Value Research Stocks

@VROStocks

Stock Ideas and Company Results

Wealth Insight – July 2025 edition is here! It's our 19th anniversary issue—and we're going big. Discover the next 100-baggers, smart screens to spot winners, timeless investing books, and why ETF liquidity can trap you. Plus, insights from Tata AMC, Nvidia’s rise & more. Let’s…

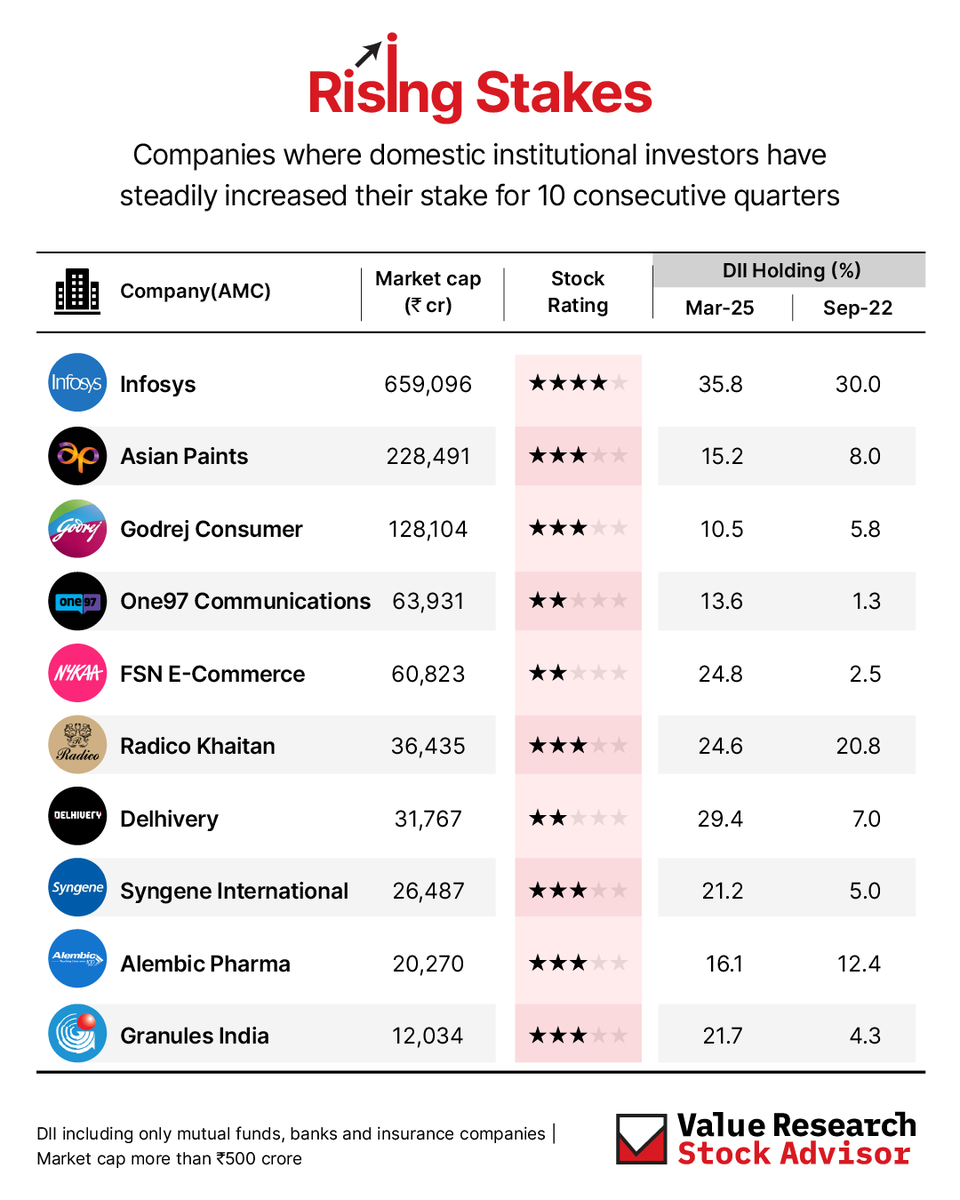

Rising Stakes 📈 DIIs have steadily upped their stake in these stocks for 10 straight quarters. But many of these stocks still have low ratings. What’s going on? Comment your thoughts below!

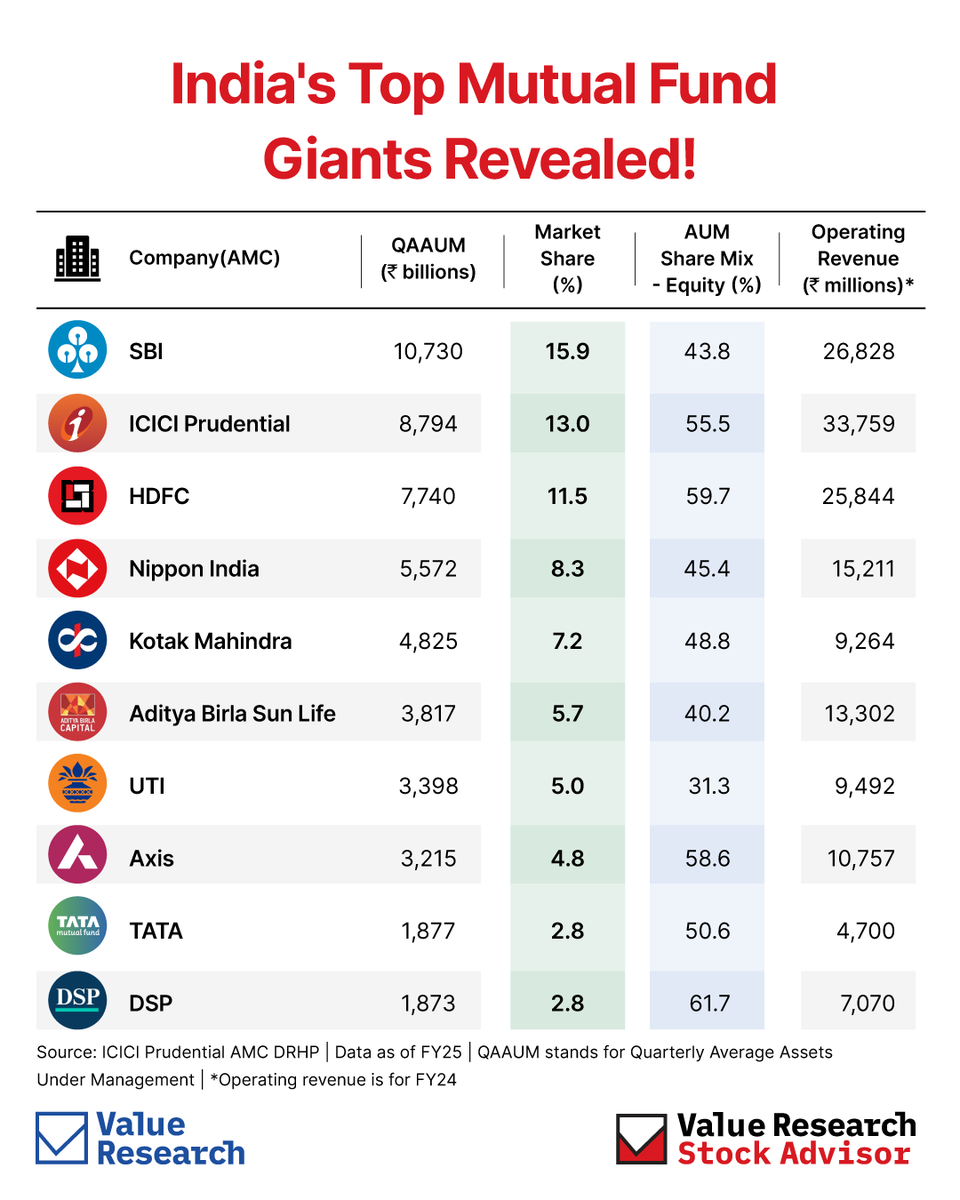

India’s top mutual fund giants: revealed! SBI leads by AUM, but ICICI brings in the most revenue. DSP has the highest equity share. See how India’s top AMCs stack up on market share, equity mix & earnings. @ValueResearch

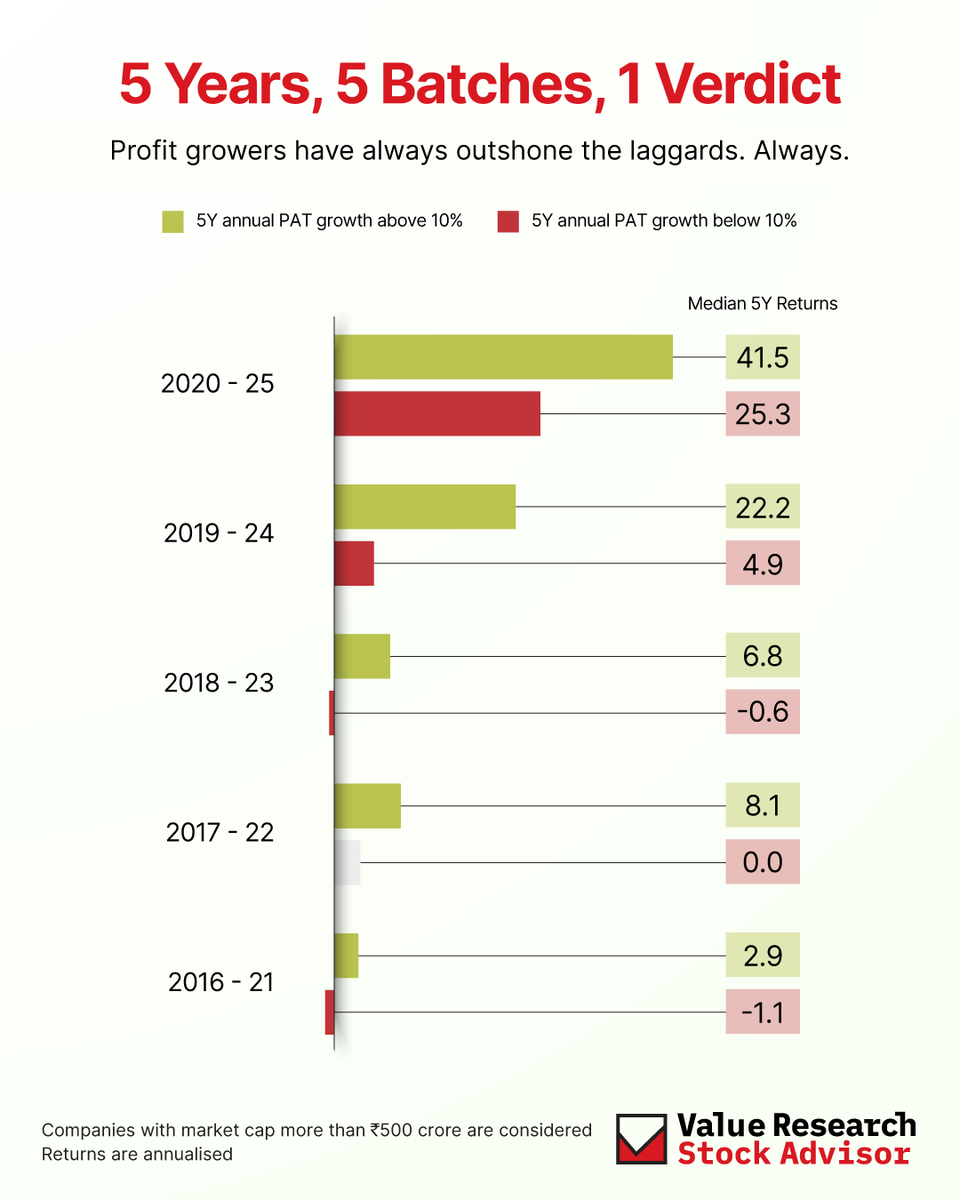

The numbers don’t lie. Companies with strong profit growth (PAT above 10%) have consistently delivered superior returns over the last five years. It’s not just luck. It’s fundamentals at work.

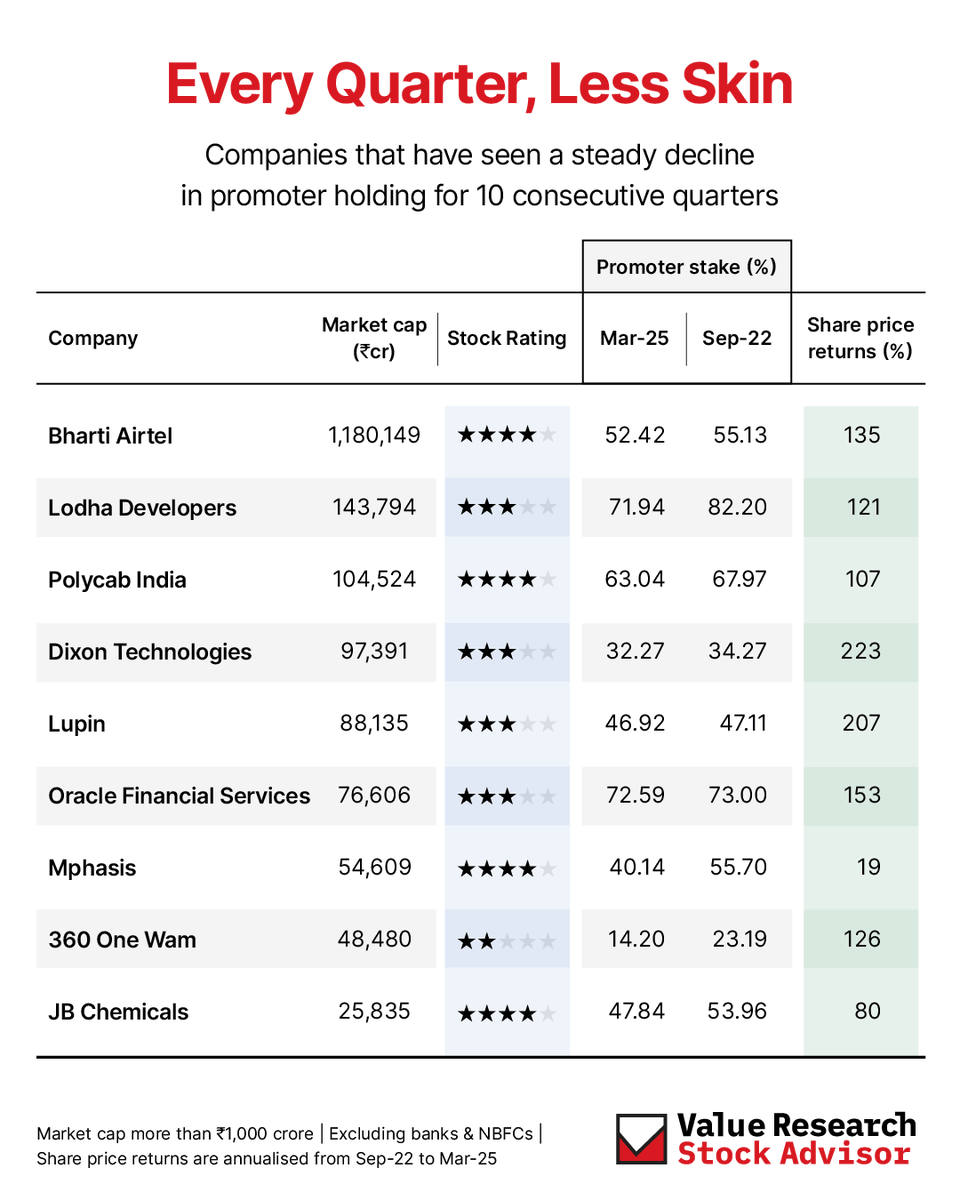

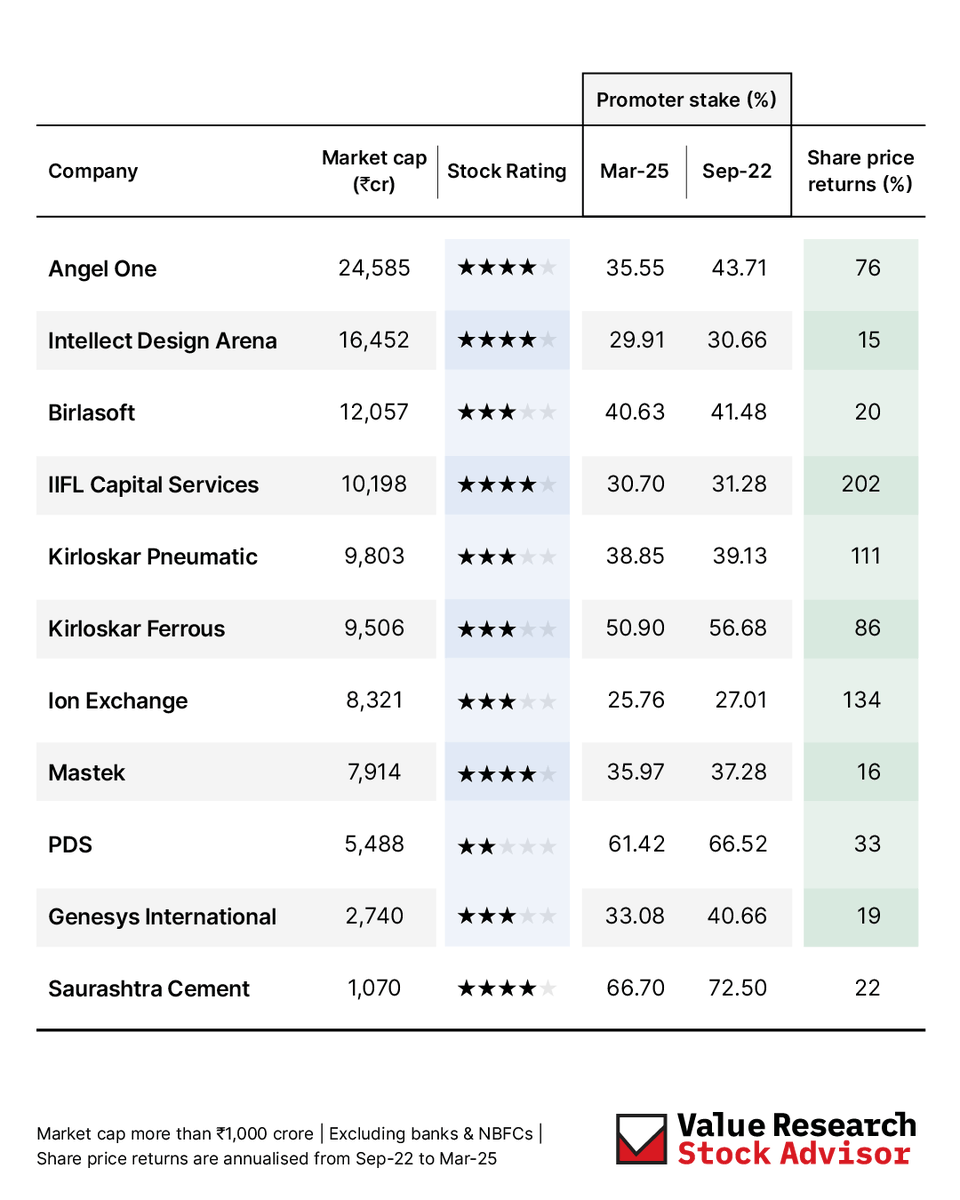

Stock doing well? Promoters trimming their stake. Not a red flag, but smart timing. Here are companies where rising prices met falling promoter holdings

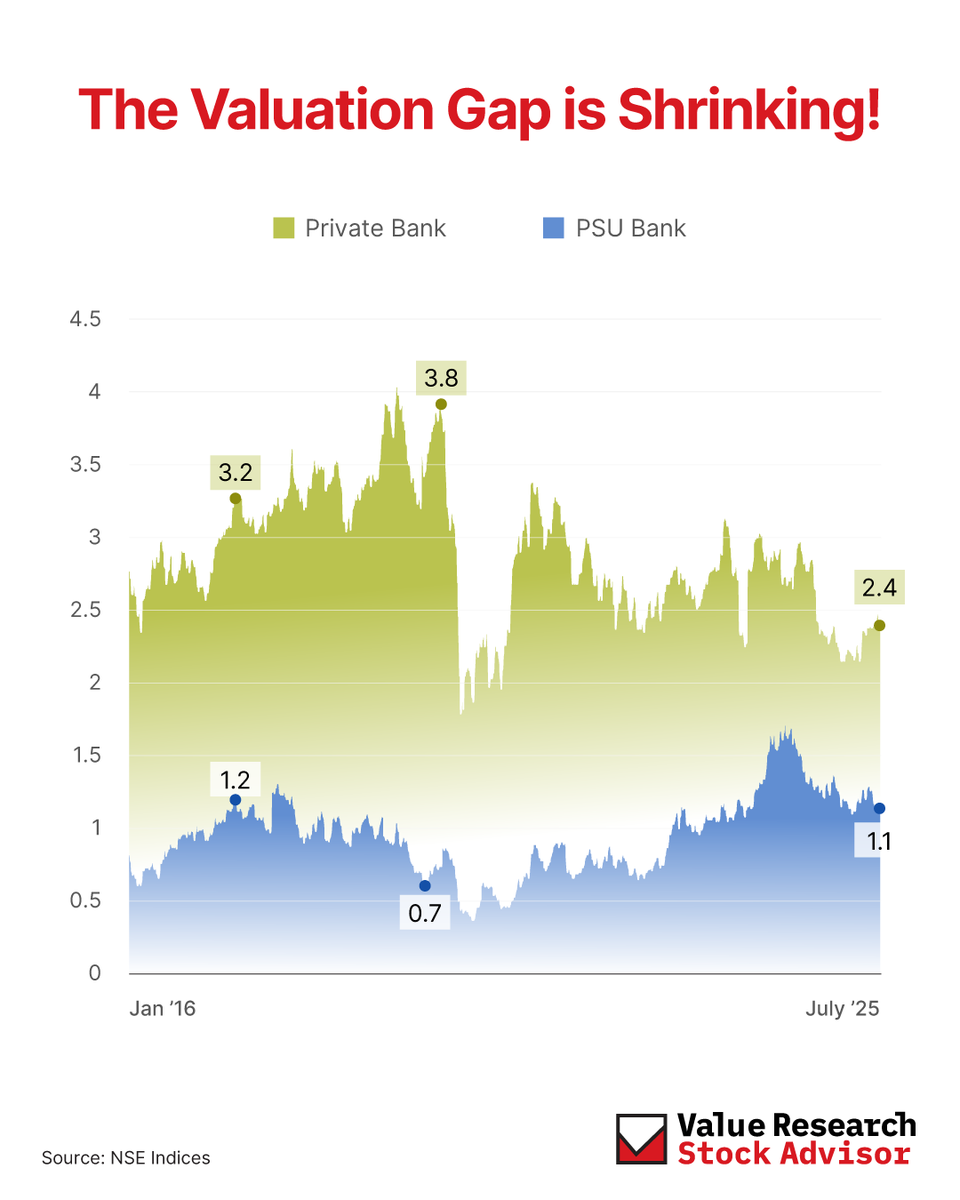

Private banks at 3.8x. PSU banks at 0.7x. That was then. Today? 2.4x vs 1.1x. The valuation gap is shrinking, and fast. Should PSU banks be back on your radar? Comment your thoughts below!

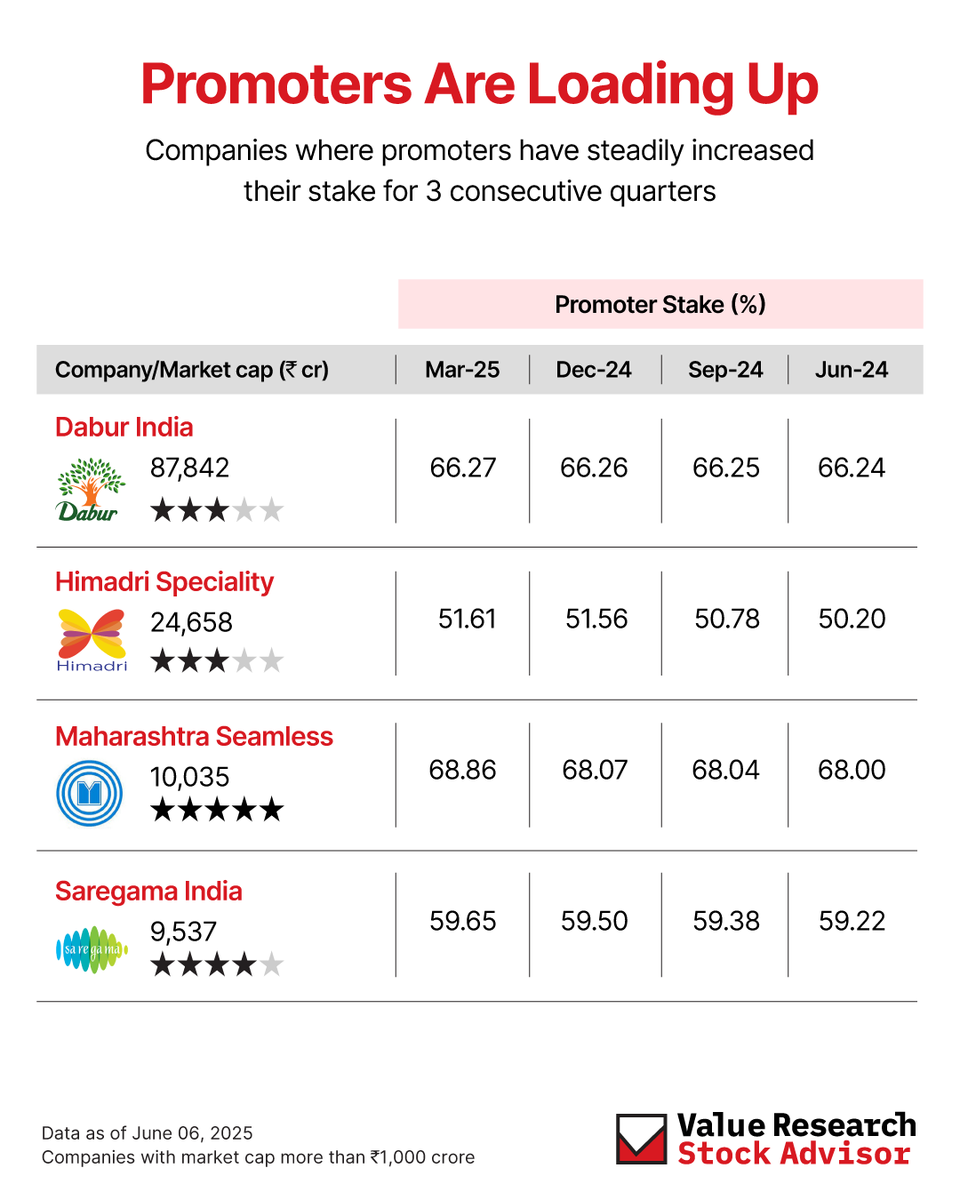

Promoters are doubling down. Are you paying attention? These companies have seen 3 straight quarters of rising promoter stakes: a strong vote of confidence from insiders. When the folks running the show keep buying, maybe it's time to take a closer look.

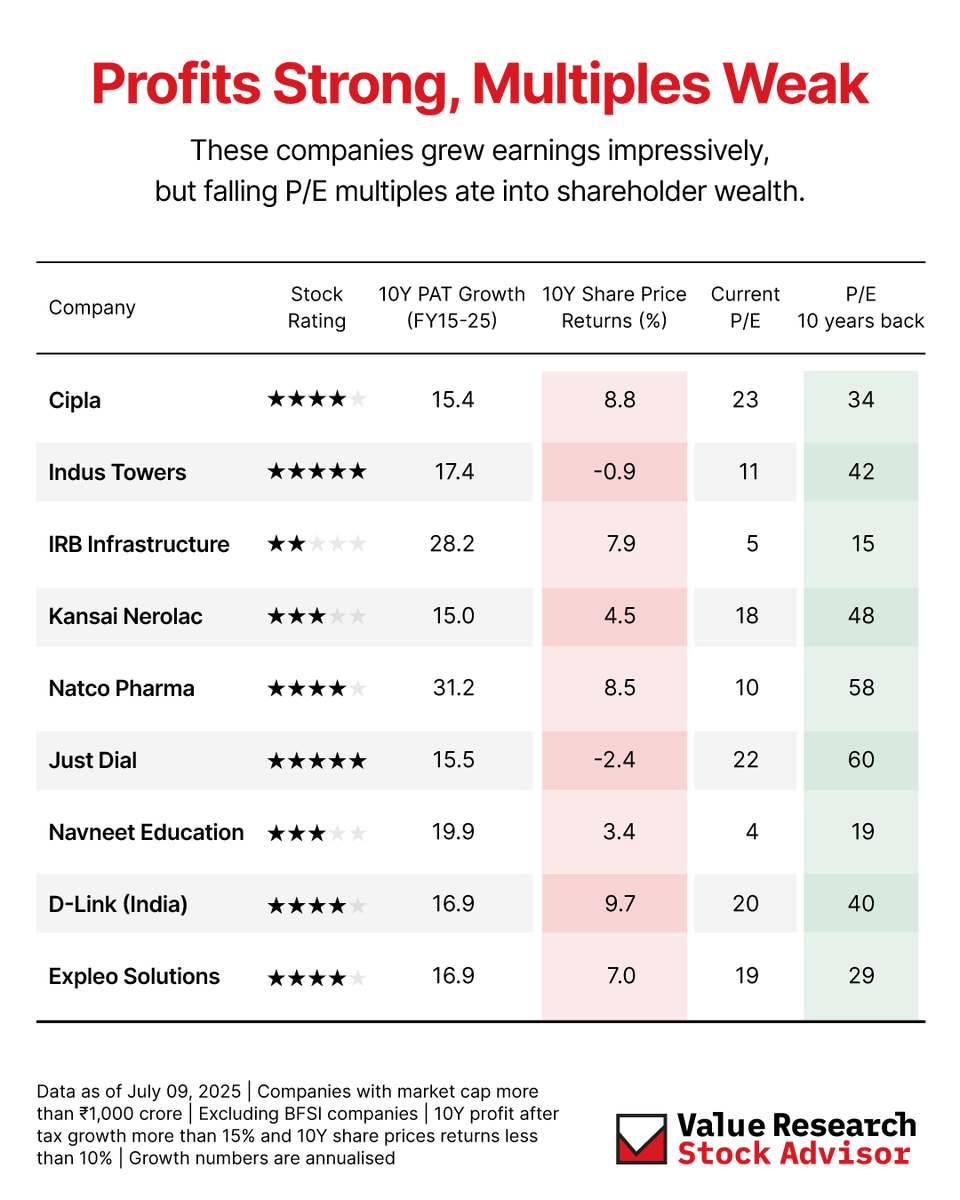

Profits soared, but stock returns didn’t? These companies grew earnings >15% annually over 10 years. Yet investors saw poor returns. Why? Falling P/E multiples. Derating can kill wealth. Check the chart 👉

Why did over 1.1 lakh investors wait for Wealth Insight every month? Because in a market full of tips & trades, Wealth Insight chose timeless wisdom. No noise. No speculation. Just stock-picking frameworks, long-term thinking & fundamentals. Subscribe: tinyurl.com/n2j8wnbw…

Buy/sell calls won’t build wealth. Wealth Insight will. Start building real wealth today: tinyurl.com/ycyej3ct

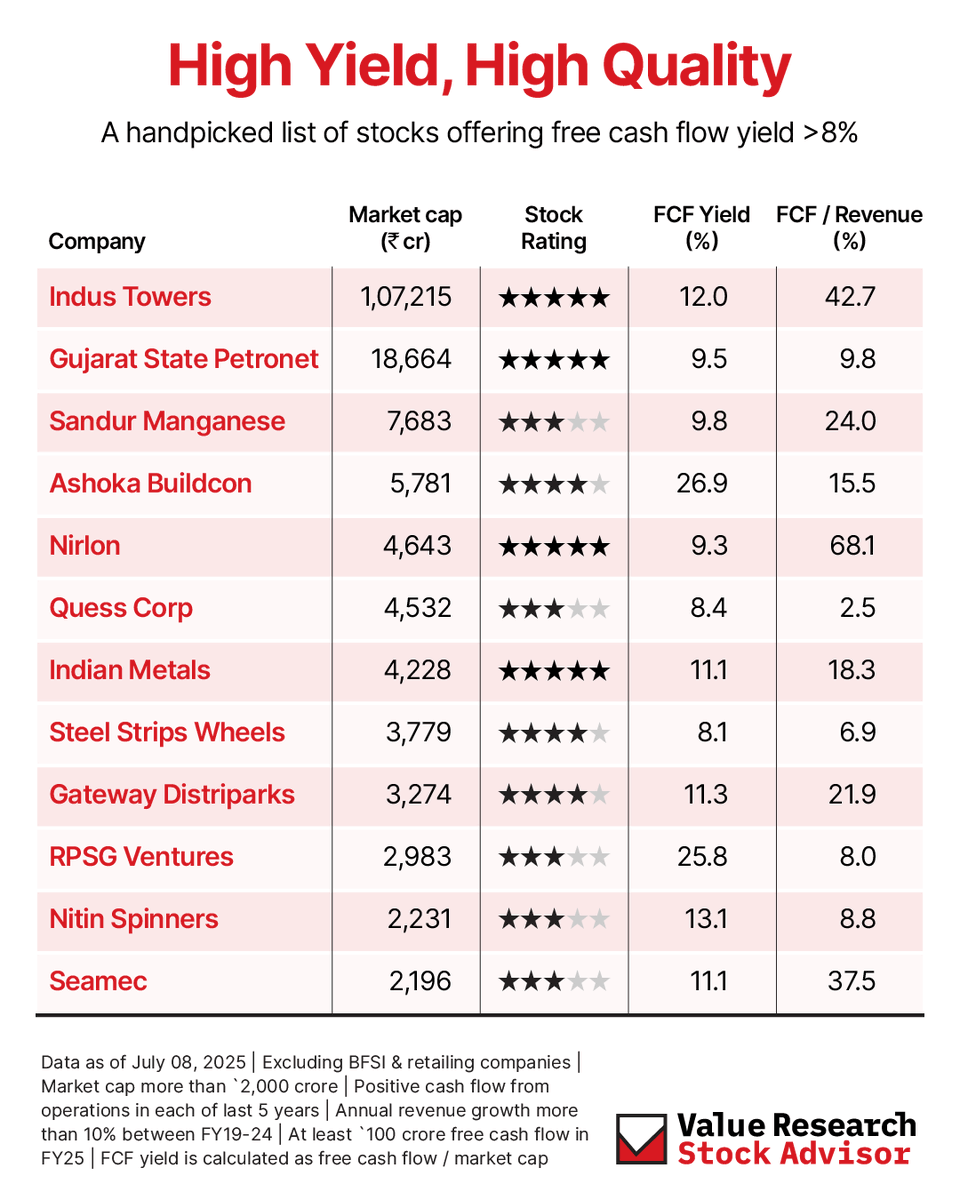

High Yield, High Quality! These stocks aren’t just growing, they’re gushing free cash! Which one’s on your radar? Comment below!

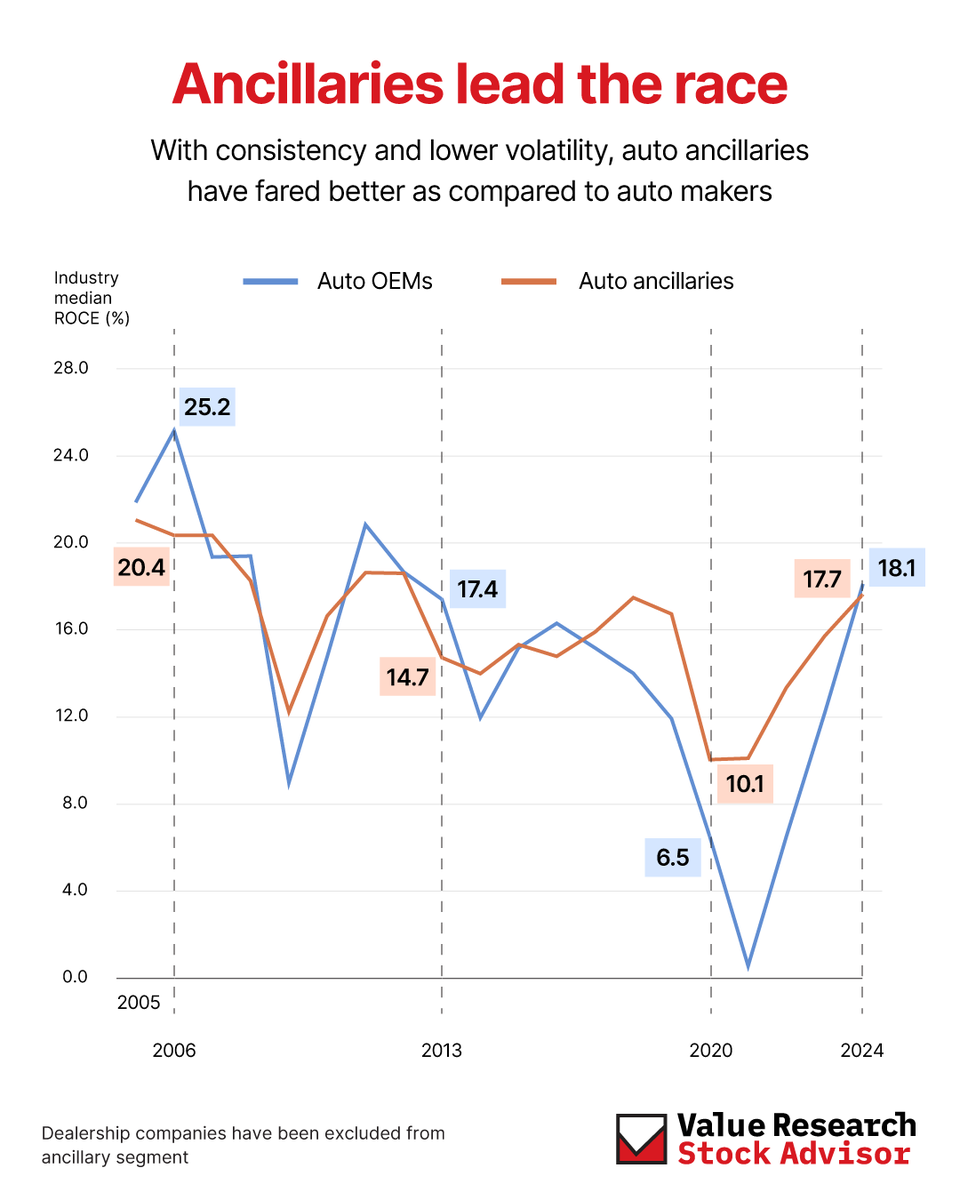

Auto ancillaries are winning the long game. Despite the flashier names of carmakers, it’s the parts suppliers who’ve delivered more consistent returns over the years. From 2005 to 2024, auto ancillaries have shown lower volatility and better median ROCE than OEMs. Steady hands…