Subu Trade

@SubuTrade

Trading large trends/key themes and smaller opportunities in between.

Large Speculators / Hedge Funds are the most net short S&P 500 futures in over a year.

Asset Managers are RECORD short the U.S. Dollar, according to the COT Report

Large Speculators / Hedge Funds are the most net short Russell 2000 futures since the 2022 bear market bottom. Almost max short small caps!!

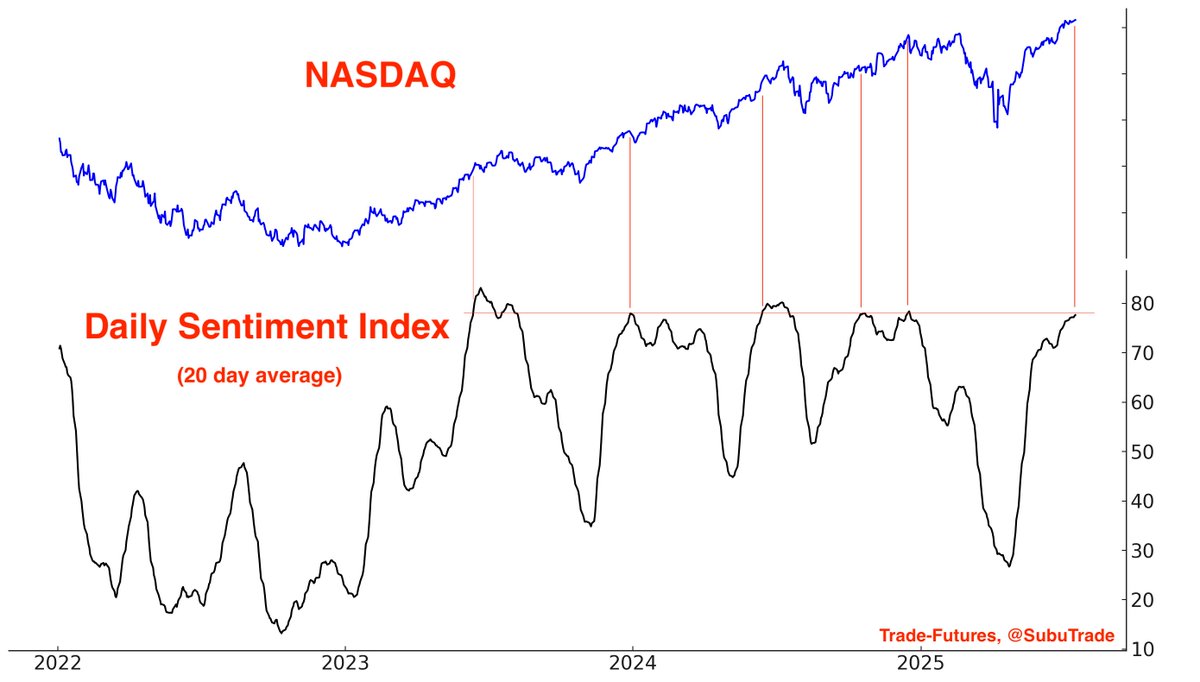

Sentiment update: NASDAQ's Daily Sentiment Index is extremely high. Pullback soon?

The S&P has been above its 20 day moving average for 52 straight days. Pullback soon?

The S&P 500 has formed a "Golden Cross" (50 day moving average crossed above 200 day moving average). Here's every Golden Cross in the past 50 years, and what the S&P did next:

The S&P 500 just made a new all-time high! It was down -18% less than 3 months ago. Here's what the S&P did after similar V-shaped rallies ⬇️

The NASDAQ 100 is at an all-time high. It was down -20% less than 3 months ago. These sharp rallies tend to be bullish.

Asset Managers are almost RECORD short the U.S. Dollar, according to the COT Report. Is this bullish for the Dollar?

Sentiment is recovering: AAII Bulls-Bears just topped +3% for the first time in 15 weeks. This is a bullish signal for the S&P 500 over the next 3-12 months

The NASDAQ 100 is just -2% below its all-time high. It was down -20% just 2 months ago. Historically, sharp rallies like this were bullish ⬇️

The S&P 500 is now -3% below its all-time high. Last month it was -18% below its all-time high. These quick recoveries tend to see stocks rally more over the next 3-12 months. Momentum is strong.

Strong momentum: S&P 500 rallied from -13% below its 200 day moving average to +3% above it. Stocks tend to go higher over the following months. h/t @mark_ungewitter