Omar

@TheOneandOmsy

Definitely NFA. Investor @Dragonfly_xyz

TLDW: - Dress for the job you want - Hedonic treadmills don’t discriminate - Celebrate wins with the people you love - Happiness is a multi-variable equation

William Demchak, CEO of PNC ($77b bank), dropping that he expects a US bank consortium stablecoin post the Genius Act during earnings tonight Heard similar sentiment yesterday (see QT below) at Citi's earnings w/ a multi-bank sponsor stable. Really sounds like we have serious…

TLDR - Citi's Stablecoin + Crypto Plans from earnings: - Citi clients want real-time multi-asset, multi-bank, x-border solution w/ compliance, accounting all solved - Citi Looking at 4 areas: ramps (fiat <-> crypto), reserve management, own stablecoin + tokenized deposits -…

~1 year later and ETH/BTC down ~55% to .02497 - A year ago on July 10th: ETH ($3.1k) vs. BTC ($58k) - Today: ETH ($2.8k) vs. BTC ($111k)

OO #43: 8-year view on ETH/BTC. Market has certainly expressed an opinion over the last 3 years. The ETF could be the catalyst that leads to a material re-pricing. But if I were to bet, I'd wager the market values simplicity over an extended roadmap H/t @FRNT_Financial

Want $300m to walk dogs for 10 years? Here's how: - Incorporate a startup, name it Wag - Describe it as the "Uber for dogs" - Go see a man named Masa Son at Softbank - Bring a deck, put a picture of his poodle on Page 1 - Collect your 9 figs Although Wag is no longer with us,…

🛑Filing Alert: Wag! Chapter 11 Wag! Group Co. and its debtor affiliates⁽¹⁾, a San Francisco, CA-based provider of technology-enabled pet care services, filed for Chapter 11 protection on Jul. 21 in the U.S. Bankruptcy Court for the District of Delaware. The filing follows…

At $5b of USDC, Hyperliquid now accounts for 7.5% of total USDC o/s by Circle - Time for Jeff to use his holdings as leverage for a material rev share on interest - If he clips 4%, it’s $200m of extra protocol revenue for a phone call (~20% boost to $1b run rate)

USDC on Hyperliquid doubles to $4.9 billion as DEX derivatives trading gains ground theblock.co/post/363653/us…

Axiom (YCombinator W25) now up to $179m in top line revenue since launching in 7 months ago in January Was the fastest company in YC history to hit $100m in top-line afaik (did it in 5 months). And about to be the fastest to hit $200m Currently running at ~$1-3m of top-line…

And just like that Axiom (YCombinator W25) hits $100m in revenue since launching just 5 months ago: - Took Cursor 12 months to hit $100m of ARR (previous record afaik) making Axiom the fastest company in YC history to hit $100m in real top-line revenue - Probably the purest…

Public multiples blowing out as markets go full risk on. NTM revenue multiples doubled from 10.3x a year ago to 21.4x today We’re 2/3 of the way to peak ‘21 Covid multiples. And if froth across private and public markets is any indicator, going to run it all the way back

OO (#25): The primary reason traditional equity deals are struggling to get done in crypto is .... MULTIPLES. A good way to get a baseline for pricing is by looking at median SAAS NTM revenue multiples in tradfi: - High Growth (>27% y/y growth): 10.3x - Medium Growth (15% -…

Biggest unlock for crypto got buried with today’s announcements. US retirement assets sit at $43T, with $9T in 401ks With Trump opening the flooodgates, if crypto sees just a 1% allocation from 401ks, that’s ~$90B in fresh inflows The retirement market is enormous, and the real…

BREAKING: Trump to open US retirement market to crypto investments, per FT. The US president is expected to sign an executive order that would open up 401k plans to alternative investments beyond traditional stocks and bonds.

TLDR - Citi's Stablecoin + Crypto Plans from earnings: - Citi clients want real-time multi-asset, multi-bank, x-border solution w/ compliance, accounting all solved - Citi Looking at 4 areas: ramps (fiat <-> crypto), reserve management, own stablecoin + tokenized deposits -…

CITI'S CEO: CITIGROUP IS EXPLORING ISSUING A STABLECOIN

8 months ago, on election night, we were on top of the world after Polymarket called the election. 8 days later, the FBI broke down my door at 6am and took all my computers and phones, looking for anything that could imply foul play. While traumatic, it etched the story of…

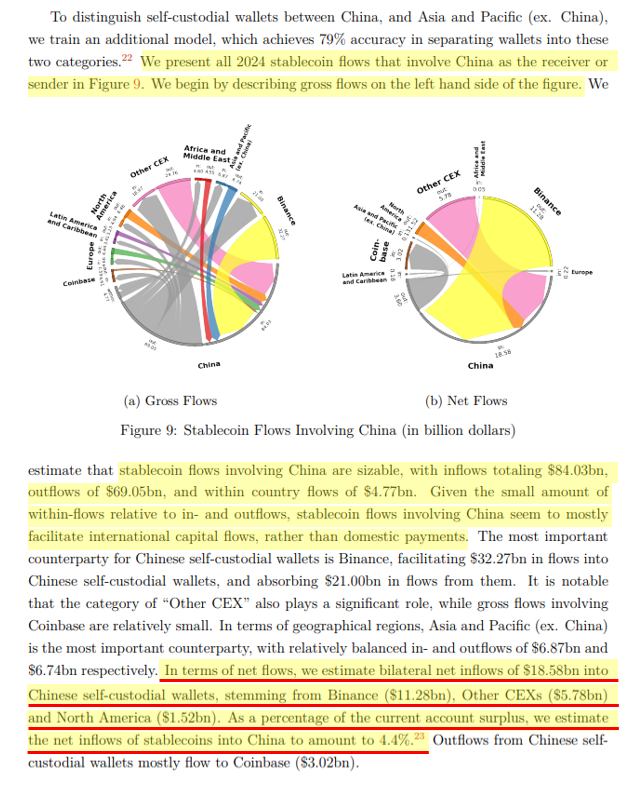

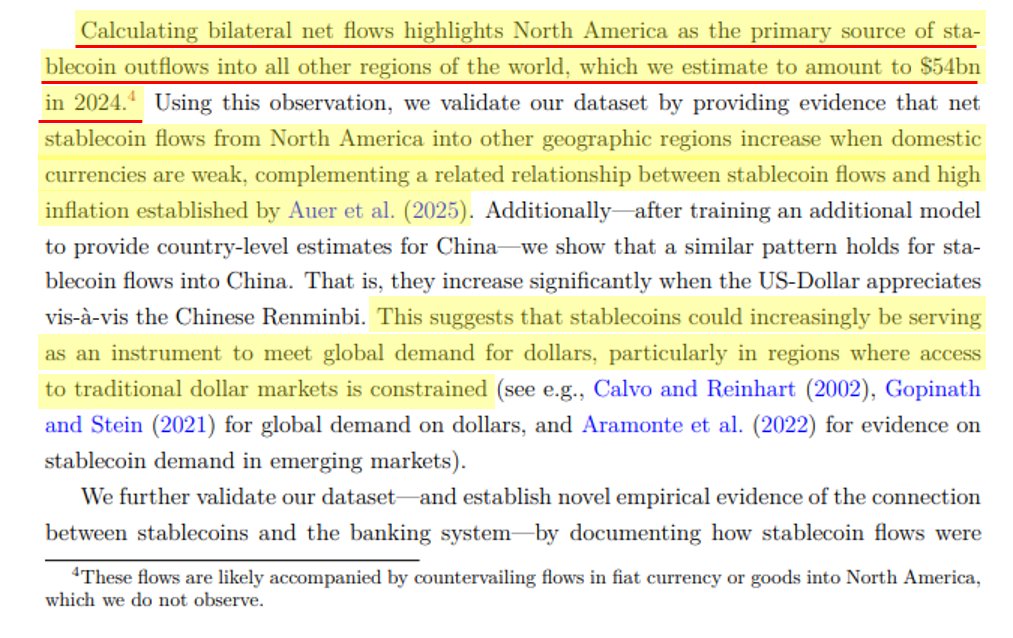

The new IMF Working Paper should just be titled: "Stablecoins: The Trojan Horse Cementing US Dollar Dominance Globally...even in China" TLDR: $54b of USD net stablecoin outflows from North America into the rest of the world in '24. $19b of net inflows into Chinese…

We're pumped to continue supporting @Nick_van_Eck, @DrakeEvansV1, Joe McGrady, and the entire best-in-class @withAUSD team as part of their $50m Series A In the last year and a half, we've watched the team go to the ends of the earth (very literally) to build Agora into one of…

So fired up to back two of the best and brightest in @Nick_van_Eck and @DrakeEvansV1 as they redefine the infrastructure for the global transmission of value on trustless systems. Thrilled they're finally coming out of stealth to re-align industry incentives and put economics…

We are thrilled to announce that Agora has raised a $50 million Series A round, led by @paradigm and with additional participation from @dragonfly_xyz. This milestone enables us to accelerate the development of Agora’s full-stack platform for stablecoin infrastructure,…

The Tether hit piece in The Economist is unintentionally some of the best marketing copy you'll ever see (includes bangers like: "Tether’s efficiency makes money-laundering so easy anyone can do it"): - On Tether's Original Conception: "It was originally intended as a gateway…

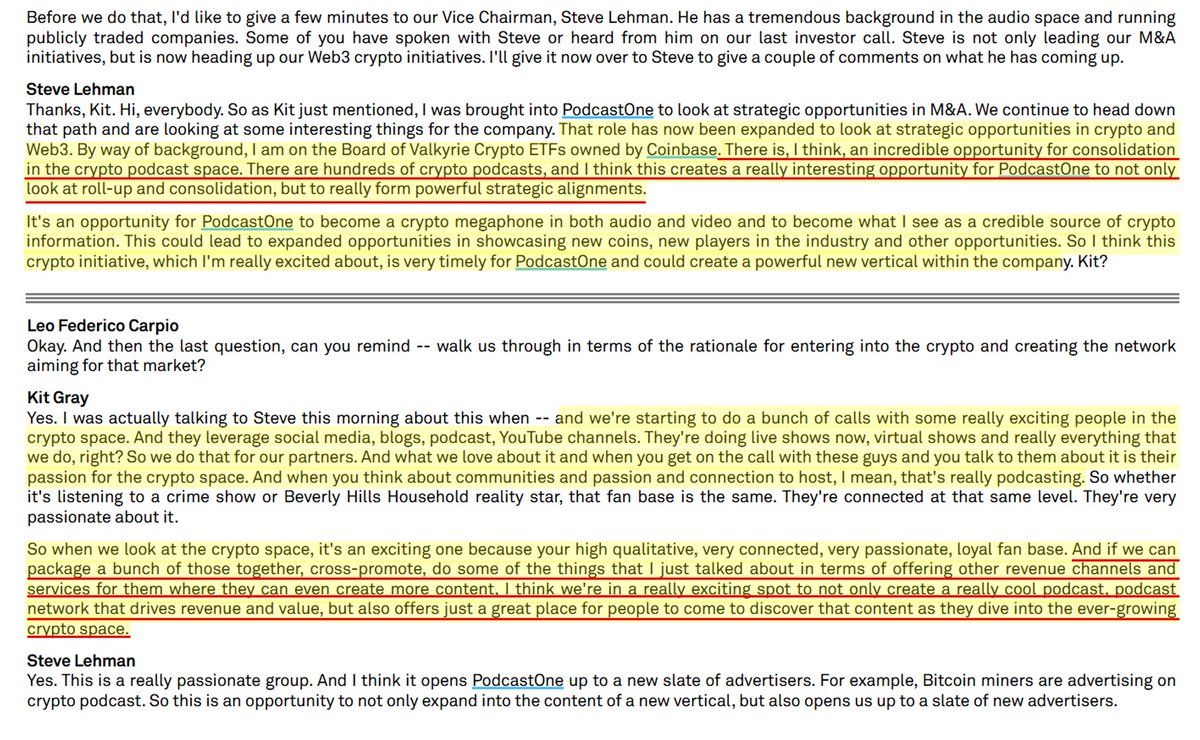

Nasdaq listed PodcastOne (PODC - $61m cap) about to start rolling up crypto podcasts? Don't think anyone was ready for crypto M&A szn (Bridge, Privvy, Hidden Road, Arbelos). And don't think anyone is remotely ready for crypto podcast M&A szn Some great pods in the space…

We're in the early innings of the 'Great Collision' (tradfi & defi)...interesting perspective on this pod from @TheOneandOmsy re $hood being a long-term net beneficiary. Certainly worth a listen.

LIVE NOW -- Robinhood vs. Coinbase: Who Wins the Future of Finance? - Business models - Growth strategies - Tokenized asset plays - Crypto, Equities, and Infrastructure Will Robinhood’s slick UX and expanding product suite win the next generation? Or will Coinbase’s onchain…

If you blink, you might just miss Vlad scaling the bloodline

On the surface, Vlad launching an Invest America onboarding experience looks innocuous. But it's really just a masterclass in playing the long game Quick breakdown: - Potential new program gives $1k gov funding for each US newborn to invest in an index ETF - There are ~3.6m…