Sébastien Derivaux

@SebVentures

#cryptobanking scholar Founding Chef at @SteakhouseFi Too boring for #DeFi, too punk for #TradFi

1/ Introducing the Crypto Banking System, a roadmap to bring DeFi to be a challenger to TradFi cryptobanking.network/the-crypto-ban…

🌀Real-World Asset Summit Cannes 2025 @centrifuge : Creating liquidity for RWAs🌀 🎙Panelists: • @SebVentures , @SteakhouseFi • @DDinkelmeyer , @MidasRWA •David Vatchev, @FasanaraDigital • @hilmarxo Hilmar Orth, @ArrakisFinance Moderator: @MarcinRedStone ,…

Public servants, paid your money, coercing you to give them more power and keep their payroll. @BIS_org should be pushed on the right path, oblivion.

"There is, no doubt, considerable room for improvement in the current system. [...] Nevertheless, the merits of the core architecture of the system with the central bank at its centre should be recognised and preserved." - @BIS_org Someone wants to keep his job above all

"a new type of financial market infrastructure – a “unified ledger” – which may or may not use distributed ledger technology (DLT)" - @BIS_org One server is Basel can solve everything. Unified under the control of the @BIS_org . Sounds like a plan.

"Stablecoins are bad as means of payment and don't work but they are such good means of payment and work so well they should be constrained to stop them competing with public sector" - @BIS_org (2025, colorized) People in nice offices frothing at the mouth about crypto again

USDT price chart is quite interesting with a regime change around April. Before there was an outside spread 0.999-1 (10bps fees from @Tether_to ). Now there is less volatility. Could be consistent demand since, more arbitragers or change of the rules.

⚡ David Vatchev, @DDinkelmeyer, @SebVentures, @mr_optimax, @bneiluj, @defin00b tackled the cost of bringing RWAs onchain. Can tokenized credit compete with TradFi, and what happens when you loop a credit vault? Panel on leverage, liquidity, legal risk: youtube.com/watch?v=rM97mn…

Enlightenment is only 4 coffee, 3 glasses of wine and 2 shots of tequila away

⚡ @SebVentures, Chef, @SteakhouseFi explored the path to stablecoin fungibility. What happens when stablecoins can’t be redeemed at par, and can atomic clearing and tokenized T-bills fix it? Listen to the talk on singleness of money and DeFi settlement: youtube.com/watch?v=BNxhPE…

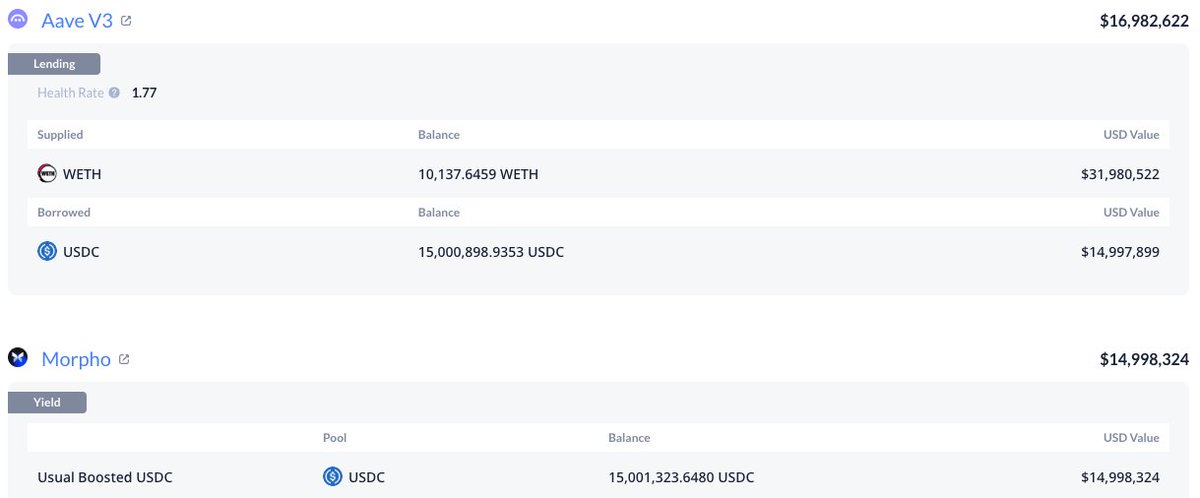

🔥 15%→28%+ APY: Private Credit On-Chain Leverage RWA Strategy 4 addresses | 20 days | $1.64M→$4.25M mF-ONE collateral 2.59x leverage | @FasanaraCapital's $5B private credit AUM @FasanaraCapital @MidasRWA @SteakhouseFi @MorphoLabs redefining on-chain finance 🚀 🧵1/6

💱 We Still Don’t Have a Unified Money Layer @SebVentures from @SteakhouseFi gave a crash course in monetary history, drawing a parallel to 1800s Scotland, where competing banks finally agreed to clear each other’s notes 1:1. That’s what enabled true financial interoperability.…

Do you wonder why tokenized public securities (stocks, ETFs, ...) are not as good as they could be? Because lack of redeem in kind. Why? Securities laws, esp broker dealer. Securities laws should be opt in, not forcing people to use worse solutions.

Speaking of regulators spending public money and their power to unfairly compete with the private sector. I will also make one bet: The offchain settlement of the € CBDC, which is their key argument for privacy, will be removed (or watered down) before launch. Can't work.

Instruments of oppression and stagnation are often disguised as a “public good” Will their CBDC protect citizen privacy? Permissionless innovation? Freedom to transact? Exit their currency debasement? The answer to is no. This is a tool of control. Crypto is the public good.

People that never really worked outside of the public sector, congratulating themselves of having a startup spirit. The ivory tower mindset is strong.

Agustín Carstens has always brought a startup spirit to central banking: curious, bold & deeply committed to public service. I’ve had the privilege of calling him both a colleague & a friend. This profile beautifully captures his brilliance & humanity. imf.org/en/Publication…

This is what real RWA adoption looks like: multiple borrowers at launch. We're early, but past PoC. A few million isn’t much, but @StakeCapital and others are now RWA network participants—driven by profit, making markets more efficient. As it should be.

Stake Capital is proud to lead the launch of mF-ONE—the first fully on-chain private credit initiative. In partnership with @MidasRWA, @FasanaraCapital, @MorphoLabs, and @SteakhouseFi, we’re bringing private credits strategy into DeFi. A major step forward. $3 trillion by 2028 😳