Dr. Steve Keen

@ProfSteveKeen

Predicted the 2008 financial crisis. Honorary Professor at UCL. Learn 50 Years of Real Economics in only 7 weeks. Apply here: https://www.stevekeen.com/books

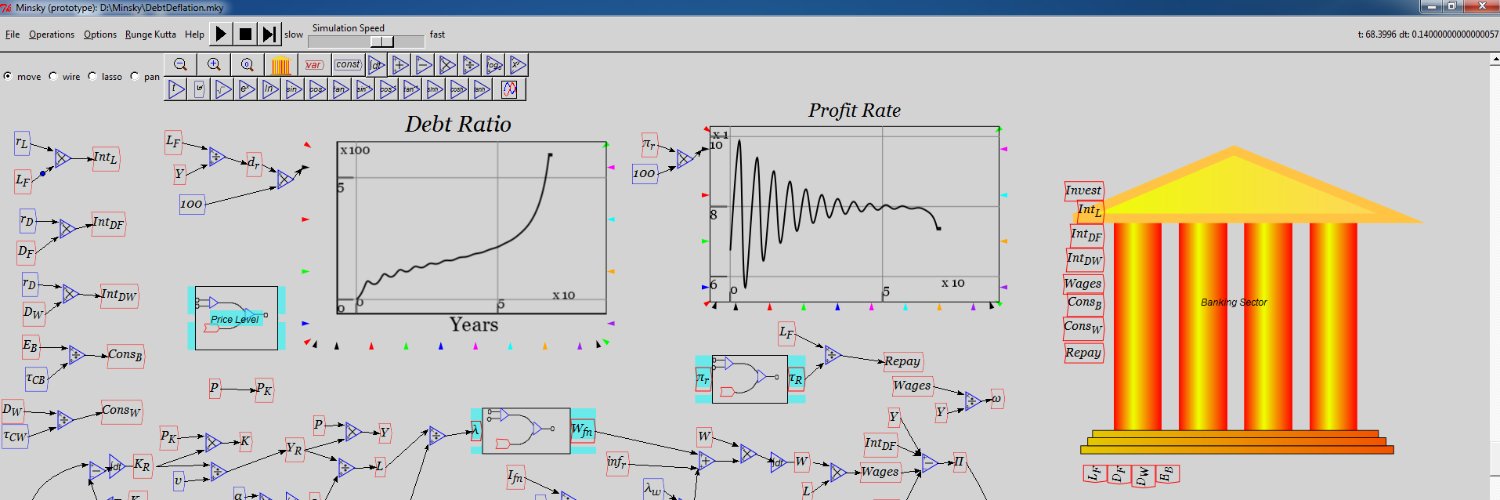

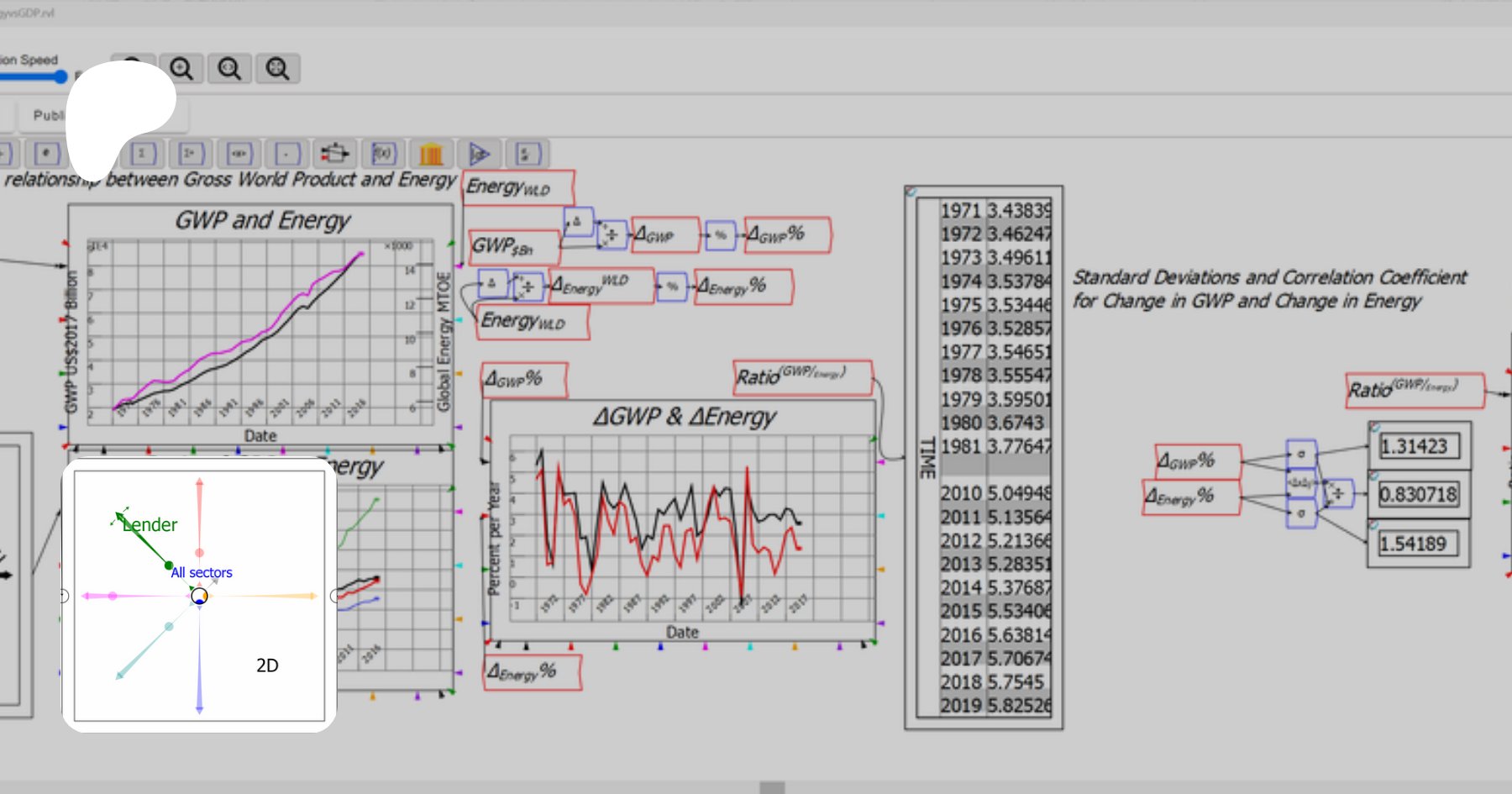

Steve Keen Explains the Minsky Software youtu.be/GzAneF7EoY4?si… via @YouTube Now called Ravel and available from patreon.com/ravelation

I do think we need to be a bit more ecumenical at times. Gary may not come at things from the same angle as others, but he is a tireless campaigner for a better society; can we at least remember that and not tear him down!

Getting the numbers we need youtu.be/ivAGQA6eSCk?si… via @YouTube

Private credit growth is basically zero - the Eurozone needs more government spending, given that world trade is not exactly increasing right now. ecb.europa.eu/stats/ecb_surv…

"Stability or tranquility in a world with a cyclical past and capitalist financial institutions is destabilizing." -Hyman Minsky

If you want to understand how economies actually evolve — and why crises happen — you need models that live in real time. Let’s stop pretending equilibrium is a destination, and start modeling history as it happens. /end 🧵

DSGE reduces the economy to a puppet show of timeless optimization. The strings? Assumptions so strong they preclude learning, emergence, or error. 8/10

System dynamics models (like mine) let the economy unfold over time: -Stocks and flows evolve continuously -Feedback loops compound -Agents adapt without “knowing” the future 7/10

Agents in DSGE models don’t truly live through time. They choose consumption, labor, investment as if they know the future distribution of shocks — and instantly adapt. This is not dynamic behavior. It’s statics wearing a watch. 3/10

DSGE models dominate macro — but they’re built on a fundamental error: They assume away time. Here’s how this hidden assumption breaks everything from policy to prediction 🧵1/10

Donald Trump’s ascent represents a predictable and deeply entrenched political outcome, that is, the logical, albeit unsettling, culmination of a bipartisan reorganization of US capitalism. Yours truly, @utahvanguard utahvanguard.medium.com/a-bipartisan-n…

I don't know why MMTers hate on Gary Stevenson so much, he clearly distinguishes the difference between the real wealth of Government and its ability to pay in its own currency. He's rocking his 15 minutes, and it looks like he practices critical thinking.🤷

Hi Ben, I wrote a full article of my stance on MMT here: opendemocracy.net/en/oureconomy/… to cut a (very) long story short, I think that it can be useful tool, but it cannot eliminate the need for taxation, only soften it somewhat - fair taxation will always be needed.

OK all you Economists out there, when the @BBC reports that the Govt has ‘borrowed’ record amounts last month….Who exactly have they ‘borrowed’ that from? @Davejones0305 @malcolm_reavell @ProfHall1955

@garyseconomics while the channel is growing and your momentum gaining, pls speak to MMT economists; your instincts and open mind will get it. Mmt is an accurate description of how a fiat monetary system works. @ProfSteveKeen has empirically proven it with his software ravel.

"Mathematics brought rigor to Economics. Unfortunately, it also brought mortis." -Kenneth E. Boulding

As well as being wrong about Argentina - the problem is the dollar-debt trap, it owes its debts in US$ - this reply is classic. The poster, possibly an anonymous bot account, is telling us that nations with supposedly democratic governments are subjugated by global financial…

Crypto just invented the most ridiculous money printer yet. It’s backed by bonds, looped into itself, and worshipped like genius. hlttps://x.com/baoshaoshan/status/1947267168447455734?t=HqOwUQ1imi7ZIFPXYn2Kjw&s=09

💰BREAKING: Down from £100bn, the cost of nationalisation is now... £1bn. By the way, the ownership model that "doesn't work" in Paris just made the Seine swimmable again after 100 years. We encourage Steve Reed to take a dip in the Thames.