Quant Data

@QuantData

Bridging the gap between institutions & retail traders since August, 2020. Our tweets are for informational purposes only.

🥳 Quant Data v3 is Live! 🥳 v3 is packed with enhancements and new features that we hope you will like. Key Updates in v3: Enhanced Performance: We've optimized the platform for faster data retrieval and a smoother user experience. New Analytics Tools: We've added…

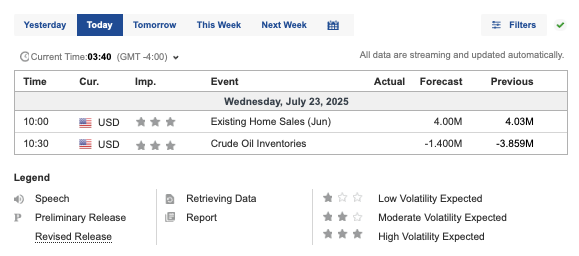

📊 Key Economic Events on Deck Today! 🕵️♂️ We’ve got 2 major economic events set for today’s session — both dropping after the market opens! ⏰ 🏠 10:00am: Existing Home Sales (June) 🛢️ 10:30am: Crude Oil Inventories Eyes on these reports — they could move the markets and set the…

🚨 $TSLA Flow Recap Ahead of Earnings 🚨 2DTE & ≤90DTE calls led puts during Tuesday’s session: 📈 2DTE calls lead puts by $8M+ 📈 ≤90DTE calls lead puts by $21M+

$TSLA reports earnings after the bell today 🔔 Will Tesla beat or miss and how will the stock react? Vote below 👇 (EPS Estimate: $0.42 | Revenue: $22.4B) 📊 What’s the outcome?

$TSLA reports earnings after the bell today 🔔 Will Tesla beat or miss and how will the stock react? Vote below 👇 (EPS Estimate: $0.42 | Revenue: $22.4B) 📊 What’s the outcome?

🚨Earnings Alert: $GOOGL & $TSLA Drop After-Hours!🚨 💻 $GOOGL — EPS Est: $2.17 | Rev Est: $93.91B ⚡ $TSLA — EPS Est: $0.42 | Rev Est: $22.4B Keep these tickers on your radar into the close — big moves could be on deck! 🔍📉📈

Mag 7 ended Tuesday’s trading session with <=90DTE calls leading puts by over $40M+ 👇

🔻 $LMT Tanks Post-Earnings as Sentiment Flips Midday 📉 $LMT ended the session down over $49 or 10% following earnings this morning 😬 At 11am, the ER conference call kicked off — and sentiment started to shift fast 🎙️📉 By the close, <=90DTE puts had overtaken calls by $2M+…

After yesterday’s about Powell news I oversized trade and got destroyed and down bad in the late session of the day. Then with ABJ’s short call this morning I made it all back with few hundo more. @aaplbottomjeans @QuantData

As I mentioned I’m going to be posting more flow reads here $VST let’s hope this hold $VST buyers ITM here @QuantData

Time for $VST to finally break that ATH 200 mark Building a really nice demand here off 180-181 Price compression = price expansion Nice $VST 200c here - 1.59 AA - 6% OTM - weekly - 145k @QuantData

👀 Big Money Moves Ahead of $GOOGL Earnings 📊 Hmmm… at 2:30pm EST, a $9M+ bullish call spike hit $GOOGL for the <=90DTE expiry.💥 $GOOGL reports earnings tomorrow evening after-hours👇

💥 Chipwrecked: Semi Sector Slammed 🔻 The semiconductor sector got hit hard today, with all major chip names finishing the session deep in the red: $NVDA -2.54% 📉 | $AVGO -3.32% | $TSM -1.80% | $ASML -1.90% | $AMD -1.40% | $MU -3.53% Heavy profit-taking? Rotation? Macro…

🎯 $SPX Nails the Target — Price Obeys Flow! 📊 $SPX ends the Tuesday trading session right at the $6,310 strike — a key level we flagged earlier as a potential price magnet! 📍 Once again, the data led the way, and price followed. Massive exposure at this level made it a…

⚖️ Tug-of-War on $SPX: GEX Battle in Focus No clear direction on $SPX today as negative GEX and positive GEX rival each other intraday ⚔️ The $6,280 and $6,310 strikes currently hold significant exposure 📊 All eyes on how this balance shifts as the session unfolds 👀

3DTE vs <=90DTE premium flow on all the tickers you mentioned below: $SMH, $NVDA, $AMD, $TSM, $MU

Can you look at the chip sector? $SMH $NVDA $AMD $TSM $MU Are all chips showing this pressure like AVGO is?

📉 $OPEN Smacked Again — Bearish Flow Takes Over! 🟥 $OPEN is getting slammed again today as ≤90DTE puts now lead calls by more than $2M+ intraday! 🔻 The stock is down over 13% on heavy downside pressure and aggressive bearish positioning.

📉 3DTE Puts COLLAPSE on $SPY — Call Flow Takes the Lead! 🟩 3DTE puts on $SPY have completely collapsed, with calls now leading slightly by $20K+ intraday! 🔁

🚨 $6,310 STRIKE HIT on $SPX — Just as the DATA Showed 📉📊 The $6,310 strike has officially been hit on $SPX! 🔥 We flagged this level earlier as a heavily exposed zone worth watching intraday, and price delivered 🎯.

⚖️ Tug-of-War on $SPX: GEX Battle in Focus No clear direction on $SPX today as negative GEX and positive GEX rival each other intraday ⚔️ The $6,280 and $6,310 strikes currently hold significant exposure 📊 All eyes on how this balance shifts as the session unfolds 👀

🍎 $AAPL’s $215 Strike Still in Focus Ahead of 7/25 Expiry 🎯 The $215 strike remains heavily exposed on $AAPL for the 7/25 expiry, with positive GEX + DEX stacked at that level 📈. Although this level was met during yesterday’s session, fulfilling the obligation of the MVC, the…

whats the chances of 215 tag on $aapl today based on your flow data?

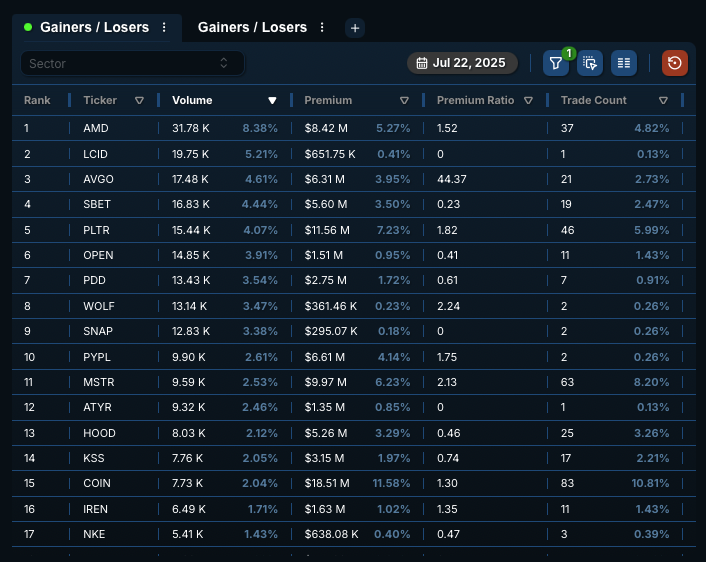

📉 $AVGO Slides as Bearish Flow Surges 🚨 $AVGO is now the 3rd most unusually traded ticker by volume excluding the Mag 7, as <=90DTE puts lead calls by $13M+ intraday. The stock is down over $8 or 3.1% on the session, with bearish sentiment dominating the tape.

Right here on $SPX GEX is why we called 6280 as our potential bottom. MVC was met, we have an 82% chance of price not surpassing this strike. Selling 6280p/6275p proved to be fruitful. Fantastic work yet again with the @quantdata team!!