Ben Ippolito

@ben_ippolito

Economist at @AEI by way of @EmoryUniversity and @UWMadison

Eligibility phase outs are a legitimate challenge for many programs and worthy of debate. But I am surprised at how much this reads like an endorsement of explicit fraud.

NEW: Here’s the story of a man who said he had to break Medicaid rules, putting him at odds with Republicans who added hurdles to qualify for the health insurance program they say is rife with waste, fraud, and abuse. @K_Hought reports. ⤵️ kffhealthnews.org/news/article/m…

To their credit, the admin has announced several good Medicare changes so far -Push towards site neutral payments -Phasing out inpatient only list -Increasing audits of MA coding -Finalizing risk adjustment changes in MA -Testing prior authorization in Traditional Medicare

Today, CMS issued the Calendar Year 2026 Hospital Outpatient Prospective Payment System and Ambulatory Surgical Center Payment System proposed rule introducing reforms to modernize payments, expand access to care, and enhance hospital accountability. cms.gov/newsroom/press…

Wisconsin passed a budget in the middle of the night that, among other things, increased provider taxes to the maximum permitted value, so they would be grandfathered before the House votes on reconciliation wpr.org/news/tony-ever…

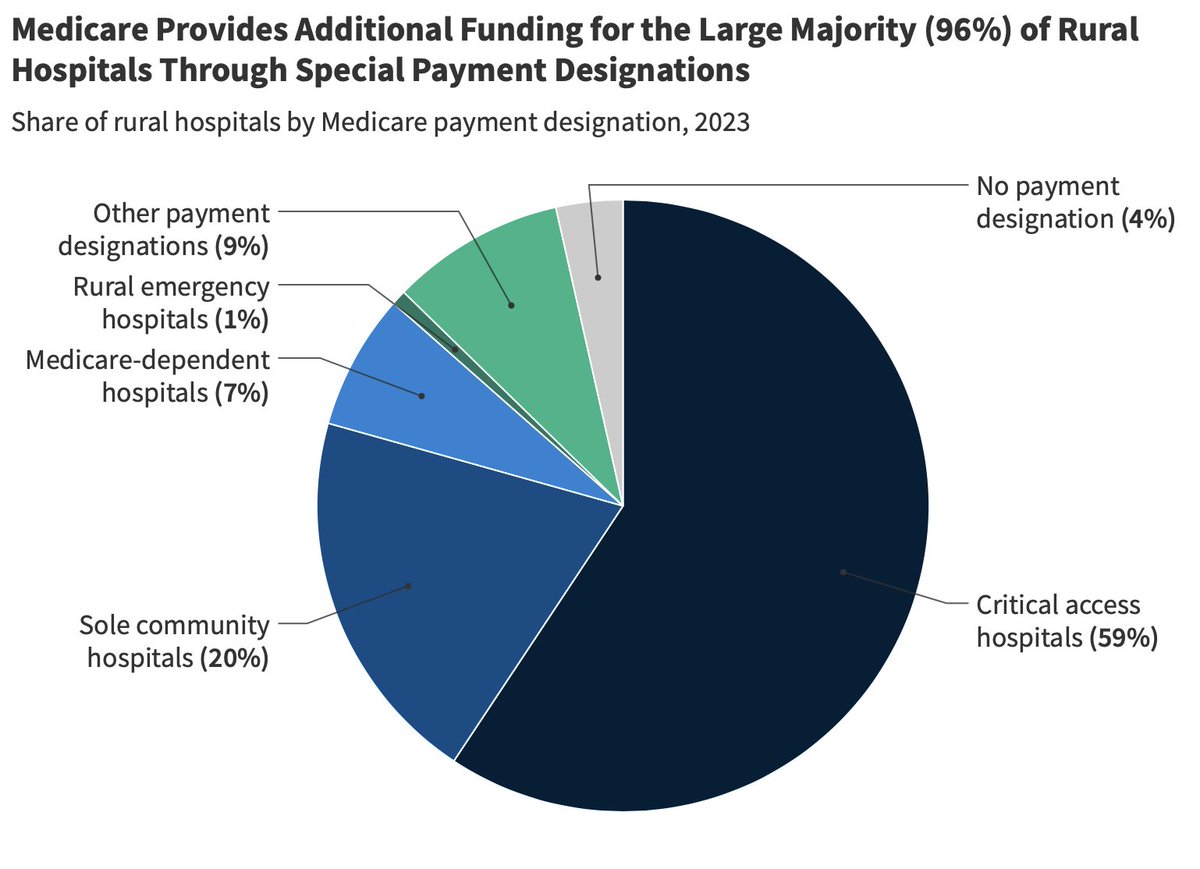

96% of rural hospitals qualify for extra funding through Medicare. Plus disproportionate share payments, 340B discounts, and various other programs. If anything, we probably need to streamline support for rural hospitals not create new programs.

CMS is launching a demonstration project to test the effects of prior authorization for a few services prone to fraud or safety concerns in Traditional Medicare. Seems sensible given the variation in program spending we've seen for decades (that isn't driven by prices).

Announced today: learn how the WISeR (Wasteful and Inappropriate Service Reduction) Model will use enhanced technologies to protect patients, decrease use of low-value care, and reduce fraud, waste, and abuse in Original Medicare: bit.ly/3TJUGSD

It would be useful to understand why some of these were struck. Presumably a version of, for example, the provider tax provision would be acceptable.

BREAKING NEWS: The Senate parliamentarian just struck a massive blow to Republicans' Medicaid cuts, per announcement from Senate Budget Dems NOT compliant w/ Byrd Rule (meaning they need to be stripped or overrule parl): -provider tax crackdown (!!!) -limiting fed $ for states…

A reminder that we never saw the full legal challenge to the Trump admin's Most Favored Nation pricing play out last time. Hammering the prices of the next negotiated drugs--including Ozempic--seems likely to become an appealing and much easier option (if less expansive)

Looks like nearly $200 billion in federal savings come from reforms to controversial Medicaid financing tactics (provider taxes, upper payment limit, and MCO tax changes). Quite a bit of money given how limited the provider tax provision is.

Reconciliation Table cbo.gov/publication/61…

Looks like freezing Medicaid provider taxes at their current levels is scored as saving $87 billion d1dth6e84htgma.cloudfront.net/E_and_C_Markup…

I am very curious how much savings CBO will assign to simply freezing provider taxes and (I think) disallowing the most aggressive MCO taxes schemes pioneered by California. Could still be a lot of money if they (reasonably) assume states quickly adopt most advantageous schemes.

CMS claims this saves $30B over the next 5 years. Once you account for likely expansion of these tactics absent a policy change, presumably federal spending reductions must be $100B+

The end appears near for some of the most aggressive Medicaid MCO taxes which inflate federal spending and clearly violate the spirit of governing rules. I believe the Biden Administration had also indicated their concern with this as well.