Selling For Premium

@Selling4Premium

Selling (aka "writing") options to generate income. Part-time trader. Self-made $$$ through grit + grind. Tweets are for informational purposes only.

Been a while, but episode 10 of the #Optionselling podcast is live! We're discussing strike selection ... what to consider when picking the strike to write on that call or put. youtu.be/yRfCmCMzXvo Podcast episode is audio only and short enough so that you can listen to it…

Got some far-OTM and far-DTE covered calls on $TSLA that will be rolled down to the Aug or Sep expiry and to around the 300 strike. Leaning towards keeping the shares for long-term, but this earnings release had terrible results. 😭 Will cut shares if TSLA dumps down to our…

Am looking at put-write trades on $HUM at the 210 strike Aug 1 expiry. Am also looking at farther-out DTE trades at the 180 put strike (that level not seen since 2016). Will adjust as necessary on Tuesday this week. Expected move is 7.5% (subject to change leading up to…

So many great #Optionselling plays next week 🤤😁 Will be 👀 these tickers for trades. Will post trade ideas here, so follow and stay tuned. $CLS $UNH $SOFI $PYPL $BA $UPS $SPOT $V $MARA $SBUX $CZR $HUM $ETSY $META $MSFT $HOOD $ARM $RBLX $MA $AAPL $AMZN $MSTR $COIN $RDDT $IOT…

Weinstein stage 2 breakout per Trendspider. Mentioned $GOOGL a while ago regarding their TPU and cloud opportunity when it comes to AI compute and data centers.

$GOOG

$SOFI has had a steep move up. Looks primed for a dump, but also looks to be building some support at the 21 level ... potentially setting up a new launching pad. Volume support in the 14-16 range. ATH is at 28 and not much overhead resistance between current price and ATH.…

So many great #Optionselling plays next week 🤤😁 Will be 👀 these tickers for trades. Will post trade ideas here, so follow and stay tuned. $CLS $UNH $SOFI $PYPL $BA $UPS $SPOT $V $MARA $SBUX $CZR $HUM $ETSY $META $MSFT $HOOD $ARM $RBLX $MA $AAPL $AMZN $MSTR $COIN $RDDT $IOT…

Looking at pre-earnings put-write trades on $CLS at the 115 strike and 135-140 strike range based on volume support, Aug 1 expiry. Expected move is ~11%. #Optionselling

So many great #Optionselling plays next week 🤤😁 Will be 👀 these tickers for trades. Will post trade ideas here, so follow and stay tuned. $CLS $UNH $SOFI $PYPL $BA $UPS $SPOT $V $MARA $SBUX $CZR $HUM $ETSY $META $MSFT $HOOD $ARM $RBLX $MA $AAPL $AMZN $MSTR $COIN $RDDT $IOT…

Don't even need fancy charts or volume profiles or expected moves for $UNH. Simply gonna write puts at the $250 strike, Aug 1 expiry. Might also take a few more #Optionselling trades at lower strikes and farther-out expiration dates.

So many great #Optionselling plays next week 🤤😁 Will be 👀 these tickers for trades. Will post trade ideas here, so follow and stay tuned. $CLS $UNH $SOFI $PYPL $BA $UPS $SPOT $V $MARA $SBUX $CZR $HUM $ETSY $META $MSFT $HOOD $ARM $RBLX $MA $AAPL $AMZN $MSTR $COIN $RDDT $IOT…

Sharing what @VolSignals said in a newsletter about $SPX since it seems that most FinTwit traders on here seem to forget ... "Most of the trades in the $SPX are volatility trades or structural hedges - NOT directional bets."

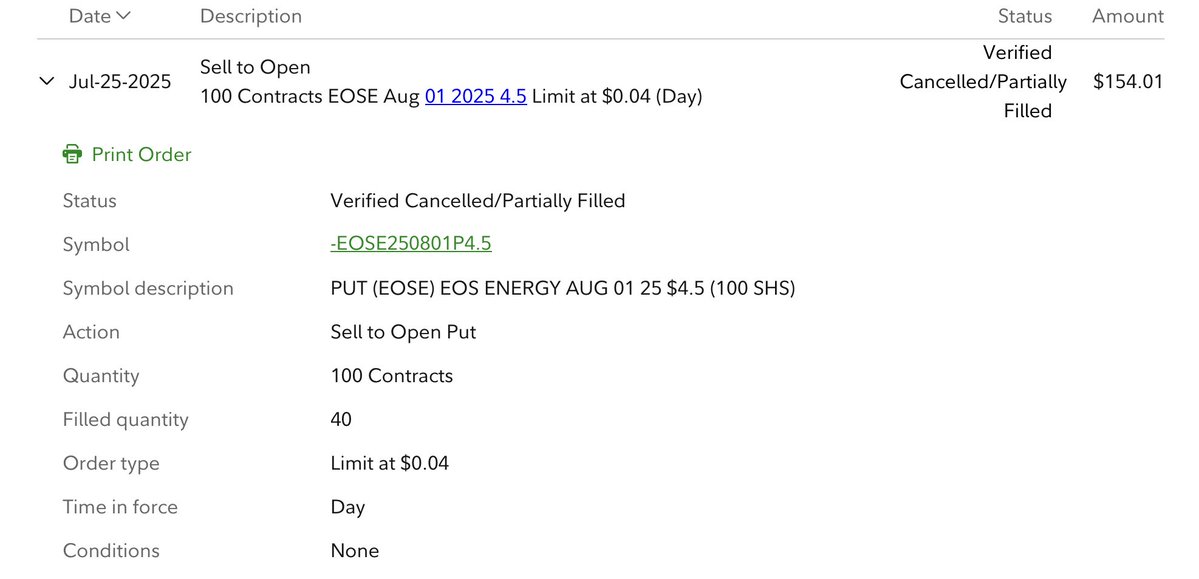

Continuing with the "free money" trade on $EOSE ... was pissed that only 40/100 contracts got filled. Will try again on Monday with a put-write trade for the remaining 60 contracts. Might go up in strike to 5 if they kill the premium at 4.5.

People are focusing too much on the short-term price action and not looking at the macro long-term set-up and opportunity for $OSCR (and $UNH $HUM for that matter). The managed healthcare sector is poised for growth due to rising demand for coordinated care (which will only…

So many great #Optionselling plays next week 🤤😁 Will be 👀 these tickers for trades. Will post trade ideas here, so follow and stay tuned. $CLS $UNH $SOFI $PYPL $BA $UPS $SPOT $V $MARA $SBUX $CZR $HUM $ETSY $META $MSFT $HOOD $ARM $RBLX $MA $AAPL $AMZN $MSTR $COIN $RDDT $IOT…

Trying to sneak in those end-of-week #Optionselling trades during the lunch hour! 😋

Took $6K profit on $CLS position. Was underwater on LEAP covered calls, and with earnings coming up next week just decided to take the trade off the table. CLS might pump up even more post-earnings. Who knows. Am happy with the profit. Will write cash-secured puts to get back…