Oil Bandit 🛢️

@OilCfd

Hydrocarbons barbarian. You are here for Oil & Tanker analytics #OOTT

First Oseberg offer (withdrawn) in the year. Mid-August man.. that's the rubicon

The Officials Dated Brent Assessment: $69.81/bbl Physical premium: 77.5c, steady from yesterday Midland bid and offered in the window, Ekofisk too. Oseberg offered by Equinor. No trades #OOTT #Oil #NorthSea

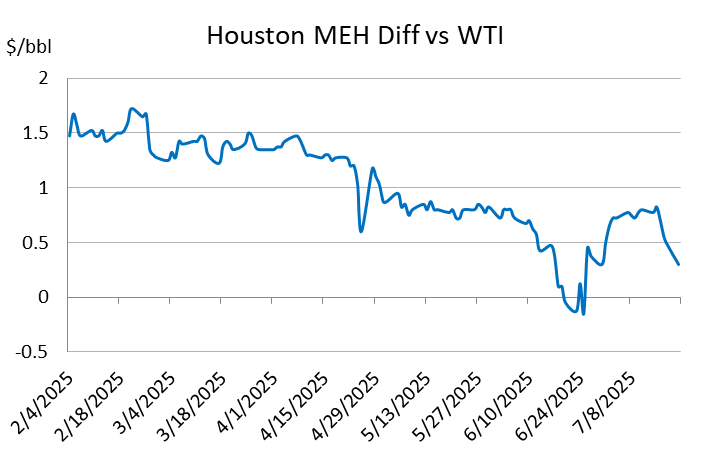

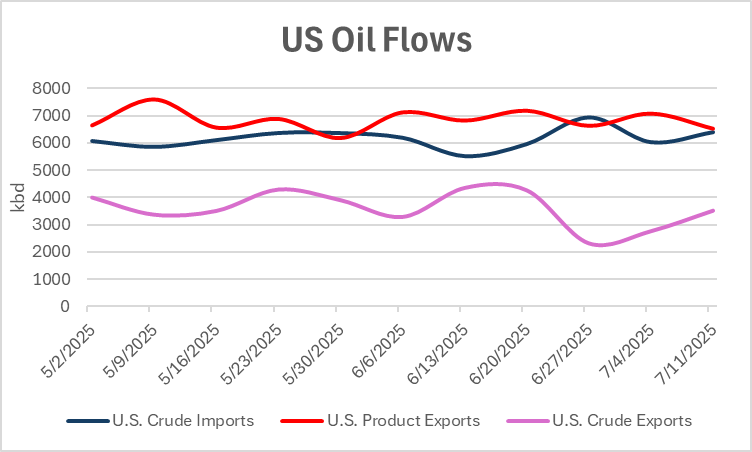

US Crude Oil exports are heading down again. Product exports topped, refi utilization peaked...the only variable left to shift is "crude imports"... or we are going to put barrels in tanks because they are definitively going to the port. Brent is safe

Bloomberg 'Petroineos cut offer for WTI Midland but failed to find a buyer. Phillips 66 maintained its offer for Ekofisk. WTI Midland: Petroineos offered at Dated +$1.95 Aug. 10-14, vs +$2.20 on Thursday Ekofisk: Phillips 66 offered at +$2 for Aug. 7-9, unchanged from Thursday.'

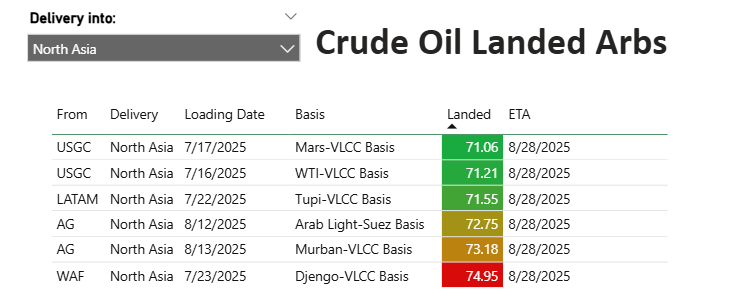

if you can tolerate a little bit of zinc in your Mars crude, is as cheap as is going to get. India is looking for 2 VLCCs already. Floor is in for the big boats

WTI Midland, CIF: Petroineos offered at Dated +$2.20 for Aug. 10-14 Brent, FOB: BP offered at +$2.75 for Aug. 7-9 Ekofisk, FOB: BP offered at +$2.55 for Aug. 9-11 Phillips 66 offered at +$2 for Aug. 7-9

PetroIneos sold that forties cargo $0.5 below yesterday offer.... we are going down. Summer is over

WTI still there...

They are onto something...

🚨 CHINA’S CRUDE OIL IMPORTS SURGE TO HIGHEST DAILY RATE SINCE AUGUST 2023

Aramco will allocate about 51 million barrels to Chinese refiners in August, (1.65 million barrels per day), 4 million barrels higher than July's allotted volume.

Total just bought 3 WTI Midland cargoes for end of July at dated +1.3 on average. We are getting there. WTI exports should ramp up from here.

Maybe is time for the boats to get some love