Tim Quast

@_TimQuast

Founder/CEO of ModernIR and Market Structure EDGE LLC. Invented Market Structure Analytics for IR. Expert on equity market structure.

Weave @tourdefrance_25 into weekly blog: Check. The market has been like Mont Ventoux - a big climb. There's also a big descent off Ventoux. modernir.com/does-anybody-k…

Round of applause for @WSJ Heard writer @Spencerjakab for today's great piece: Why are stock up? Nobody knows. wsj.com/finance/stocks…

As the @EdgeStructure mob knows, new options for August expiration traded today. Stocks started strong and finished weak on less demand for leverage than anticipated. Tomorrow is #CounterpartyTuesday when the books on these and the ones expiring last week are squared.

I remind everyone, because I've not heard it mentioned anywhere by anyone, that the market is up today because of #index #options expirations. Tomorrow are #stock options expirations. The arbitrage trade between them is the same that Jane Street pursued in India (in wklys).

This view of $GPN shows one predictive signal of #activism. If at options-expirations, there's mass #short covering, it may be somebody building a stake. The trouble is, Elliott and other activists don't create shareholder value. Their targets are booted from #Passive baskets.

What if the #stockmarket isn't priced by #tariffs or #inflation or whether the President fires the Fed Chair? Then we're looking in the wrong places for #risk. modernir.com/heuristics/

I don't think most appreciate how anomalous conditions have been Apr-Jul 2025. Almost never does this relationship -- converging Demand/Supply -- produce gains. It did in June 2025. It did not today.

Always beware of Context -- cadence and calendar of the market. This is the calendar (as earnings kick off):

The US economy is a massive aircraft carrier. The @federalreserve tries to manage rates like one person swimming out front with a tow rope. It's cognitively dissonant, destined to fail. The Fed does not try to prevent tulip manias. The Fed tries to prevent falling prices.

$NVDA update: Demand/Supply divergence spurs gains. Check. Now, Supply is rising. Demand is strong -- but that's convergence now, not divergence, into next week's options-expirations. @EdgeStructure

I'm traveling so market strategist Brian Wilson is hosting the @EdgeStructure discussion. Snippet from his Market Desk note today (free signup for those). A few seats left at 230p ET: calendly.com/marketstructur…

Five more single-stock leveraged #ETFs start trading today, courtesy of @CBOE. This kind of exposure is now a major characteristic of large-cap stocks, outranking sector and fundamentals. It's one reason why the market is no longer a reliable barometer for earnings multiples.

Here's why $CORZ isn't getting love on the $CRWV deal. Supply most times in deals moves down sharply. Not so here, so price has fallen. Meaning? Obstacles to the deal?

One more, $AVGO. Over three years, it's gone from a #value stock (lots of time at 5.0), to #momentum (bouncing from 1 to 10), to for the first time having a pattern like $NVDA recently. What's made it more volatile since mid-2024 is a steep drop in Supply (short volume).

As $NVDA hits $4T, here's a simple way to know when to own it: When Demand hits 10.0 and then remains over 5.0. When Demand breaks below 5.0, wise to leave. That nearly happened at June opex. Options expire next week.

Ahead of the open, here's our take on the Jane Street saga in India. #arbitrage is massive, issuers and investors. You need strategies for navigating it. modernir.com/merry-jane-str…

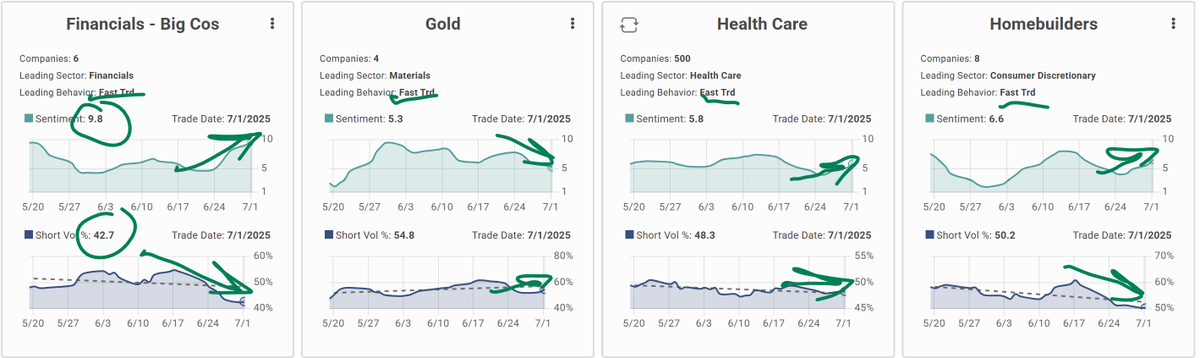

A row of portfolios from my @EdgeStructure dashboard. Big six banks are 9.8 Demand, 42.7% Supply (Reg SHO rule 201 data). Smoking. But near a top. Gold, converging, weaker. a $ spike coming? Healthcare, some divergence, good. Homebuilders, about to top. Fast Trading leads all.

As the #momentum market bears down on monthly jobs data, here's something to ponder. Half of you will disagree. You can send me hate posts. modernir.com/open-letter/

Wrote this for the @IBKR quant blog: interactivebrokers.com/campus/ibkr-qu…