Sean | Derive

@SeanNotShorn

Head of Research @derivexyz

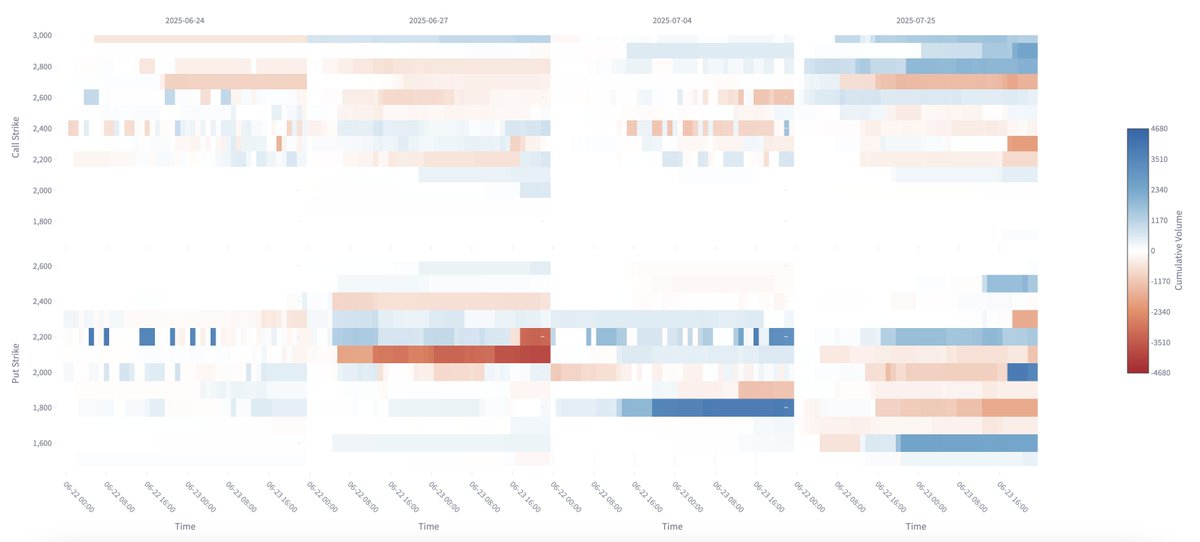

Seeing big ETH call accumulation in the $2800-$3000 range and put buying in the $1800-$1600 range. If conflict with Iran escalates, put buyers will be paid. Otherwise, we could see a quick bounce to high low $3k July shaping up to be a volatile month 🍿

“The short-term narrative is on Ethereum,” @SeanNotShorn, Head of Research at on-chain options platform Derive, told @DecryptMedia

Here's Why Ethereum ETF Investors Are Outperforming Their Bitcoin Counterparts ► decrypt.co/331370/ethereu…

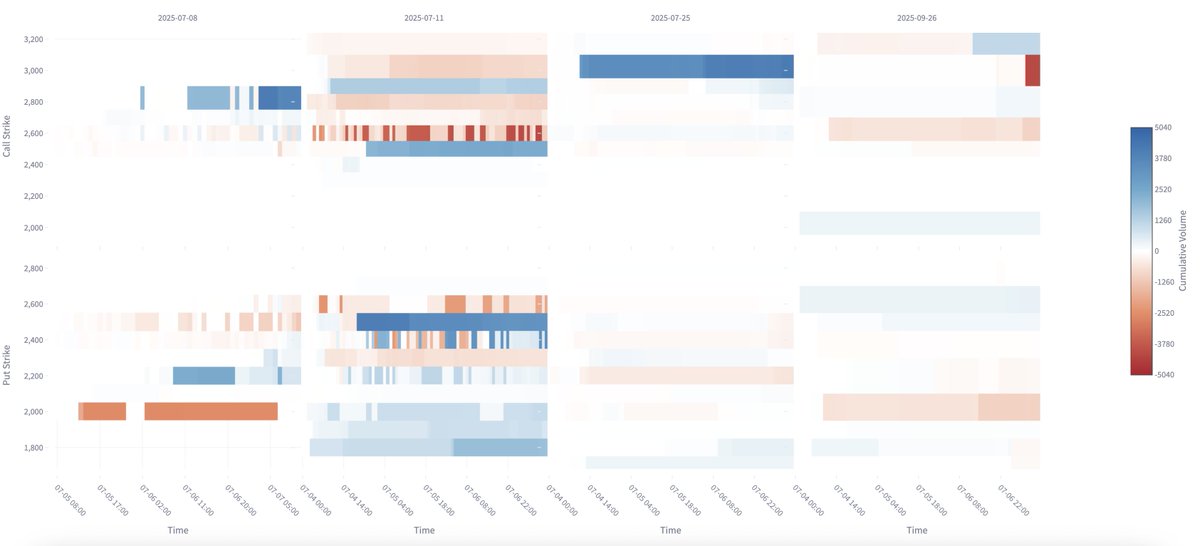

SOL traders appear to be preparing for a “turbulent month,” Sean Dawson, Head of Research at options trading platform Derive, told @Decryptmedia. He points to a growing gap between 30D realized and implied vols. IV has more than tripled from 4% to 14%.

Solana Clinches 5-Month High, Where to From Here? ► decrypt.co/331184/solana-…

Dr. @SeanNotShorn, Derive’s Head of Research, said "traders are aggressively positioned for a rapid move to $4K” and called the spike “a regime change” for ether."

Wave of short liquidations drives ETH past $3,600 as analyst calls price shift a ‘regime change’ theblock.co/post/363347/wa…

"A strong signal that traders are aligned on a fast, continued breakout and reflects a growing appetite for leveraged long exposure as bullish conviction builds." - Dr. @SeanNotShorn, Head of Research at Derive, told CoinDesk.

Traders position for a continued rally in $BTC and $ETH, with bullishness more pronounced in Ethereum's native token. by @godbole17. trib.al/zGUhD3V

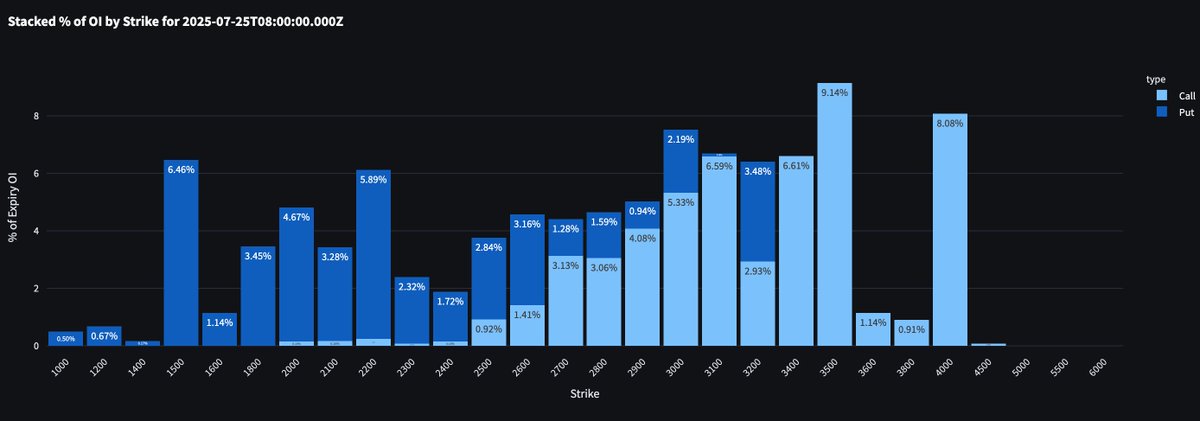

ETH rips +10% Over $190M in shorts liquidated Options traders on Derive stacking $4K calls for July 25 – 25% of all $ETH volume Probability of $5K ETH by year-end is now 27% “This isn’t just a spike, it’s a regime change,” said Derive's head of research: @SeanNotShorn

.@SeanNotShorn Head of Research at Derive, told @DecryptMedia that the confluence of "favourable U.S. government policy and well-timed institutional engagement has resulted in blood rushing back into the crypto market." The article is currently on the front page @DecryptMedia👇

$4k ETH by end of July confirmed

Gm ETH bulls 🐂 25% of @derivexyz's ETH open interest for 25JULY expiry is > $3400. Markets also implying ~25% chance of ETH > $4K by end of year for a nice little Christmas present 🎅🎄

Gm ETH bulls 🐂 25% of @derivexyz's ETH open interest for 25JULY expiry is > $3400. Markets also implying ~25% chance of ETH > $4K by end of year for a nice little Christmas present 🎅🎄

Looking back, @SeanNotShorn 4th of July market review was packed with alpha. blog.derive.xyz/derive-xyz-mar… Looking at options data gives you way more edge then mindlessly scrolling CT. Get in fellas.

The perfect combination of giga brain and perma-bull. Very excited for what's the come ! 🔥

ETH Strategy Announces Acquisition of 6,900 ETH

Will ETH shoot past $3K this July? 💹 This weekend in ETH options: - July 11 expiry: Call selling & put buying on the $2500 strike means traders are betting on a subdued mid July -July 25: Traders stacked 15,000 x $3000 strike calls, possibly betting on a late-month breakout.

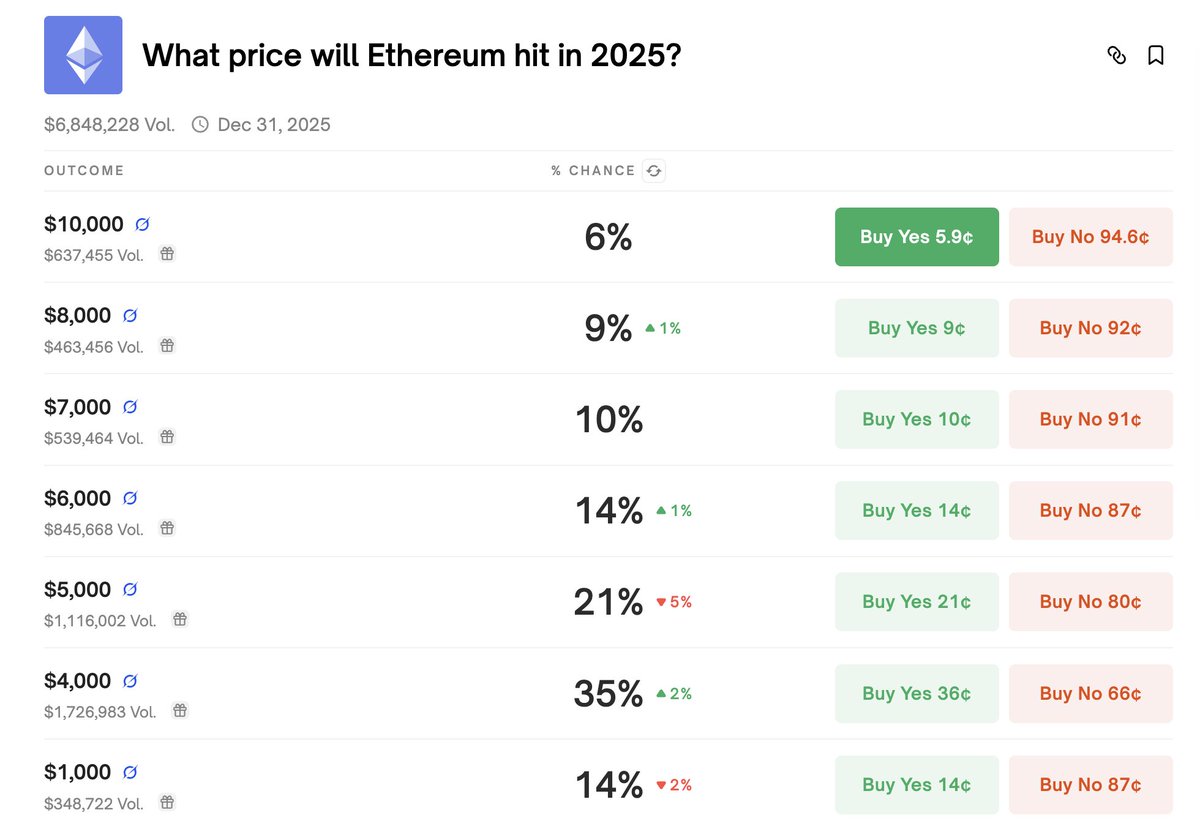

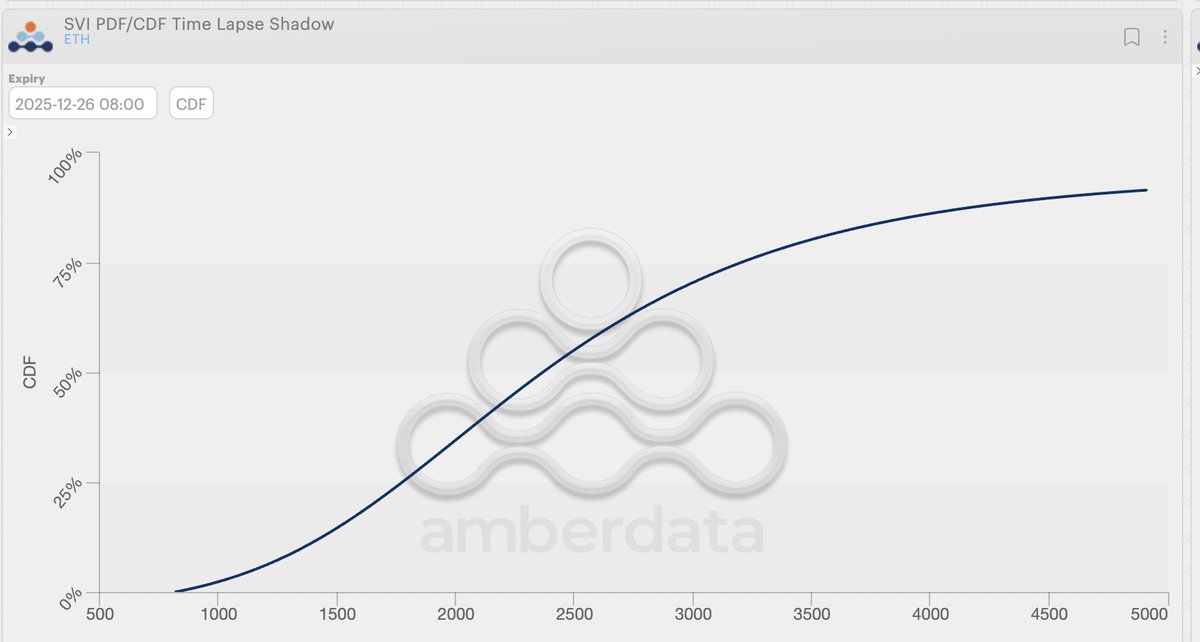

Arbitrage idea: @Polymarket pricing ETH > $5K by the end of the year at 21%. Option markets implying barely a 9% chance ⁉️ If you're an ETH bull, lever your upside by - Sell "Yes" on Polymarket to farm premium - Buy cheap strikes around $5K 26DEC expiry on @derivexyz

Good things come in threes 🔺 1) Huge improvement in capital efficiency across the board 2) Max loss now required for spreads/flies (> 3x improvement) 3) Unlock 12 unique forms of collateral, ranging from LRTs (e.g. @EtherFi ETH/BTC) to @ethena_labs sUSDe Super excited for the…

Introducing Derive Pro, the most customizable trading interface. Shape your strategy with modular tools, enjoy 2-3x better capital efficiency, and experience lightning-fast execution that rivals top CEXs. Customization. Capital Efficiency. Speed.