NextWave EFT

@NextWaveEFT

Fundamental analysis in the energy space. Not investment advice.

Those Tamboran Australian shale wells…not good. $TBN Based on IP results, well productivity looks like Barnett (1 bcf/1000), but with costs similar to Western Haynesville (>$20mm)…. And no market to sell the gas. Mgmt will hype this another 36 mos and then this will all end.

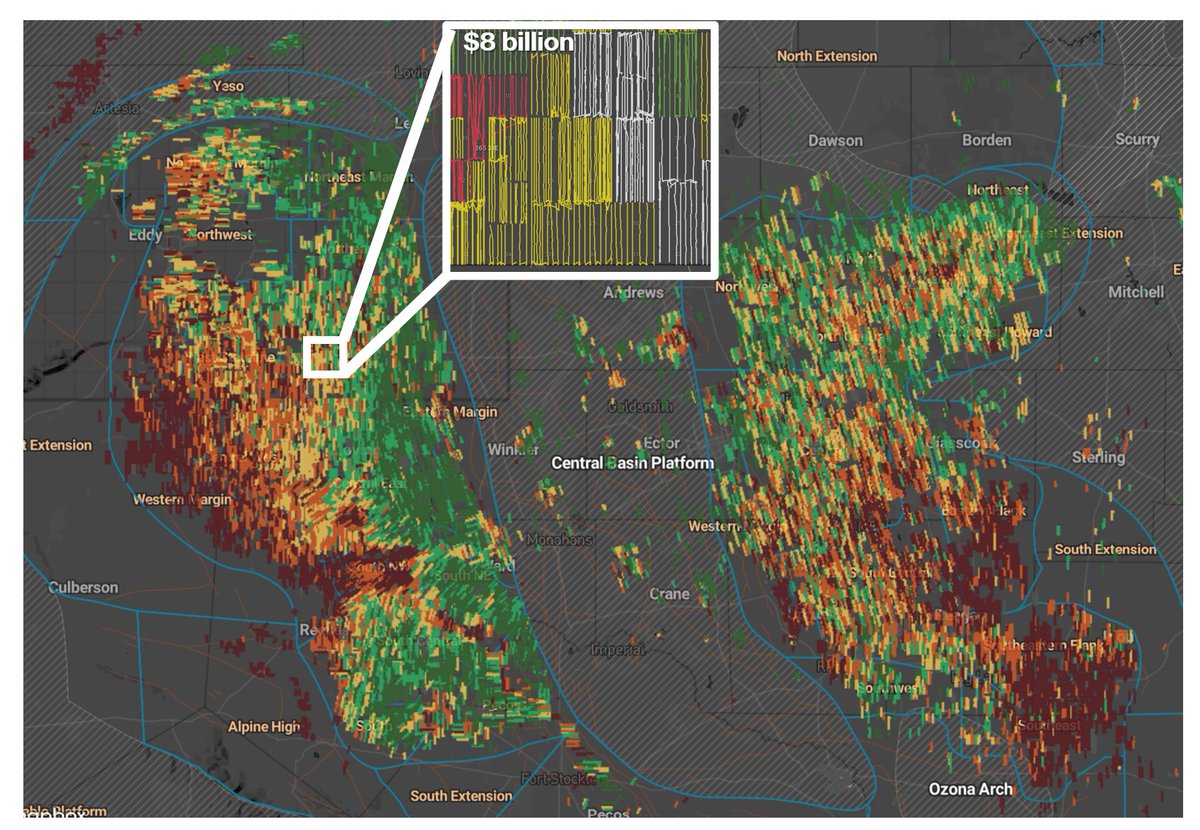

Sometimes you gotta step back and just look in awe at what the American Oil and Gas industry is capable of. Permian Basin Stats - 250+ companies - $500 billion invested - 50,000 wells - Made the US the #1 oil producer There's no other country on earth that could achieve this.

Open AI: I will pay 2x spot rates to secure energy for my datacenter. Don’t care if it’s wind or coal. META: 5x spot rates. Any energy other than a melted down nuclear power plant lol Google: I’ll take that melted shit. 7x rates. Chamath: Energy costs are going to zero.

Sankey always does a great job communicating the status of oil markets. Clear and concise. Recent cnbc piece is worth a watch.

Global oil market at historic inflection point as supply, demand falls, says Paul Sankey @CNBC cnbc.com/video/2025/06/…

Calling c the "speed of light" completely misses the point. Rather, c is the "spacetime exchange rate": how many units of space you can exchange for one unit of time. In actuality, everything travels at the "speed of light", just not necessarily through space alone... (1/4)

Here are the price differences for the avg american consumer from 2005 to 2025: Groceries: +155% Housing: +90% Healthcare: +120% Education: +58% ——— Gasoline: 0% Over that 20 yr span the US Oil and Gas Industry became a global energy superpower. This ^ is the result.

Here’s a freebie for $CRK mgmt: Stop trying to accomplish both delineation AND HBP of your Western Haynesville at the same time Your standalone wells are spoiling 2000’ on each side, and at $30mm each it’s an ineffecient means to HBP Replace 75% of hzs with verts + spread out.

Which E&P company has the biggest mismatch between quality of assets (good) vs quality of management team (bad)? I’ll go first: Comstock

We’re in the phase of a downturn where it still feels like it’s a great time to buy. Wait until when you’d feel sick to your stomach pulling the trigger bc “this time is truly different”. We’re nowhere near that.

A non-consensus (non-extreme) take on oil’s drop to $55-60/bbl: - US oil rig count drops 25% - US oil prod falls 500k bopd y/y - pubco’s decline 0-5% y/y but stay fcf positive - associated gas flat to slightly down - 25-27 gas story stays strong despite recession possibility

Student loan forgiveness, but instead of taxpayers footing the bill, it’s on the colleges who charged $130k for their useless degrees. Why isn’t this a thing?

“Don’t cry because it’s over. Smile because it happened” - Dr. Suess

Tamboran (Aussie shale) $TBN up 50% the last 60 days Reminder of what their challenges are: 1) Find lots of gas (Easy) 2) Hope somebody builds pipe to coast (Hard) 3) Hope someone builds new LNG facilities (V Hard) 4) Hope their gas can land in Asia cheaper than the US (lol)

It’s amazing there’s an entire ecosystem of “breakthrough drilling technologies” led by the GEOTHERMAL industry (…not oil and gas, lol). Pulsed drilling, laser drilling, etc. To the gullible finance/tech “visionaries” that are backing this shit: They don’t work.