VolumeLeaders

@VolumeLeaders

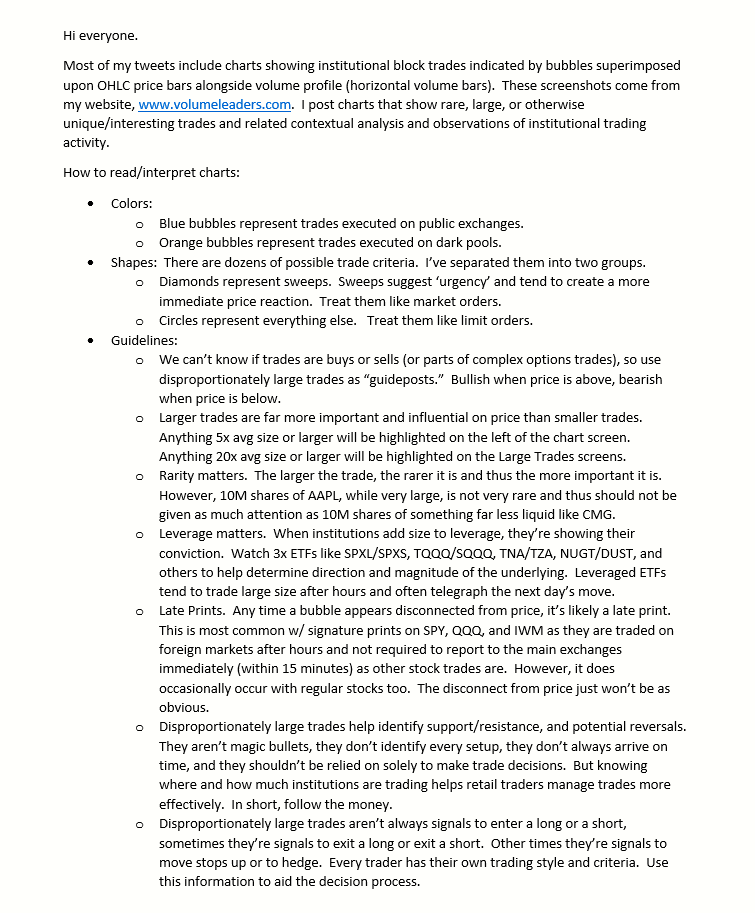

Context, analytics, and visuals pertaining to institutional trades. http://volumeleaders.com/register http://youtube.com/@volumeleaders *Opinions Only*

Rules / Guidelines / FAQ about my tweets can be found below. Reach out if you have additional questions / comments / feedback. I'm here to help. 👊

$TRI - Joined the S&P at Friday's close, which means institutions could offload into forced buyers if they wanted to. #1 trade and #1 cluster on Friday. ATH was two weeks ago. volumeleaders.com/register

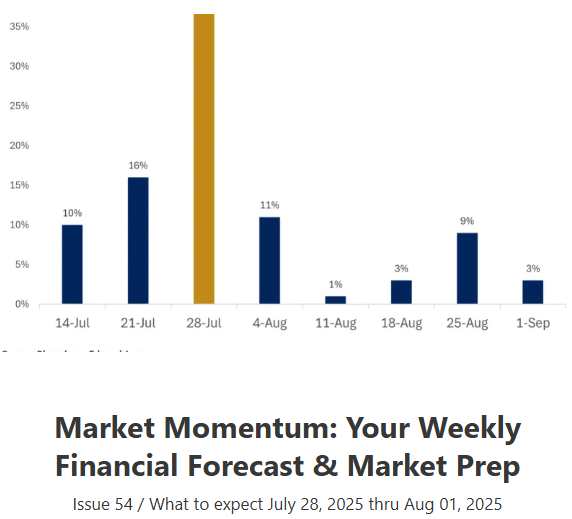

- Markets trading sideways into month-end rebalancing. - Institutions circled software & pharma while unwinding energy bets -Dark pool activity picked up in semis & staples - Momentum pockets in biotech, consumer names surged - Financials & energy lagged as tech held firm…

$TSLA - Combining VL contextual metrics with other tools and analysis to inform profitable decisions. 👏👏

@volumeleaders The long this morning worked well. TSLA hit 323 before descending. Call buying and put selling until 1230 before reversing.

$TSLA - And now after a decent sell we get $2B+ and #23 rank at the close, right on support. 2M+ on the long leverage too. #6 rank. Similar large positioning came at the previous low after a large sell. volumeleaders.com/register

$TSLA - Long after the bell yesterday at 5:48PM EST, institutions snuck in this #2 ranked $TSDD short position, which is quite green as I type this. They also added some $TSLQ at the same time after printing #3 at yesterday's open. volumeleaders.com/register

$TSLA - Long after the bell yesterday at 5:48PM EST, institutions snuck in this #2 ranked $TSDD short position, which is quite green as I type this. They also added some $TSLQ at the same time after printing #3 at yesterday's open. volumeleaders.com/register

$SBET - They hit it hard at the close yesterday. Longs safe above $25.80 in the near term. volumeleaders.com/register

$NFLX - Now trading below the two largest trades since inception, and two of the five largest levels as well. $NFXS (2x Inverse) #1 and #3 remain green. volumeleaders.com/register

$SPY - Unusual cluster of late-reported dark pool trades coinciding with this intraday spike.

$NVDL (2x $NVDA) - Everything is on super slow mode this summer, but after a week of churn price finally resolved below these three prints. That suggests these three blocks were long-exits after one hell of a run off the April low. That #1 level at $82.20 is worth monitoring…

$SPY - Visual representation of those phantom prints. 15 trades amounting to $4B.

In my weekend edition, I expected the $SPY phantom prints to hit 630.30. They did today even though price never hit that level on Friday Level to level to level is the way to make $$$

$FXY - Follow up on the $Yen trade from last week. Price is now up about 1% off the #3 print suggesting institutions are positioned bullishly in the near term. volumeleaders.com/register

$FXY - The $Yen enters the chat with the largest trade since 2019. 3rd largest since inception. volumeleaders.com/register

$AAPU (2x $AAPL) - #4 arrived a couple days after #1 providing additional support. The level held for a few sessions as price grinded sideways into OPEX. Today price resolved higher again. volumeleaders.com/register

$AAPU (2x $AAPL) - Tested from above and held. Not the most impressive move off a #1 leveraged print, but profitable nonetheless. volumeleaders.com/register

$BULL - #1 printed and moments later the news came out. volumeleaders.com/register