Ayham (AJ)

@ayham_eth

Co-founder @silofinance - Growth Strategy TG: Ayham.eth Etherean | Nerazzurri 🖤💙 | Cyclist | @ATXDAO

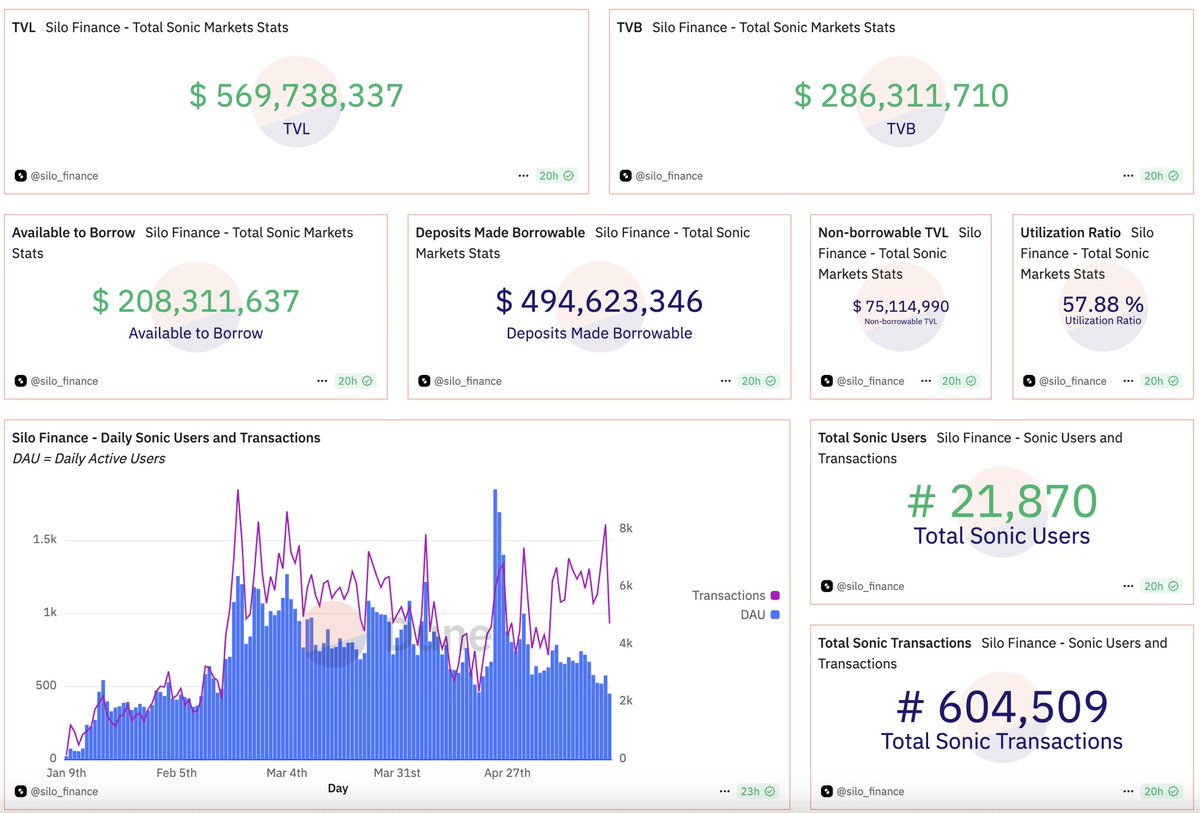

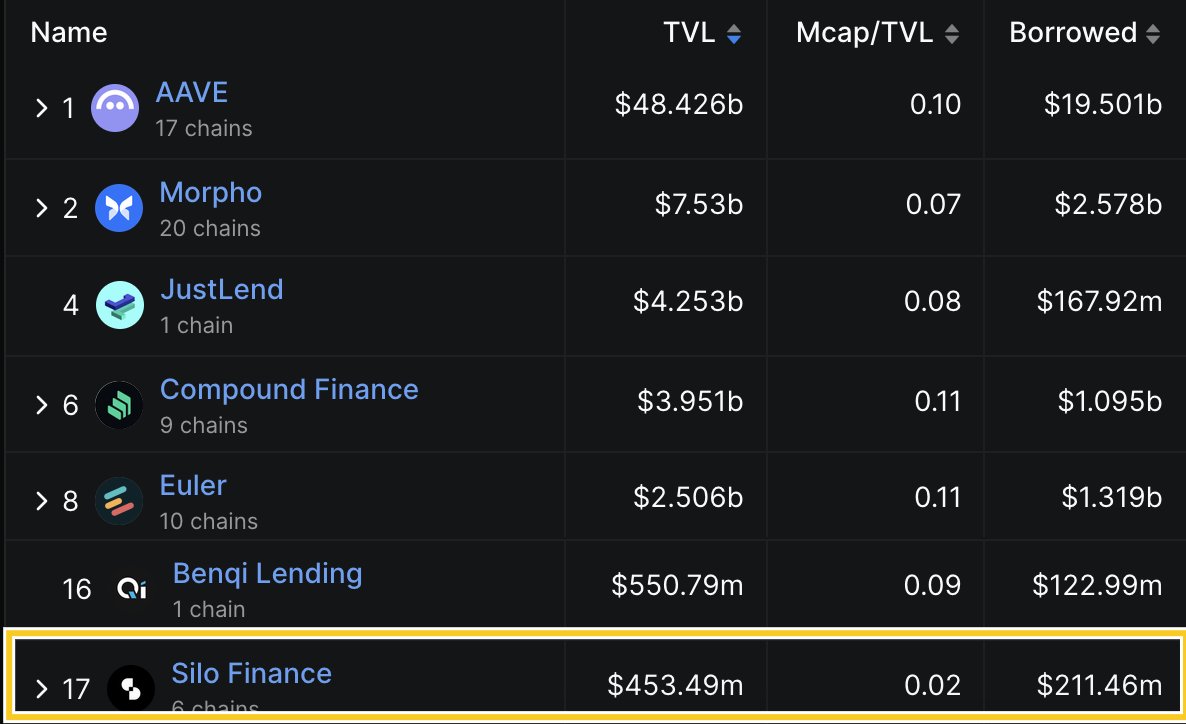

Silo's TVL, active loans, and revenues have grown significantly since V2 was launched, while its market cap has plummeted. Are fundamentals dead in DeFi? What drive a project's MC?

Silo Labs has engaged @GSR_io as the official market maker for the SILO token. By enhancing liquidity on decentralized and centralized exchanges, we aim to maximize accessibility and distribution as we proceed to the next steps of our growth phase.

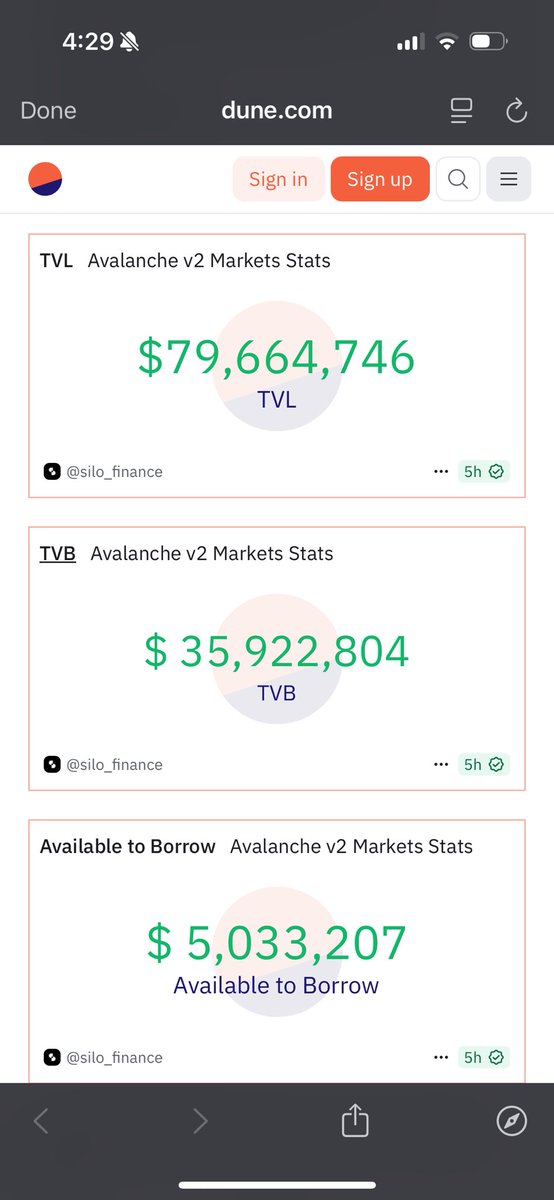

We've just crossed $100m in total deposits on Silo Avalanche, officially making it our second largest Silo deployment. From stablecoins to BTC, Silo v2 is providing the infrastructure to scale all forms of yield and leverage. On to the next $100m 🤝

After Sonic, Silo Avalanche is scaling nicely with almost $80M TVL and impressive 87% utilization of USDC. @SiloFinance V2 high-yield, isolated lending markets are crushing it.

$SILO is massively undervalued at the moment. With Mcap/TVL at 0.02, the upside is huge. - +200M in borrows - Close to half $bn in TVL - Over 60% of $SILO locked out of circulation

A story in four parts: 1. Falcon announces 36x Miles for Pendle sUSDf 2. PT-sUSDf implied APY spikes to 12.65% APY 3. USDC borrow rates against PT-sUSDf sitting at measly 6.8% APR 4. PT-sUSDf loopers printing 65% APY YES THIS IS ALPHA - 65% APY on stables if you get in quick.

Post-mortem on yesterday's security incident. TL;DR ✅ User funds safe at all times ✅ Scope limited to an audited, unreleased smart contract, unrelated to the core protocol ✅ 244 ETH lost by SiloDAO Tracing and recovery are now underway - thank you all for the support.

We can confirm that the Silo protocol is safe, including its isolated markets and vaults, and users can continue using it confidently.

Earlier today, an audited contract for an unreleased leverage feature was exploited. This contract was for testing only. Core contracts are safe - Markets and Vault. ✅ No user funds were lost, except for some Silo DAO's funds, which were used to test the leverage feature. We…

Silo v1 deployed for the first time on Ethereum Mainnet in 2022. Three years later, we finally return to the chain where it all began with a redesign of our isolated lending vision. Silo v2 is live on Ethereum - and the first ever lending integration for @pendle_fi LPs. 👇

We're excited to announce that we've adopted the @Chainlink interoperability standard. SILO is now a Cross-Chain Token (CCT), unlocking seamless, secure, and timely transfers across all our supported chains via Chainlink CCIP.

Silo, a leading lending protocol on Sonic with $506M+ TVL, is going cross-chain. @SiloFinance has adopted Chainlink CCIP and the Cross-Chain Token (CCT) standard to enable secure transfers of its SILO token across @arbitrum, @ethereum, and @SonicLabs.

The next phase of Silo tokenomics have been shared on the governance forum. It introduces the xSILO staking module, $SILO buybacks, and revenue distribution. More details below.

Silo Sonic now serves 21K+ active wallets across 35+ markets, from blue-chip to esoteric assets, with 57%+ utilization and $40M+ daily volume. @SiloFinance ❤️@SonicLabs