Paul Davies

@PaulJDavies

Global Banking at Bloomberg Opinion. Ex-WSJ and FT. Why, why, why, why, why? Opinions mine, "likes" are often bookmarks, RTs don't mean I agree.

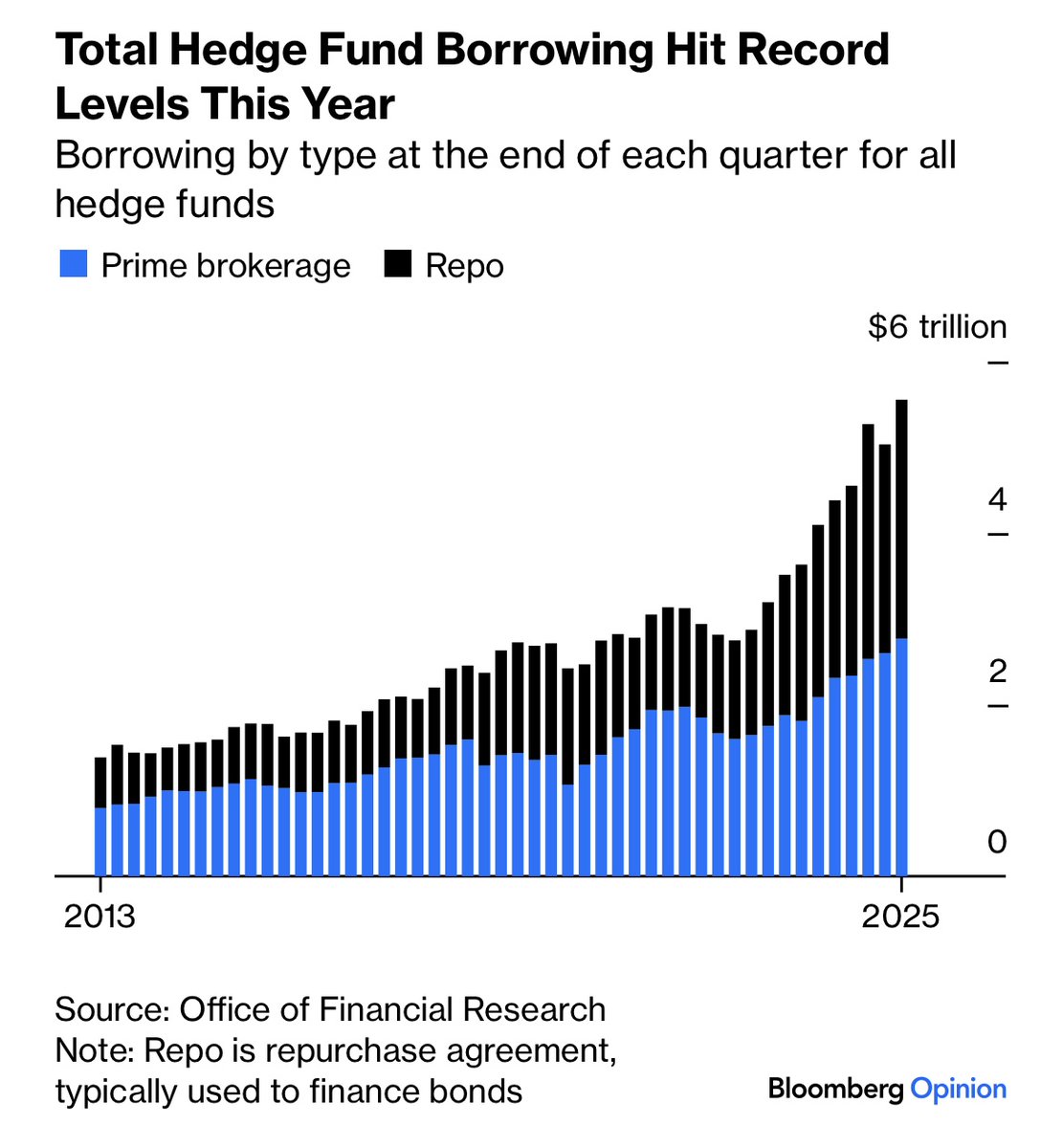

🧵A massive sell-off in Treasury markets is threatening to turn Trump’s tariff war into full blown financial crisis. Hedge funds unwinding leveraged basis trades is fuel to these fire sales – that’s bad on its own but these trades are much more important than just bets on markets

Italy’s government is determined to shape its financial sector to its own liking, frustrating competing visions. That’s bad for the banks involved and their investors. It’s also bad for the country: Many of its firms may become uninvestable. @opinion bloomberg.com/opinion/articl…

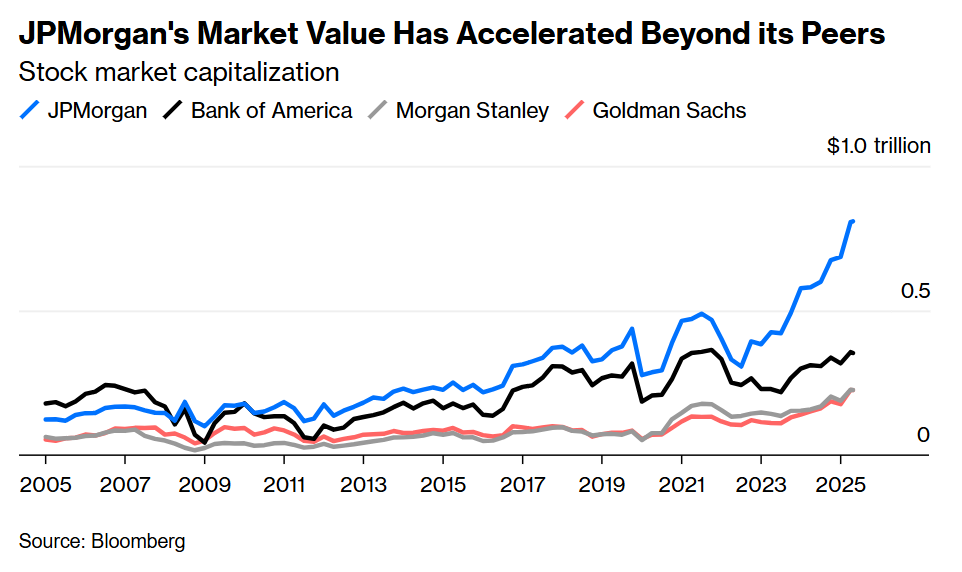

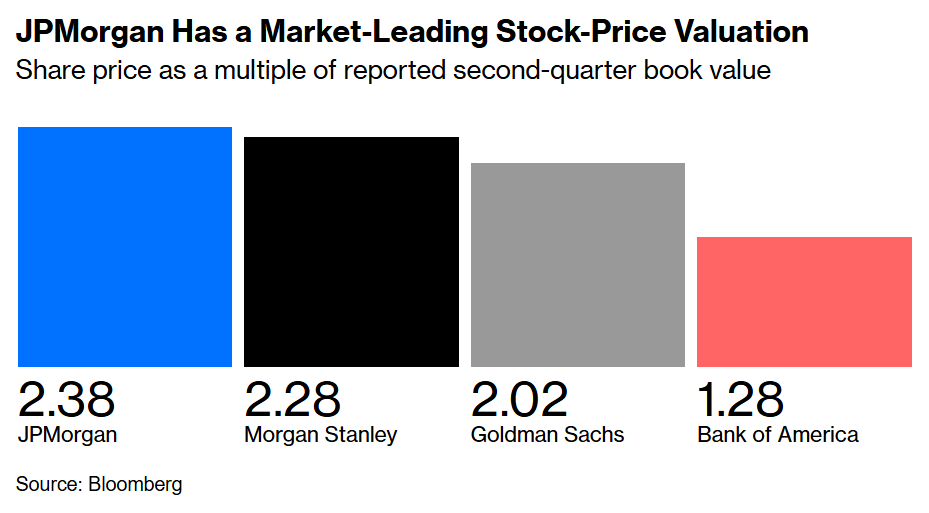

Size alone isn't enough to win, Jamie Dimon wrote in his first CEO letter 20yrs ago. “If not properly managed, it can bring many negatives.” JPMorgan is now SO much larger and has $60bn of excess capital burning a hole in its pocket. What next? @opinion bloomberg.com/opinion/articl…

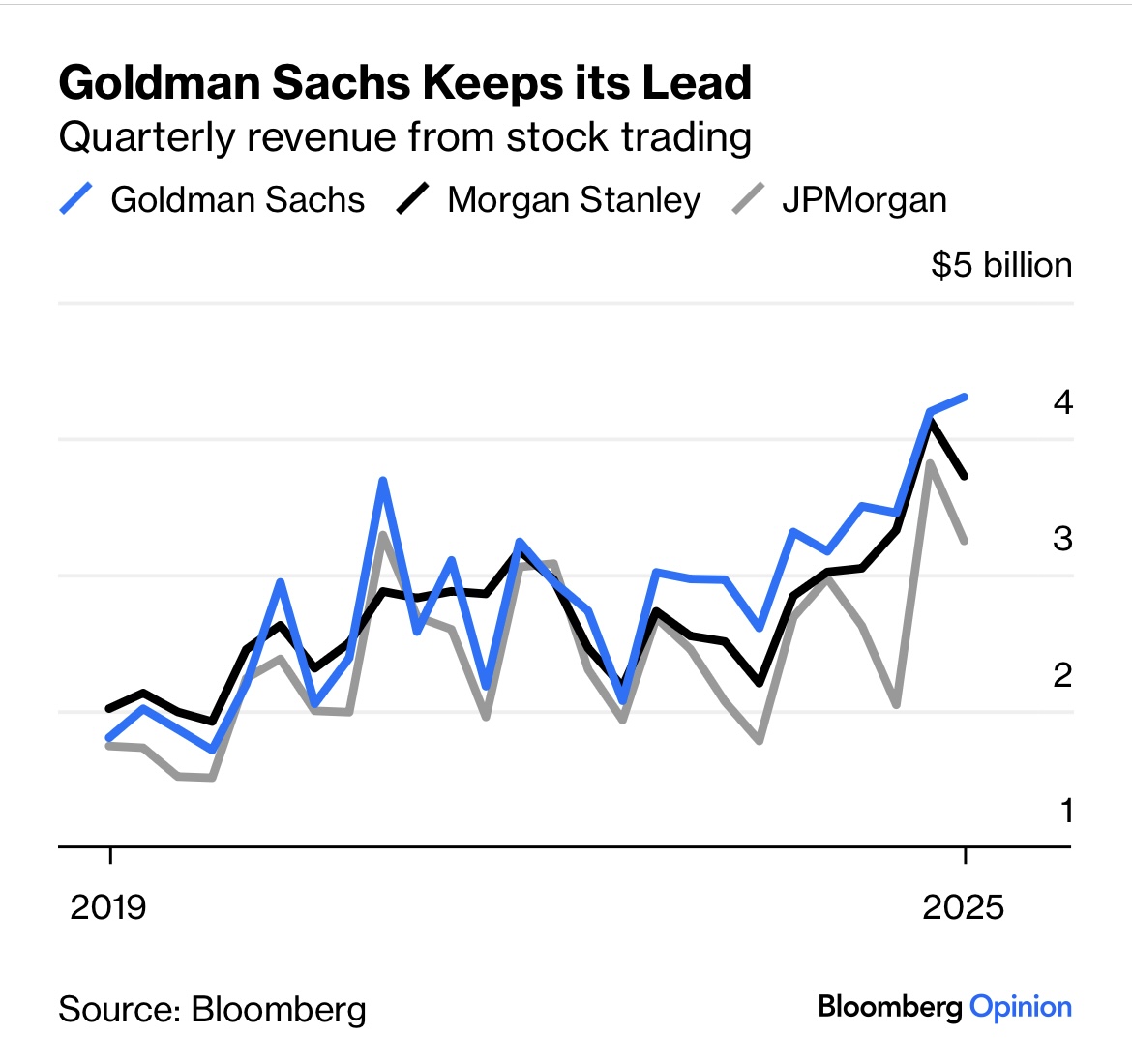

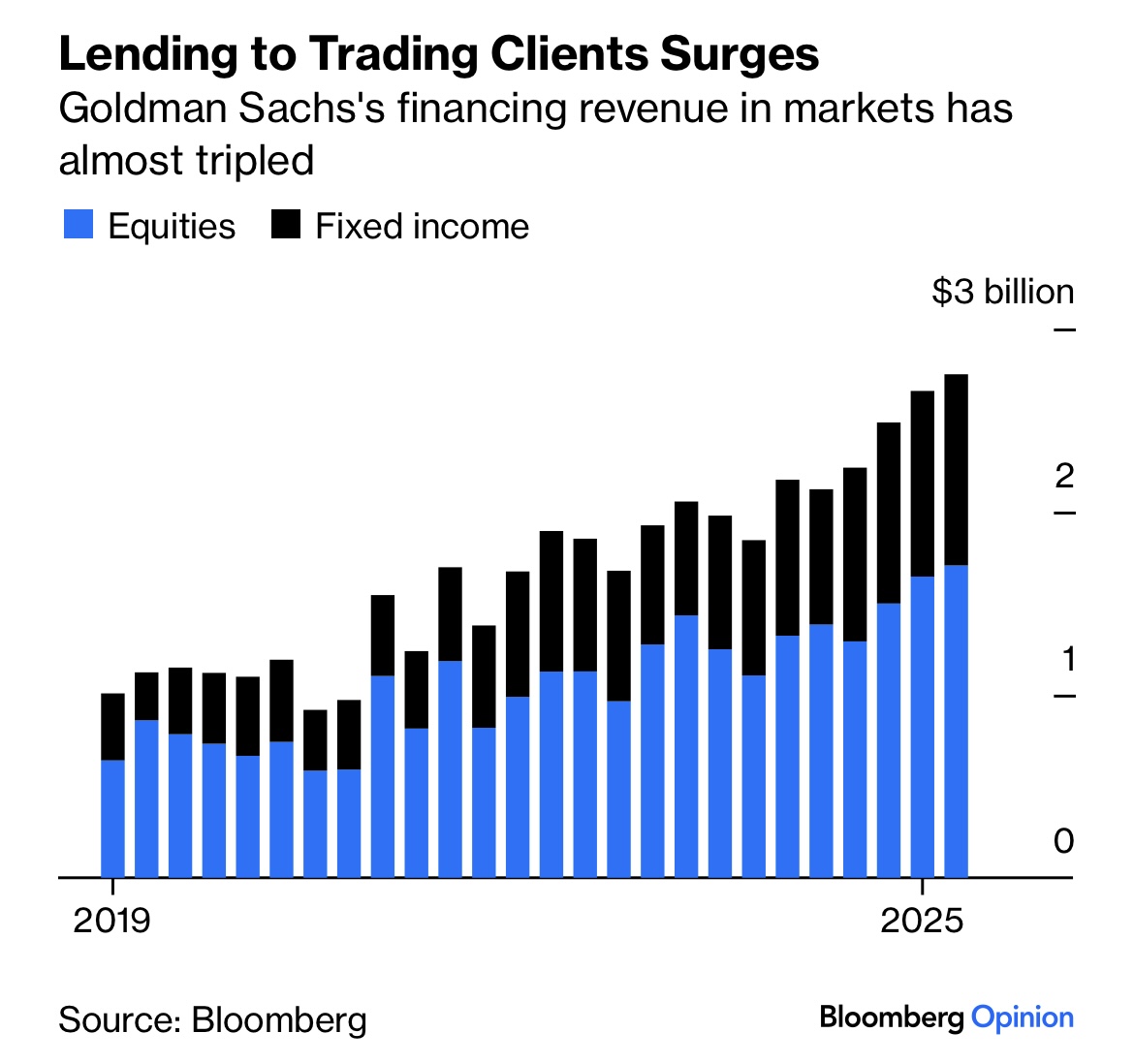

Where are Solomon’s critics now? Goldman Sachs is winning bigly from pursuing more business from big hedge funds in these Trumpy markets >> bloomberg.com/opinion/articl…

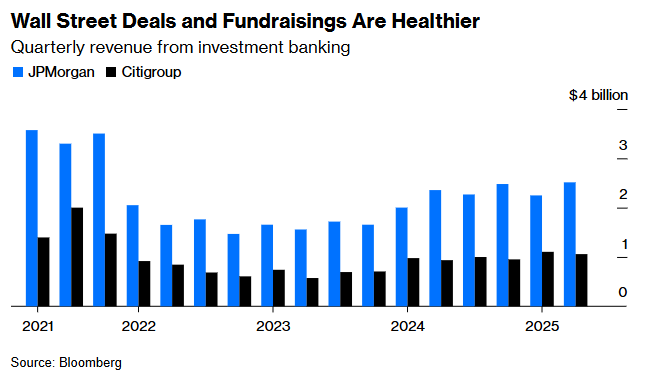

Assimilating the chaos>>> #JPMorgan and #Citigroup results show that deals and fundraisings are getting done as executives adapt to volatility and uncertainty @opinion bloomberg.com/opinion/articl…

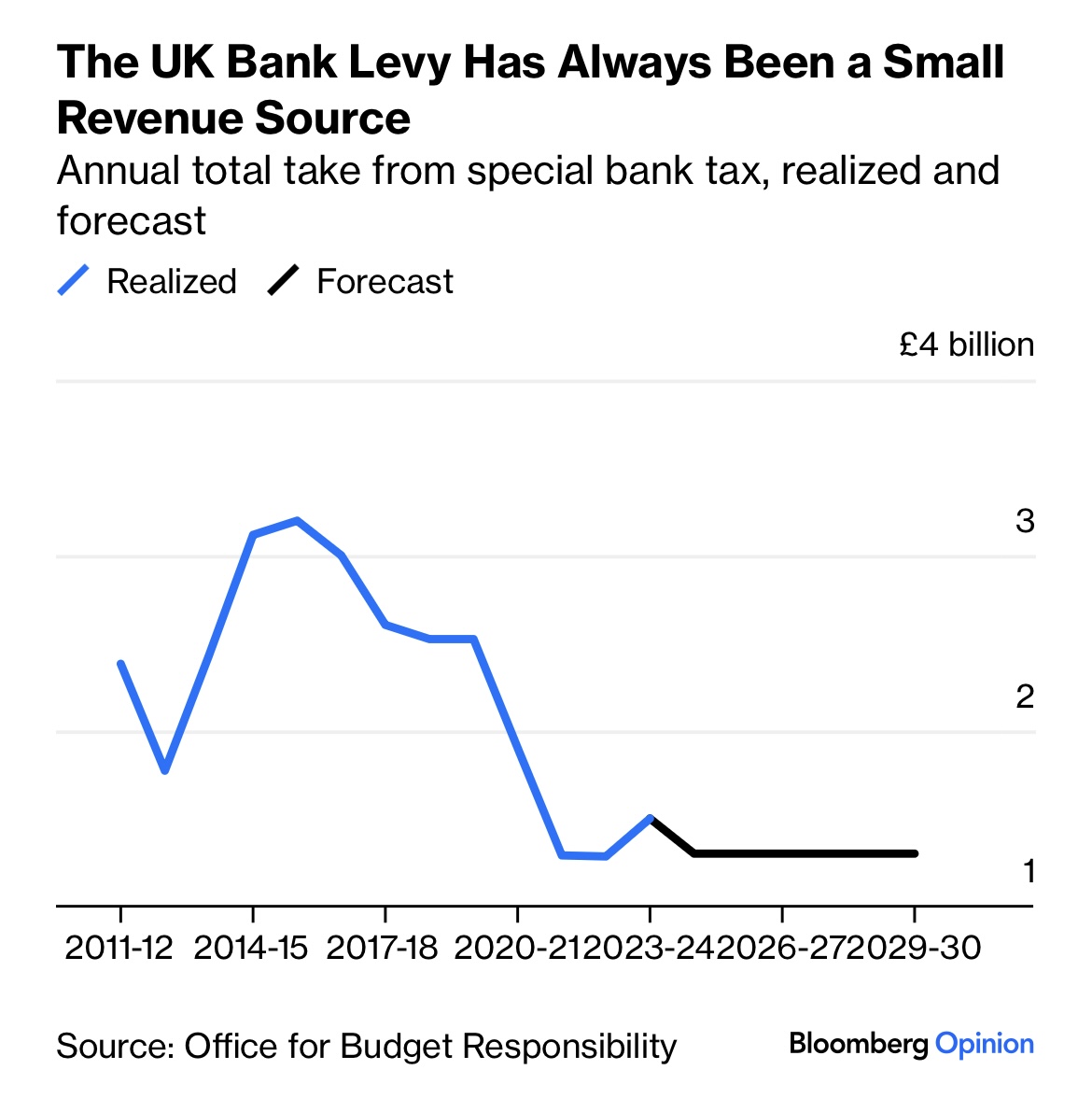

Bank levies aren’t the answer to the UK’s fiscal needs: @PaulJDavies bloomberg.com/opinion/articl… via @opinion

Hitting UK banks with another extra profit tax is politically attractive but economically pointless, even harsh versions raise a pittance. Via @opinion.bloomberg.com bloomberg.com/opinion/articl…

Global central bankers have ducked a chance to push for tight borrowing limits on the biggest hedge funds, and cut the power of shadow banking to hurt the pricing and supply of funding to the economy. Via @opinion bloomberg.com/opinion/articl…

Make Runaway Inflation Great Again! Brainard: "There you have it: The Fed should just cut rates to 1% (a cut of more than 3 ppts) to reduce the debt-service costs on the trillions added to the national debt by the GOP mega-law." washingtonpost.com/opinions/2025/…

The next must-have accessory for crypto and tech bros is far less sexy than a Lamborghini — it’s a banking license. But Circle, Erebor, Ripple and others will be too tied to hyper-volatile sectors, just like Silicon Valley Bank in 2023. Via @opinion bloomberg.com/opinion/articl…

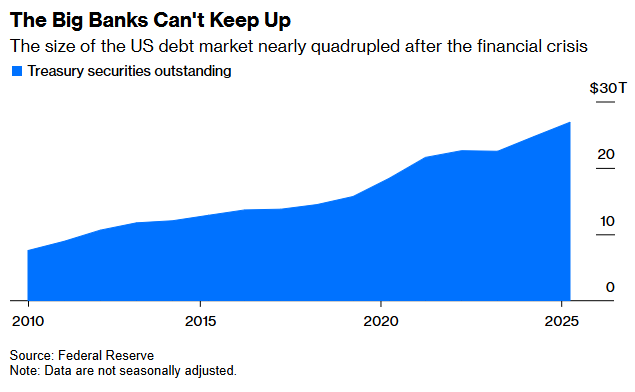

Freeing the largest banks to own and trade more Treasuries is more likely to inject added risk into the financial system, at an already perilous moment bloomberg.com/opinion/articl…

Giorgetti and Meloni to basically everyone: "Screw you! We're building the banking sector *WE* want!" Italy will reimpose its conditions for UniCredit’s planned takeover of Banco BPM bloomberg.com/news/articles/…

EXODUSSSSS!!! What? Wait... Um A member of the multibillionaire family behind Thomson Reuters agrees to buy a high-end London apartment for about £25 million, in the latest sign of North Americans bolstering the city’s luxury market bloomberg.com/news/articles/…

“In the United States, we’ve never had [a fiscal crisis]. Most of us can’t even imagine that this ignorance is a privilege we could lose.” The pressure on the treasury market >> harpers.org/archive/2025/0… via @Harpers

Excellent lede on this piece about Jane Street…… bloomberg.com/news/features/…

JPMorgan’s investment bankers eked out a surprise gain in the second quarter, signaling what may be the start of a dealmaking rebound after widespread hesitation tied to US tariff policies bloomberg.com/news/articles/…

There's already more non-institutional money in illiquid private credit than you think - via @huwsteenis >> Gates open for affluent to invest in private credit ft.com/content/13b772… via @ft

The EU is set to rebuke the Italian government for imposing harsh conditions on UniCredit's takeover of Banco BPM, setting up a power struggle between Brussels and Rome over the fate of the deal bloomberg.com/news/articles/…