Zharta Finance

@ZhartaFinance

Where assets turn into liquidity. Boost your gains with the ultimate Finance tools for NFTs, AMM LPs and RWAs.

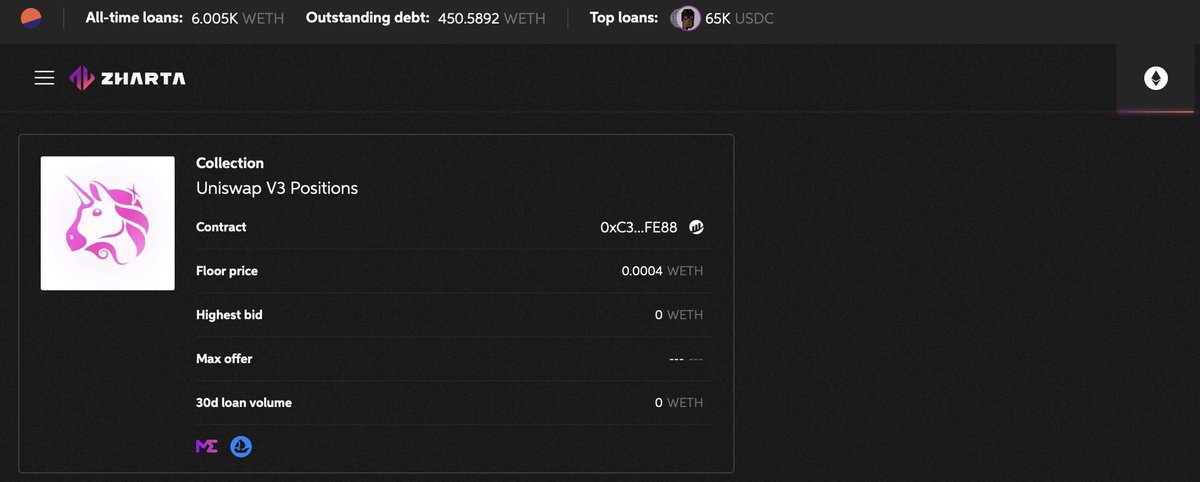

You’ve been underusing your Uniswap LP positions. That ends now For years, LP tokens just… sat there. Earning fees, yes — but totally illiquid Capital locked. Strategy stalled Not anymore With LP-as-collateral, you can now borrow stablecoins against your LPs → Unlock…

There’s a quiet shift happening in DeFi No longer just about eye-popping yields, it's becoming the backend of modern finance where apps abstract the rails, institutions bring scale, and RWAs unlock capital The infra is maturing. And the surface is just starting to reflect it

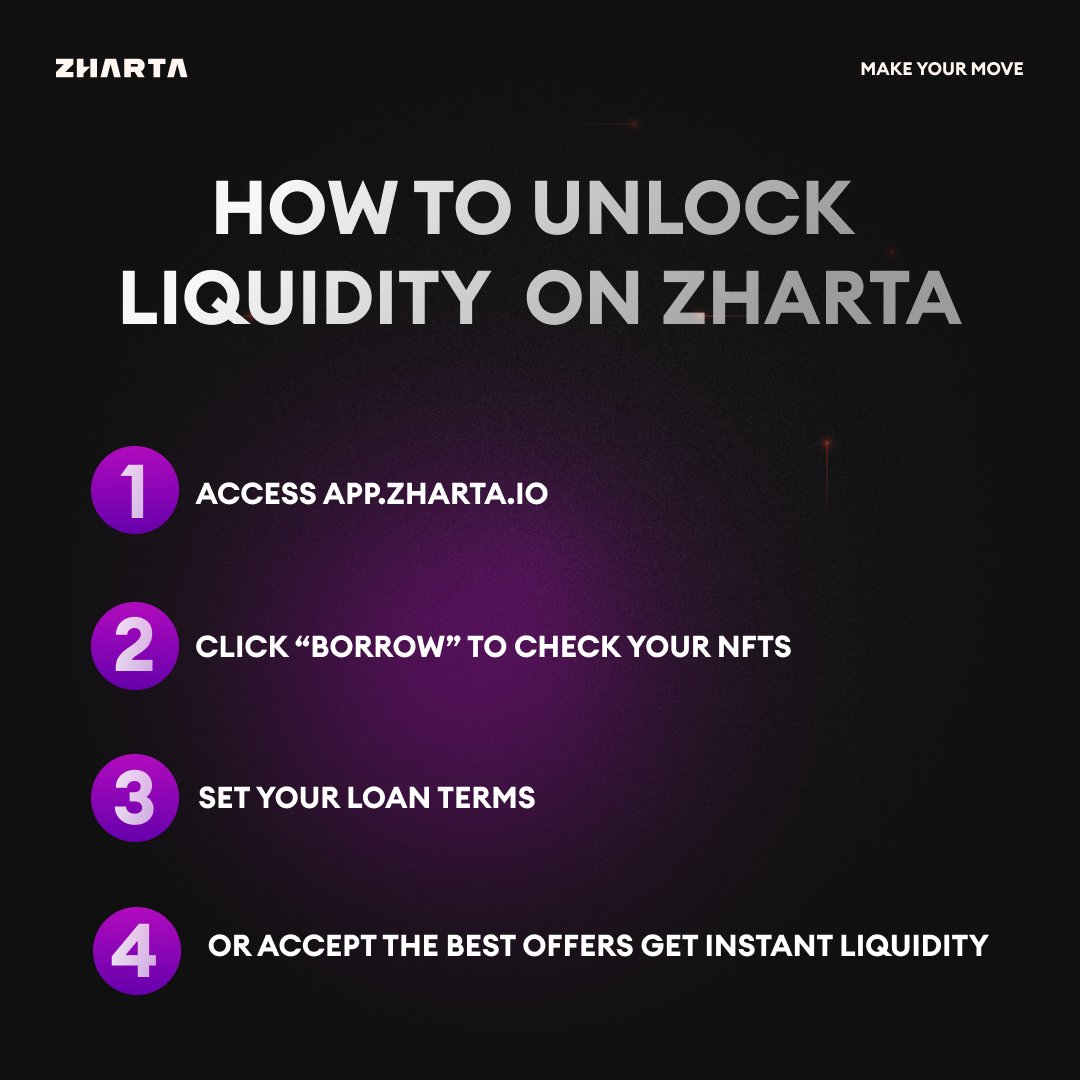

DeFi starts with what you hold On Zharta, you can unlock liquidity directly from your assets, no need to sell, no strings attached 📍 Just connect your wallet, check your assets, set your terms, and borrow onchain From LP tokens to tokenized assets, your collateral is already…

We’re building credit rails for DeFi.. As institutional interest in DeFi grows, so do the expectations They’re not just looking for yield, they need structure ✅ Stability without friction ✅ Collateral flexibility ✅ Smart contract transparency ✅ Composability across…

DeFi isn’t a trend , it’s the infrastructure of tomorrow Transparent, permissionless, and built to scale The future of finance is already being deployed...

Why put your crypto assets to work as collateral? Here are 3 reasons that go beyond the usual “loan” narrative: 1️⃣ Stay exposed, stay positioned Using your assets as collateral doesn’t mean leaving the market. Whether it’s USDC, LPs, or NFTs, you retain upside while unlocking…

The Future of DeFi: Institutions Need Structure to Enter the Game As DeFi evolves, institutions are drawn to its flexibility and composability. But participation at scale demands more than interest, it requires infrastructure Bridging both worlds calls for more than code. It…

Earn yield by lending to @Uniswap LP-backed positions At Zharta, liquidity providers can unlock credit by using their Uniswap LP tokens as collateral, without unwinding their positions or missing out on fees As a lender, you provide liquidity and earn interest, with your loan…

🔗 DeFi’s real unlock? Composability Protocols stack like money legos, enabling rapid innovation, programmable finance, and capital efficiency Why does it matter? Because composability lets builders extend and interconnect financial primitives, permissionlessly This isn’t…

Not all collateral is static LP positions like Uniswap v3 concentrate liquidity, shift exposure, and evolve over time At Zharta, we've built infrastructure to support this kind of composability, with the precision it demands Live at Zharta. Pushing the boundaries of what DeFi…

DeFi isn't just about unlocking capital It's about directing it, across systems that increasingly depend on each other That requires intent. Structure. And respect for the rails value moves on We've taken that seriously from day zero... Because in DeFi, how capital moves is…

DeFi protocols are entering a new phase... The direction is clear: capital must flow more efficiently, systems must compose with minimal friction, and users, retail or institutional, must understand the risk environment they’re operating in These aren’t burdens on innovation.…