Brittany Lewis

@_brit_lewis

Assistant Professor @WashUOlin | Ph.D. @KelloggSchool

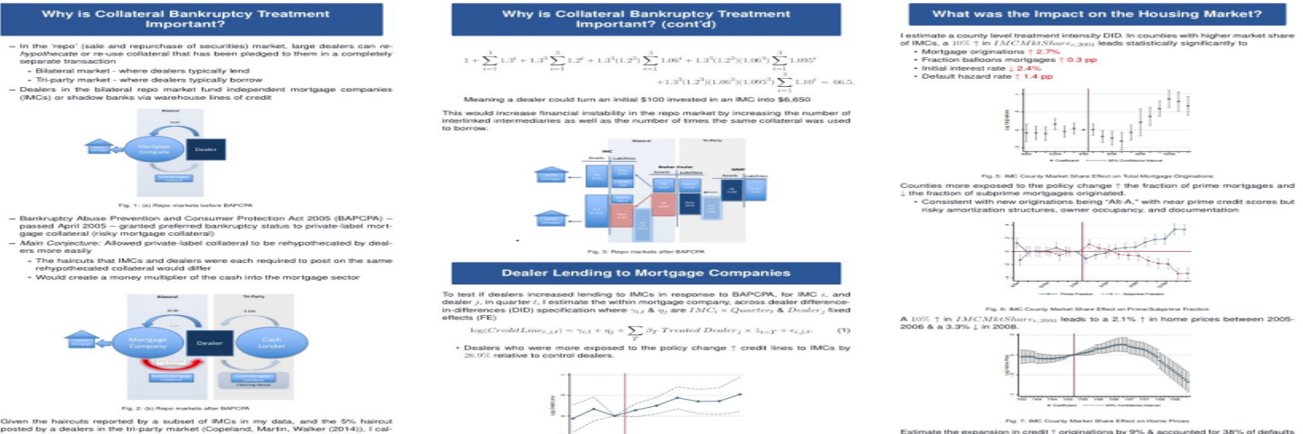

Just finished my poster ⬇️ for the ASSA on “Creditor Rights, Collateral Reuse, and Credit Supply.” It explains the money multiplier generated in the repo markets and it’s affect on credit supply! (Paper here papers.ssrn.com/sol3/papers.cf…) Conference link ➡️ aeaweb.org/conference/

Some questions triggered by the release of DeepSeek R1 on January 20. These are formulated as questions, because I do not know the answers and it may well be that most of these answers are only things we can find out over time. First, perhaps the most important question is this:…

Excited to join @AoifinnDevitt’s podcast tomorrow to discuss the current landscape of financial regulation, unintended consequences of past regulation, and alternative investments. Join us at live at #Moneta Wealth Management if you’re in Clayton!

Great work @Simon_Mongey @tradewartracker ! Check out Gupta (2025) which shows these facts in the Indian context! ➡️ papers.ssrn.com/sol3/papers.cf…

Very neat! this lines up well with the results by Gupta (2024) that demonstrate these facts using Indian data. Cool to see this in a macro framework papers.ssrn.com/sol3/papers.cf… @Simon_Mongey @tradewartracker

Submit submit! @menaka_hampole @greg_buchak @veecy3401 @TahaChoukhmane @mboutros_econ @_brit_lewis @JuliaAFonseca @JanSchneemeier @luliu_fin @ioannisspy @DecairePaul @alz_zyd_ @Ed_Van_Wesep @JacobCConway @SashaIndarte @VrindaMittal2

Call for papers for the very 1st UMass Amherst Finance Conference isomfinancedept.wixsite.com/finance-confer… The conference is on Friday, May 9, 2025 The deadline for submitting your paper is February 1 @econ_conf #econtwitter @UMassAmherst @IsenbergUMass

As a member of the Rising Scholars Committee for #EasternFinanceAssociation, I wanted to share that the call for papers is due tomorrow 9/30/24 & has a no fault dual submission with @TheFinancialRev. I will be on the committee choosing PhD paper awards! easternfinance.org/2025-meeting/

Black and Hispanic homeowners earned higher rates of returns on housing than White homeowners from 1974–2021, driven by higher rental yields for minority owners, from @rebeccardiamond and @wdiamond_econ nber.org/papers/w32916

Just posted a new paper: "Racial Differences in the Total Rate of Return on Owner-Occupied Housing" with @rebeccardiamond . We examine racial inequality in "total returns:" house price appreciation, a home's rental value, property taxes, and maintenance. papers.ssrn.com/sol3/papers.cf…

One of the most striking charts this year: China’s startup ecosystem has almost completely collapsed in the last 5 years.