TechStockFundamentals

@TechFundies

Tech investor for ~25 years. Ran large hedge fund for 10 of those. Here to help. Not investment advice.

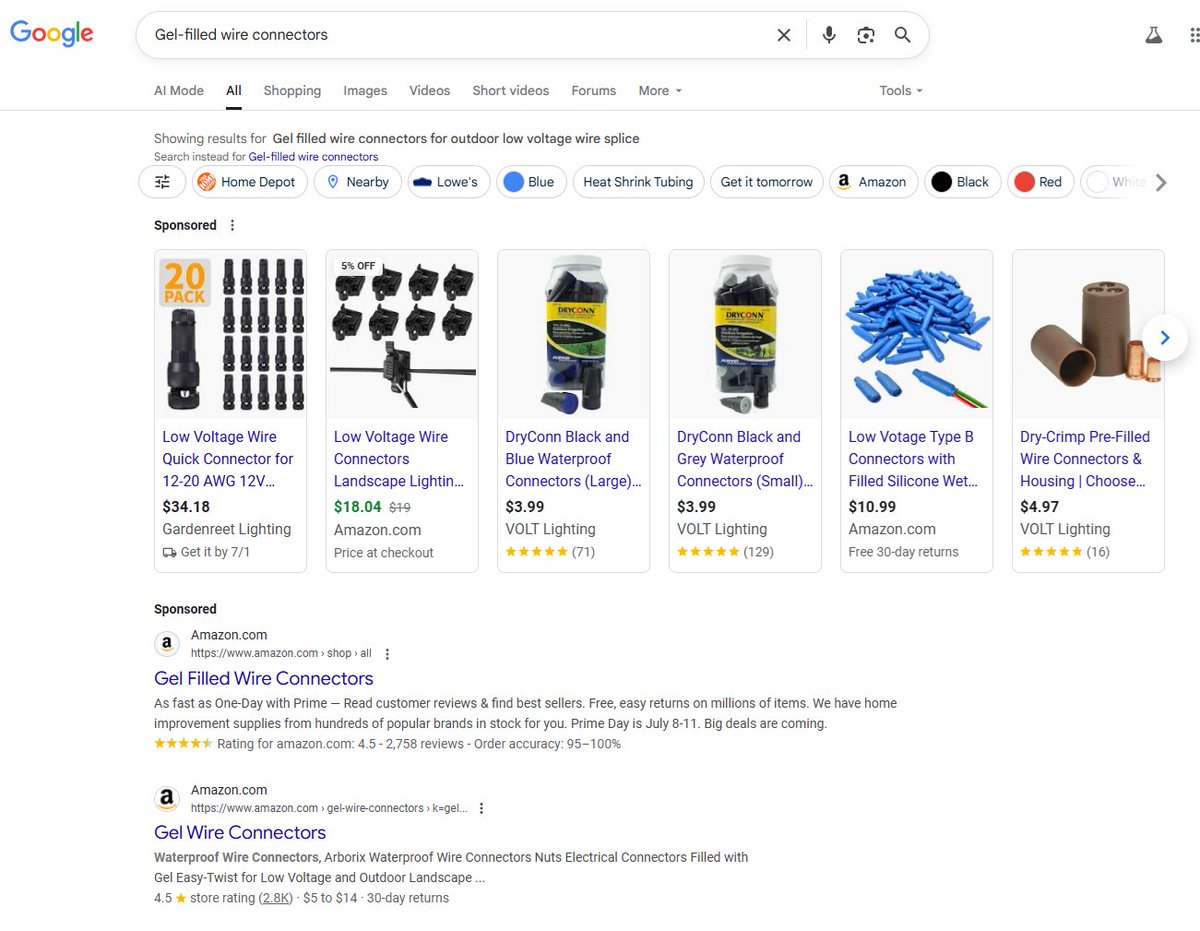

$NOW had a solid quarter and is doing great as an operation platform for large enterprise. Story is solid and numbers seem total fine. Risk / reward not as attractive up here. 0% upside to 40x my above street CY2026 FCF, 25% upside on CY2027. -27% downside to 24x street…

One edit on the $GOOGL qtr. So the Big Beautiful Bill will allow GOOGL to deduct capex up-front starting next year. This won't impact GAAP EPS much but will be a huge tailwind to FCF that likely will more than offset the increases in CAPEX. Interestingly, no street models…

$GOOGL reported a solid quarter. Story seems to be getting better on margin as 1) search continues to do well across both traditional / AI in an environment where ChatGPT / Grok adoption still increasing dramatically [bears would say impact not yet seen bc the AI competitors…

Noticed I somehow let a Perplexity Pro subscription keep going and figured might as well clean it up. They are offering discounts to stay? Really? $20 is too much? At this stage (this isn't NYT or ADBE)? Hmmmm. (sidenote - Perplexity real time transcripts are awesome).

Watched a Databricks webinar on Agentic AI. Think the punchline was basically this agentic stuff doesn't seem to really work right now. This was an opportunity for them to really showcase what's possible today, and I think the absence of hard examples speaks volumes. So this…

3P Contact works on e-comm / retail at OMC was pretty positive on $MNTN. Solid CTV platform w/ large reach, solid tech (easy to use, easy to upload first-party data including from third-party sources, verification built-in, AI targeting as good / better than TTD Kokai), ROAS…

I'm not finding $AMZN or $MSFT that interesting up here from a risk / reward perspective. I'm guessing numbers will mostly be fine but think it is increasingly likely that CAPEX is going to increase meaningfully next year and both stocks are very expensive on FCF. Maybe market…

Some of these $GOOGL AI results are just great. Typed a search related to trimming puppy eye hairs into Chrome url bar, and got great info / product results. Can see how my clicks would go down but price would go up meaningfully. Another win / win / win for consumer /…

Been traveling around MA over the past week. $LYFT won nearly every ride vs $UBER - typically 20-35% cheaper for exactly the same thing. Haven’t seen that in a while.

Contact works at Thermo Fisher Scientific. Pretty positive on $MDB as leading No-SQL database, and using their vector products for AI. Expects core MDB growth of 20-30% going forward, and potentially 30-45% w/ AI contribution. Highlights -Enterprise apps use ORCL while most…

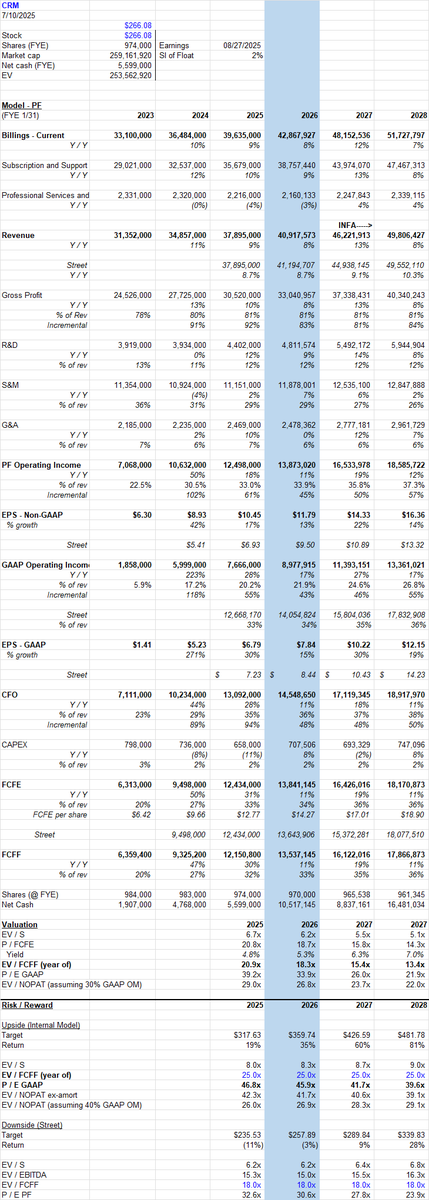

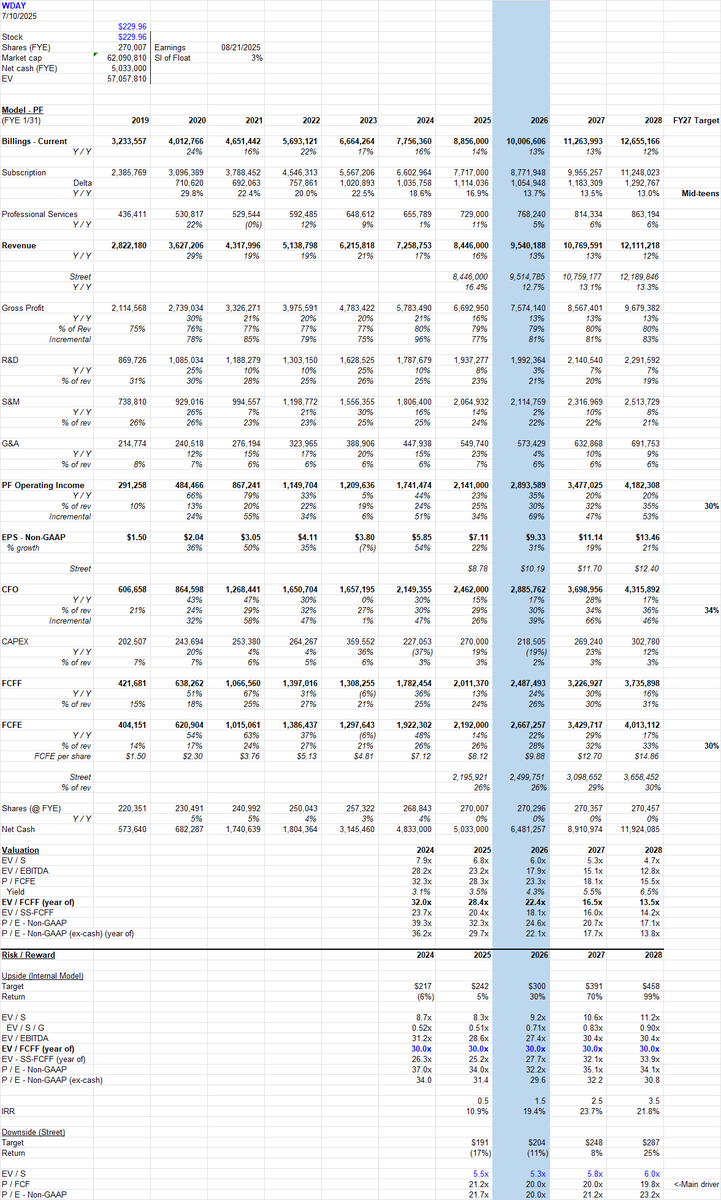

Horizontal, platform SaaS getting pretty cheap again. Q1 had a tough comp against leap year, concluded in the midst of the tariff frenzy, and is seasonally irrelevant anyways. Let's see what Q2 brings. $CRM now trades at 26x CY26 GAAP EPS / 15x FCF (ex-SBC)... $WDAY now…

3P contact is senior exec at 1-800Accountant and purchaser of $CRM. Pretty positive on AgentForce product. Highlights -CRM gets it as far as vision and product for AI. -15 Agentforce (AF) use cases in production right now,and 100 more agents in queue for development -Most are…

Update - pretty sure the prior analysis which suggested buying at highs somehow generates higher results was incorrect. I ran my own which I think is better: Using daily close date from 1/1/2011 through today, I simply look at the forward 1 and 2 year returns for each day…

Chart from a smart wealth-advisor. Shows the counter-intuitive: that forward returns are higher from all-time highs. Not advocating buying here at peak multiples - just sharing.

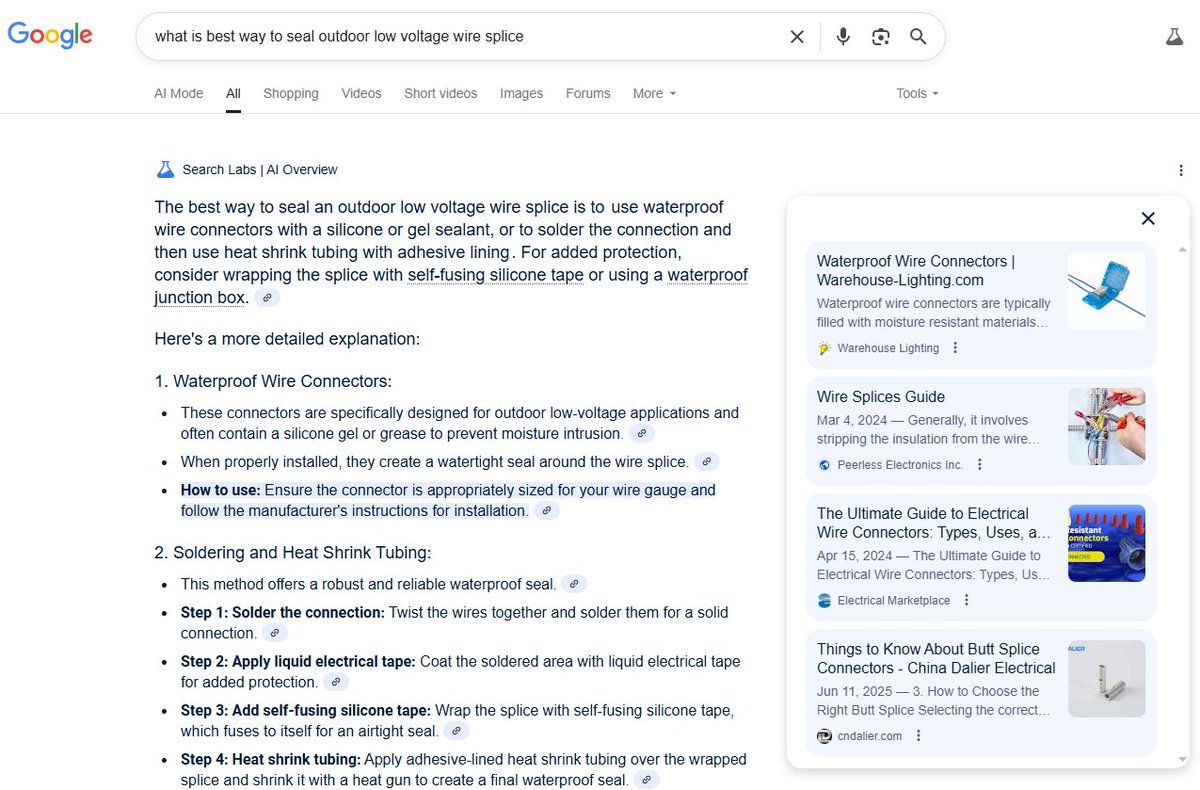

Just had my first $GOOGL AI search experience where they nailed it (meaning both good AI search results for me, and good monetization results for their business). Searched for best way to splice an underground wire. It showed me various techniques. I clicked on the link for…