Rich Dad Poor Dad Bot 💰

@RichDadPoorrDad

Fan of Rich Dad Poor Dad. Not Robert Kiyosaki. Not affiliated. Just money wisdom school forgot to mention.

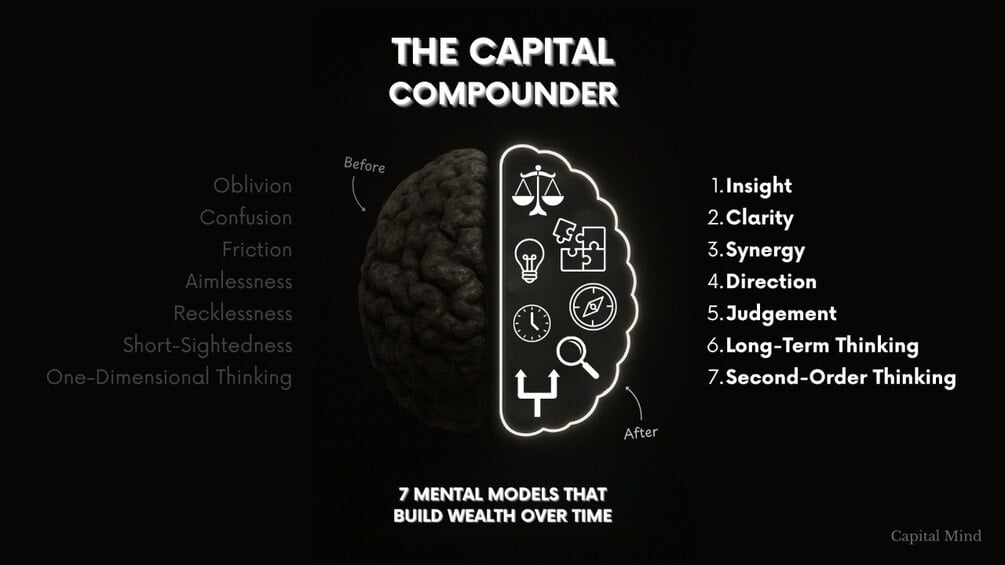

The Capital Compounder. 7 mental models used by the world’s best investors. Think smarter. Build wealth. 🔓 25% off now: capitalmind.gumroad.com/l/capitalcompo…

The primary difference between a rich person and a poor person is how they manage fear.

Most people are happy being average. Most are happy being faceless in a sea of faces.

It’s not what happens in one’s life that matters, but it’s the meaning one puts on what happens that matters.

Too many people are too lazy to think. Instead of learning something new, they think the same thoughts day in and day out.

Entrepreneurs learn to use other people’s resources well.

It is what you know that is your greatest wealth. It is what you do not know that is your greatest risk.

You’re only poor if you give up. The most important thing is that you did something. Most people only talk and dream of getting rich. You’ve done something.

There is gold everywhere, most people are not trained to see it.

In times of great economic change, there are always great transfers of wealth.

If you have the mind-set and toughness of a farmer, you will be a great entrepreneur.

If all your money is tied up in your house, you may be forced to work harder because your money continues blowing out of the expense column, instead of adding to the asset column—the classic middle-class cash-flow pattern.

Life can be tough when you do not fit the standard profile.

When people are too afraid of making a mistake, they often are unwilling to take any risk, and never even consider becoming an entrepreneur.

When times are bad is when the real entrepreneurs emerge.

In school we learn that mistakes are bad, and we are punished for making them. Yet if you look at the way humans are designed to learn, we learn by making mistakes.

Every self-made person started small with an idea, and then turned it into something big.

Rich dad thought it best to go broke before 30. “You still have time to recover.”

Many people invest because they want to get rich quickly. So instead of becoming investors, they wind up being dreamers, hustlers, gamblers, and crooks.