Silbergleit Junior

@SilbergleitJr

Providing advice your financial advisor does not know or does not want to share.

"If you want to be wrong then follow the masses." - Socrates

I am pleased to see that $OPEN management is not sleeping, and is indeed working behind the scenes to boost revenues. Good sign.

Introducing Cash Plus: The newest way to sell with Opendoor ✨ Sell us your home, we'll renovate and resell it, and you get all the upside. It's a win-win-win. Cash Plus is available now in select markets. Learn more at opendoor.com/cash-plus youtu.be/bmWcUO6VN6o

It's funny how many people think that flipping houses is a great business venture when their uncle does it, but it's suddenly a bad unsustainable business model when Opendoor does it at scale. $OPEN

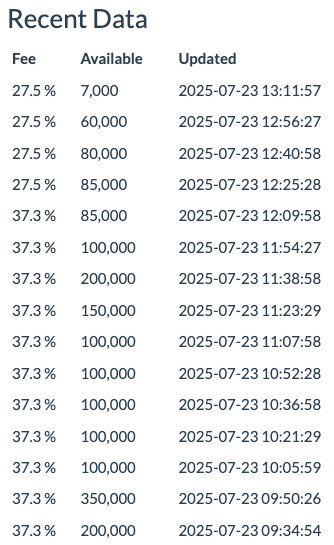

No $OPEN shares available to borrow on Interactive Brokers. Meanwhile, Shares Failed to Deliver is going up as the saga continues. Make it make sense!

No $OPEN shares available to borrow at IBKR. If you can locate some shares, please let us know.

No $OPEN shares available to borrow at IBKR. If you can locate some shares, please let us know.

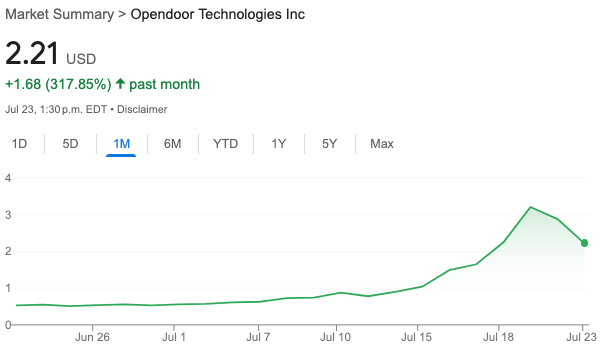

Soon we shall receive a letter from NASDAQ, letting us know that $OPEN is compliant again after closing above $1.00 for 10 consecutive trading days, and that reverse split is not required anymore. Cheers! 🥂

Very pleased with $OPEN management deciding to postpone the reverse split meeting. Most likely it will be canceled all together soon.

Breaking news: Opendoor ($OPEN) to postpone Special Meeting of Stockholders to August 27, 2025 At close of business today, $OPEN will have regained compliance with Nasdaq listing rules.

$OPEN still having higher options volume than $GOOGL, $PLTR, or $AAPL. Why? I thought the squeeze is done and we are going back under $1.00.

Another trading week ahead of us. I'm excited for the market to $OPEN.

$OPEN shorts are busy celebrating pennies while the big boys keep swallowing millions of shares. Retail is distracted, but the smart money is quietly cornering supply. They know what is coming. Someone is about to get rug-pulled and it ain’t the longs.💵

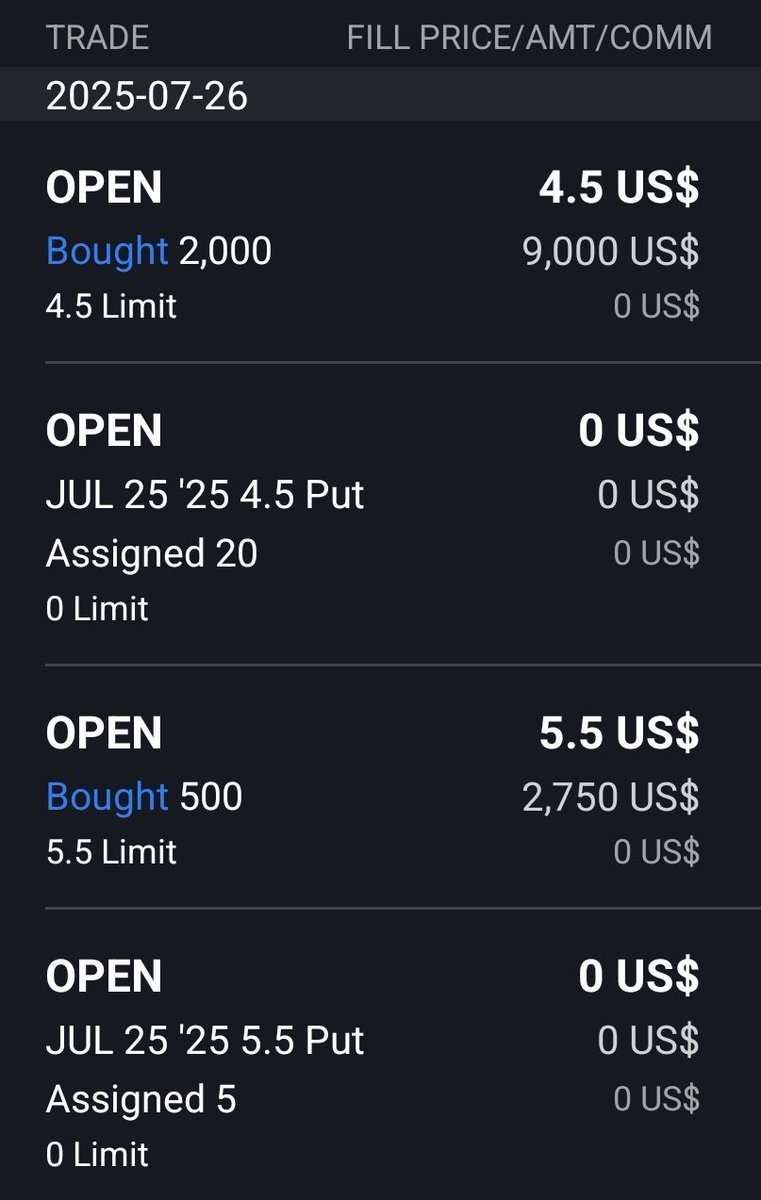

While you are complaining about $OPEN being $2.50, I got assigned on the puts I sold earlier this week, and had to buy shares at $4.50 and $5.50.

While you are complaining about $OPEN being $2.50, I got assigned on the puts I sold earlier this week, and had to buy shares at $4.50 and $5.50.

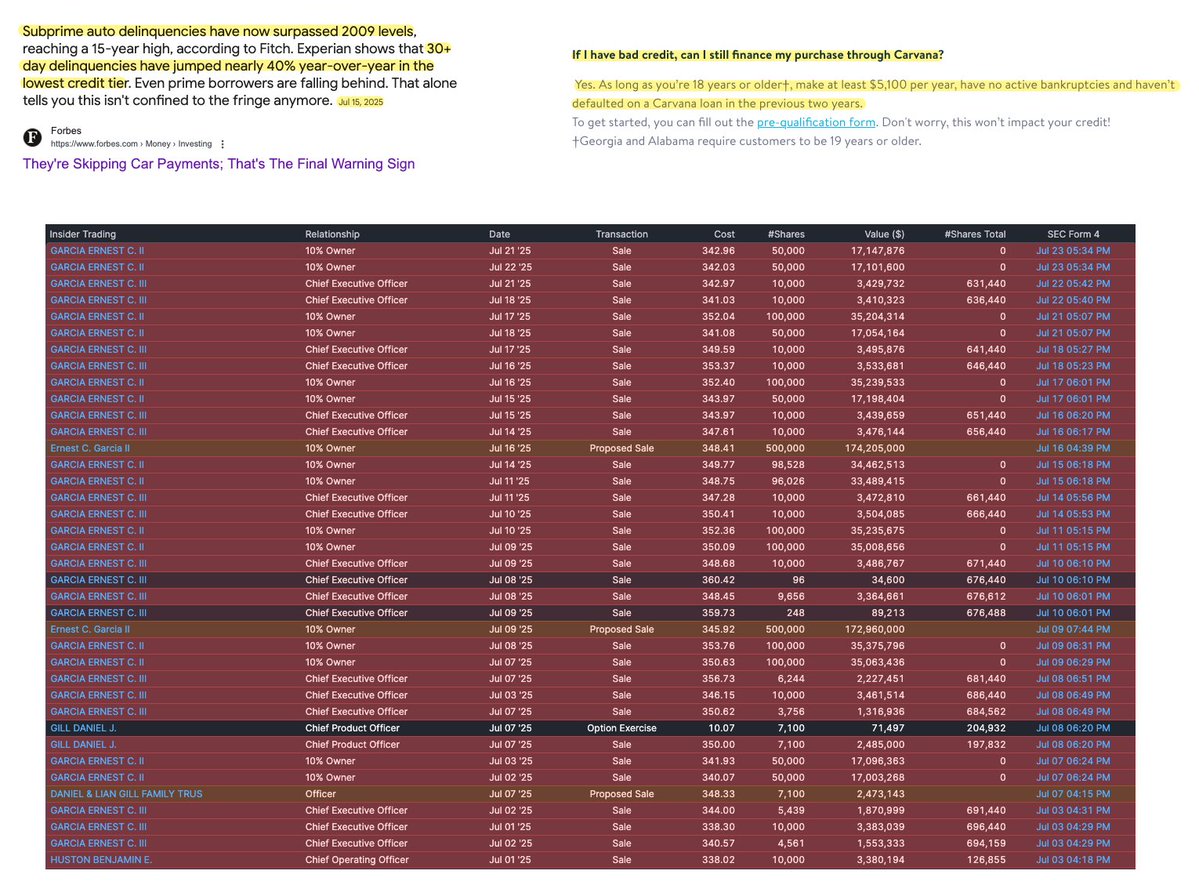

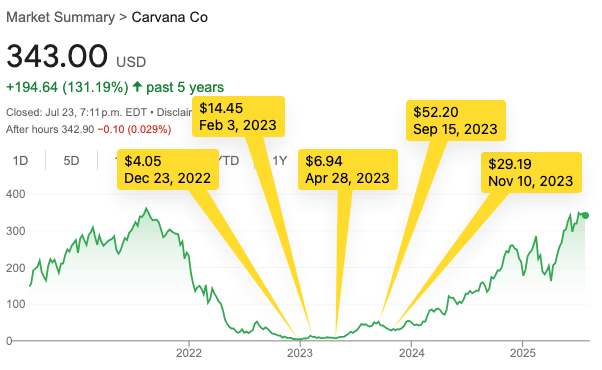

Many of you have asked: "How can you be bullish on $OPEN and bearish on $CVNA at the same time, especially when you're comparing them?" The answer is simple: Over a five-year span, Carvana is up 123%, while Opendoor is down 78%. Up until mid-2023, they were trading close…

$NVDA, $AAPL and $MSFT currently account for ~20% of the entire S&P 500.

$OPEN shareholders are set to vote on the proposed reverse stock split at a special meeting scheduled for July 28, 2025 at 9:30 a.m. PT. The board is asking for approval to consolidate shares at a ratio between 1‑for‑10 and 1‑for‑50, though the exact ratio and timing will be…

Soon it will be pretty clear to everyone why insiders were selling their $CVNA shares.

Doing some late night technical analysis on $AEO after watching Sydney Sweeney's commercial. The stock has a history of bouncing off low $10s and going into low $20s. As per current P/E ratios, American Eagle is in line with other retail stocks. AEO: 10.99 ANF: 9.36 GAP: 9.01…

Is this bullish for Carvana $CVNA?

Subprime auto delinquencies have now surpassed 2009 levels, reaching a 15-year high, according to Fitch.

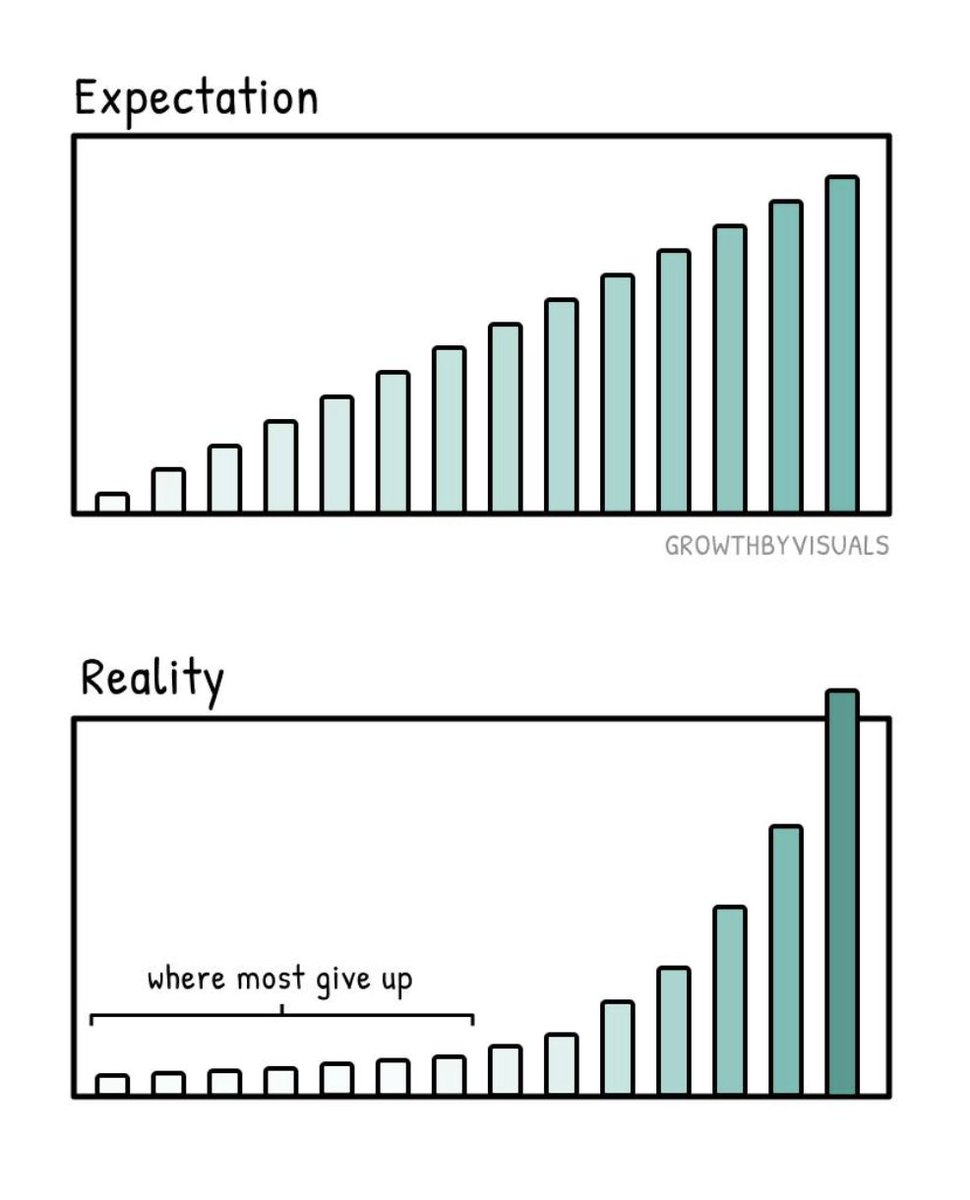

I feel that many new investors and new traders are scared and worried about $OPEN going down -50% in the past 2 days. Consolidations during multi-quarter bull runs are completely normal and expected. That's how market participants process the new information and build their…

An inspirational post I've seen on Instagram. A good reminder for everyone in the investing game.

I'm finding it funny how big fintwit accounts are making fun of $OPEN being red the past few days, as if we all bought at the peak. The reality is: - the stock is still +317% since the bull run started - the borrowing fee is 27% indicating there are not many shares available to…