Andrew Lautz

@andrew_lautz

director of tax policy @BPC_Bipartisan. CT for 18 years, D.C. for 13. @BrittanyEHarvey's husband. Views/opinions my own.

Homeowners can already exclude the first $250k in capital gains ($500k for married couples) on a principal residence if they lived in the house for 2 of the prior 5 years. The exclusion costs around $45 billion per year. Via CRS:

President Trump says he wants to eliminate the capital gains tax on home sales.

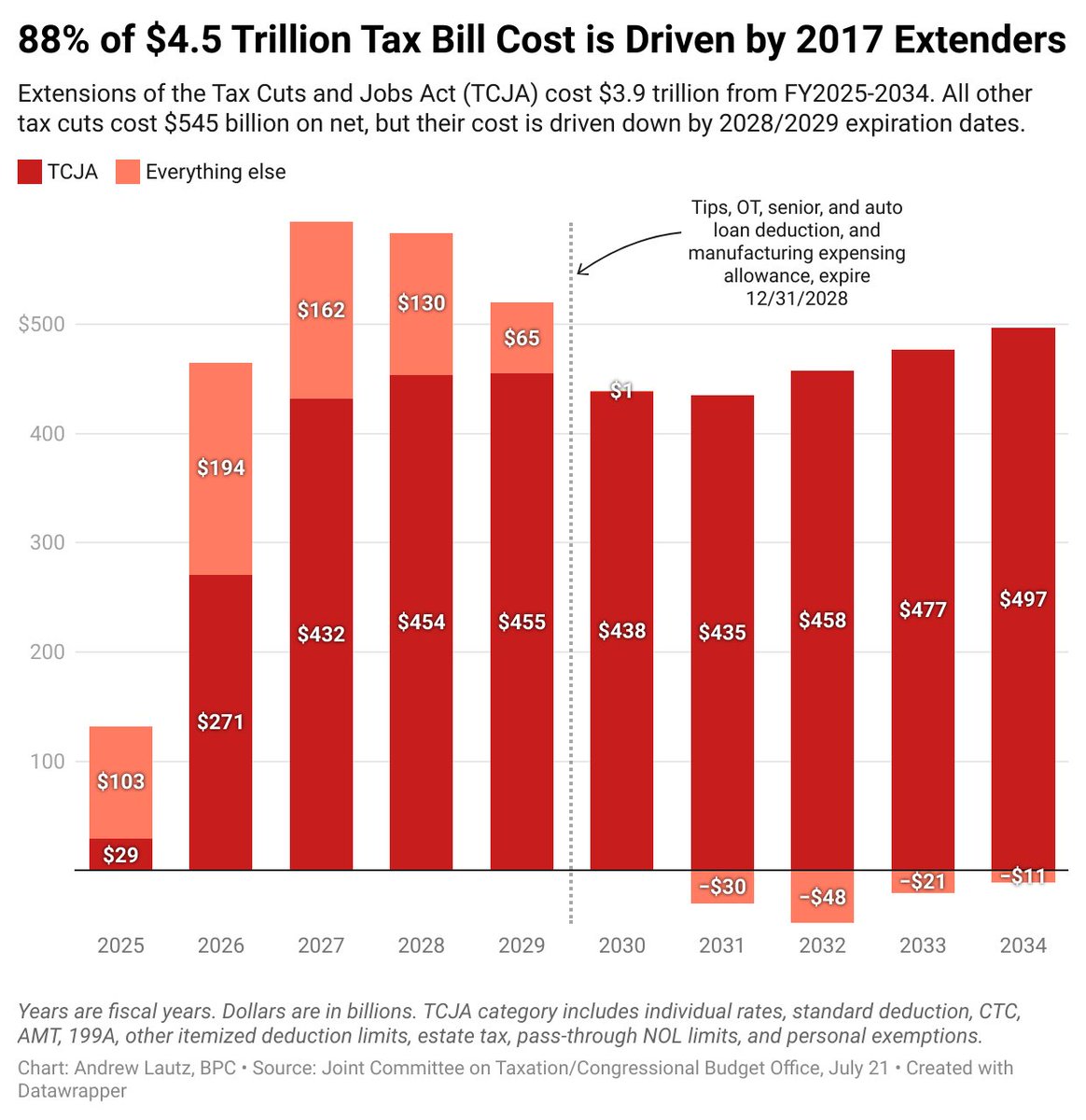

📊 Why do the One Big Beautiful Bill's tax cuts tally up to $4.5 trillion? Almost $0.90 of every $1 in tax cuts is just making permanent the expiring 2017 tax cuts. The remaining dime is for all the new stuff: no tax on tips, OT, etc.

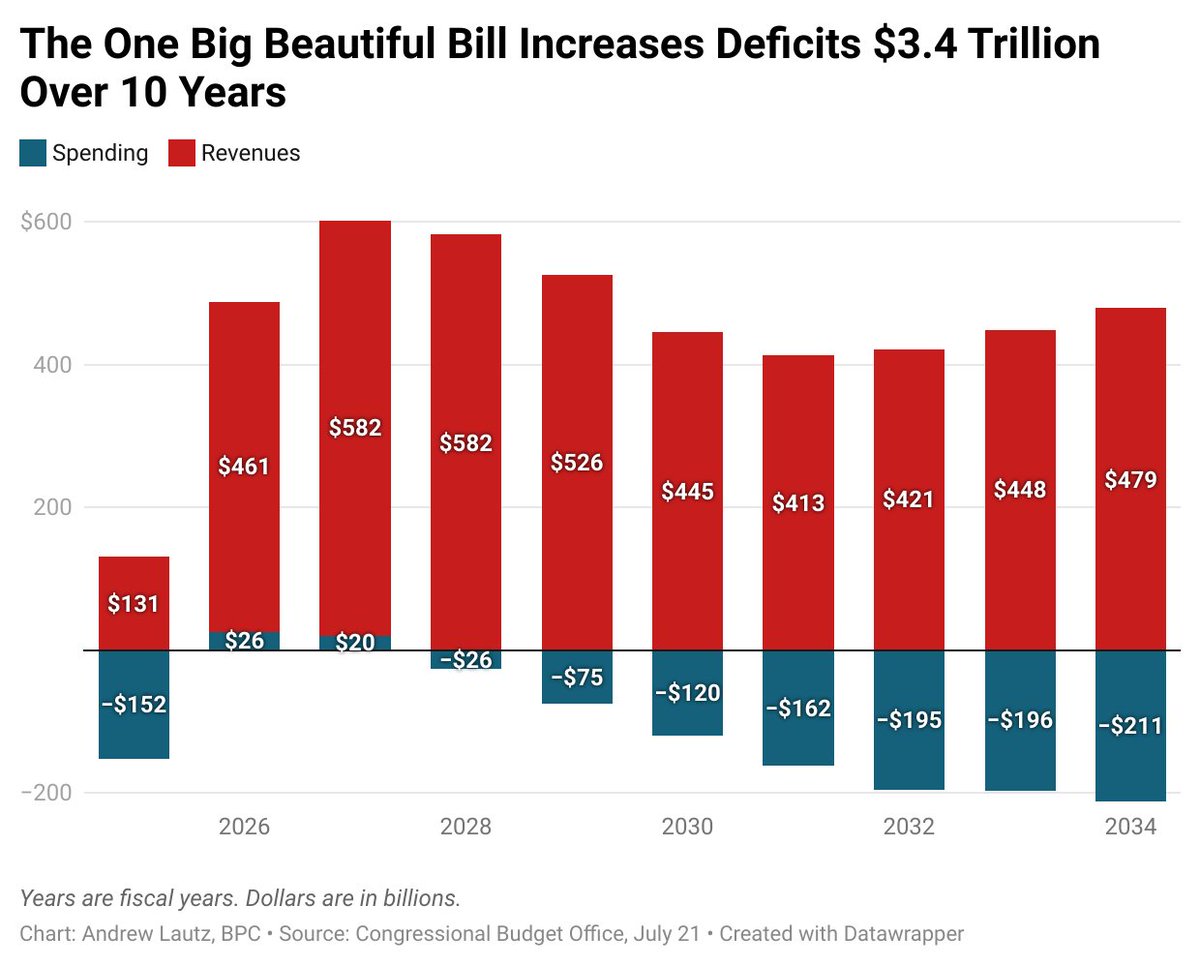

📈chart showing the One Big Beautiful Bill's cost under conventional current law (+$3.4 trillion) vs. bespoke "current policy" (where $3.8T in TCJA extensions are baked in). That's a big gap, which will be larger still if temporary tax cuts in OBBB (tips, OT) are made permanent.

Estimated Budgetary Effects of Public Law 119-21, to Provide for Reconciliation Pursuant to Title II of H. Con. Res. 14, Relative to CBO’s January 2025 Baseline cbo.gov/publication/61…

.@USCBO out with their official-official score of the One Big Beautiful Bill. I will have more charts later but here's the basic one showing: - Year over year tax cuts (+ = tax cut) - Year over year spending cuts (+ = spending increase, - = spending cut) cbo.gov/publication/61…

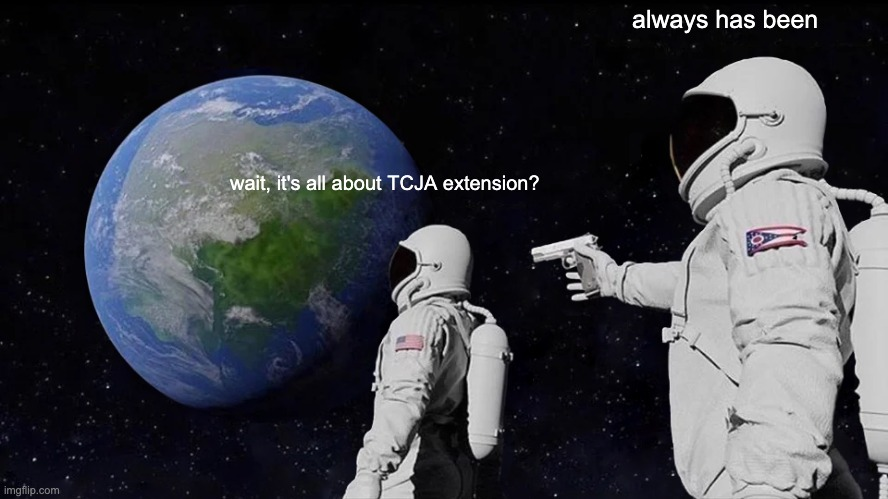

Enjoyed working with @Elaijuh and @tmthomasdc on this new @politico interactive. To sum it up: the cost has always been driven by extending TCJA! politico.com/interactives/2…

My predictions are rarely correct, but I think this DOES mean that the FY2027 reconciliation bill is going to be called OBBB3: Tokyo Drift.

Is the Speaker a Vin Diesel fan? Per Curtis Beaulieu, senior adviser for tax & trade to Mike Johnson, GOP leadership is referring internally to a follow-up reconciliation bill as "2 Big 2 Beautiful," a nod to the 2 Fast 2 Furious sequel to the movie franchise. from @doug_sword:

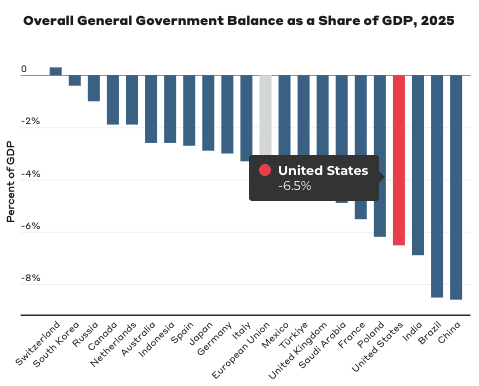

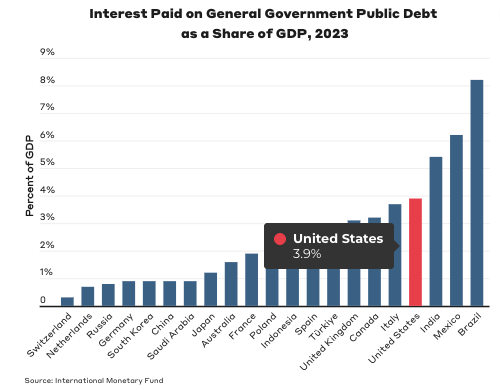

Ever wonder how U.S. government spending, revenue, deficits, and debt compare to our peers around the world? My colleague @ariannafano has you covered in this excellent new @BPC_Bipartisan explainer! bipartisanpolicy.org/explainer/u-s-…

A similar deduction limit was proposed by Simpson-Bowles, Obama, Dave Camp, and others. Kudos to OBBBA for actually enacting it. But right now, it’s tiny. It’s time to strengthen it.

Related to the improvement with the top rate described below, OBBB also adopted a new, better way of limiting the value of itemized deductions for taxpayers in the top bracket. OBBB's 37% top rate on a broader base is superior to a 39.6% top rate on a narrow base. Limiting…

For a more detailed explanation, @andrew_lautz and @RachelSnyderman at @BPC_Bipartisan published a great piece back on June 24: bipartisanpolicy.org/explainer/how-…

Related to the improvement with the top rate described below, OBBB also adopted a new, better way of limiting the value of itemized deductions for taxpayers in the top bracket. OBBB's 37% top rate on a broader base is superior to a 39.6% top rate on a narrow base. Limiting…

One of the best outcomes of OBBB for the politics of tax policy going forward is the permanent deletion of the 39.6% rate from the tax code. For 32 years — since its creation in 1993 — most Democrats considered 39.6 to be sacrosanct, the “perfect” top rate bracket over which it…

To the best of my knowledge, we don't have county-by-county data for the gambling loss itemized deduction. We DO have data for "misc." itemized deductions, ~80% of which were gambling losses in 2022. Anyone have a guess which county was #1 for misc. itemized deductions in 2022?

If anyone's curious, we have an enrolled bill on Congress.gov now for H.R. 1, the One Big Beautiful Bill Act. Link below. We also have a public law number - PL 119-21! (For reference, TCJA was PL 115-97.) congress.gov/bill/119th-con…

Some professional news, though not the biggest tax news you've seen this past week: I've been promoted to Director of Tax Policy @BPC_Bipartisan! Excited to continue a) working with a great team of colleagues here who make me better, and b) nerding out on tax policy every day.

I helped @ashhwu, @christinezhang, and the @nytgraphics team on this interactive quiz for folks to understand how the One Big Beautiful Bill Act affects them. I love these tools bc they help people grasp the impact of big laws like this. Check it out: nytimes.com/interactive/20…

Looks like JCX 35-25 will be our new JCX 67-17 after all! I am sure @andrew_lautz is looking forward to have 97 copies of these on his computer in the coming years. cc @RichardRubinDC