Rihard Jarc

@RihardJarc

Tech Investor & writer. I cover in-depth dives and alternative data on tech (here and in my newsletter with over 14k subscribers). Tweets are only opinions.

I just published my article on DeepSeek. It examines their innovation on the R1 model, their implications for the industry, and how they affect companies like $AMZN, $MSFT, $GOOGL, $NVDA, $TSM, $META, and others: uncoveralpha.com/p/deepseek-and…

The problem $NVDA competitors face is that while everyone is trying to catch up to $NVDA on the AI data center front, the next frontier with humanoids $NVDA has again captured the whole ecosystem. Companies in the robotics field lack confidence in their ability to grow an…

Some interesting takes on $GOOGL from an Oppenheimer U.S. adults survey. - 66% of the people find $GOOGL's AI Mode results more helpful than $GOOGL Search. - 60% find $GOOGL's AI Mode results more helpful than ChatGPT - 64% would prefer AI Mode as the default $GOOGL Search…

I am publishing an alternative report on my newsletter tomorrow, before Big Tech starts earnings. In this report: - Valuable insights on the $NVDA/ $AMD/ ASIC race - Some really good data on cloud positioning of $AMZN $MSFT and $GOOGL before earnings. Link bio.

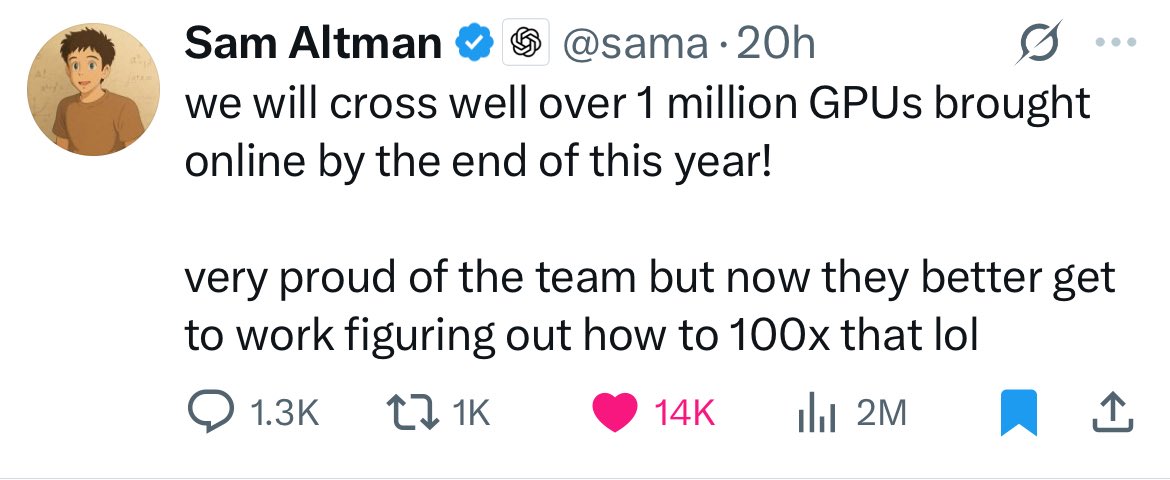

$ORCL and OpenAI have entered an agreement to develop 4.5 GW of additional Stargate data center capacity, which will run over 2 million chips. It seems OpenAI is starting to lean heavily on $ORCL as $MSFT is maybe not willing to commit to these heavy numbers for one customer.

Just think about what this means if it turns out to be true… Right now the US GDP is $27T $NVDA market cap is $4.2T …

Outside of Traditional Search, all of the other $GOOGL's assets like GCP, YT, DeepMind, Waymo, Chrome, Android are highly valuable and unique assets in the AI age. Additionally, Search can still serve as a valuable "feeder" for the new AI Search and AI agents on top of Search,…

The rise of AI agents might actually accelerate demand for new CPUs as well, as the faster the hardware is (servers, PCs etc.) the faster the agent can do its job. $AMD, $INTC, $ARM benefiting?

A staggering number of investors are still underestimating the amount of compute, especially inference compute that we will need with AI agents going mainstream. It sounds crazy but the chip sector is just starting the cycle.

$AMZN's AWS unit is cutting jobs. Again, no surprise, the new era of tech is here. From OpEx to CapEx.

Big Tech is entering a new era of higher net income margins, driven by AI, as the need for workers is reduced: - $MSFT just announced it is laying off 4% of its workforce. - $GOOGL offering buyouts to more workers - $META tightening performance standards for employees (might be…

$TSM just raised 2025 revenue guidance to 30%. (before it was mid 20s)

The AI backbone company, $TSM, just reported earnings. Another monster quarter with EPS up almost 61% YoY. 3nm/5nm are now 60% of wafer revenue. Gross margin up to 58.6% $TSM is my top 3 positions right now.

No surprise. As the market shifts to inference $GOOGL GCP with TPU will gain a lot of share IMO.

$GOOGL's GCP with its 7th generation of TPU infrastructure is one of the best assets in the AI world. There is a reason that both startups founded by former high-profile OpenAI employees, Mira Murati and Ilya Sutskever, chose GCP as their cloud provider.

$META has poached 5/21 OpenAI o1 reasoning foundational contributors already. Never bet against Zuck.

OpenAI o1 reasoning Foundational Contributors.

A MUST READ INTERVIEW with a current Director at $MU on HBM & GPU/ASIC market ( $NVDA, $MU, Samsung struggles ): 1. The hyperscalers $AMZN, $MSFT, $GOOGL are achieving significantly higher GPU utilization rates than they had in the past years. In 2022 and 2023, the GPU…