13D Research & Strategy

@WhatILearnedTW

Knowledge is a competitive advantage. We want to share it.

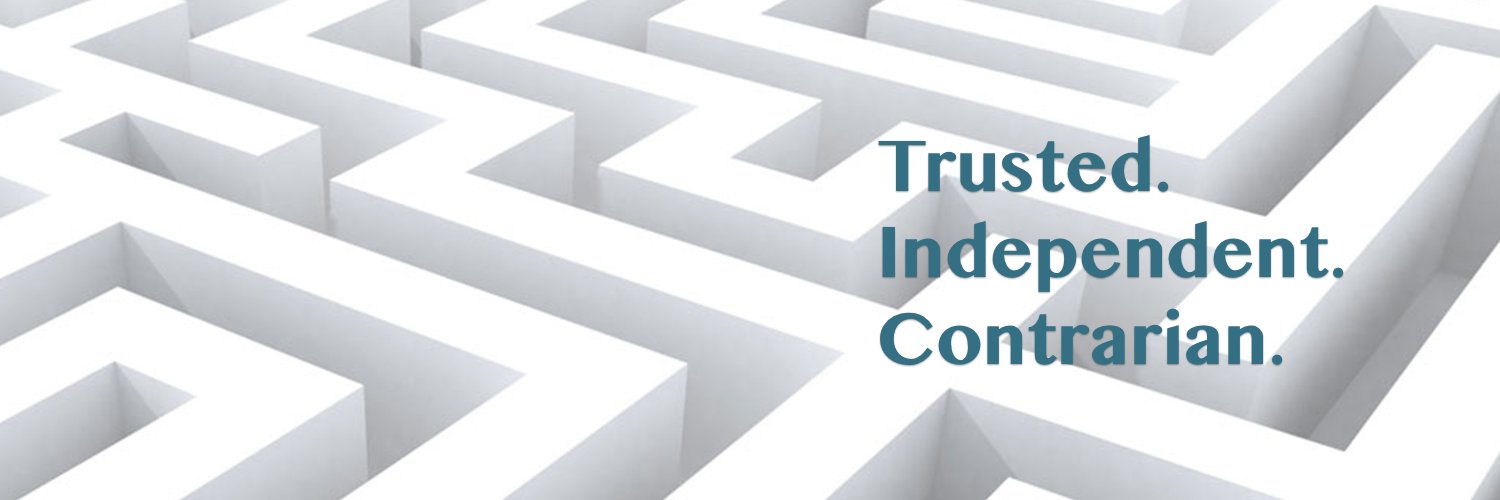

Since the April 22nd interim-high, USD-gold has been chopping just above the channel breakout-area — a healthy consolidation that could refresh the uptrend. The price-action has whip-sawed most traders and caused large swings in sentiment, which should allow the uptrend to…

As noted previously, the choppy price-action in USD-gold has caused whipsaws for short-term traders and large swings in sentiment. This kind of volatility is often part of a healthy consolidation before a trend resumes. Interested to learn more? Book a call:…

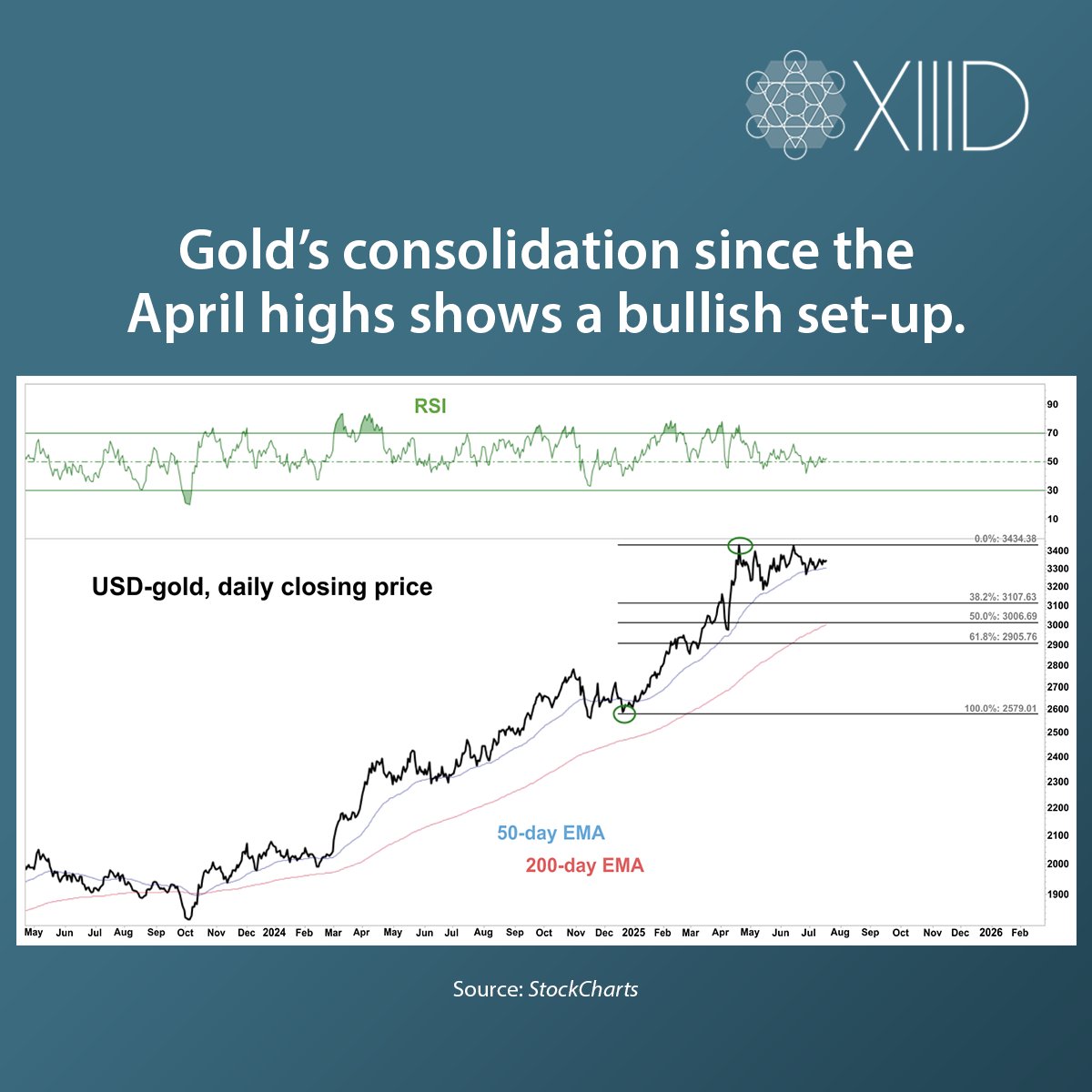

Back in May 2024, we hosted a webinar entitled The Case for Gold Miners and Agnico Eagle Mines, with 13D Research & Strategy’s Senior Managing Director, Jay A. Sellick and Ammar Al-Joundi, President and CEO of Agnico Eagle Mines. The stock price has since doubled. 13D clients…

🌍 As a global team, we don’t often get the chance to be in the same place at the same time — which makes moments like this even more meaningful. Whether it’s collaborating across time zones or sharing a meal in person, connection is at the heart of our culture. Learn more…

DID YOU KNOW? Real investment in US #mining declined over 50% since the peak in the early-1980s, the number of #graduates of US mining programs has collapsed, and land-use #restrictions and #permitting delays have led to one of the longest lead times for mining in the world -…

Last week we were delighted to host a series of client meetings in London, including a roundtable at the Berkeley Hotel in London. Led by Woodley B. Preucil, CFA, Senior Managing Director, and Lachlan Nieboer, Senior Research Associate at 13D Research & Strategy, the session…

Last week we had the pleasure of hosting a series of client meetings in Zurich including a roundtable at the Baur au Lac. Led by Woodley B. Preucil, CFA, Senior Managing Director at 13D Research & Strategy, the session explored the reconfiguration of global power through the…

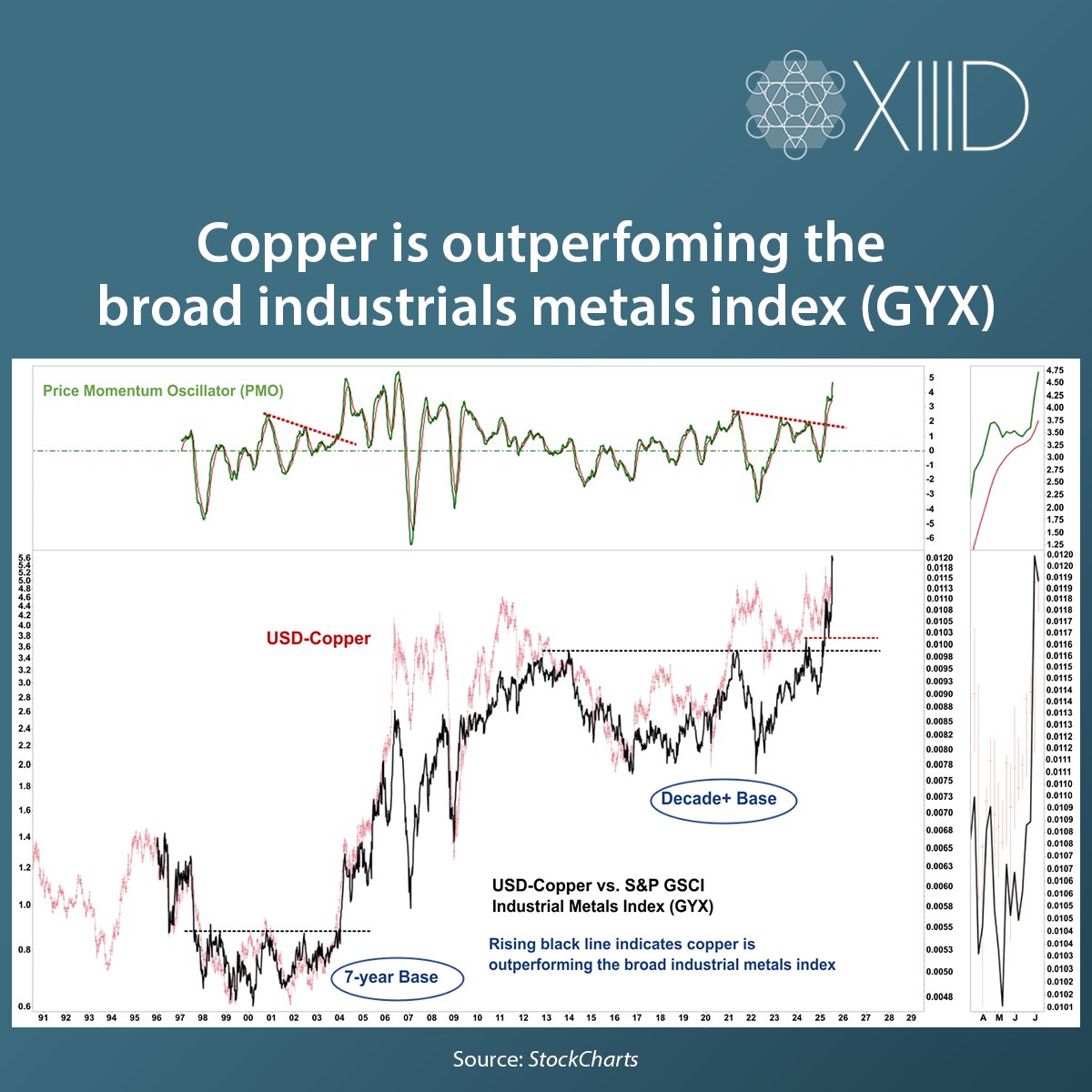

The ratio’s huge breakout appears to be following a nearly-identical profile as occurred in 2003—which correctly signaled much higher copper prices. Copper was a key focus in both Thursday’s WILTW and Sunday’s WATMTU this week. Interested to learn more? Book a call:…

The Shanghai Stock Exchange Composite Index (SCOMP) formed a nearly perfect “triangle” consolidation after the large advance from the 2024 bottom. A “measured target” move suggests a 28% advance from the breakout-area, or up another 23% from current level. As noted previously, a…

The huge base since the 2016 top suggests a sustained breakout, as we expect, is very likely to herald a large, multi-year advance in the silver mining-stocks. We could see a robust period of “rising animal spirits” in the coming weeks and months in the gold and silver…

While in London recently, we connected with the Money Awareness and Inclusion Awards (MAIAs), which held their first in-person ceremony in partnership with the London Foundation for Banking and Finance. The MAIAs spotlight an often overlooked, yet essential pillar of personal…

A continued increase in demand for clean electricity will lead governments to continue to extend the lives of existing reactors and restart old nuclear plants. The 13D Uranium Index has outperformed the S&P 500 by over 6x since we became bullish on the sector in 2018. Want to…

The miners have made several new daily and weekly bull-market closing highs since USD-gold’s interim-high at $3,500 on April 22nd. This action is very different from the past, as it suggests rising/strong market confidence in gold’s uptrend. And it shows the gold miners are now…