Rob Anderson

@_rob_anderson

U.S. Sector Strategist at Ned Davis Research

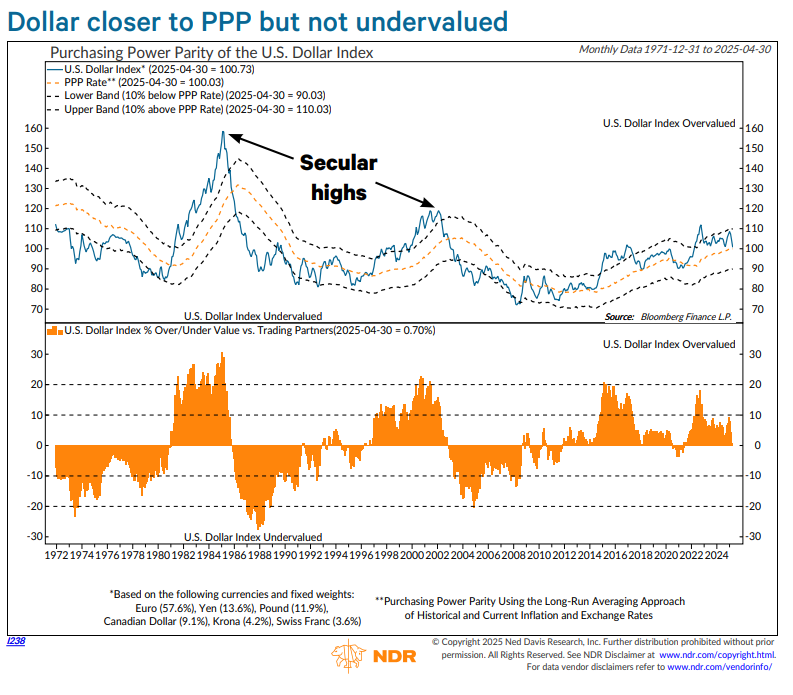

The U.S. Dollar Index has stabilized in recent weeks after plummeting during the first half of the year. From a PPP perspective, the dollar is no longer overvalued. However, prior secular tops saw the dollar overshoot, dropping to more than 20% undervalued in both 1987 and 2004.

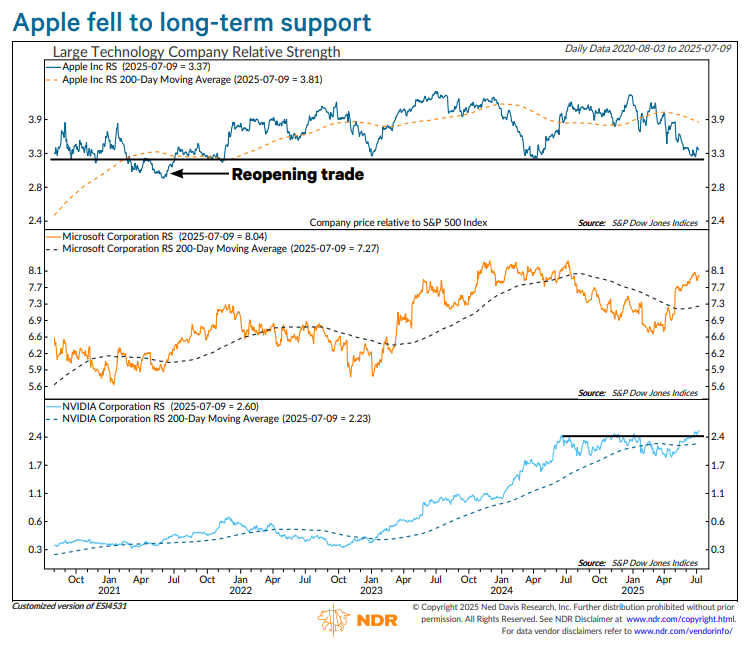

$AAPL now trades near the bottom of its five-year trading range, a level only breached during the reopening trade in 2021. A bounce would go a long way in keeping Tech a leading sector in the second half.

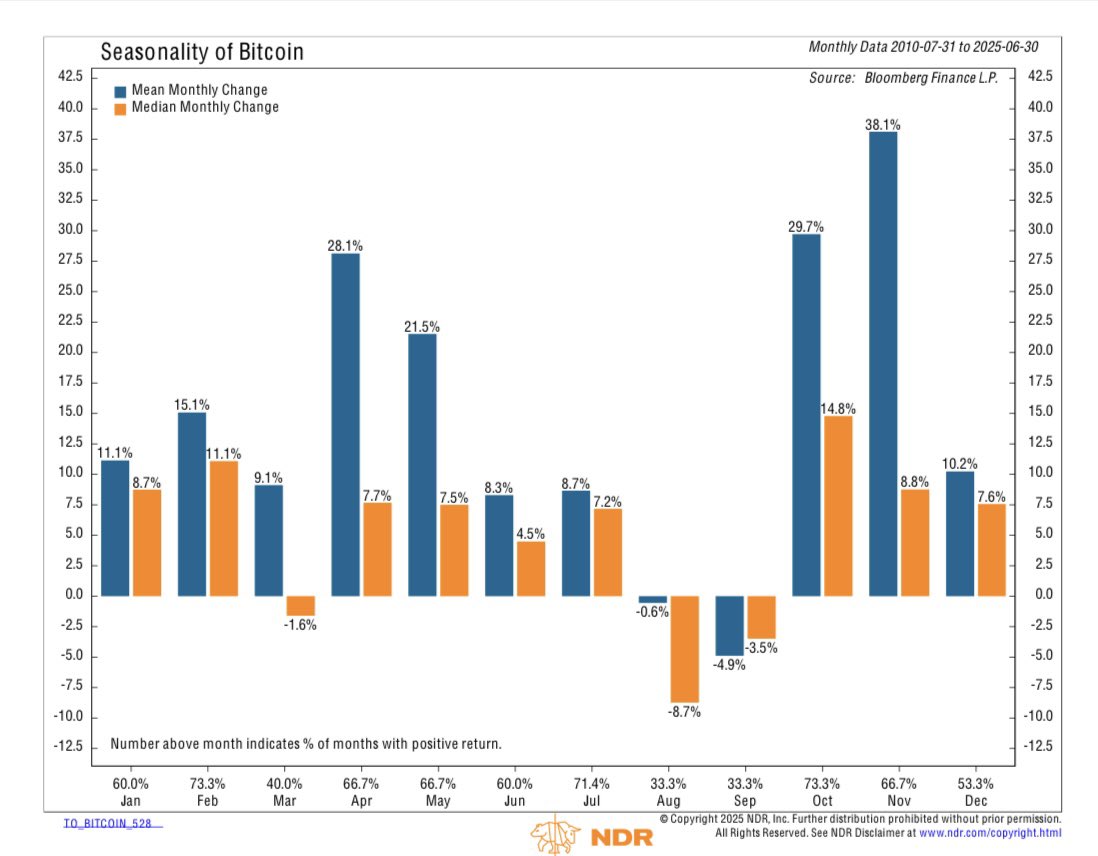

Bitcoin is entering its most difficult stretch of the year from a seasonal perspective. It has risen only a third of the time in both August and September with negative average and median returns.

Relatively stronger breadth from cyclicals over defensives is the type of participation expected during bull markets. Recently, defensive breadth has improved vs cyclical even as the S&P 500 has made new highs. The condition warrants monitoring as divergences can precede selloffs

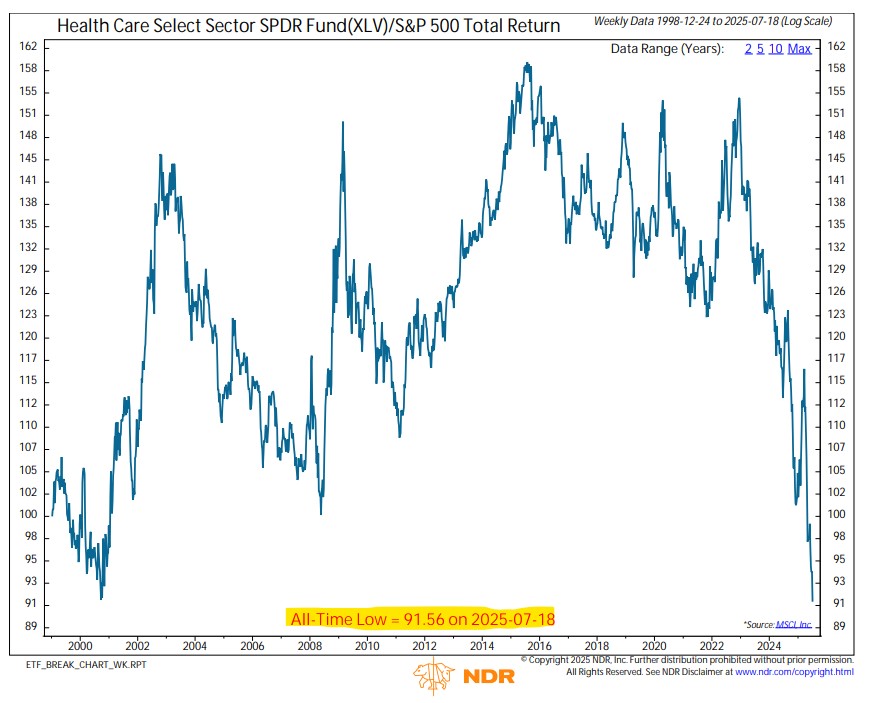

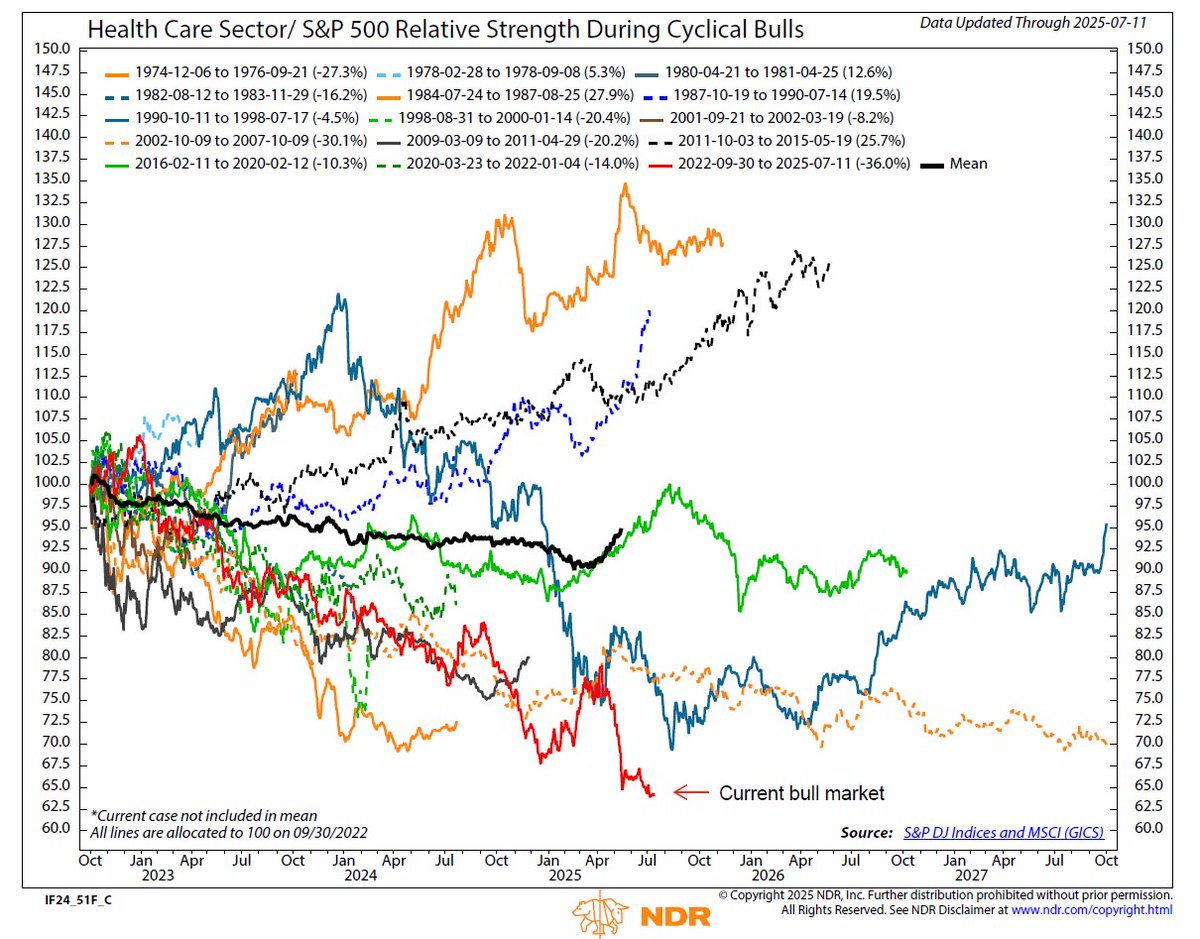

Pardon me for another Health Care chart. $XLV / $SPY

NEWS: 5⭐️ Jason Crowe Jr. has committed to Missouri, source told @Rivals. He’s the program’s second-highest ranked recruit ever — only behind Michael Porter Jr. The 6-3 guard and top-10 player chose the Tigers over Kentucky, USC, others. Monumental pickup for Dennis Gates.…

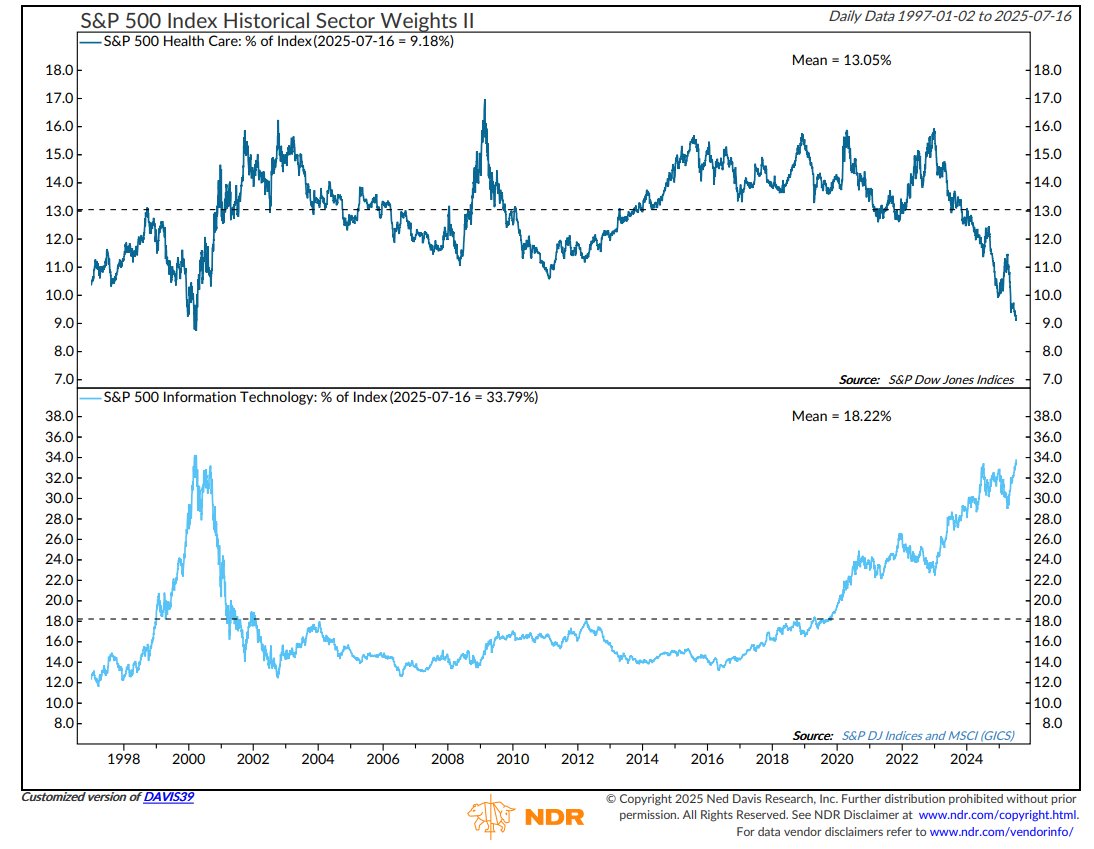

Both Health Care and Technology weights in the S&P 500 are currently the most extreme since March 2000.

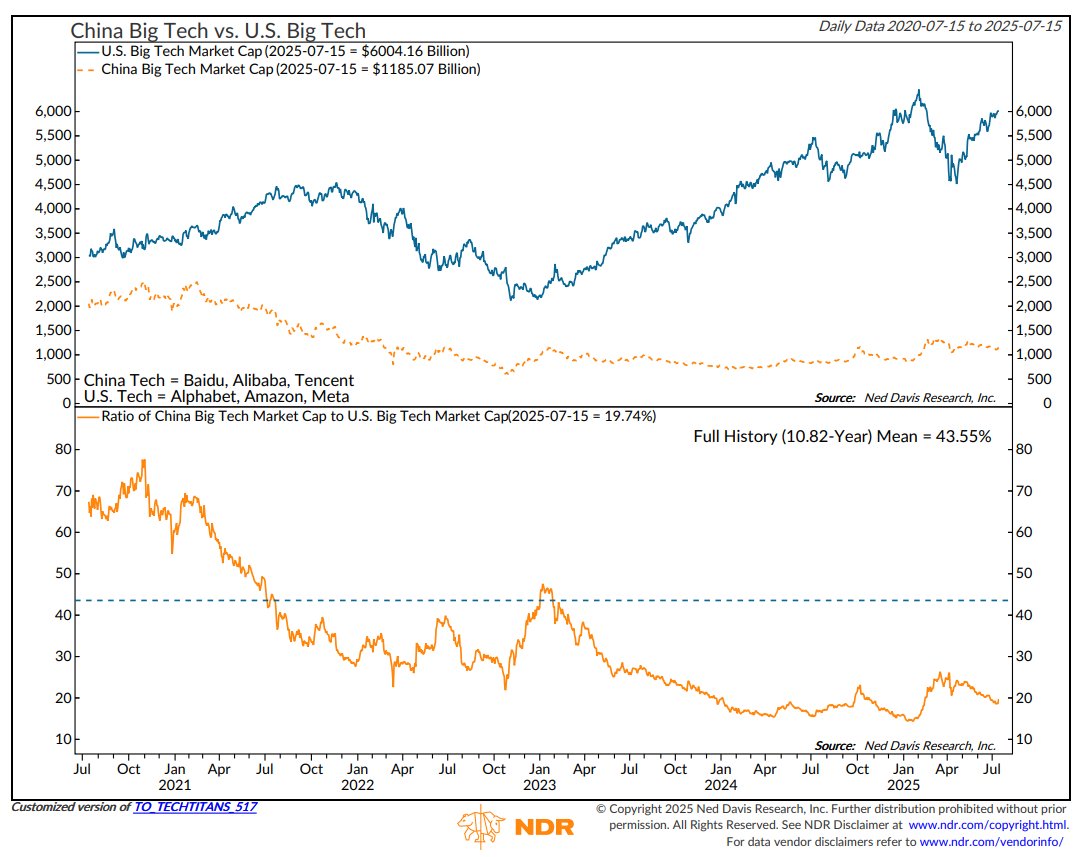

Amid the China tech rally, here is some longer-term perspective. Over the last 5 years, U.S. big tech has roughly doubled, while China big tech has been cut in half. The combined market caps of $BIDU, $BABA and $TCEHY is 20% of their American counterparts $GOOGL, $AMZN and $META.

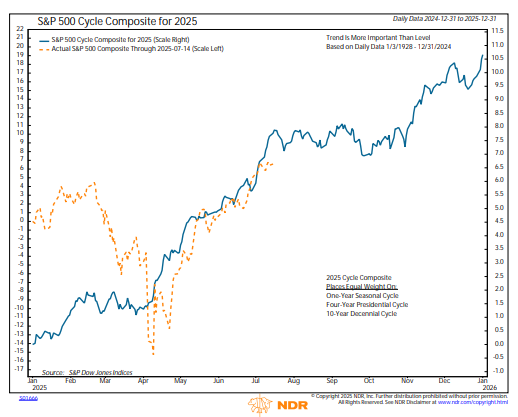

The NDR Cycle Composite shows we are entering a less bullish phase of the year from a seasonality perspective. Despite the volatility, 2025 has so far tracked the trend closely.

Another test for one of the key pillars of the bull market tomorrow.

This is Helene Meisler You might have noticed my account was hacked by some crypto spammer. Getting it back seems unlikely. You can now find me over on Bluesky at hmeisler. If you could could RT this so that the word gets out that Dune is not me, I would really appreciate it

Another perspective on the magnitude of Health Care underperformance.

Update - No signs of a bottom for Health Care. The sector has now trailed the S&P 500 by almost 60% over the trailing three years, the worst stretch ever for the sector.

Persistent underperformance has left Health Care deeply oversold. The sector has lagged the S&P 500 by a staggering 42% over the last 3 years. Prior three-year oversold readings that approached or exceeded 2.0 standard deviations have occurred near relative lows for the sector.

Persistent underperformance has left Health Care deeply oversold. The sector has lagged the S&P 500 by a staggering 42% over the last 3 years. Prior three-year oversold readings that approached or exceeded 2.0 standard deviations have occurred near relative lows for the sector.

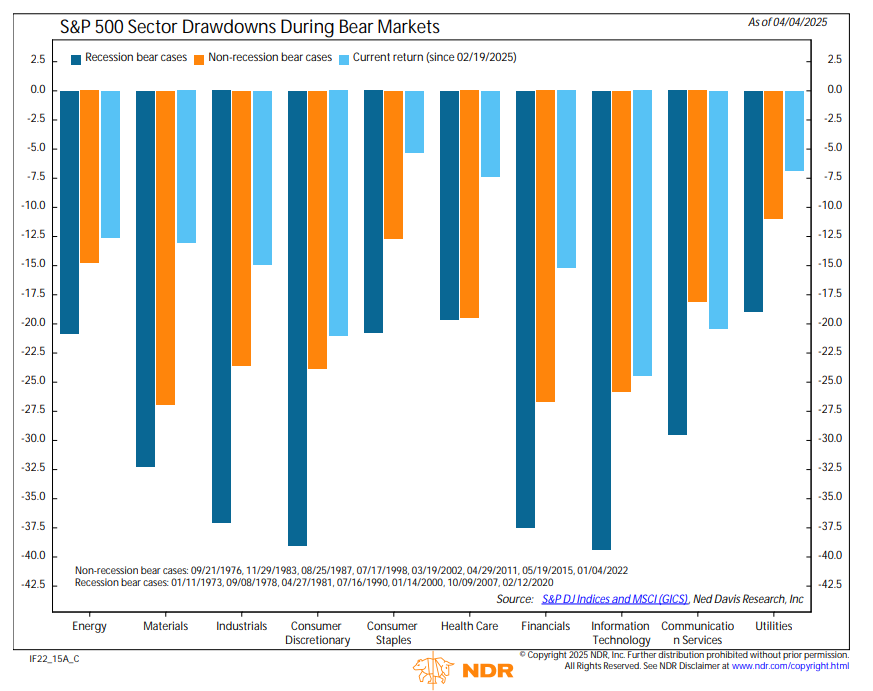

The S&P 500 is off 17% from the high vs. an average drawdown of 25% for bear markets with no recession and 35% for bears that overlap with a recession. Growth sectors have fast approached their non-recession averages, but all have much more downside risk if there is a recession.

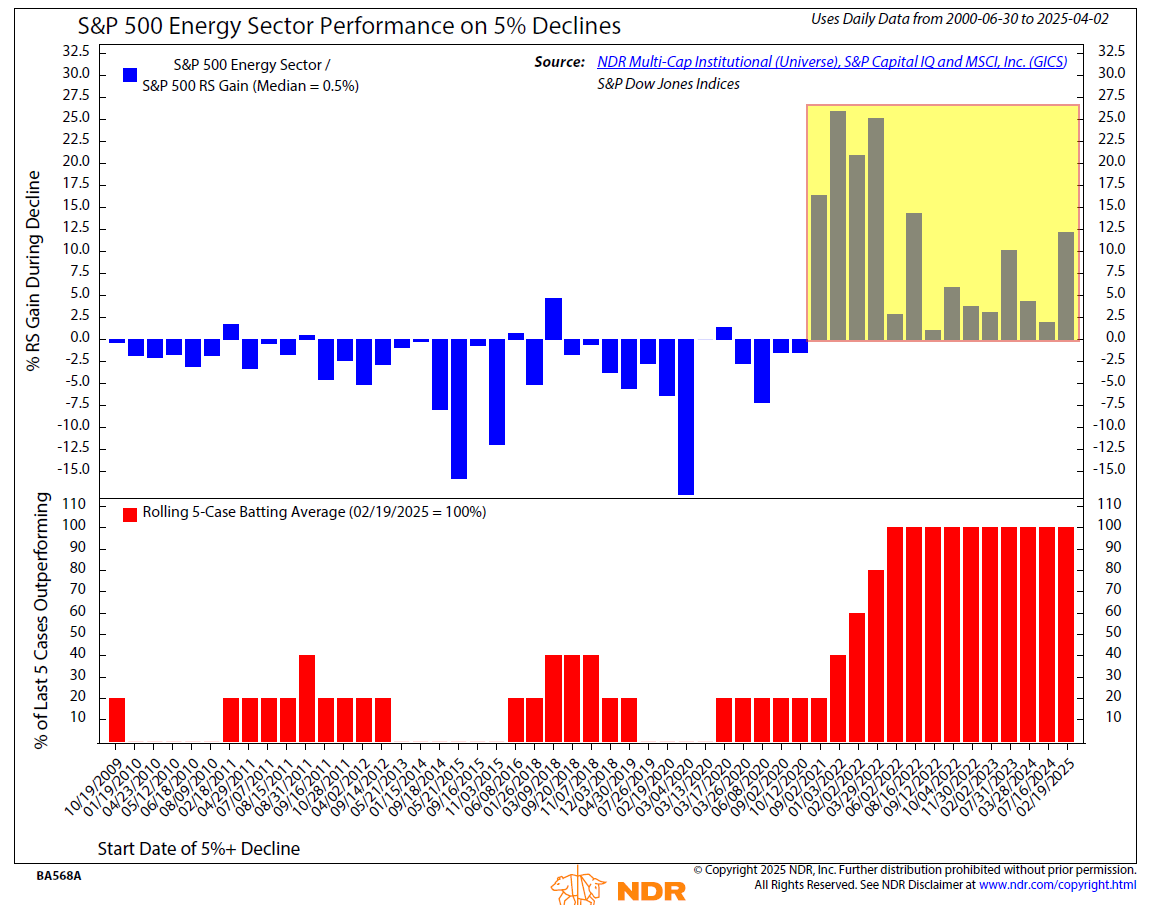

Energy, which has been the most defensive sector since 2021 - outperforming during the last 14 S&P 500 declines of 5% or greater - is down big today. A continuation could signal a narrative shift for the sector from inflation hedge beneficiary to a potential recession loser.

For those interested, Tech underperformed the S&P 500 by 8.6% in Q1. It was the sector's worst quarter relative to the index since Q2 2006 and the worst Q1 since 2001.

The Tech sector is on track for its worst Q1 relative to the S&P 500 since 2002 and its sixth worst since 1972. Following prior weak Q1s by the sector, weakness has tended to persist, with additional underperformance in Q2 and Q3, on average. 1/3