Taiwo Mercy Akintunde

@TeeClassy29

Accounting grad with ICAN and AAT qualifications. Skilled in financial reporting, analysis, and compliance.

Graduated as the 3rd best graduating student in the Accounting department with a CGPA of 4.45.

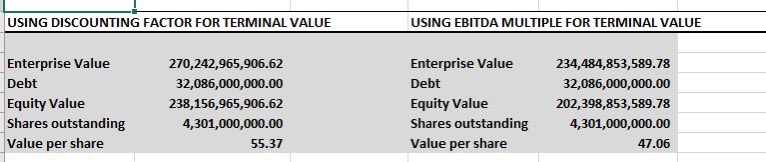

Also valued Coca-Cola with 2 DCF approaches: 📌 Using terminal value (discounted) → $55.37 📌 Using EV/EBITDA multiple → $47.06 Still learning 😅 but getting closer gives me confidence. Valuation isn’t science — it’s craft 🔍

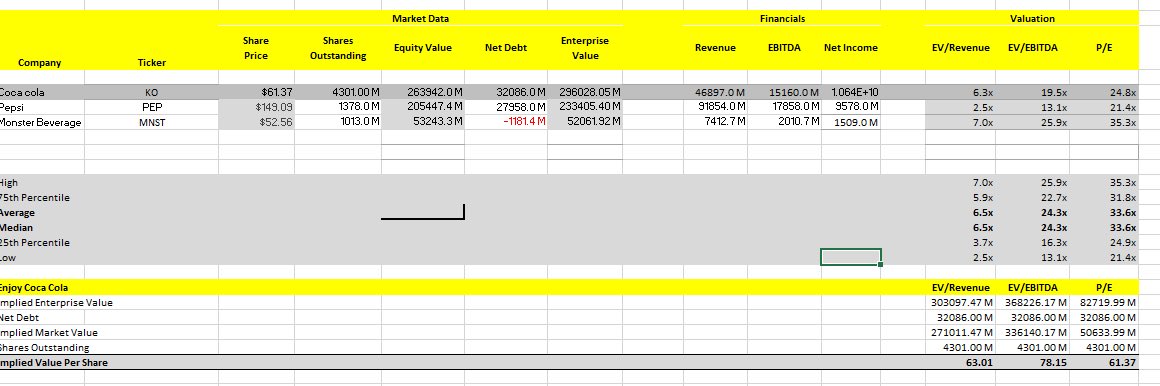

Just valued Coca-Cola using comps like Pepsi & Monster 📊 Got $61–$78 per share from EV/Revenue, EV/EBITDA & P/E As Damodaran said, “Valuation isn’t science.” But when it aligns with the market, it boosts your confidence 😅 Still learning—I can’t brag about my share price

Sometimes, 24 hours feel like 6. Between learning, working, NYSC, and just breathing. But we move — one line of model, one valuation attempt, one email at a time. Slowly but surely, we’ll get there

Aswath Damodaran also added Craft is a skill that you learn by doing. The more you do it, the better you get at it. Valuation is a craft. So don’t wait to be perfect. Start valuing companies — again and again. ☺️ Your skills will only get better with time and practice.

Aswath Damodaran once said something that really struck me: “Valuation is not a science — because in science, if you get the inputs right, the output will be right too.” But in valuation, you can get all your inputs right and still be wrong.

My first valuation project is on Shake Shack — a US-based fast-casual burger chain 🍔 Used comps: Sweetgreen, Chipotle, and Portillo’s. Can’t brag about my share price 😅 But one thing’s clear: the stock is overvalued and too volatile for my taste. I no be risk taker abeg 🚩📉

A whole CFO of a well-known Nigerian brand reached out on LinkedIn, ready to employ me 😭😭 But NYSC say “not so fast” 🙃 I’m fully committed to serving my fatherland first 🔥🫡 Guys, let’s just keep learning and building — you never know who’s watching 👀

Wahala be like Shack Shake oo 😭 Tried valuing $SHAK and e nearly carry me go — this stock too volatile! Still working on it sha 📊 #Valuation 🙂↕️

Correct, you also need to factor in the sector the business is playing in too, each sector with its own unique biz risk and potential

Valuing companies using comparables? The key word is comparable. If the companies you’re using aren’t truly similar in size, business model, or growth potential… The valuation loses meaning. Garbage in, garbage out.

How I explored Goal Seek in Excel, and I’m loving how powerful it is! It helped me find the input needed to reach a specific financial target — one of those little Excel gems that makes life easier!☺️

Finance is one career path that can lift you out of the trenches. Think Equity Trader. Think Fixed Income Trader. Think Portfolio Manager.

So na even Nepo not nepa 😂😂

That 4.45 wey I get for public uni, I fit get 4.6+ for private 😩 Some courses na “nobody gets A”, unlike private uni. Add small teaching, big exam question join — e choke 😮💨 Me sef for don drop first class certificate when Adekunle asked for one Nepa kids I envy u die🙃

😂😂😂😂

Nepo baby is “biggie” LAPO baby is “okpom” “orobo” Nepo baby is “caramel skin” LAPO baby is “blackie” When Nepo baby fail na “slow learner” When LAPO baby fail na “olodo” When Nepo baby rest na “beauty sleep” When LAPO baby rest after 6hrs traffic na “laziness”. No problem. O…

That 4.45 wey I get for public uni, I fit get 4.6+ for private 😩 Some courses na “nobody gets A”, unlike private uni. Add small teaching, big exam question join — e choke 😮💨 Me sef for don drop first class certificate when Adekunle asked for one Nepa kids I envy u die🙃

Nepa kids are real 😭 My twin started Law at AAUA same time our friend entered a private uni. He’s done with Law School. She’s still waiting for AAUA to call her

Are you interested in honing your skills in business valuation? These books would be very helpful. I’m a living witness.

If you are in finance, please learn Excel. Learn it very well. Excel skills can easily make you stand out.