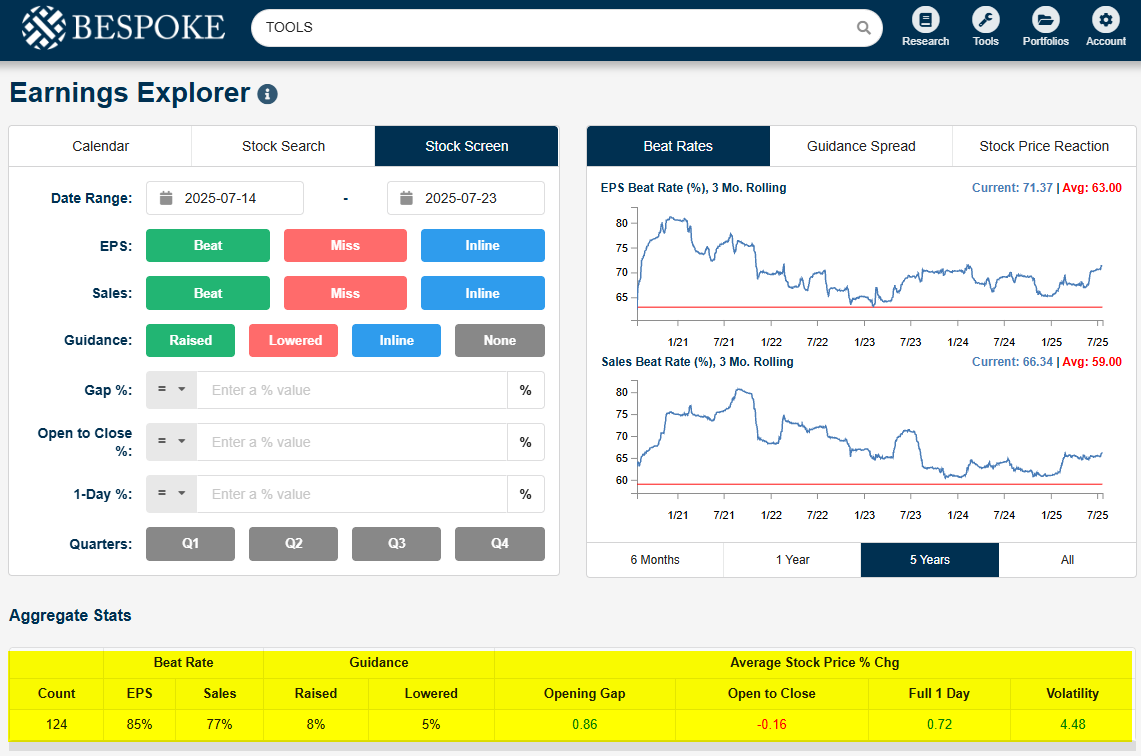

Only 124 companies have reported earnings so far this season up until today, but the current EPS beat rate stands at 85% (normal is 66%) and the sales beat rate is at 77% (normal is 63%). Average stock has gained 0.72% on its earnings reaction day.

An un-Happy month continues for Netflix $NFLX. It peaked on the last day of June and is now down 12% month-to-date.

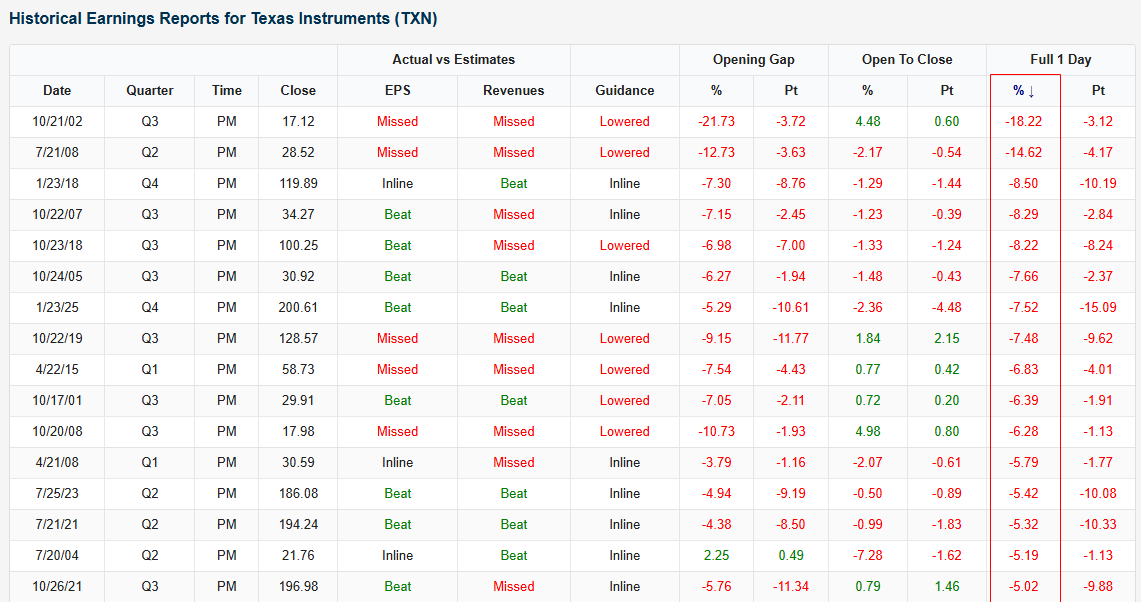

Texas Instruments has declined 5%+ in reaction to earnings plenty of times over the years, but the last time it fell over 10% was in 2008. $TXN

Stocks are higher after the US announced a trade deal with Japan, though details are cloudy. Optimism is tempered by uncertainty over implementation, but Japanese auto stocks are surging, fueling global equity strength. Start a trial to read today's Morning Lineup!

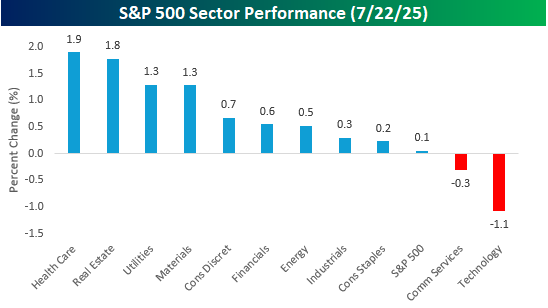

While the S&P 500 was up less than 0.1% yesterday, nine sectors finished up on the day, including four that were up over 1%.