RS

@WithRitesh

Full Time Trader. Economy | Politics. Former Head of Capital Markets at Bank of America. Modi + Yogi era. Select Posts in Highlights!

Risk off sentiment in the markets. #realestate

रियल्टी इंडेक्स 5वें दिन टूटा Jul 28 -3.50% Jul 25 -0.99% Jul 24 -1.04% Jul 23 -2.60% Jul 22 -1.01%

Over the last three weeks, good price correction seen across sectors and stocks. Nifty overall now sits at close to zero return in last one year.

Kotak Mahindra joins HDB Financial in highlighting pain in commercial vehicles.

Some pain points, highlighted by lenders: 1. Bajaj Finance - MSME & two wheelers 2. HDB Fin - Commercial Vehicle 3. AU SFB - Secured retail 4. L&T Finance - Collection in SME loans

Investec on TCS.

So much pessimism around India’s growth and IT sector relevance just because TCS is cutting 2% workforce combined across all verticals/geography. The crowd is really shortsighted and jumps to obituary of everything. We love disruption in growth. TCS annual attrition is ~84,000.…

So much pessimism around India’s growth and IT sector relevance just because TCS is cutting 2% workforce combined across all verticals/geography. The crowd is really shortsighted and jumps to obituary of everything. We love disruption in growth. TCS annual attrition is ~84,000.…

Who will win: Reliance or Blinkit? Quick commerce in India is no longer a question of whether it’ll scale—it’s a question of who’ll own it, or at least a significant chunk of it.

Kotak Mahindra Management says: Elevated slippages on account of MFI and Commercial vehicle portfolio. NIM contraction due to repo rate cuts. (On expected lines)

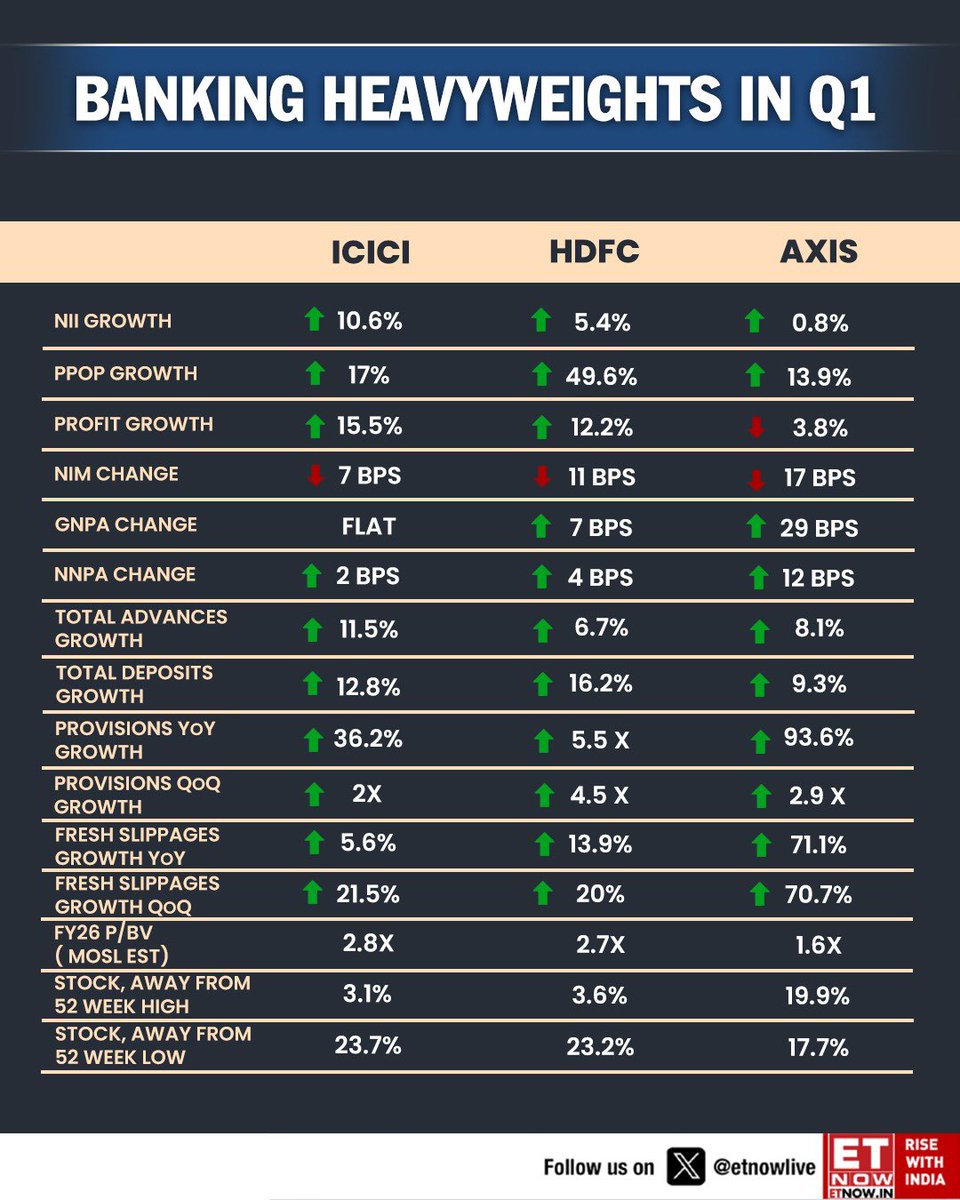

Axis Bank fell 5% on its numbers. Kotak Mahindra will face similar fate?

"My only measure of success is how much time you have to kill." — Nassim Taleb

"Psychology swings much more than fundamentals, and usually in the wrong direction or at the wrong time. Understand the importance of resisting those swings—profit if you can by being counter-cyclical and contrarian." — Howard Marks

Finally, Income Tax recognises the following professions: 1. F&O Trader 2. Speculative Traders 3. Social Media Influencers

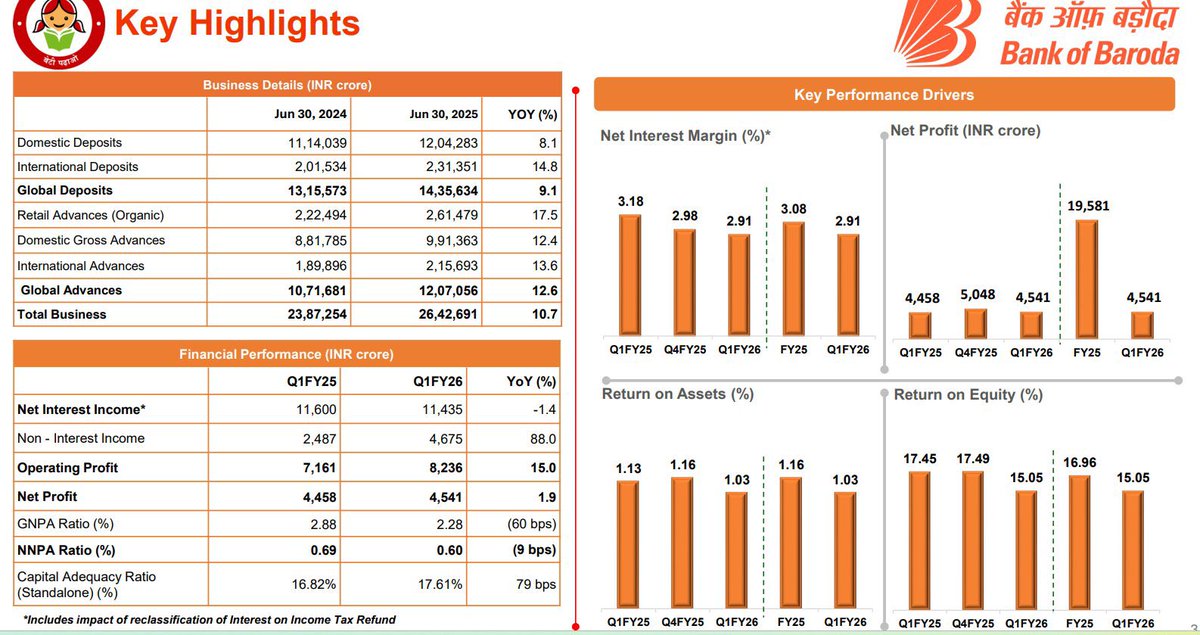

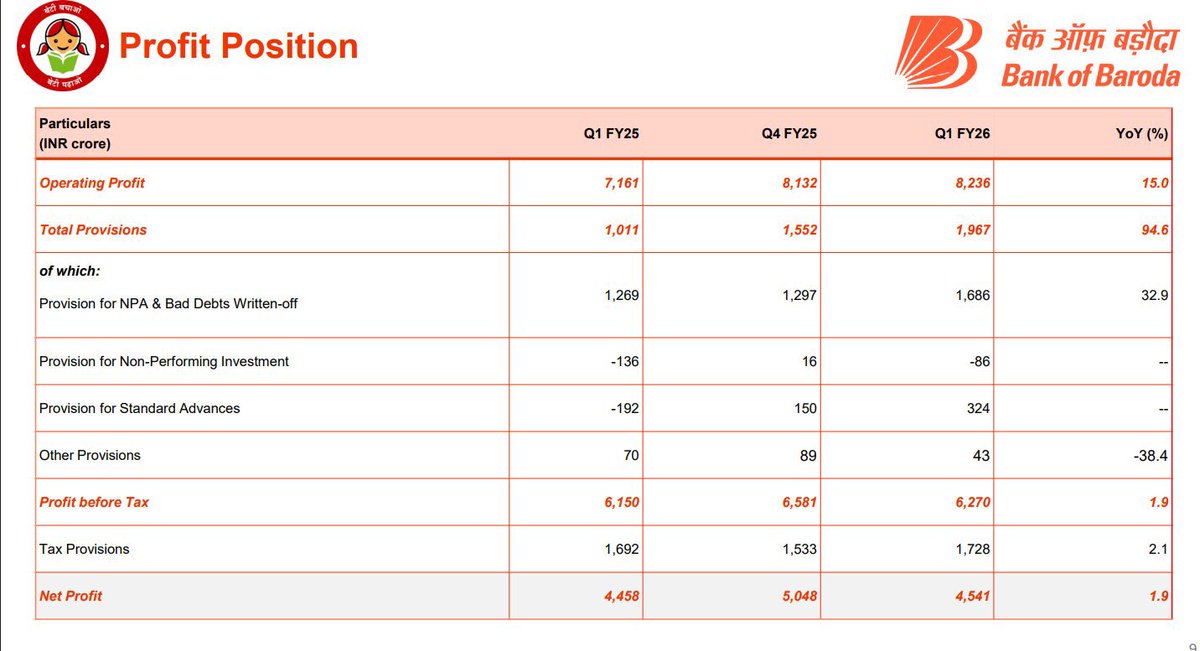

Bank of Baroda NII dropped -1.4% YoY. It increased for big private banks. BoB NIM is flat at 2.91% vs last quarter. NIM’s dropped for big private banks. BoB advances is better than private banks. Asset quality has improved. Operating profit growth is 15%. Provisions are…