Paul H. Tice

@PaulHTice

Analyst, Advisor and Adjunct Professor | Energy Advocate and ESG Critic | "The Race to Zero: How ESG Investing Will Crater the Global Financial System"

Here’s hoping that Sunnova’s June 2025 bankruptcy filing marks an acceleration of the recent residential solar trend that will hopefully lead to fewer unsolicited daily robocalls to my landline by aggressive salespeople trying to sell me rooftop solar panels for my house. A boy…

We need to add a new line to the golf lexicon. In addition to Mark Twain's "a good walk spoiled," we now have "a beautiful view ruined" to describe the sight of colossal wind turbines dotting the landscape of Northern Ireland as the world's greatest golfers compete for the 2025…

“Let the TVA Power America’s Nuclear Future,” WSJ, 6/27/25 TN Governor Lee is correct to call for an expansion of U.S. nuclear capacity to keep pace with technology-driven electricity demand, but he is wrong about SMRs being the chosen path and the part about TVA leading the…

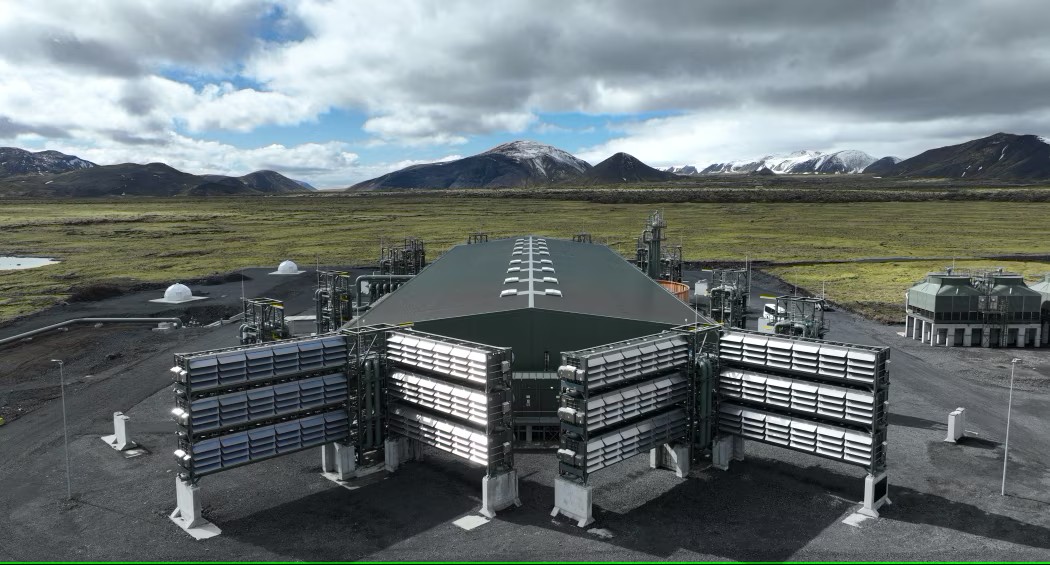

“Carbon Removal Startup Climeworks Fundraising Moves Past $1 Billion,” WSJ, 7/2/25 Seriously, who provides the financing for non-productive CCS vanity projects? Are these pecuniary investors (however speculative and risk tolerant) focused on making a financial return despite…

“The Oil Tycoon and the Philosopher Threatening Big Oil’s Carbon Capture Plans,” WSJ, 6/28/25 I am going to have to go with the oil tycoon and the energy philosopher on this one. Big Oil companies like OXY feeding at the government trough for tax credits to support their…

Even though Shell has publicly denied any interest in acquiring its cross-town London rival BP, the recent speculation about a potential European super-major combination highlights the pressing need for an M&A fix to the self-inflicted problems of both integrated companies. Both…

Not surprising that fewer U.S. companies feel compelled to waste time on earnings calls dealing with questions about climate change and other non-financial sustainability issues now that the threat of ESG financial regulations has receded under the Trump administration. In March…

While it sounds good that NYS Governor Kathy Hochul is now directing the New York Power Authority (NYPA) to “add at least 1 gigawatt of new nuclear-power generation to its aging fleet,” NYPA mainly manages hydroelectric facilities and does not currently operate any nuclear…

Best self-serving ESG statement of the week: “Many companies insist that the business case for pursuing net-zero emissions remains strong, the new leader of the nonprofit that sets climate action standards said.” Remember: the official sounding Science Based Targets initiative…

Given the recent win by the socialist Zohran Mamdani in the Democratic primary for NYC mayor (which makes him the prohibitive November favorite in a city that is 65-70% registered Democrats), probably a good time to brush up on the lyrics to Billy Joel's Miami 2017 (Seen the…

I spoke with Fortune’s Nino Paoli yesterday about the oil market implications of the U.S. bombing Iran’s nuclear facilities over the weekend, which has already apparently led to a capitulation on the Iranian side. Here is his Fortune article, which includes great additional…

The U.S. should be fine not medaling in this non-competition. #energy #climate #esg #sustainability #markets #investing #renewables #CleanEnergy The U.S. Gave Up Its Lead in Clean Energy Sectors Before. It Might Be Doing It Again. wsj.com/articles/the-u… via @WSJ

Whenever the IEA flashes this misleading energy investment graphic to promote its green agenda, there should be a truth-in-advertising requirement that it be accompanied by the chart on the right, kind of like the black-box warning used by the pharmaceuticals industry. The IEA…

“Without binding regulation, banking on climate chaos will remain banks’ dominant investment strategy, tanking our economy and our planet,” said Allison Fajans-Turner, policy lead at the Rainforest Action Network. Financial regulations that prohibit investing in the fossil…

Apparently, the Trump administration’s strategy to “unleash American energy” and get U.S. oil and gas companies to “drill, baby, drill” hinges on jacking up oil prices by starting another military conflict in the Middle East. The WTI front month contract is up roughly $20/bbl…

2024 was not "the hottest year ever recorded" since our modern average global temperature measurements (which are still flawed) only go back to 1979. Clean energy investment levels are much higher than those for fossil fuels, but environmental groups and NGOs will not be…

BREAKING! The annual #BankingOnClimateChaos reveals that fossil fuel financing from the world’s top 65 banks has reached $7.9 TRILLION since 2016. See how your bank is using your money at bankingonclimatechaos.org. #DefundClimateChaos #BOCC

My review of Benjamin Wallace’s new book about the pseudonymous founder of Bitcoin, “The Mysterious Mr. Nakamoto: A Fifteen-Year Quest to Unmask the Secret Genius Behind Crypto,” in the Culture section of today’s Washington Free Beacon. Methodically researched and very well…

Someone needs to take the car keys back from the people running Texas these days. Lone Star State officials are not even self-aware enough to realize that, at the same time they are suing BlackRock and other money managers for a convoluted conspiracy to raise the price of coal by…

This is a tough one to trade from a stock perspective. Exxon doubtless has an air tight ROFR in its operating agreement with Hess (given how financially weak the former integrated Hess was at the time of the partnership's signing roughly a decade ago). If Exxon prevails in…

My latest op-ed in RealClearPolitics on how Big Oil is getting in the way of fixing U.S. energy policy (both at the federal and state level) at this critical juncture in American politics. For the past two decades, the oil majors have taken a cynical approach to the industry…