Size Credit

@SizeCredit

The only fixed-rate lending protocol for any maturity. Built on @base and Ethereum.

Roll into the best borrow rates continuously Then roll out at any time Here’s why our NEW Variable Rolling Rates change the game ➿

USDC variable borrow rates on @Base are pamping Instead of paying today's ~1% spike on Aave, lock in a low 7d rate at app.size.credit 🐋

Retro evolution 🐋 Size is developing the fixed-rate fundamentals of existing global credit markets to create DeFi's first unified, truly scalable liquidity baselayer docs.size.credit

A DEFI FIRST! Saturday saw a degen lock in the longest custom loan ever using Size. 180 days at 4% against wstETH 🆙🆙🆙

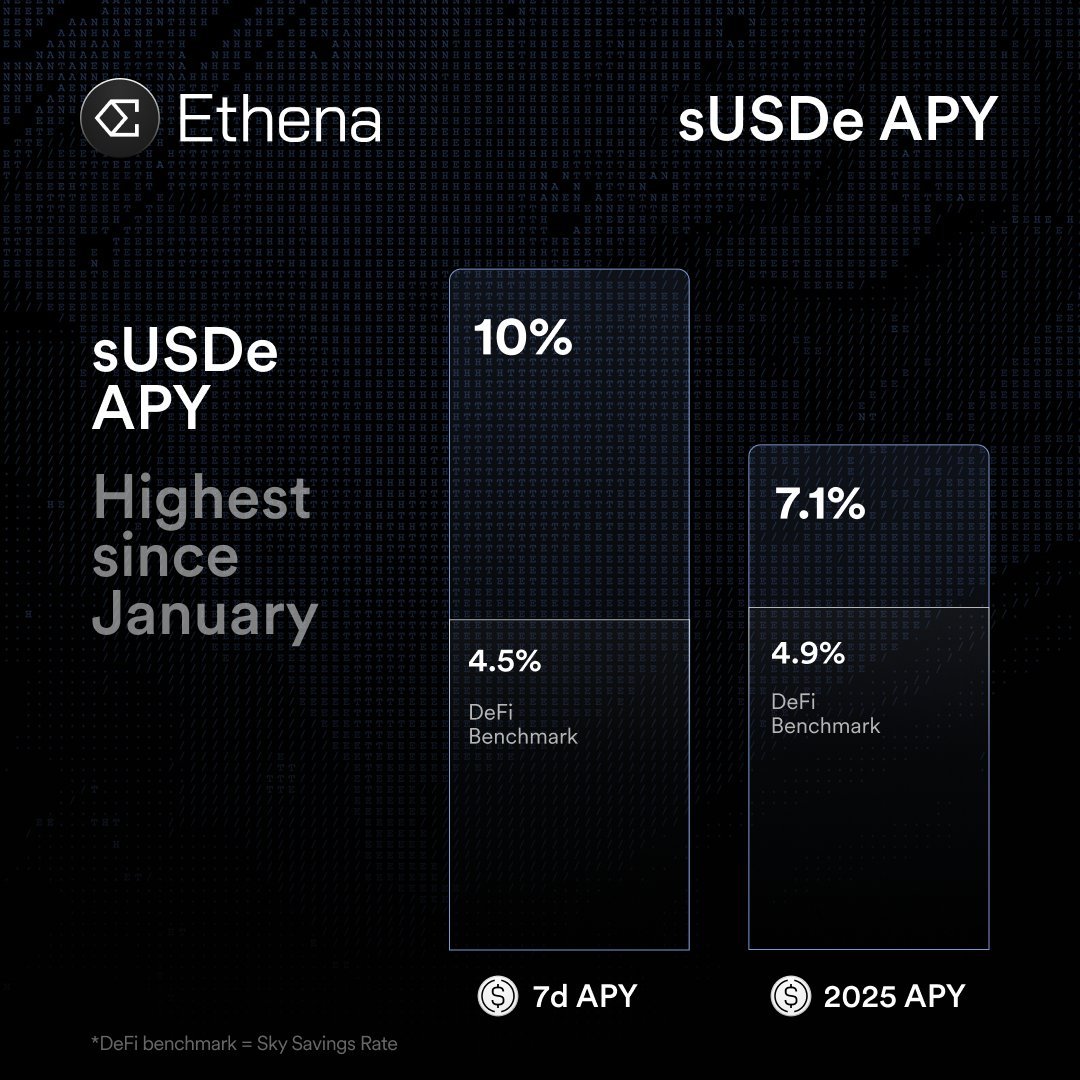

Here is the DeFi term structure for this week (according to data coming from Aave, Morpho, Term, Notional for USDC as supply against blue chips collateral i.e. WETH, WBTC, cbBTC) Tried to fit different models for comparison As usual we have very few data points (5 only) so…

A Size user just locked in a 4% fixed-rate borrow for 180d against their wstETH - a first for DeFi 🐋 Who said degens don't understand term structure...?

🆙 Lever up new levels 🆙 Use sUSDe to secure a low 180d fixed rate. Earn 8% before even deploying. Exit at any time. sUSDe Yield: 12% 180d USDC Fixed Rate: 4%

Crypto rates = your market compass 🧭 Follow + turn notifications on 🔔 for weekly yield analysis from the Crypto Yield Curve podcast

Pouring one out for the homies who got an expensive lesson in @aave utilization rate risks yesterday Your next stop should be Size - no spikes, no stress 🐋

Up to 1000% stablecoin APY was on offer during our first Earn campaign Earn season #2 is coming asap... and it's going to be even bigger Sign up now on the app /Earn page for first access 🐋

A user just locked in a borrow rate against a SIZE-able wstUSR-PT bag 🐋

Listen up, dorkzzz Taking time out of my v.busy day to land sum @SizeCredit knockout alpha Wanna slurp 53.13% F-I-X-E-D yield with your sUSDe PTs? Get tf in 🛗

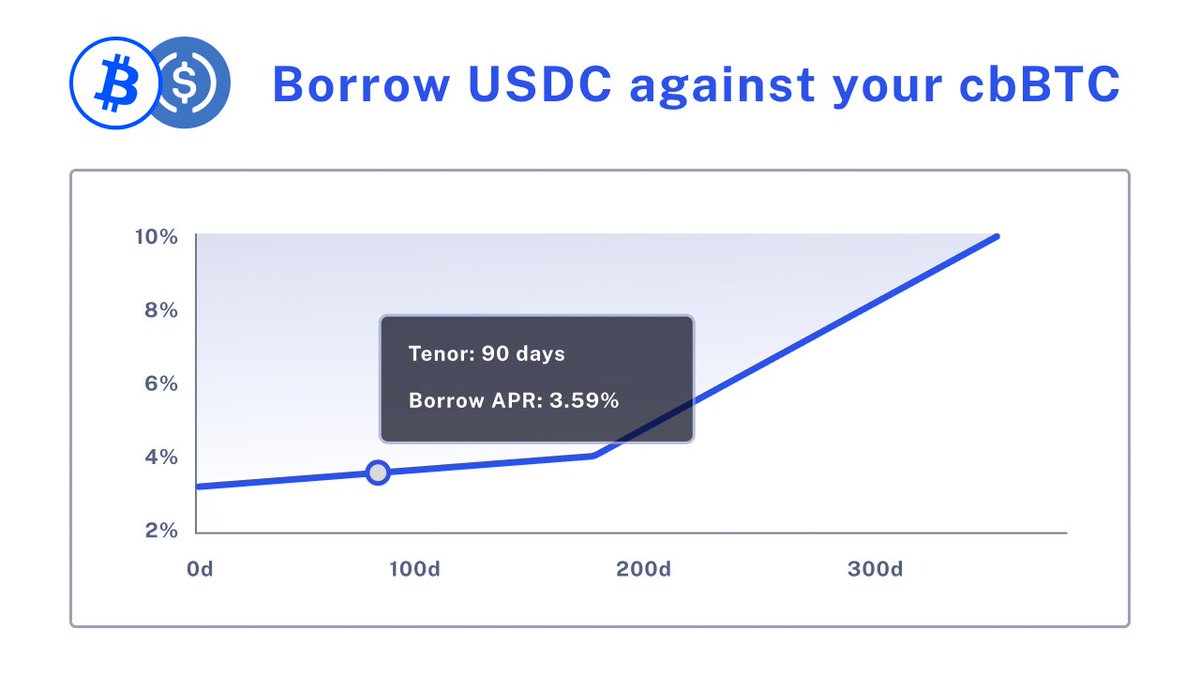

Your next sUSDe stable-stable play with Size 🐋 ➡ Stack sUSDe (10% yield) ➡️ Borrow fixed-rate USDC against it (from 3.2%) ➡️ Touch grass & get paid up to 6.8% to borrow

Swerve variable borrow costs 📈 Set fixed rates for any due date 📅