Super฿ro

@SuperBitcoinBro

Technical analysis should be made as simple as possible, but no simpler. --Albert Einstein, probably *not financial advice* 👇👇 free open-source indicators

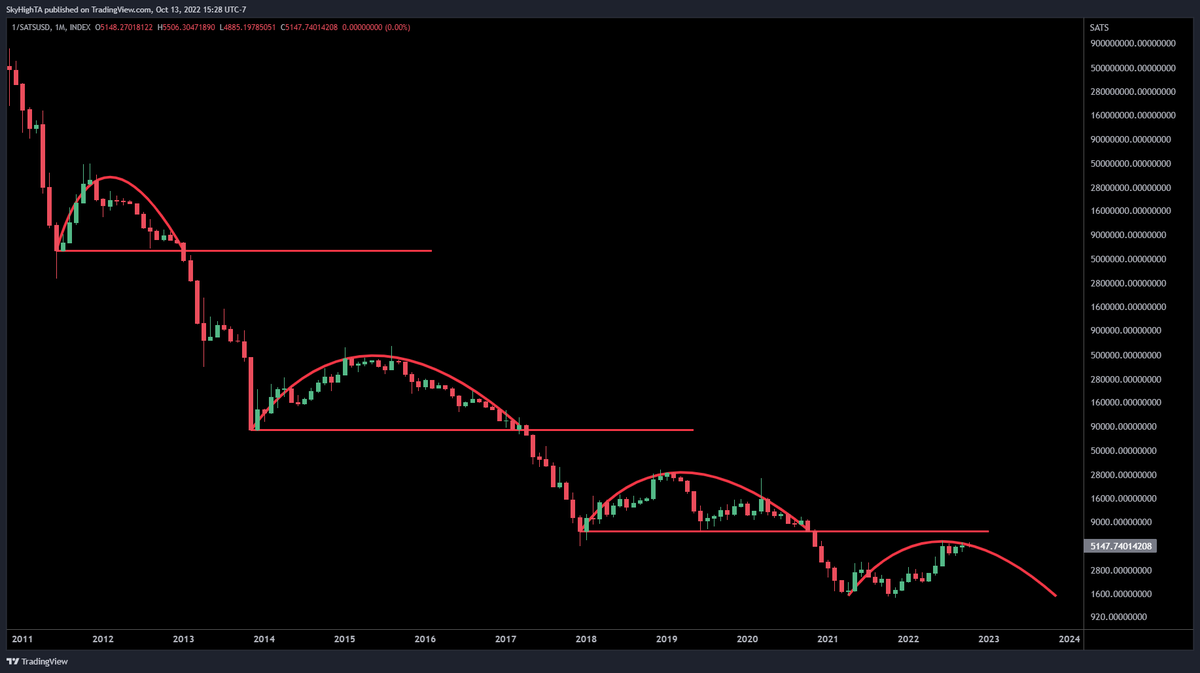

This is my long-term base case for $BTC USD is going to zero when priced in sats May or may not be more pain in store for hodlers but don't get too cute trying to play the dollar long

$BTC first ever daily close above $120K! 💪 Everyone is sleeping on bitcoin right now. $150K should wake them up. LFG!!

$BTC weekly highest close ever insanely bullish no matter how you slice it

$BTC weekly breakout and retest with all MAs in full bullish alignment anybody who is bearish here has obviously never ridden a high timeframe bullish trend in their life and is only useful as counter-signal

$BTC lower liquidity taken, the juiciest fruit is now above

$BTC daily Approaching a retest of last week's low, the FVG and the uptrend from the April low. Will it finally take the remaining liquidity near $115K or front-run it once again?

$BTC daily Approaching a retest of last week's low, the FVG and the uptrend from the April low. Will it finally take the remaining liquidity near $115K or front-run it once again?

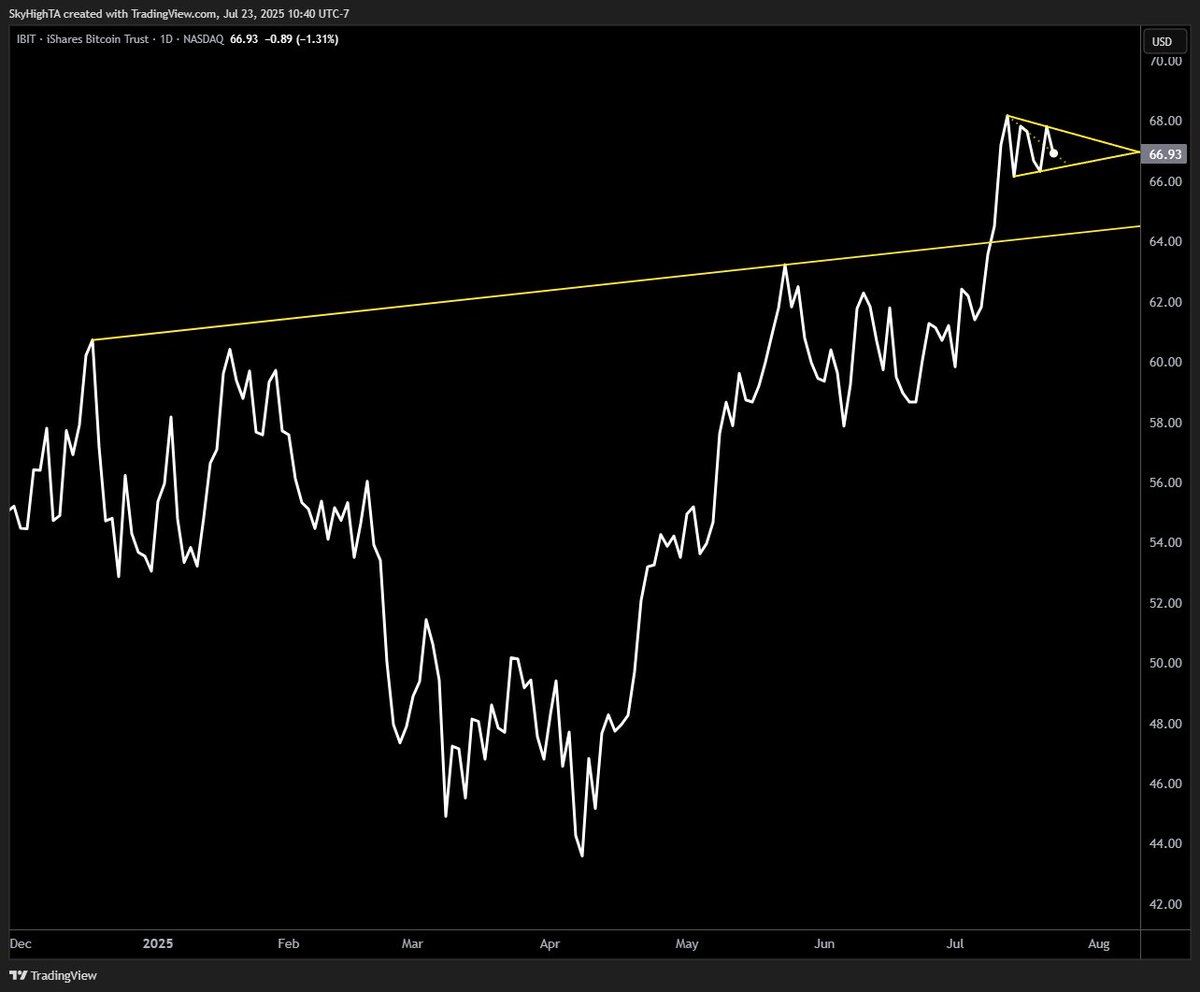

tradfi $BTC aka $IBIT could not look better right now pennant at the highs favors continuation

$BTC potential long liquidations could bring another retest of the FVG around $115K. Unlikely to see much lower than this, the next $20K+ move will be higher.

$BTC weekly this could not be any cleaner the more weak hands we shake out, the better

$BTC daily looking for this bull pennant at the 10 MA to initiate the next leg up

$BTC daily hang on, $123K was just a test pump there are no sellers here, just leverage liquidations

$BTC weekly the inverted ascending scallop we've been tracking since February confirmed emphatically with a $10K weekly candle conservative linear target = $148K aggressive log target = $244K

Lots of calls for a bitcoin dominance top here. Once again: the top is not in for BTC.D. Not even close. While alts have likely bottomed, Bitcoin's market cap will grow much faster as bitcoin enters price discovery while alts work through significant resistance.

Been a while since I posted a bitcoin dominance chart because $BTC.D is mostly irrelevant now. Bitcoin won. Excluding stablecoins, bitcoin is over 2/3 of the total crypto market. Every single one of the million+ altcoins combined is less than half of bitcoin. The snowball is…

$BTC attempting a breakout of the cycle peak trendline this is where the real fun begins

the linear trendline along prior cycle peaks is the last major resistance before $BTC reaches clear blue skies currently just above $115K this trendline will flip to support before the cycle is over

$BTC daily looking for a breakout of the inverse H&S continuation linear target is mid $140K's while the log target is pushing $160K

This $BTC cycle shows more similarity to 2017 than 2021 as far as DXY is concerned.

Measuring prices in USD is like using a broken ruler. If you fail to understand this, you will set your BTCUSD targets far too low and take profits too early. $150K is barely getting started. The USD lost enough strength relative to other fiat currencies, and lost even more to…

$BTCUSD daily got a nice little pump with the bullish SMA alignment. Now let's multiply by DXY for a "global" BTC price and do it again.