Noah

@TraderNoah

Investment Team @ Theia

One of us!

The coordinated pumping of $OSCR by retail Twitter accounts led their followers to slaughter. Down 40% in the last three weeks. Careful out there

Given treasury strategies holding the same underlying asset are direct substitutes for each other, if they all trade at a material premium to nav a prisoner's dilemma forms. If they work together (illegal?) to not crash the market with a ton of ATMs, then they can slowly grow…

low-medium conviction view: My bias is that SOL is skewed towards the downside through EOY. I think this has become somewhat consensus based on positioning and price, but think the treasury vehicles have skewed r/r back to the downside after pushing price to $200. Proponents…

Solana has one of the tightest, most effective narrative propagation operations in crypto. The main brand + its founders + press + KOLs pick up then drive narratives quickly and synchronously. The $PUMP ICO is a great example: ICO scheduled for July 12, unclear narrative for…

"Venture Capital"

The Celestia Foundation has worked with Polychain Capital to assign Polychain’s entire remaining TIA holdings to new investors. This month, the Foundation purchased 43,451,616.09 TIA from Polychain Capital for $62.5m. Polychain will shortly be undelegating their entire staked…

Surely the price action prior to the announcement was completely unrelated...

back in high school, we used to play counter strike and when you wanted to disrespect a player you just killed you’d stand over their body and press the crouch button repeatedly, known as “teabagging”. that’s what saylor is doing to the financial world with this slide.

If you're in this industry, read this so that you understand what is happening with these treasury vehicles and can be prepared for the consequences: There are two types of treasury vehicles: those that create buy pressure and those that create sell pressure. Treasury deals…

There’s already a $500K exemption How many more tax cuts can one country do for rich boomers? The answer: always more

🚨 TRUMP: WE ARE THINKING ABOUT NO TAXES ON CAPITAL GAINS ON HOUSES

US Treasury Secretary Bessent: Fed should be cutting rates now.

US Treasury Secretary Bessent: Fed should be cutting rates now.

0/ The third cohort of the Token Transparency Framework is LIVE. This round we welcome Euler dYdX ZKsync Layer 3 These teams are elevating the industry's disclosure norms. Let's dive into the details...

But this time they've structured the deals to be much more favorable for them🫡

last cycle all the crypto vcs poured capital into an opaque leverage bubble after it blew up they wrote masturbatory thinkpieces about how that couldn't happen in defi the exact same people are once again pouring billions into an opaque leverage bubble

I've seen tweets bragging about buying PUMP ICO when it was trading at $6bn, and now see people claiming it was priced correctly bc price is at $4bn. Let's hold off on conclusions of fundamental market efficiency based on short-term price action.

This is the blueprint for the best case outcome for these treasury vehicles. Premium goes to 0, occasional retail speculation that leads to high premium, that gets sold into. Euthanasia roller coaster

History doesn't repeat, but it often rhymes

there is blatant insider trading on some of these public market treasury vehicles

Many crypto fundamental analysts would be better off analyzing slot machines

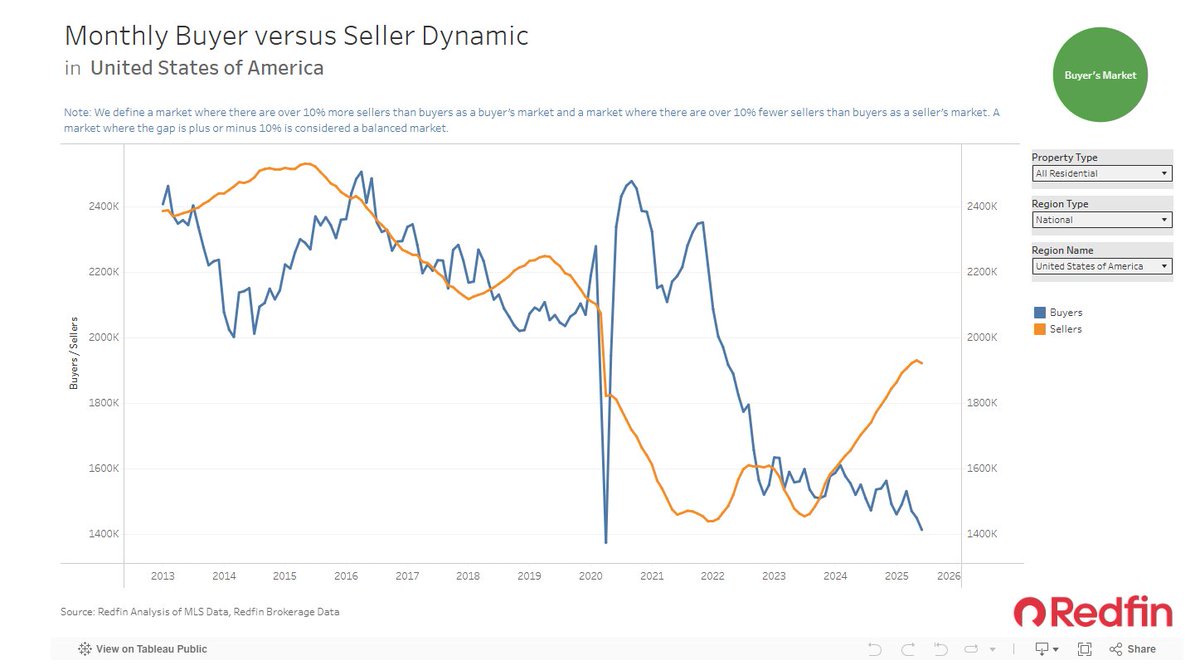

If long-term rates are going to keep going up, rents need to be raised, or house prices need to fall. I'd guess a mixture of both