Art Berman

@aeberman12

I am a geologist and writer doing energy-related work. Energy is the economy so that covers economics, environment, geopolitics , ecology & human behavior

I'm no longer going to waste my time arguing with people about whether climate change and ecocide are real. If you want to ignore data & scientists who know far more than you or I can ever know, that's your choice. Act out your infantile fantasies somewhere else. #energy…

The world’s demand peak has quietly moved from winter to summer. China and India didn’t just raise global consumption—they rewired oil’s seasonal heartbeat. China doesn't use oil for winter heating like much of the Global North. bloomberg.com/opinion/newsle… #energy #OOTT…

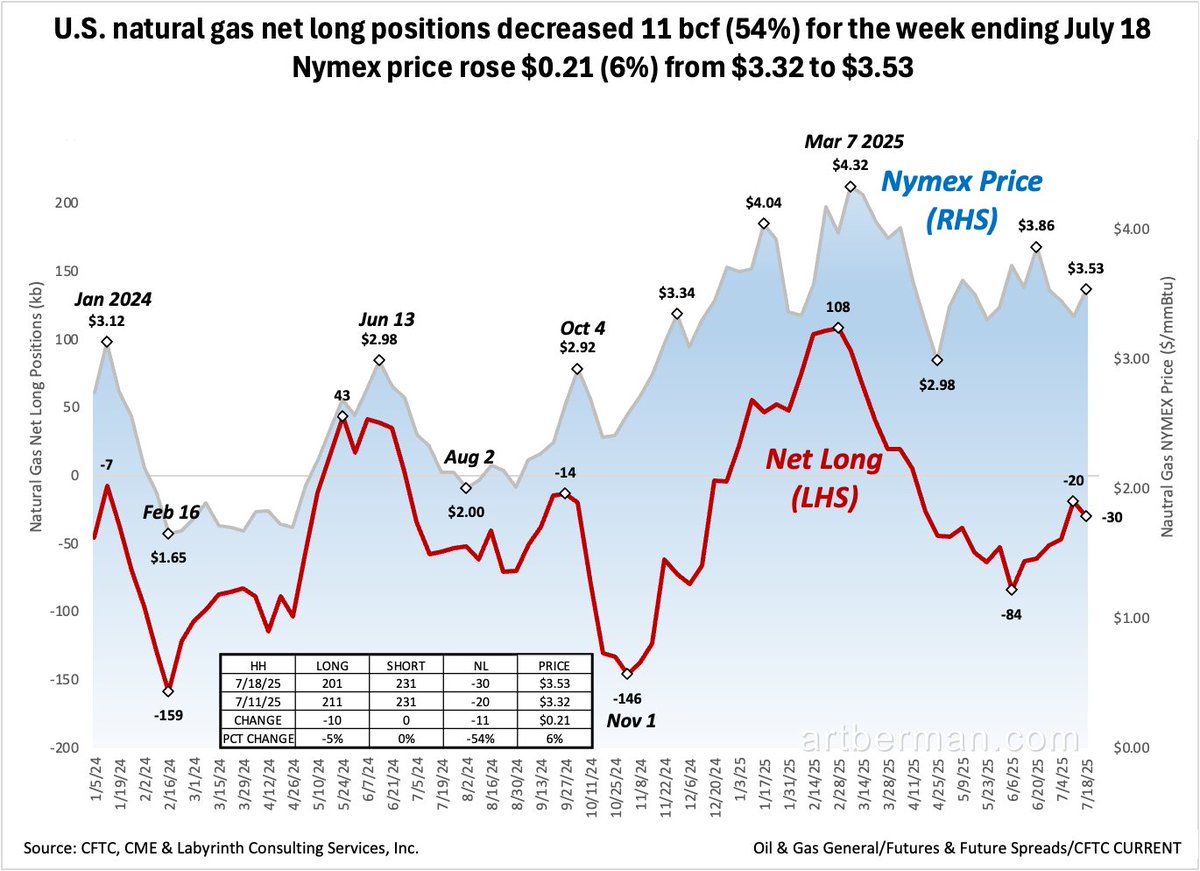

U.S. natural gas net long positions decreased 11 bcf (54%) for the week ending July 18 Nymex price rose $0.21 (6%) from $3.32 to $3.53 #energy #NaturalGas #shale #fintwit #oilandgas #Commodities #ONGT #natgas

The Scythians revolutionized warfare by combining horseback riding with powerful recurved bows around 650 BCE, writes @Peter_Turchin Mounted archers--the most important military revolution before gunpowder, transformed warfare & lead to what has become modern geopoltics…

The talk of peak oil demand is premature. As billions strive to escape energy poverty, real-world needs—not climate targets—will shape the future. Africa may be the surprise that rewrites the forecasts. arjunmurti.substack.com/p/super-spiked… #energy #OOTT #oilandgas #WTI #CrudeOil #fintwit…

When a free-market purist like Lacy Hunt backs tariffs, it's a wake-up call, writes @JohnFMauldin Free trade neoliberalism hollowed-out America's industrial base. Now, tariffs are the only way to restore resilience. mauldineconomics.com/frontlinethoug… #politics #geopolitics #Tariffs…

The total rig count in the US fell by 2 rigs to 542. The number of oil rigs fell by 7 to 415 and gas rigs rose by 5 this week to 12 oilprice.com/Energy/Energy-… #energy #OOTT #oilandgas #WTI #CrudeOil #fintwit #OPEC #Commodities #commoditiesmarket #NaturalGas #shale #ONGT #natgas

Hedge funds slashed bullish bets on U.S. crude to a three-month low. Net longs on WTI fell by 10,018 to 86,088 Brent positions dropped 11,352 to 227,393 in the week ending July 22. bloomberg.com/news/articles/… #energy #OOTT #oilandgas #WTI #CrudeOil #fintwit #OPEC #Commodities…

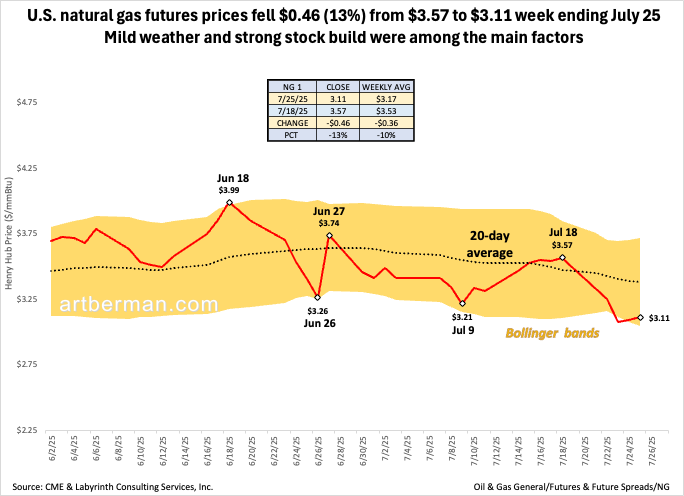

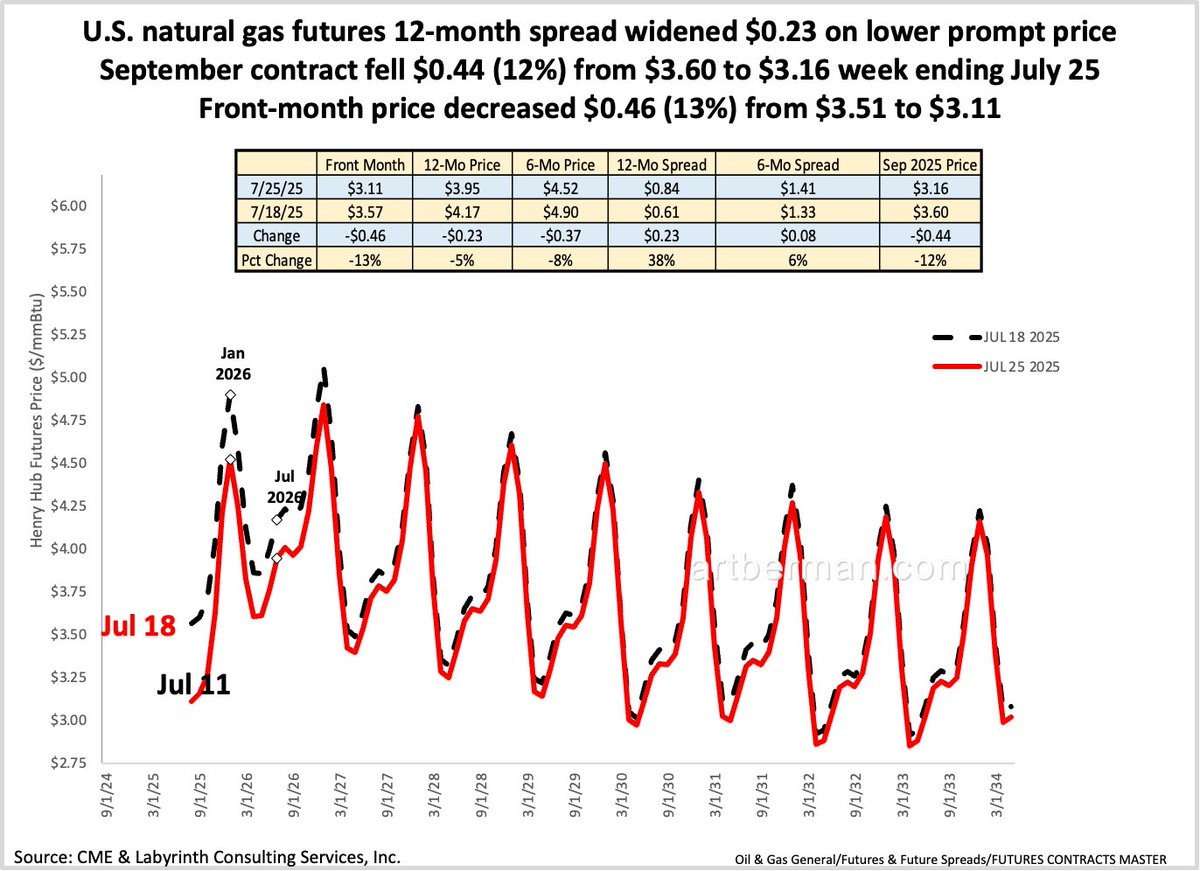

U.S. natural gas futures 12-month spread widened $0.23 on lower prompt price September contract fell $0.44 (12%) from $3.60 to $3.16 week ending July 25 Front-month price decreased $0.46 (13%) from $3.51 to $3.11 #energy #NaturalGas #shale #fintwit #oilandgas #Commodities #ONGT…

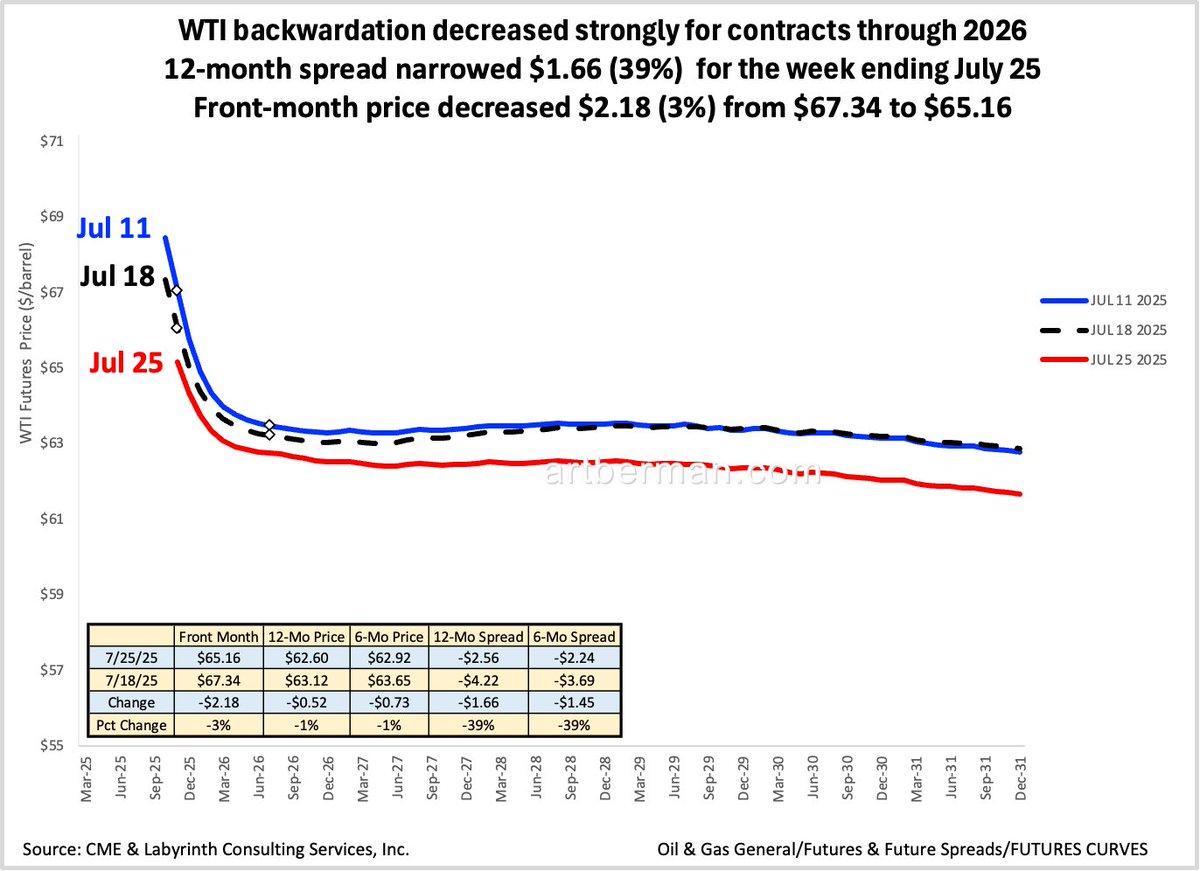

WTI backwardation decreased strongly for contracts through 2026 12-month spread narrowed $1.66 (39%) for the week ending July 25 Front-month price decreased $2.18 (3%) from $67.34 to $65.16 #energy #OOTT #oilandgas #WTI #CrudeOil #fintwit #OPEC #Commodities #commoditiesmarket

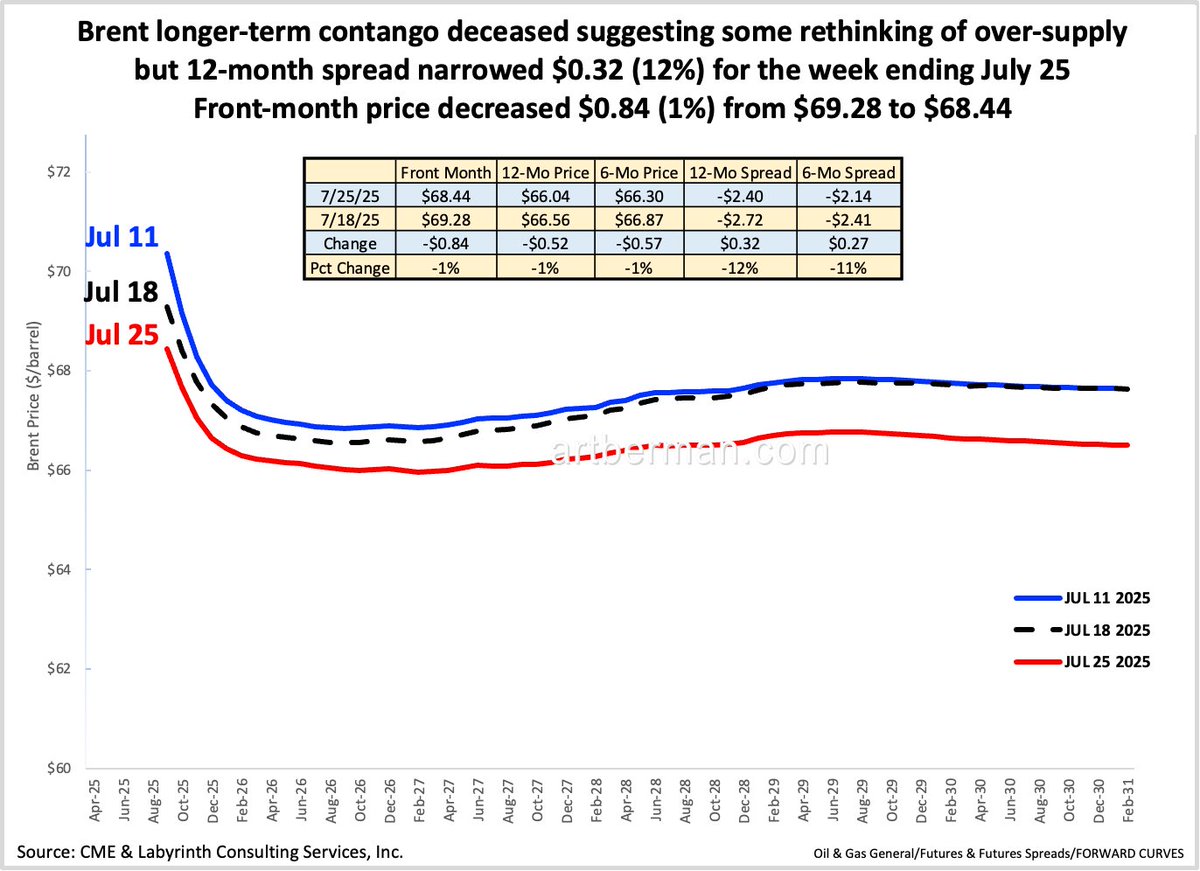

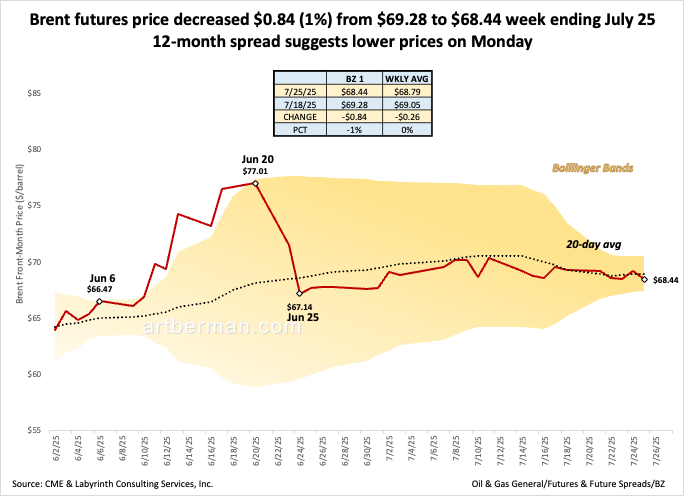

Brent longer-term contango deceased suggesting some rethinking of over-supply But 12-month spread narrowed $0.32 (12%) for the week ending July 25 Front-month price decreased $0.84 (1%) from $69.28 to $68.44 #energy #OOTT #oilandgas #WTI #CrudeOil #fintwit #OPEC #Commodities…

“The hype around nuclear and AI is deeply childish.” —Vaclav Smil elmundo.es/papel/el-mundo… #energy #EnergyTransition #ClimateActionNow #renewables #NetZero #EnergyStorage #ClimateCrisis #ClimateAction #GlobalWarming #Fossilfuels #oilandgas #WTI #CrudeOil #Commodities…

Data not platitudes & not pasted articles by journalists @todd_ramos How about you post propaganda on your own feed, not mine People on this one have seen nuclear hopium addicts come & go. We don’t need another w/ nothing new to show. artberman.com/?s=Nuclear

Each sector and subsector needs dedicated macro and micro analysis...especially a sector like nuclear energy, the supply side of what powers it, and the increase in energy demand that AI brings to the table, and how nuclear energy's role, worldwide, will increase....vs. decrease.

Small-scale, not yet operating & yet to prove commercial. A footnote—not a turning point—in U.S. energy policy @todd_ramos Show me the time line & cost to build enough nuclear plants to move any needle in the next decade or two. Then we have something to talk about.

nucnet.org/news/nrc-appro…

I haven’t watched F1 @mark_wraith

Tell me you don't watch F1 without telling me 😆

My expertise is energy @todd_ramos I know a lot about a lot—probably more than you. Behave or be blocked.

His expertise is oil. Use the hashtags #uranium and #nuclearenergy to find experts in the subsector. Such as @MalcolmRaw99915 who is a 40 year, nuclear energy, veteran.

Brent futures price decreased $0.84 (1%) from $69.28 to $68.44 week ending July 25 12-month spread suggests lower prices on Monday #energy #OOTT #oilandgas #WTI #CrudeOil #fintwit #OPEC #Commodities #commoditiesmarket

WTI futures price fell $2.18 (3%) from $67.34 to $65.16 for the week ending July 25 12-month spread suggests the possibility of lower prices on Monday #energy #OOTT #oilandgas #WTI #CrudeOil #fintwit #OPEC #Commodities #commoditiesmarket

U.S. natural gas futures prices fell $0.46 (13%) from $3.57 to $3.11 week ending July 25 Mild weather and strong stock build were among the main factors #energy #NaturalGas #shale #fintwit #oilandgas #Commodities #ONGT #natgas