Ryan Telford

@RTelford_invest

Quant microcap investor, engineer, Founder of "GUTS" investing. Head of Evidence Based Research @MicroCapClub. Portfolio123 creator, ext. free trial below

Some people have asked about what I look for in #microcaps. I run different strategies, but they all have one thing in common: GUTS. Growing Undervalued Timing Sentiment A thread 🧵 (1/n) 👇

1. Had early success with quant investing. Got cocky, levered up, nearly blew up. 2. Gave up, tried residential real estate. Near disaster. 3. Came back to quant investing, doubled down, re-evaluated my approach, new research, developed GUTS. Needed 1 & 2 to reach 3.

share a piece of investing lore about yourself

Frugality is a must when starting out and building your capital base. It is also an exercise in de-risking as many financial transactions as possible. But to start accumulating, arguably more risk is required than the “frugal” mindset. Most great investors I know are cost…

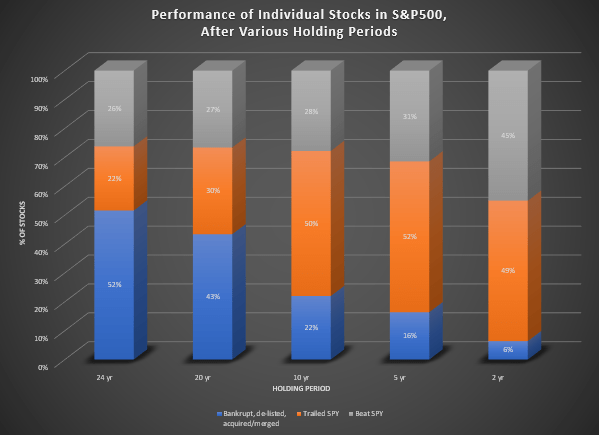

"if you hold long enough it will go up" Not according to the data. The *longer* stocks are held, the lower the chances of beating the S&P500. 2 yr holding: 45% stocks beat SPY 24 yr holding: 26% stocks beat SPY There are exceptions of course, but as a group "longer" does…

I have a bad habit - I rarely finish reading investing books. 📖 It's usually for 3 reasons: * ideas are outdated and no longer "work" * the same "long term compounding" wrapped in a different package * or even newer ideas that don't really work in reality (when tested in…

6 Powerful Reasons 💪to Try Portfolio123 👇 For an extended free trial (35 days vs 20), click below. As always, I'm available for any questions to get you started! portfolio123.com/index.jsp?apc=…

A common anecdote: “You buy a stock at $5, sell at $8. Buy at 10, sell at 15. Buy at 18, sell at 25. Just buy at 5 and hold until 25 and you’ll be much better off.” This of course is clear in hindsight. But what is to say the stock even makes it to $10? Let alone $15 or $20?

Contrarian investing: The alpha is often made not when you buy before everyone else, But when you *sell* before everyone else.

"Not All Dilution is Bad, Not all Buybacks are Good - 3 Ways to Look Differently at these factors" New post @MicroCapClub We look at some dilution/buyback stats for microcaps, and take a deep dive into: *level of dilution/buyback *leverage *timing community.microcapclub.com/forums/topic/5…

(1/3) Forward ROIC - Continues to Beat the S&P500 $SPY is notoriously difficult to beat with factor investing. But Forward ROIC continues to outperform the SPY - equal weight, quarterly rebalance in the last 10 years. 16.7% vs 13.4% SPY Tickers in post below (2/3) 👇

Many investors strive for the elusive 100-bagger. But - They are extremely rare. Focus on 2x, 3x and 5x stocks - which consistently over time can bring you life changing wealth - and are much more attainable than the infamous 100x stock.

“Dilution” and “buybacks” are headline events - but leverage is usually a key unspoken factor.

"Not All Dilution is Bad, Not all Buybacks are Good - 3 Ways to Look Differently at these factors" New post @MicroCapClub We look at some dilution/buyback stats for microcaps, and take a deep dive into: *level of dilution/buyback *leverage *timing community.microcapclub.com/forums/topic/5…