Scott Skyrm

@ScottSkyrm

Executive Vice President at Curvature Securities. Author of: The Repo Market Shorts Shortages & Squeezes, More Rogue Traders, Rogue Traders, The Money Noose

O/N Rates are finally dropping. GSE cash pushed rates down, but that cash leaves on Friday. The market is pricing rates to move higher after the GSE cash leaves and pricing month-end to trade 4.53%/4.50%. I believe the market is pricing too much funding pressure over month-end

Same here, we saw term GC widen as SOFR fixed higher post “BBB” being signed. Next week will start the month end ascent as usual.

Imo the Fed has to forcefully grow its balance sheet every year to the tune of government deficit + weighted avg cost of govt debt - GDP growth

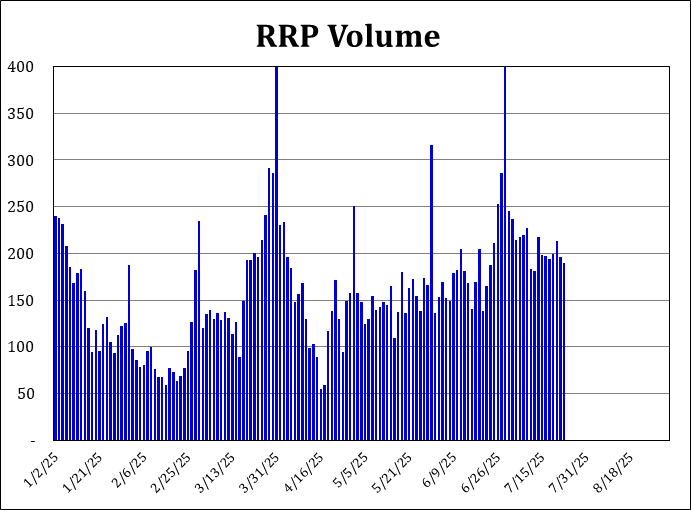

I've been calling for RRP volume to drop to zero for a while, so keep that in mind with my current rationale! RRP volume dropped to a low of $54.8B in February, but is currently higher due to less Treasury issuance and Balance Balance Sheet Runoff tapering

With the passage of the One Big Beautiful Bill, the Treasury needs/wants to replenish the TGA account. That'll be an increase of $450 to $500B in bill issuance. More bills will soak up cash in investment portfolios, MMFs, etc. and that will decrease the cash that goes to the RRP

Balance Sheet Runoff (BSR) continues, though it's running slower. Where in 2024, the size of the SOMA portfolio declined by an average of $13 billion a week, in 2025 that average is down to $6 billion a week. The difference may sound small, but it equates to $364 billion a year

Even though the Fed is shrinking the balance sheet, it's still large by historical standards. In August 2007, the SOMA portfolio stood at $870 billion and was 6% of GDP. Now the portfolio is $6.7 trillion and stands at 22% of GDP

Yeah, much more issuance since the Big Beautiful Bill was signed. I expect a Big Beautiful back-up in rates starting Monday ... 😂

Surprisingly soft considering the 67bln in bills today and Thursday.

I believe they trade from the EU. And I believe they are STIR traders who dabble in FX, but will let them clarify.

This is a huge problem within the Fed. They don’t understand the stigma and want it to go away. They don’t Fed knows this and other facilities have to become regular parts of the money market.

The Standing Repo Facility (SRF) was rolled out by the Fed in 2020 in response to the September 2019 Repo market panic

It remained unused for over five years until September 2024 quarter-end. That day, overnight rates were much higher than the SRF rate, but no Primary Dealer stepped in to intermediate liquidity in the Repo market because the banks all had asset limits for quarter-end

That left a conundrum - how useful is a Fed facility if when the market needs intermediation the most, the banks don’t participate?

The second problem with the SRF was solved recently the timing. The original SRF auction was at 1:45 PM. Too late to help "morning rush" liquidity imbalances. Since then, the Fed added an additional SRF auction at 8:30 AM. That solved one problem

The third problem is difficult- there is a stigma associated with the SRF - akin to the Discount Window. Historically, banks that went to the Discount Window collapsed soon thereafter

Which brings me to the third problem. Evidently, the decision to go to the SRF is not at the Repo desk level at most banks. Some banks need senior management approval to use the SRF

The Federal Reserve did a study* of the size of the Repo market which was published this month. Many economists and institutions have tried to estimate the size in the past, with no clear results. There are two hurdles:

First, there's no centralized market, most Repo transactions are between 2 private institutions. Second, rehypothecation makes the estimate harder. If a portfolio lends to a broker-dealer, who lends to a bank, who lends to a Money Market Fund, is that 1 transaction or four?

The Fed put the size of the REPO market at $11.9 trillion, an increase of 70% over the past 10 years. They adjusted for affiliate transactions, inter-dealer trades, foreign branches, netting for account statements, etc. Overall, it's the best study that I've seen.