Nicoper

@NicoperJES

My alter ego, focused on investing 🍀 I write on Substack and SeekingAlpha hoping for constructive arguments http://nicoper.substack.com/about

I like beautifying my simulator outputs. Give me your favorite company and tell me what you consider to be a period of comparable operating model (length of timeseries in which the business was managed as today, irrespective of the price). I will give you the results. 🍀

Wanted to check something on Terravest and pressed enter at an odd moment. What is this now?

One habit I have is to describe a business I like in unfavorable way, in order to break my own confirmation bias. Found this for Vysarn. Made me laugh.

The consistency is really good Organic growth rates Q4 '24 +27% Q1 '25 +30% Q2 '25 +29% Q3 '25 +27% Q4 '25 +28%

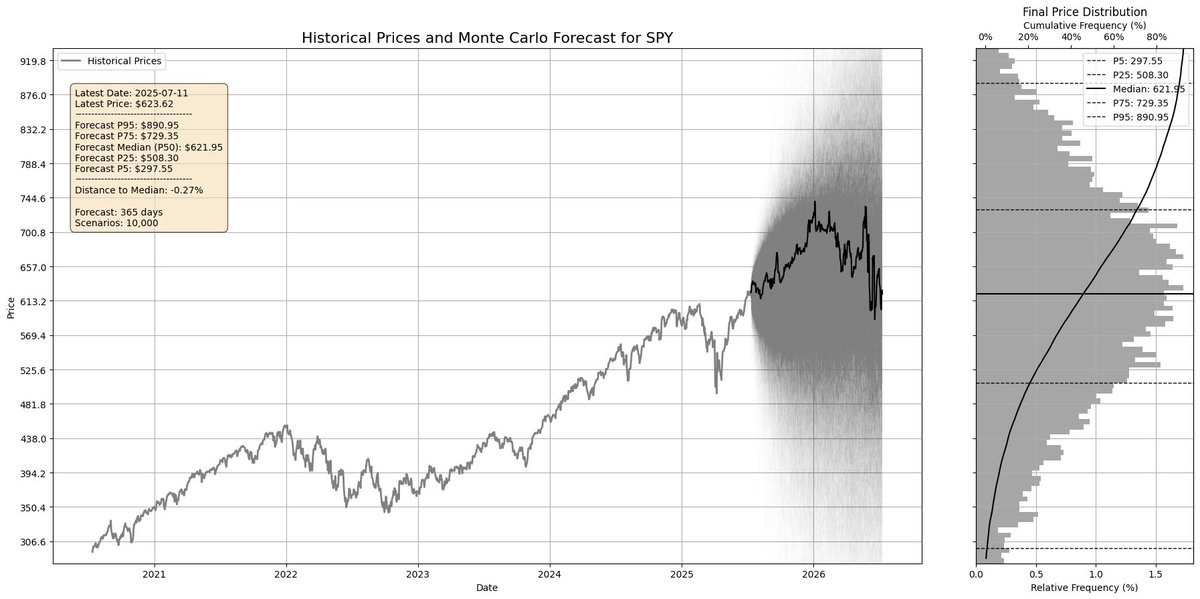

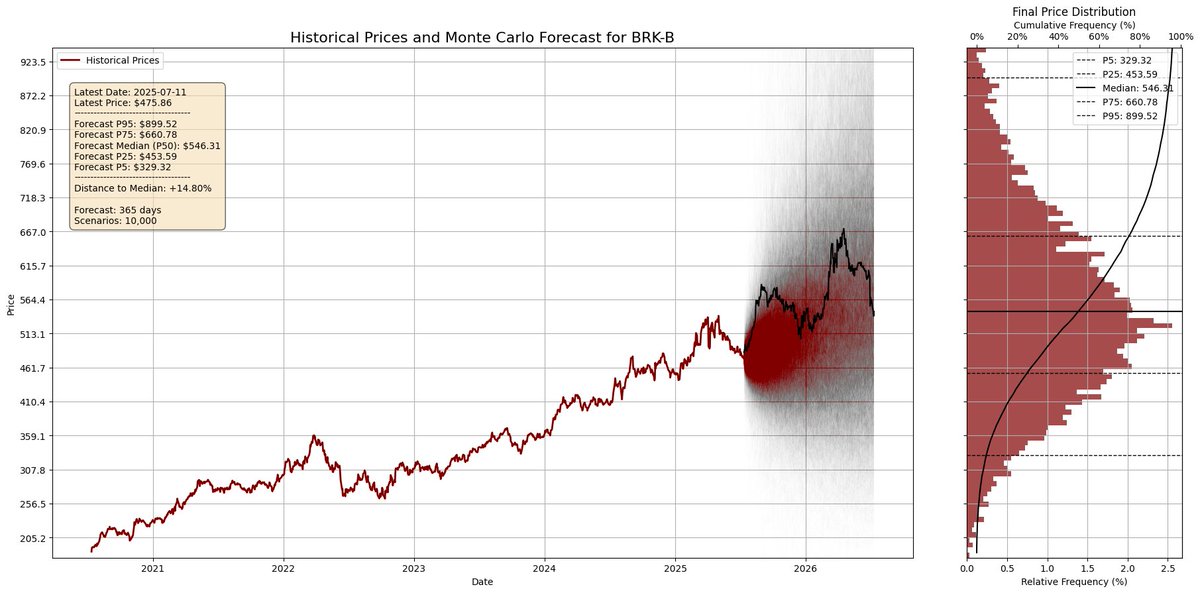

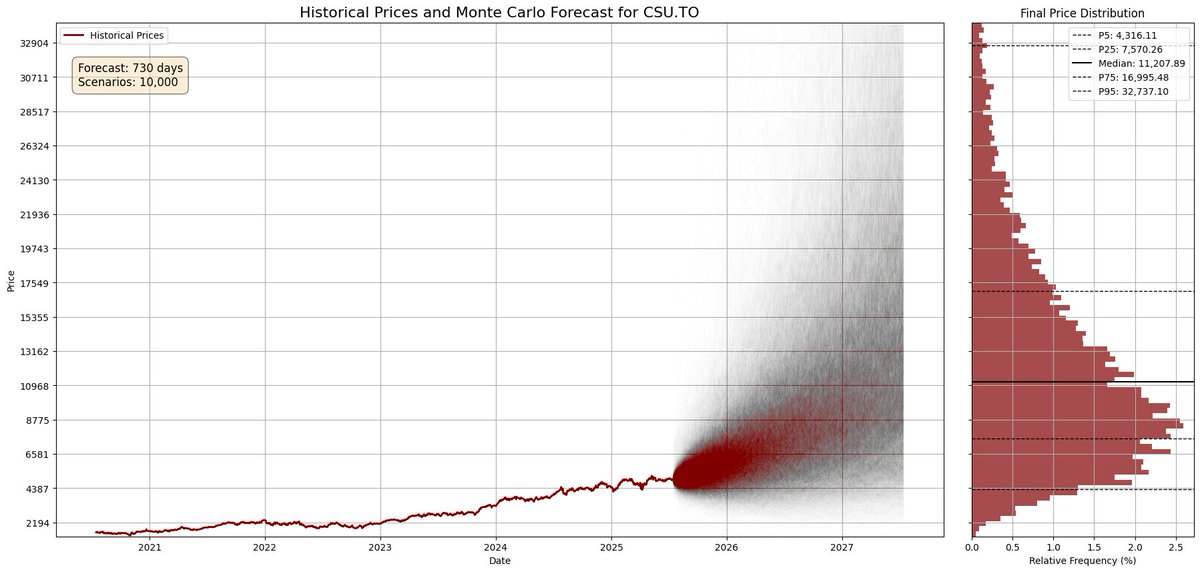

Updating my Monte Carlo toy with some ai recommendations how to better visualize the data. This is far from accurate price prediction. Rather it is something I use to understand the probable volatility (since volatility is only an estimate, and never a direct measure).

Enghouse - no cheap enough, Conexxion - too concentrated and in service of the management instead of owners, Janison Education - early turnaround with low certainty of turning around, Plover Bay - too expensive for political risk. Last month of my research. Nothing interesting🍀

Transaction settled today. This was an odd opportunity, probably due to low float. Found it by accident since Janison Education reminded me of them. It is nice having a small portfolio sometimes🍀

Proeduca Altus delisting will occur in next few days. Better not to calculate annualized return. 🍀

I am not finding any news about BFF Bank. Anyone aware of something fundamentally relevant?