๒๒๒ץợ_ợץ๒๒๒

@bbbyq_qybbb

Bed Bath & Beyond is the Catalyst. 741 is the Key. GMErica is the Plan.

🍪 They hid your stock behind a cookie in 1999- the year Congress repealed Glass-Steagall and quietly repealed ownership itself. The Gramm-Leach-Bliley Act was sold as "modernization." But what it really did was fuse three forces that were never meant to coexist: ➡️ Risk…

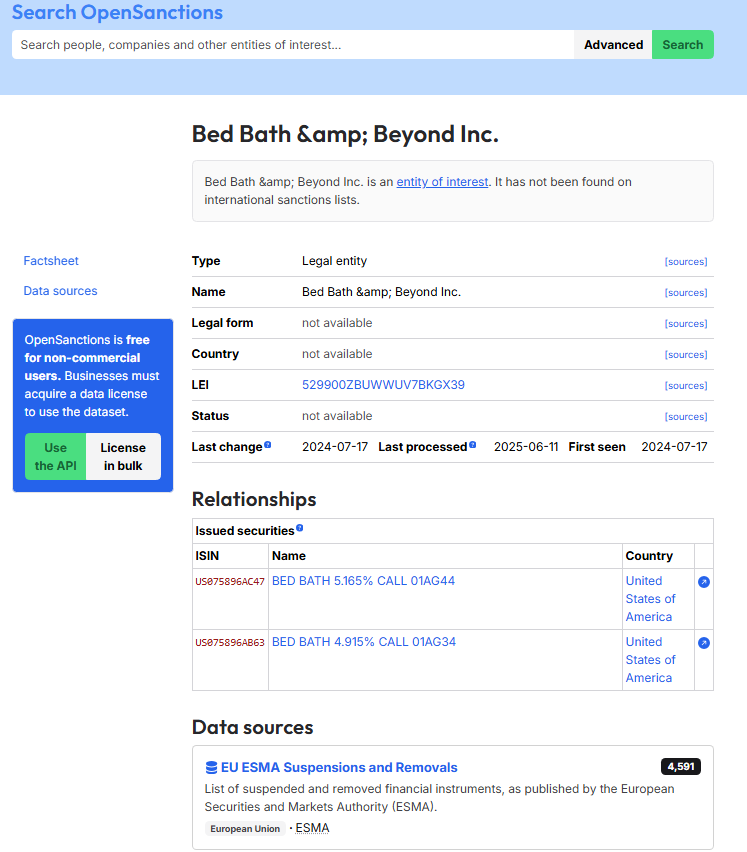

What @nobles305 has discovered is a non-standard forward contract on a single equity (BBBY), with a spread-bet payout trigger and cash settlement. The structure of this contract was actively validated or republished on July 1, 2025, which aligns with OpenSanctions Last processed…

The Emergence of Truth Part 1 🔵 Actual forward contract tied to #BBBY recovery •Real money. Real terms. •No AI-driven summaries. •No sentiment-cycle cosplay. Meanwhile, the so-called “experts” are AWOL.

🔍 On OPENFIGI, there’s an Amazon Flex Option (2AMZN 08/01/25 C220 FLX) tied to the exact share class as DK-Butterfly / Bed Bath & Beyond common stock... Share Class ID: BBG001S720V4 👀 Since June, Jeff Bezos has unloaded $1.4B in AMZN stock. That capital may be moving through…

Shares within the same share class are treated as one entity, typically holding equal rights and value. When looking at Bed Bath & Beyond, Inc. tickers on OPENFIGI, they appear to be structured with embedded currency codes, which hints at the link to crypto. This combined with…

Virtu Financial has been in advanced settlement discussions as of July 1, 2025 with the final order granted on July 2, 2025. 👀 Because ITG Posit exchange was the trading venue for $BBBY , this settlement is possibly a resolution for all of the synthetic equity that was routed…

Does anyone think this is worth looking into? On March 1, 2019 Virtu Financial Completed the acquisition of ITG, The exchange where BBBY's stock was held. -One Liberty Plaza New York City

Ryan Cohen was set to talk on CNBC at 7:10AM ET, he was a little behind- showed up right at 7:14AM ET😂

Today, 7/11, marks 2 years since the buybuy BABY sale hearing (July 11, 2023). In 3 days, it will be 11 years since BBBY’s July 14, 2014 $1.5B Free Writing Prospectus- the open shelf that never closed. That same day, July 14, 2025, the switch flips. ISO 20022 goes live.…

11:11

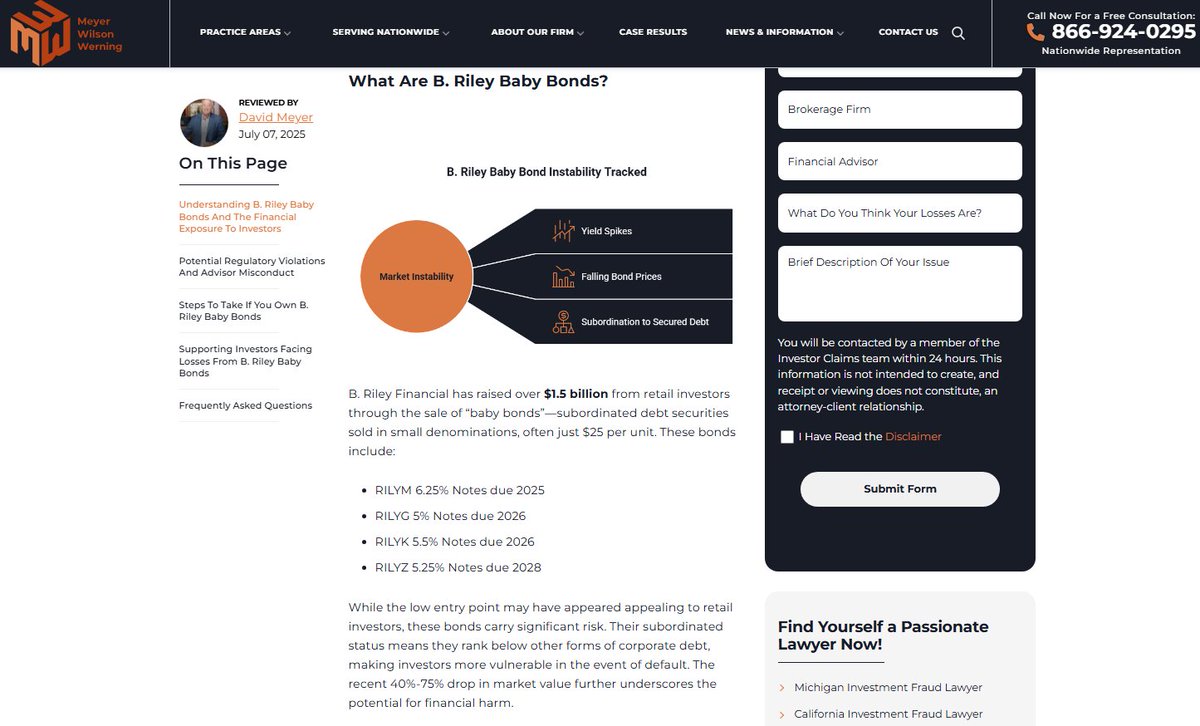

"B. Riley Financial has raised over $1.5 billion from retail investors through the sale of “baby bonds”..." B. Riley Baby Bonds??? 🔍🤨 Dated July 7th, 2025: investorclaims.com/blog/b-riley-b…

Project 🦋|͎||͎|͎|͎|͎||͎|͎|͎|͎|͎|͎͎͎|͎|͎|͎||͎|͎|͎|͎|͎||͎|̴|̴|̴|̴|̴|̴|̴|̴|̴|̴||̴|̴|̴|̴|̴|̴|̴|̴|̴|̷|̷|̷|̷|̷|̷|̷|̷|̷|̷||̷|̷|̷|̷|̷|̷|🚀

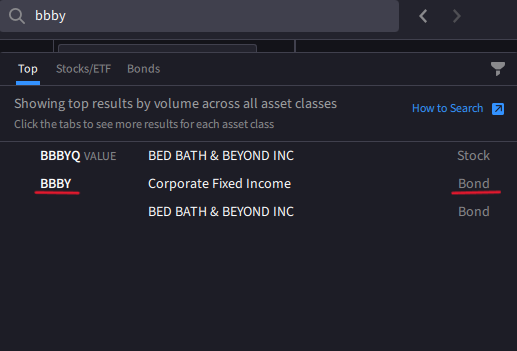

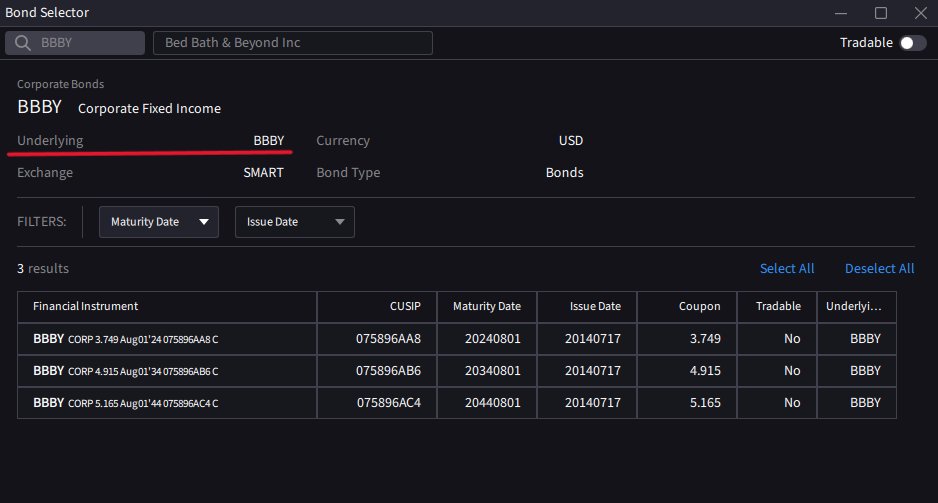

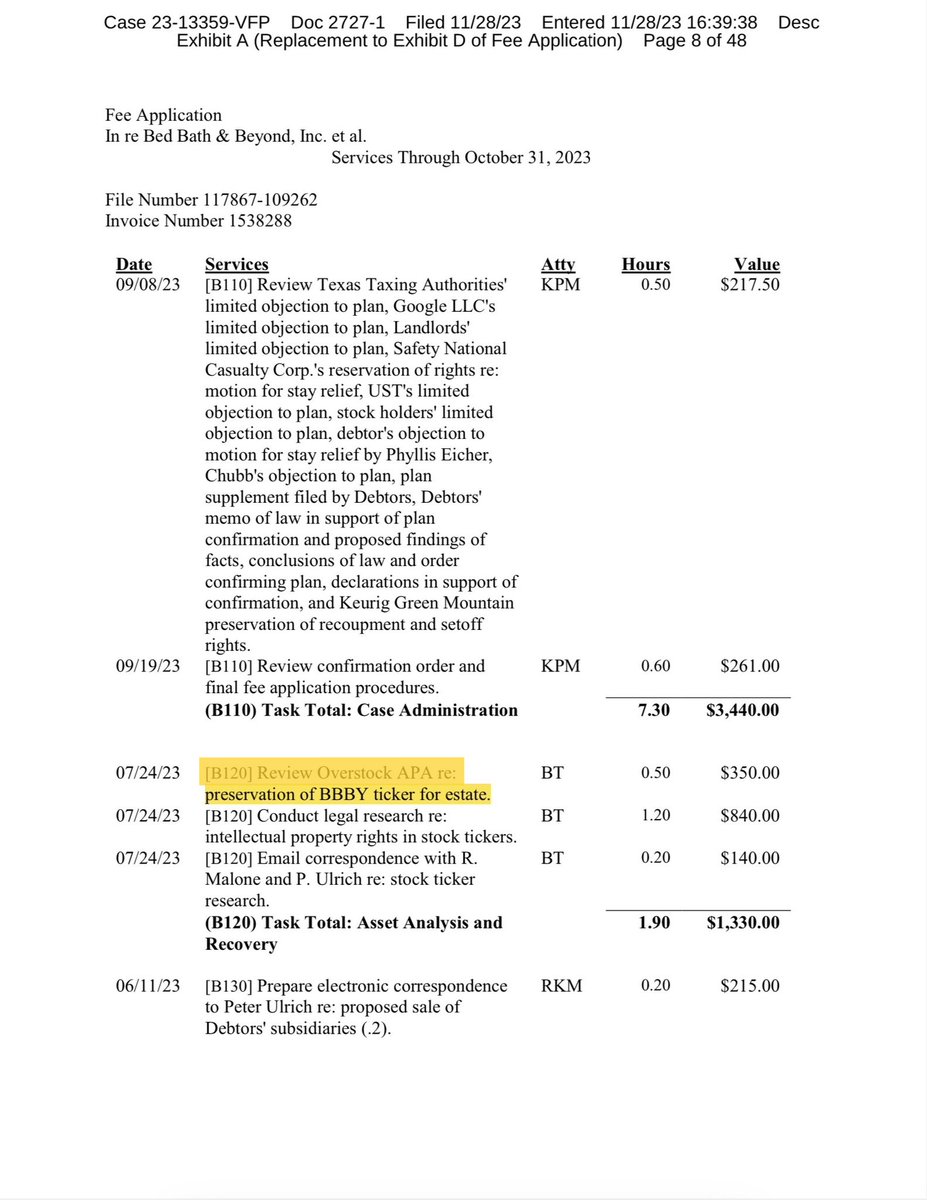

🧵 $BBBY Bonds = $BBBY Equity? The BBBY bonds reference the $BBBY ticker (issuer) in backend systems. The Overstock APA explicitly addressed preservation of the $BBBY ticker for the estate during bankruptcy. If the estate uses the preserved $BBBY ticker for debt-for-equity…

⏹️On Webull my Trading History says BBBYQ, but my Trading Record says BBBY | EQUITY😏