Rick Palacios Jr.

@RickPalaciosJr

Director of Research | John Burns Research & Consulting @JBREC | Previously @MorganStanley & @MilkenInstitute | All things housing

It’s clear home prices are falling in more markets as supply (namely resale now not new homes) grinds higher, but with limited demand or urgency at today’s affordability. High-income job growth declining YOY in many geographies also isn’t helping. Identifying WHO is selling…

Homebuilder earnings kick off tomorrow, and falling new home prices (as shown in these charts) will likely be part of the discussion.

Consumer still holding up but housing in clear recession seems to capture state of economy for now.

Housing industry holding its breath as this starts getting priced into long-term interest rates…

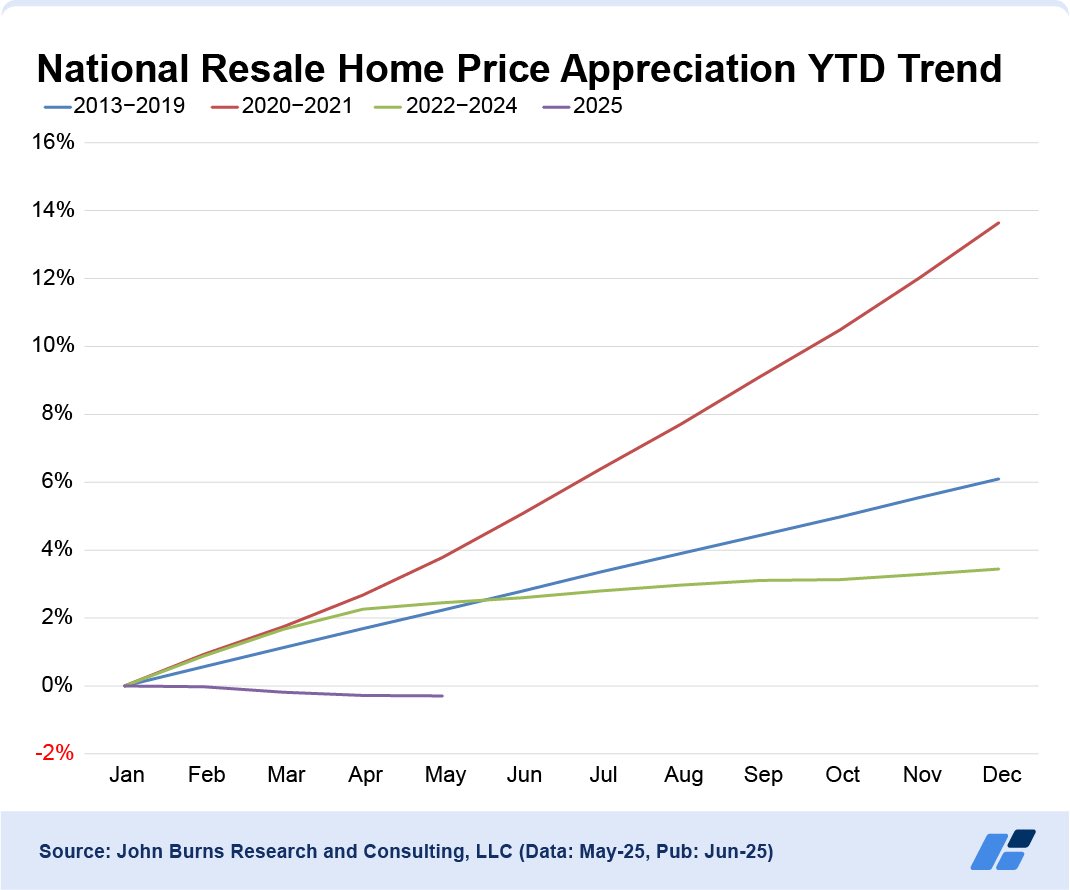

Housing-related inflation has been cooling for a while in our hard and soft survey data. Moderating single-family rent growth (namely new lease). Homebuilders cutting prices. Resale home prices down YTD. Building products suppliers dialing back price hikes as housing struggles.

Denver is now one of the worst homebuilder markets in the country. Comment from a local builder in our survey this month sums it up: “Home sales [per community] are ~70% of 2023-2024. Financing incentives are still playing a big part, but not moving the sales needle much.”

Very little inflation for housing through June according to homebuilders we survey. Tariffs are having minimal impact on construction costs, and labor costs are muted as builders renegotiate with their trades now that new home sales and housing starts are stalling out.

Home prices are falling YTD, which isn’t normal.

Today’s new home sales release for May was bad. Moreover, the May sales figures are inflated given new home sales are contract signings and don’t account for buyer cancellations which are rising the last few months in our homebuilder survey.

Rough week for housing so far. The main theme across our housing coverage lately (homebuilders & existing home market) is that the for-sale housing slowdown is spreading geographically. Showed up clearly in this month’s homebuilder and resale agent surveys, along with hard data.

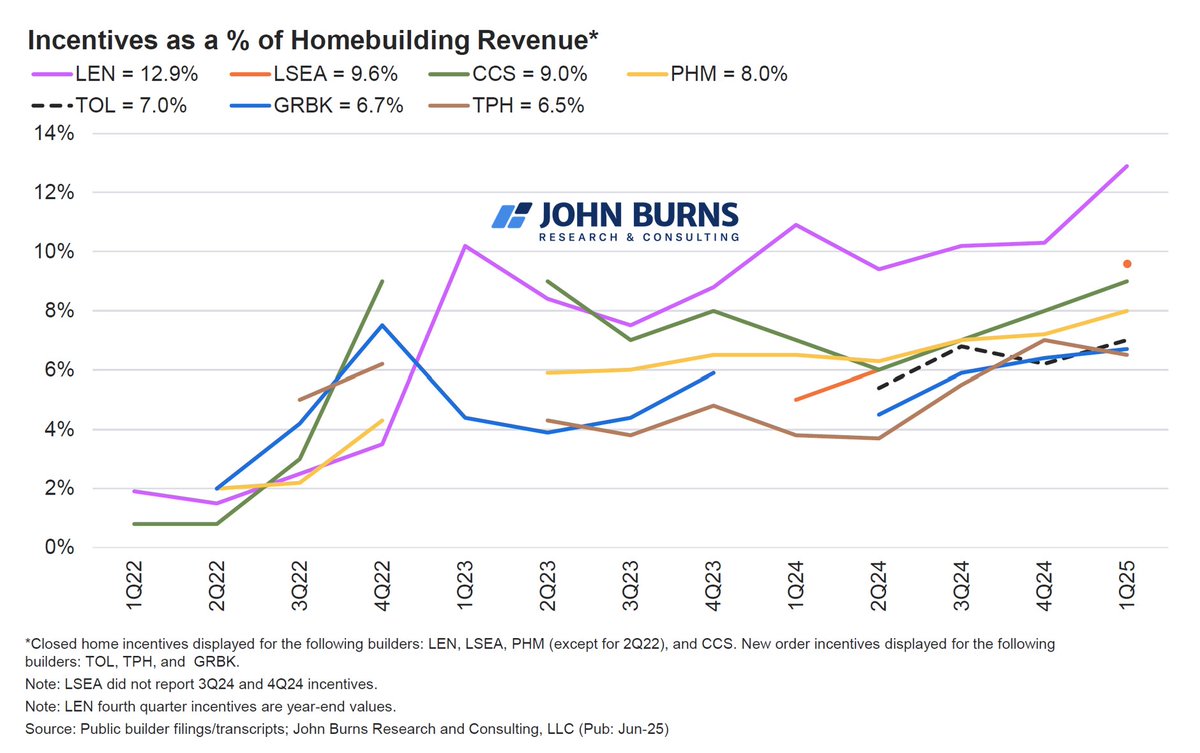

Updated incentives chart for Lennar through 2Q-2025. $LEN

Lennar 2Q25 incentives rose to 13.3% according to earnings call going on now, hitting a new cycle high. $LEN

Chart of the summer for homebuilders ahead of $LEN & $KBH earnings. The pricing backdrop for homebuilders has softened materially in our channel checks the last few months, so it’s very likely these buyer incentives aren’t falling.

Chart of the summer for homebuilders ahead of $LEN & $KBH earnings. The pricing backdrop for homebuilders has softened materially in our channel checks the last few months, so it’s very likely these buyer incentives aren’t falling.

Haven’t heard “date the rate, marry the house” in quite a while. Whole housing industry seems to have let that ‘strategy’ die on the vine finally in 2025.

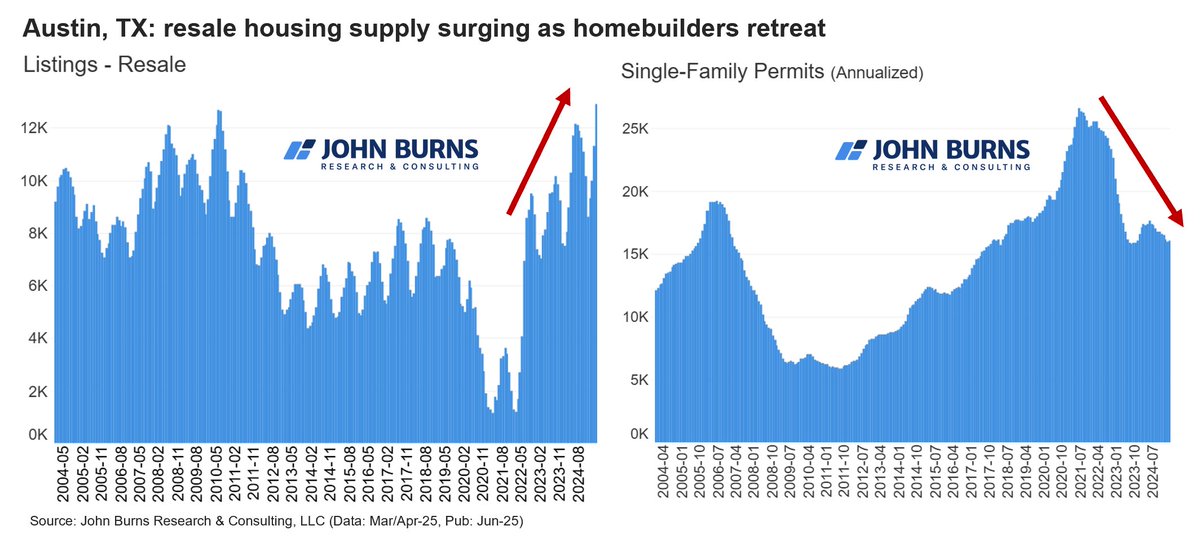

#Austin resale housing supply keeps rising, and homebuilders keep retreating. Seeing this dynamic across more markets lately.

Another great chart from our head of demographics @EricFinnigan.

For the first time in the US, more babies are now born to moms 40–44 than 15–19. This marks 2 historical shifts for the US, plummeting teen pregnancy and gradually rising fertility for older women.