Ryan Chow

@RyanChow_DeFi

Co-founder @SolvProtocol | Pioneering BTCFi through $SolvBTC | Integrating BTC ETFs into BTCFi to unlock new liquidity for digital assets & RWA

Recap of SolvBTC holders on berachain since POL started Since Solv started @berachain POL with @KodiakFi islands in March, additional $70m of SolvBTC (and xSolvBTC) inflows to Berachain ecosystem (excluding the ~$300m from SolvBTC.BERA Boyco). These are smart money. Because…

SolvBTC.BERA Transitions to PoL Strategy The Boyco Pre-Deposit Campaign is wrapping up soon, and we’re now transitioning to a Proof of Liquidity (PoL) strategy on Berachain. Deposit today! - app.solv.finance/bera?network=b… Here’s what you need to know 🧵👇

SolvBTC.BERA Transitions to PoL Strategy The Boyco Pre-Deposit Campaign is wrapping up soon, and we’re now transitioning to a Proof of Liquidity (PoL) strategy on Berachain. Deposit today! - app.solv.finance/bera?network=b… Here’s what you need to know 🧵👇

As Bitcoin smashes through its all-time high, we’re honored to have @RyanChow_DeFi featured in @Forbes’ latest coverage on the hype wave building behind crypto adoption. Read more here: forbes.com/sites/digital-…

I had the pleasure of interviewing the Co-Founder of @SolvProtocol, @RyanChow_DeFi recently. We talked about all things BTCfi, BTC Yields, Solv, and why they chose to make a yield-bearing BTC instead of another yield bearing stablecoin, and how that bet has paid off for them.

2022 was the year it all broke. BlockFi. Celsius. 3AC. FTX. Everyone chasing “safe” yield on their Bitcoin suddenly realized: the yields weren't real. And for me, that changed everything. I’d been in crypto long enough to believe in decentralization, but it wasn’t until that…

How did @RyanChow_DeFi and his team get SolvBTC TVL into the billions? It all started in 2022. BlockFi, Celsius, and co were going under. People were hungry for decentralized alternatives to earning yield on BTC. So @SolvProtocol stepped into the arena.

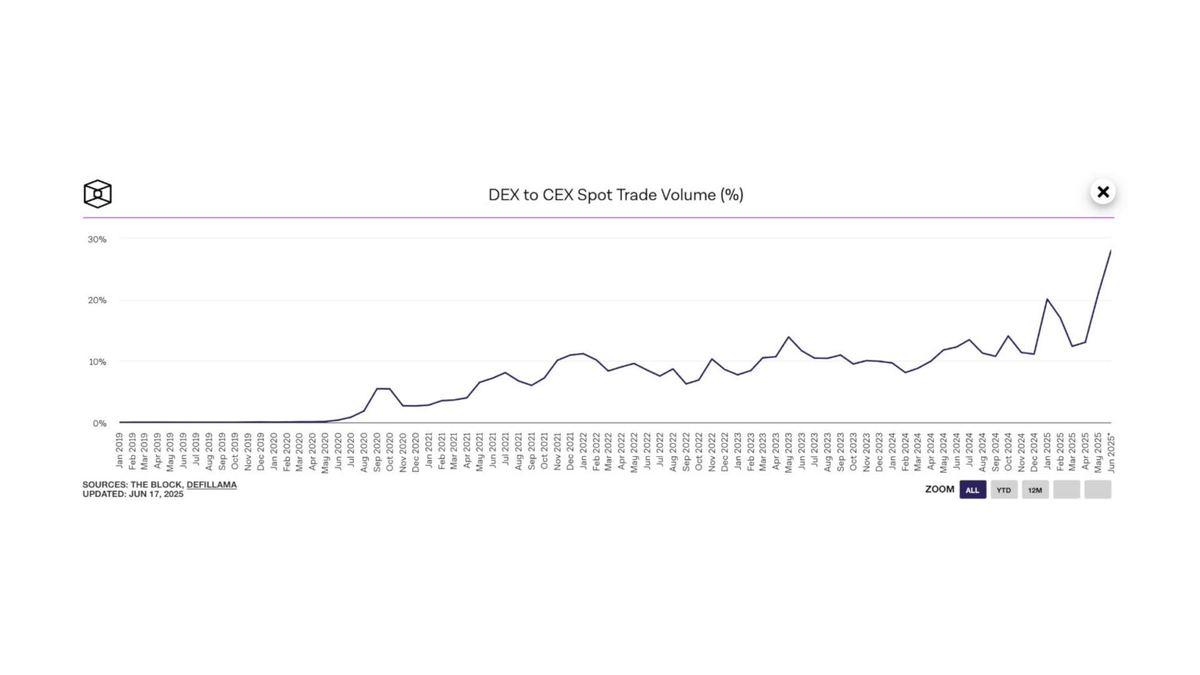

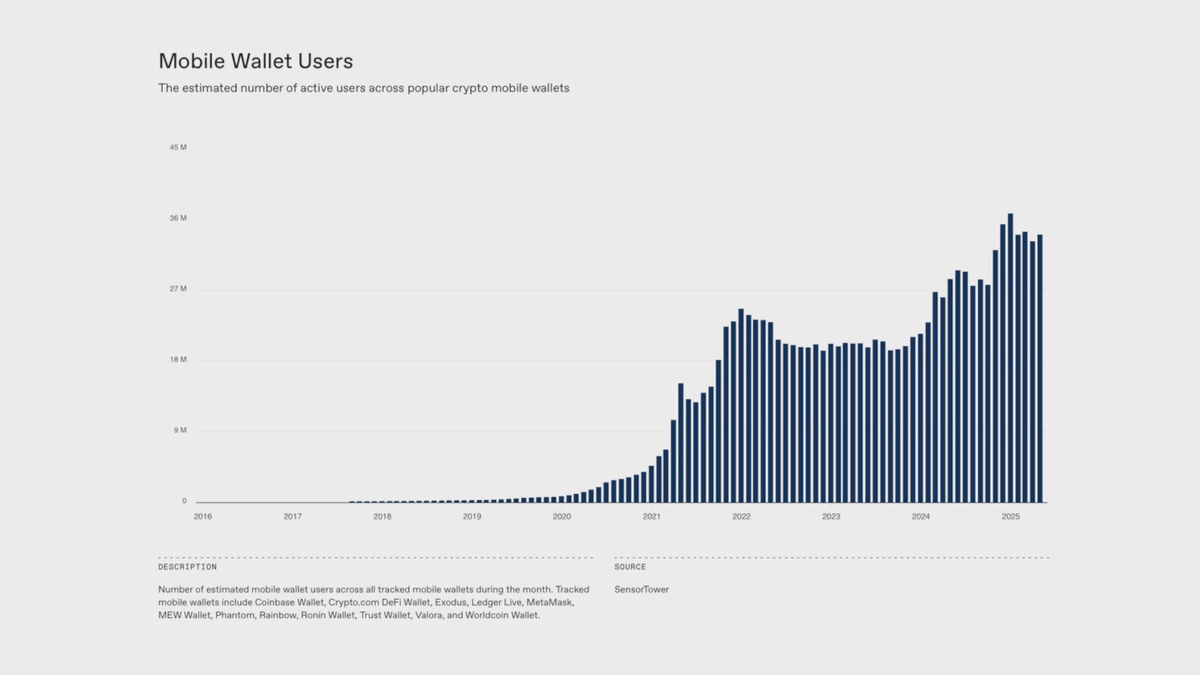

I see Web3 growth channels redirecting in the past months. Users are no longer entering through the “traditional” funnel: Centralized exchange → KYC → Buy → Explore. Instead, they’re discovering apps via: Wallet → DEX → Explore → Maybe KYC later And this new flow is…

I’ve thought about this exact problem every day since Q4 last year. This becomes essentially critical in the context of what Saylor said recently: on-chain proof of reserves is a bad idea. Why? Too much attack surface and meaningless without Big 4-verification. I believe it’s…

Chainlink’s Proof of Reserve solves your concerns @saylor, as it doesn’t require making your BTC addresses public Independent auditors attest to BTC holdings, which is cryptographically signed and published onchain by a decentralized oracle network @coinbase, @BitGo, @21Shares,…

Solv’s Vision for Bitcoin Finance at TOKEN2049 Dubai! @RyanChow_DeFi discussed with @BTCTN on how Solv is laying the groundwork for Bitcoin Finance—from native BTC to composable assets. This is just the beginning! Watch the full interview 👇

🔥 Bitcoin DeFi is finally catching fire and @RyanChow_DeFi is lighting the match! At @token2049 Dubai, @_dsencil sits down with the founder of @SolvProtocol to unpack: 🔸ERC-3525: The future of tokenized finance 🔸On-chain yield for $BTC holders Watch the full interview👇

Solv has integrated Chainlink Proof of Reserve (PoR) for real-time transparency. This secures over $2B+ in tokenized BTC and RWA yield products, including SolvBTC, xSolvBTC, and Solv Protocol itself. A new standard for institutional-grade Tokenized Bitcoin Finance 👇

Happy ₿itcoin Pizza Day! 🍕 100 $SOLV for a pizza today. 100 pizzas for 1 $SOLV in 2026? 👀

Proud to see that Solv's multi-chain expansion accelerating with @chainlink’s CCIP. The result: → $2.5B+ TVL → $1.16B+ cross-chain volume → $960M+ in market cap growth Composable liquidity + programmable yield

Solv acc(SOL)erates Bitcoin Finance with @chainlink. Solv + Chainlink CCIP = Institutional-Grade Interoperability With Chainlink CCIP now deployed on @solana mainnet, Solv’s strategy to expand Bitcoin use cases across the cross-chain ecosystem is scaling fast. This unlocks…

👀

BlackRock has initiated the first direct DeFi integration of its nearly $3 billion tokenized Treasury fund sBUIDL with Euler on the Avalanche network, utilizing Securitize’s sToken framework to enable sBUIDL tokens as on-chain collateral for lending and borrowing.…

When we started building in Bitcoin Finance, one thing became clear. Most Bitcoin “yields” in crypto come from unsustainable emissions. Structurally real BTC yield is hard because it comes from funding spreads, staking rewards, and RWA cash flows. I see Bitcoin as the macro…

x.com/i/article/1921…

🎙️对话Ryan Chow:千亿美金级别的BTC链上资管才刚开始 播客上新,这集我和 @RyanChow_DeFi 对话。很多人知道 @SolvProtocol 是因为SolvBTC,但从20年开始,Ryan的团队就做了很多DeFi产品尝试,踩了坑也收获到教训,最后在#BTCfi 生态起飞前,押注比特币资管。 🎧 收听链接:xiaoyuzhoufm.com/episodes/681d7……

x.com/i/article/1920…

Why I Believe Trump’s 2nd Term Would Crown Bitcoin Gold benefited in the 1970s. Bitcoin is that asset for the 2020s. This is massive for crypto and even more for the financialization of Bitcoin. Here are some of my thoughts here about Trump’s 100 days in office and the trade…

It’s LIVE: fragBTC has arrived on @solana! Introducing the first-ever native, yield-bearing Bitcoin on Solana, built on @fragmetric’s FRAG-22 standard, powered by SolvBTC.JUP strategy, and secured by @ZeusNetworkHQ. Here's how you can earn native BTC yields on Solana 🧵👇

Today, we reveal the Fragmetric staked BTC (fragBTC): the first yield-bearing BTC on @Solana, built on the battle-tested FRAG-22 (Fragmetric Asset Standard), co-launched with @SolvProtocol & @ZeusNetworkHQ stake your $zBTC and let Satoshi get to work > app.fragmetric.xyz

SolvBTC.BERA Now Live on Berachain! SolvBTC.BERA is now natively deployed on @berachain, making it easier for Bitcoin holders to access PoL yields on Bera! 🧵👇 🔗 app.solv.finance/bera?network=b…

We’re live on @BinanceAcademy's Learn & Earn! Calling all new users to learn about @SolvProtocol, and earn $SOLV rewards. FCFS so start learning & earning 👇

Ready to learn and earn? Learn about @SolvProtocol and complete the quiz to earn SOLV rewards 👇 academy.binance.com/en/learn-and-e…

I’ve always believed Bitcoin could be so much more. Beyond being an institutional-favorite asset, it should be the backbone of a compliant, yield-driven financial system that connects every part of the world. Today, we’ve achieved our first Shariah-compliant certification, a…

SolvBTC.CORE Unlocks $5T+ in Middle East Funds Solv, with @Coredao_Org & @NawaFinance , launches the world’s first Shariah-compliant Bitcoin yield product. 🧵👇 coindesk.com/markets/2025/0…

We’re proud to introduce fragBTC, @solana’s first native yield-bearing Bitcoin! A liquid restaking BTC, powered by SolvBTC.JUP, co-launched with @fragmetric & @ZeusNetworkHQ. The next chapter for Bitcoin on Solana begins here 🧵👇