DB

@NotTheNewsDB

PhD in Entrepreneurship | Postdoc @imperialcollege | Market analyst @WealthGroup

Weekly market overview is ready covering my key LTF and HTF levels for BTC and my main zones of interest for new swing trades, considering indexes like total market cap, total 3 and USDT dominance. All in-depth analyses shared only in the best group in the market @WealthGroup

I want to measure the current sentiment in the market. Where do you think $BTC will top this cycle?

🎥 Top Takeaway from the latest @NotTheNewsDB stream in @WealthGroup! We go live daily in Discord to cover: 📊 Real-time trades 🧠 Strategy & education 🚀 Market reviews & alpha drops Want in? Join the community and level up! 👇 whop.com/wealthgroup/

Members in @WealthGroup group printing so hard right now. @CryptoGodJohn @Tareeq_23 @NotTheNewsDB

Everything discussed on Friday already unfolding for $BTC. Target for Others reached as well. Make a sure to go over this overview to understand my current view on the market 👇

Weekly market overview is ready, covering my current thoughts on BTC, USDT dominance and the altcoin sector represented by the OTHERS index. Market is moving which makes understanding key levels, trends and patterns even more important. Enjoy! @WealthGroup

Divergences played out and alts had a good run. I don't think they are done yet, but Others/BTC is approaching a big area that can be problematic to be flipped initially. Divs forming up to the 8H. Flip above and we get a true run on alts, but below alts can lose a bit of…

Daily divergences on BTC.D, Others dominance and Others/BTC. Could be interesting few weeks for altcoins.

Alts can still have a lot of fun in this period before most of them die forever. We called the top for BTCD last month and nothing has changed yet. I expect it to drop more on HTFs as BTC reaches new highs, a signal that this cycle is coming to an end.

My honest thoughts are that the top for $BTC for this cycle is not in yet, but it will happen in the next few weeks before a broader bear market. I see it between $140K and $130K. Monthly three-drive in play. 2W and 1W as well. Very clean PA if you ignore the external noise.

My honest thoughts are that the top for $BTC for this cycle is not in yet, but it will happen in the next few weeks before a broader bear market. I see it between $140K and $130K. Monthly three-drive in play. 2W and 1W as well. Very clean PA if you ignore the external noise.

Weekly market overview is ready, covering my current thoughts on BTC, USDT dominance and the altcoin sector represented by the OTHERS index. Market is moving which makes understanding key levels, trends and patterns even more important. Enjoy! @WealthGroup

USDT dominance breakdown continues down towards May lows. The 4.5% area was reached and breached instantly after not showing any signs of positive momentum for the index. As of now, just as for BTC, there are no HTF signs of weakness from this index that could suggest that it…

USDT dominance gave that final retest of the 4.85% area before breaking down and reaching my target at 4.50%-4.55. Well played 🤝

USDT dominance gave that final retest of the 4.85% area before breaking down and reaching my target at 4.50%-4.55. Well played 🤝

USDT dominance has now dropped over 4% from our 4.9% area, which was the last push before a larger move to the upside in the last 2 days. Nevertheless, we are now approaching serious support areas, and more HTF bullish divergences are forming for this index, more specifically…

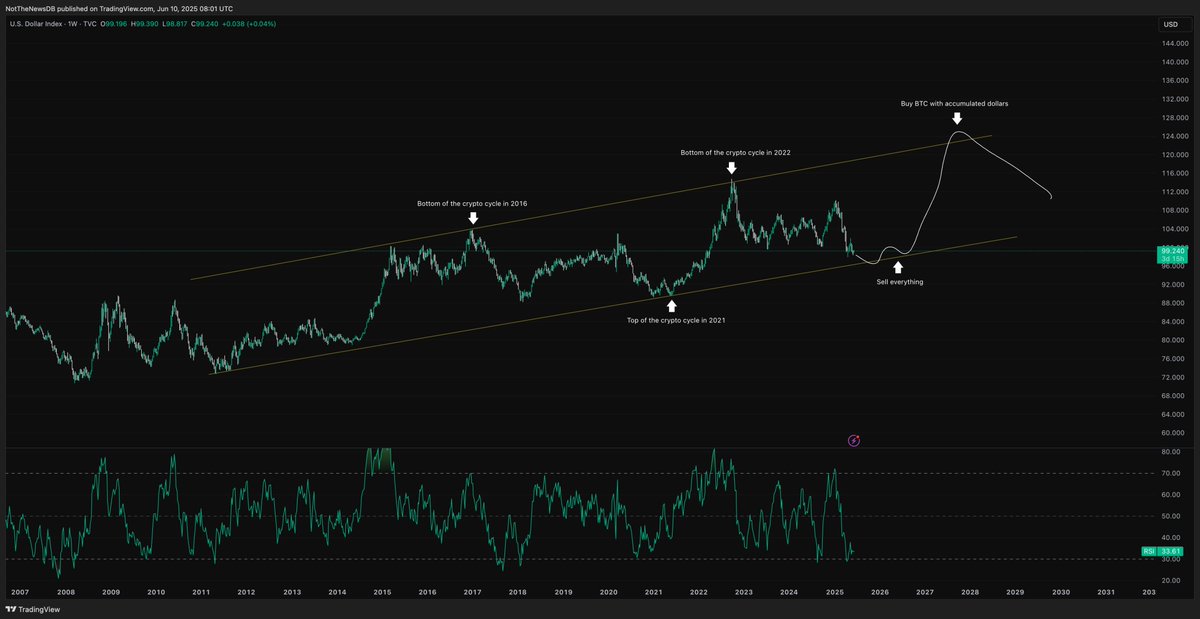

The two most important macro charts for speculative assets like crypto but also US equities will be the DXY and SPX index in the next weeks and months. This should not be relevant for short-term trading, but certainly for forming a long-term bias towards our market. While the…

Financial plan for the next 18-24 months

BTC dominance played out perfectly in the last weeks. No signs of strength yet. Called the top early on 🤝

Plan for BTC dominance has played out. Daily RSI now at 50. Big zone. Lose this and we will have a few more days of positive PA for altcoins. I do not expect new highs yet for this index. LTF pumps are not relevant.

Weekly market review is ready, covering my current thoughts on the market, focusing on $BTC and $USDT dominance. Enjoy! @WealthGroup

USDT dominance has now dropped over 4% from our 4.9% area, which was the last push before a larger move to the upside in the last 2 days. Nevertheless, we are now approaching serious support areas, and more HTF bullish divergences are forming for this index, more specifically…

Intraday plan will be to let this divergence on $BTC play out before looking for new swing longs. 4.9% on USDT dominance is a big AOI.

Plan for BTC dominance has played out. Daily RSI now at 50. Big zone. Lose this and we will have a few more days of positive PA for altcoins. I do not expect new highs yet for this index. LTF pumps are not relevant.

Daily divergences on BTC.D, Others dominance and Others/BTC. Could be interesting few weeks for altcoins.