Kim Ritter

@Syrakritter

Enrolled Agent, mom of teen boys, wannabe runner, avid reader, Caps fanatic.

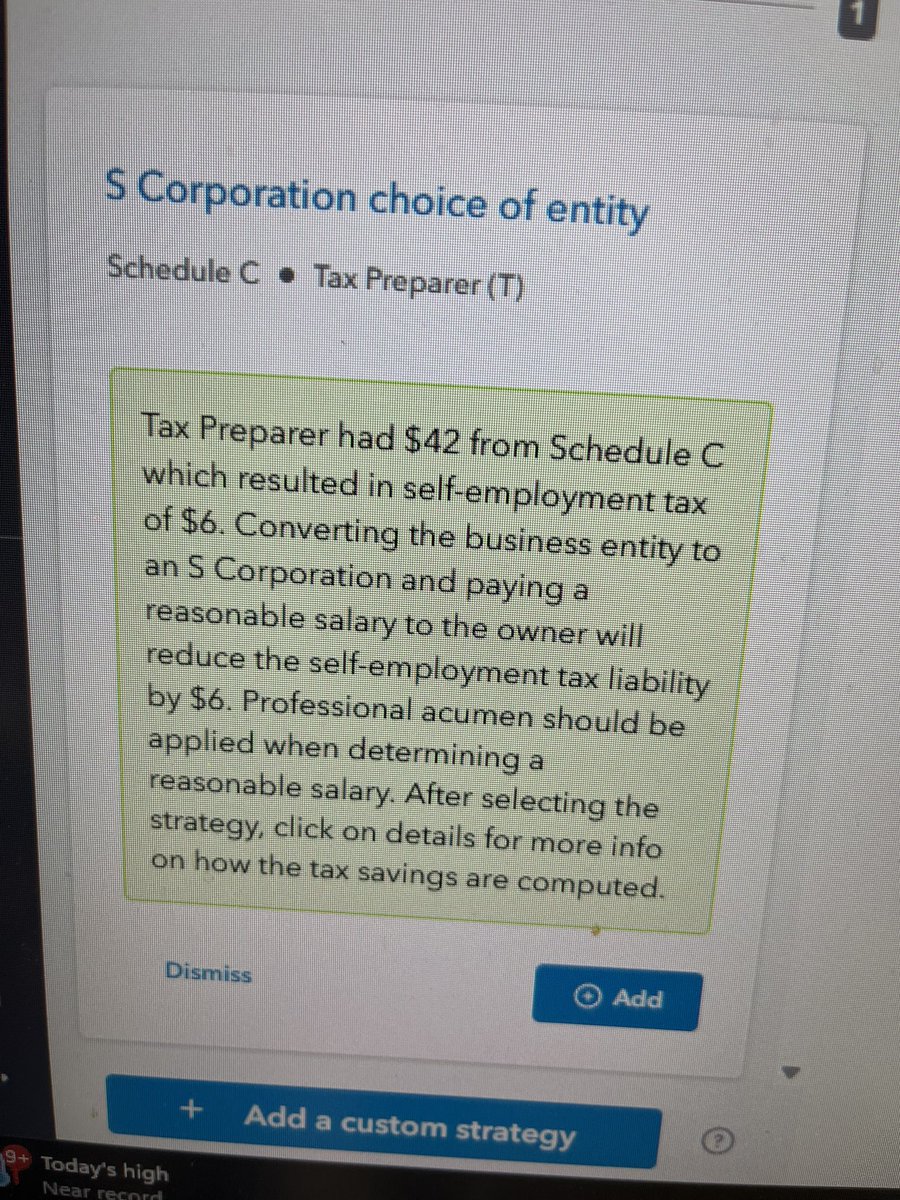

Looks like Intuit needs to reconfigure their AI. Ran Intuit tax advisor on ProConnect and this was a suggestion on a sample return with $42 of Sch C income. #TaxTwitter

#TaxTwitter Question- we have until 7/15/23 to amend 2019, correct? I feel like it's a dumb question, but then again, the IRS and Covid rules are dumb, and it makes me question everything I know, lol.

Congratulations @CuseMSOC on an amazing season! It was a joy to watch you all season long.

#TaxTwitter Client paid ex for 1/2 the value of house @ divorce and deed was transferred. Ex was given ROFR, he declined. Agreement says he also receives 1/2 the proceeds of the sale when client sells house. R/E attorney says entire 1099S is going to client. What is her basis?

Soooo....today I received 2 phone calls from people who received a letter from the IRS saying that they didn't pay their 2021 balance due. Funny thing is, they did pay. 🤦🏻♀️ The IRS is broken. #TaxTwitter

Last Saturday in the office for a while. Let's goooo!! #TaxTwitter

My client may not know this, but this made me smile on a busy day where there's not much smiling going on. #Taxtwitter

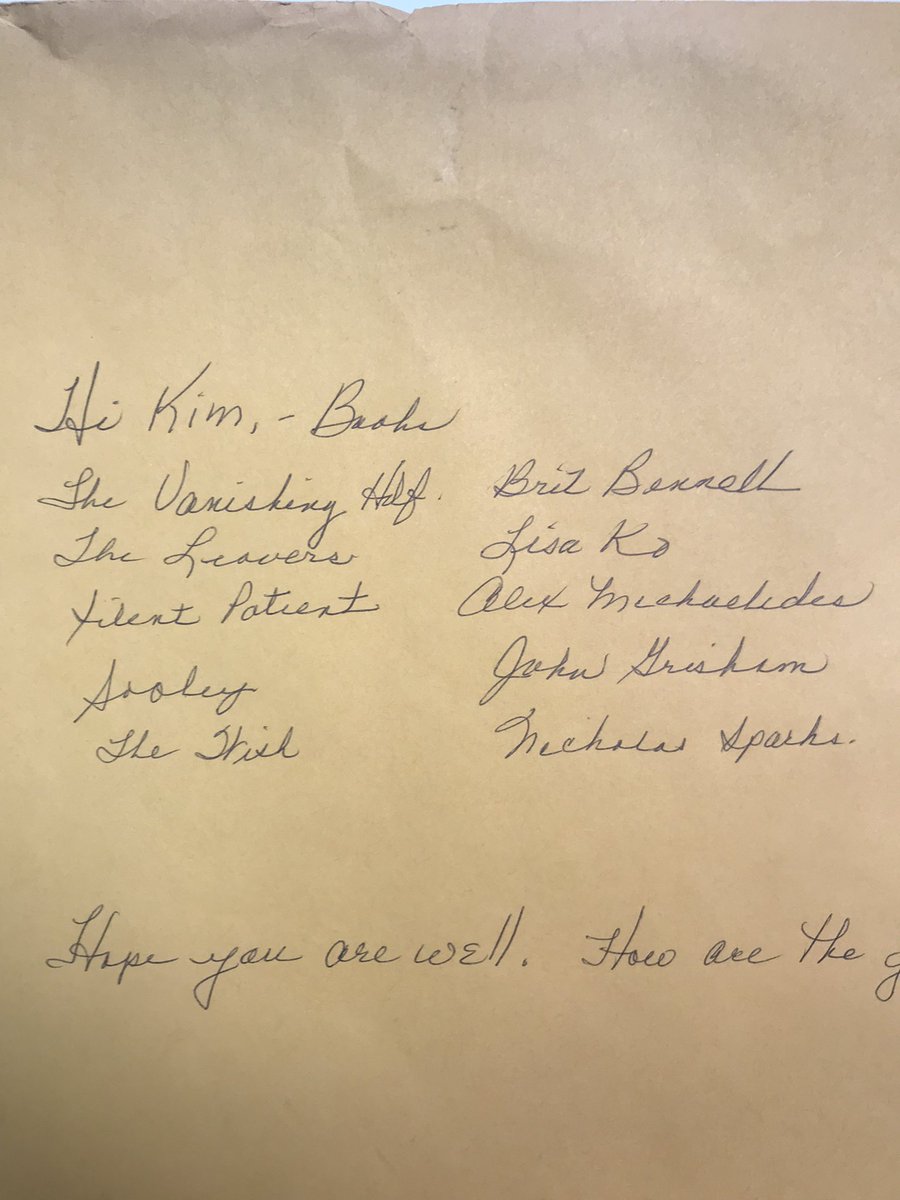

Tax season is tough. But this lovely client made my day when she gave me a list of books to read on the outside of her tax packet. This connection is why I don't hate my job. #TaxTwitter

When you Facebook stalk a sketchy client trying to find a good reason to fire them… and you accidentally send a friend request instead 🤦♀️ Oh well, maybe they will take their business elsewhere 🤷♀️

Said goodbye a client who is moving back to their home country, Germany. It took all the restraint I had not to sing "so long, farewell, auf wiedersehen, goodbye". #TaxTwitter

Thanks NYS. Not being able to file NYS45s online right now is really ruining my flow. #TaxTwitter #YearEnd

IRS announced that Child Tax Credit Letters will go out on Jan 19th. DO NOT THROW THIS LETTER AWAY You will need it when file your taxes next year, your refund will be delayed if file your return without it.

SCorp client waits until Aug 20 to tell us bookkeeper quit and no 2020 work was done. We finish return on 9/12, he signs 9/14. Emails us 9/16 asking if personal return is done. Coworker wants to reply to ask if his balls are brass or bronze. Inappropriate response? #TaxTwitter

Hey #TaxTwitter how are you all handling this debacle? Married clients are getting too much unemployment exclusion refund. wkbw.com/news/local-new…

A great day for our Liverpool HS soccer teams as they partnered up with @LFC to bring the two Liverpools together. Thank you @NBCSportsSoccer and Robbie Earle @The2RobbiesNBC for providing this experience for our athletes! @lpoolboyssoccer @Lpoolgirlssocc1

#TaxTwitter Me to IRS Agent: My client didn't get credit for nonrefundable ERC from 2020 A: Should have applied for it in 2020 on original return Me: Didn't qualify until 2021 when rules changed A: Well it should have been on original 941. Complain to Congress. Seriously??