Varlamore Capital

@VarlamoreCap

DeFi-specialized liquidity allocator maximizing risk-adjusted yield for depositors through active capital management. Building on @SiloFinance.

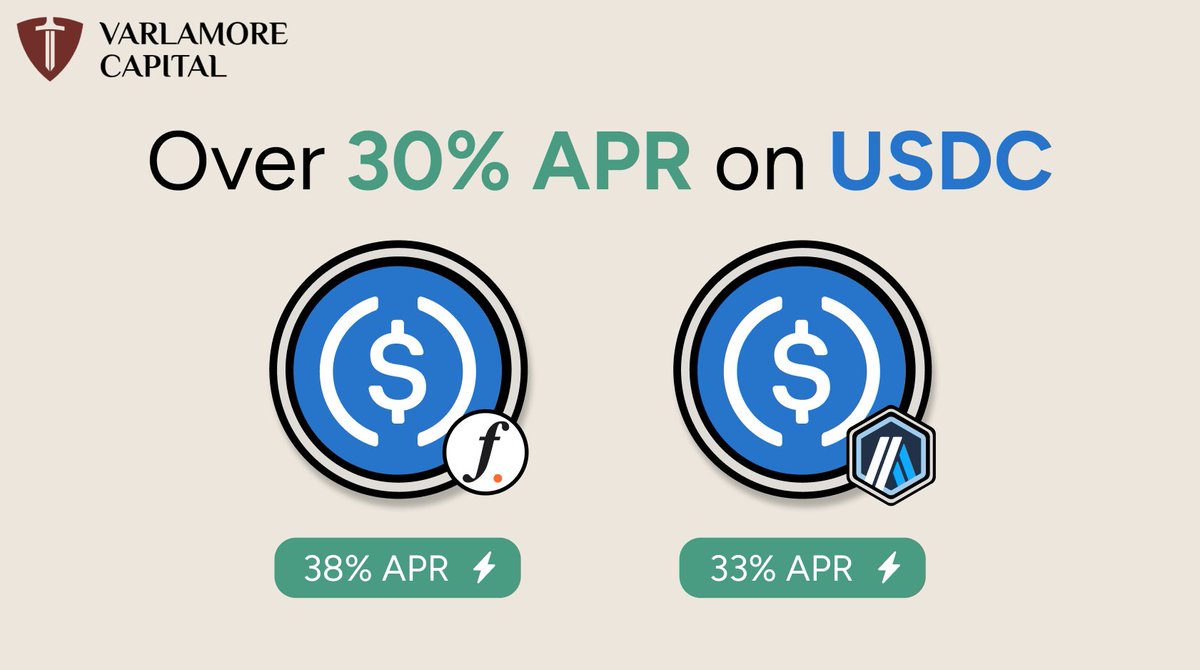

Varlamore Vaults continue to print the highest $USDC yields on the market: 1⃣ Falcon USDC (vfUSDC) → 38% APR 2⃣ USDC Growth (vgUSDC; Arbitrum) → 33% APR Markets picking up steam means borrow demand is at all time highs. 👇

3 new Falcon Miles routes opened today ✈️ Earn up to 30x Miles/day on: • Silo • IPOR • Superform Live now → app.falcon.finance/miles Track + claim your Miles.

New stablecoin 3pool just launched on @beets_fi! 🔋 Boosted by yield vaults from @SiloFinance 🔐 Curated by @VarlamoreCap & @Re7Capital 🎁 Co-incentivized by dTRINITY, Beets, Silo & @Trevee_xyz ——— In the name of the Stablecoin, the DEX, and the Lending Protocol (▲)

1/ A new multi-stable Boosted Pool just dropped on @SonicLabs, and it’s curated to perform. Powered by @SiloFinance and partnered with @dTRINITY_DeFi, this pool routes $scUSD, $dUSD, and $USDC liquidity into expert-managed lending strategies. Let’s dive in. ⬇️🧵

Today your boy tasked himself with a simple goal: Find >15% APR on USDC for his beloved followers. Here is his fine selection: 1. Varlamore Falcon USDC → 17.1% APY 2. Varlamore USDC Growth [Arbitrum] → 18.1% APY 3. MEV USDC [Avax] → 28% APY Job's done.

If you're not earning 38% APR on stablecoins, you're not farming hard enough. Deposit in the Varlamore Falcon USDC Vault today to take advantage of those hungry borrowers 😋 Over $100k in USDf and xSILO rewards still streaming.

They: Show off your highest yielding stablecoin position atm. Me: Ask no more. S/o to @SiloFinance and their Varlamore USDC growth pool on Arbitrum.

➥ Where To Park Your Stablecoins? With $BTC seemingly on a fast track to $200,000 (God willing), many friends often ask where they should park their stablecoins. In this risk-on market, making profits is easy, but preserving them is the real challenge. I have several…

Origin ARM - powered by Varlamore.

🔁 Baseline ARM Yield Idle $S is redeployed to @VarlamoreCap $S Vault, with interest and rewards passed back to ARM depositors. This remains available to facilitate peg arbitrage if the opportunity presents itself. Baseline rewards ✅

One of the inch resting thing about Silo v2's design is we now have a: 1. Base layer of isolated markets 2. Aggregation layer of managed vaults Such a design is actually better for lenders, borrowers, AND external protocols alike - allow me to explain. 👇 We now have 3 core…

The Varlamore Falcon USDC Vault has the recipe for the hottest stablecoin yields on Ethereum. Your yield: 19.1% APR (10.2% paid in stablecoins) Your exposure: The Falcon Synthetic Dollar Ecosystem $100k/m in incentives now streaming exclusively to this vault.

USDf, sUSDf, PT-sUSDf are now listed on @SiloFinance Loop with isolated lending, no cross-asset contagion. First month's boost with $100,000 USDf rewards. Get in early 🧑🌾 Deposit here: app.silo.finance/vaults/ethereu…