NEXBRIDGE

@NexBridgeSV

Bringing real-world exposures on-chain with regulatory clarity and institutional trust.

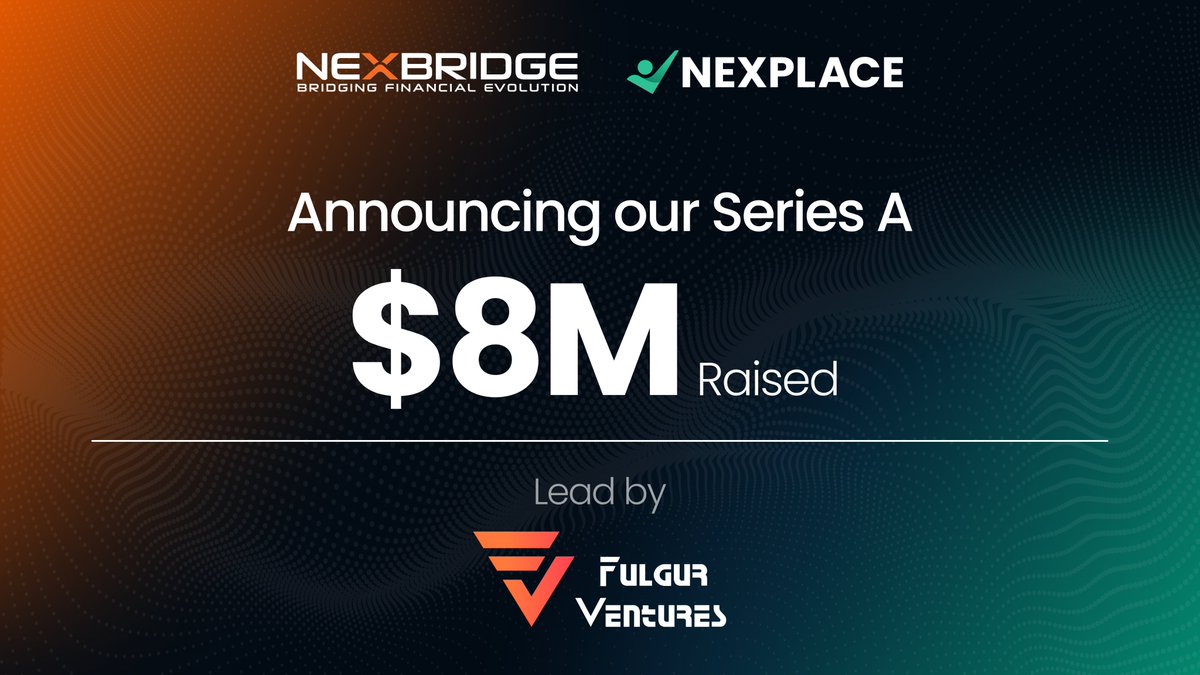

Regulated digital asset issuance on Bitcoin is entering the institutional mainstream. Together with @Nexplace_Global, we've completed an $8M Series A round led by @FulgurVentures to scale the issuance and adoption of regulated digital assets on the @Liquid_BTC. 🟧 Since…

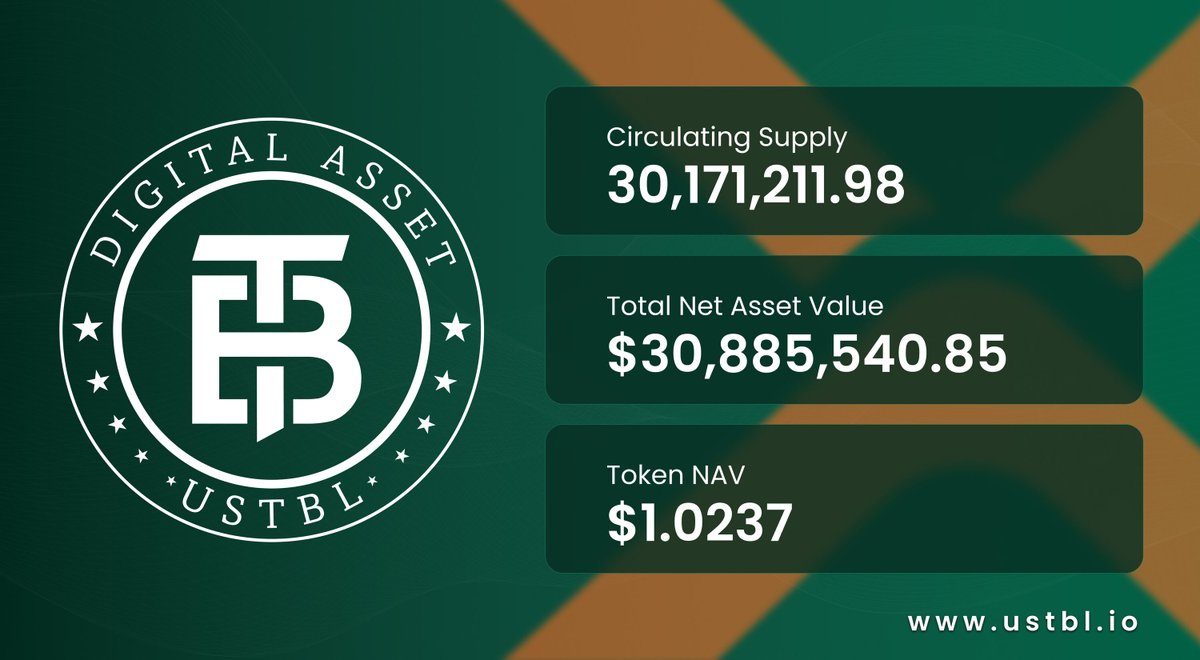

There’s a massive gap between market demand and legacy infrastructure. Why build your 2025 portfolio on 1975 rails? ⦿ Slow settlements ⦿ Custody friction ⦿ Limited auditability #USTBL bridges that gap. Exposure to short-term U.S. Treasuries — fully backed by the iShares…

#Bitcoin | Producto tokenizado en bitcoin recibe calificación «A» en El Salvador El primer instrumento financiero digital basado en bonos del Tesoro de EE. UU. recibió una calificación “A” de la agencia Particula. Clic acá:⬇️ diarioelsalvador.com/producto-token…

🇸🇻EL SALVADOR BITCOIN CAPITAL MARKETS: FIRST 'A' RATING FOR A DIGITAL ISSUANCE El Salvador is becoming the Switzerland of Bitcoin. There is no 'crypto revolution' here. There is just excellence and emerging bitcoin capital markets.

USTBL receives ‘A’ rating from @particula_io USTBL, issued by NEXBRIDGE, has received an ‘A’ rating from Particula, a leading independent digital asset rating agency, setting a new benchmark for regulated digital assets on Bitcoin. Particula’s rating highlighted key…

USTBL receives ‘A’ rating from @particula_io USTBL, issued by NEXBRIDGE, has received an ‘A’ rating from Particula, a leading independent digital asset rating agency, setting a new benchmark for regulated digital assets on Bitcoin. Particula’s rating highlighted key…

🇸🇻BITCOIN CAPITAL MARKETS NEWS OUT OF EL SALVADOR The Bitcoin Office is excited to see bitcoin capital markets continue to grow in Bitcoin Country. 🚨NEXBRIDGE & NEXPLACE have raised $8M in a Series A round to launch integrated Bitcoin capital markets ecosystem from El…

Top 7 Funding Rounds of This Week @withAUSD – $50M @DigitalXLtd – $13.5M @KuruExchange – $11.6M @NexBridgeSV – $8M @RemixGG_ – $5M @Velvet_Capital – $3.7M @Uweb_org – $3M 👉 cryptorank.io/funding-rounds

Not everything that starts early becomes meaningful. But everything meaningful starts early. Building capital markets on Bitcoin won’t happen overnight. But we now have the tools to do it right—from infrastructure to regulation, and the vision to connect them. Grateful to the…

Why USTBL stands out among tokenized treasury products. Many tokenized treasury products offer: • Exposure through complex fund structures ❌ • Multiple blockchains without focus ❌ • Limited liquidity and high minimums ❌ • Hidden fees and complicated structures ❌ In…

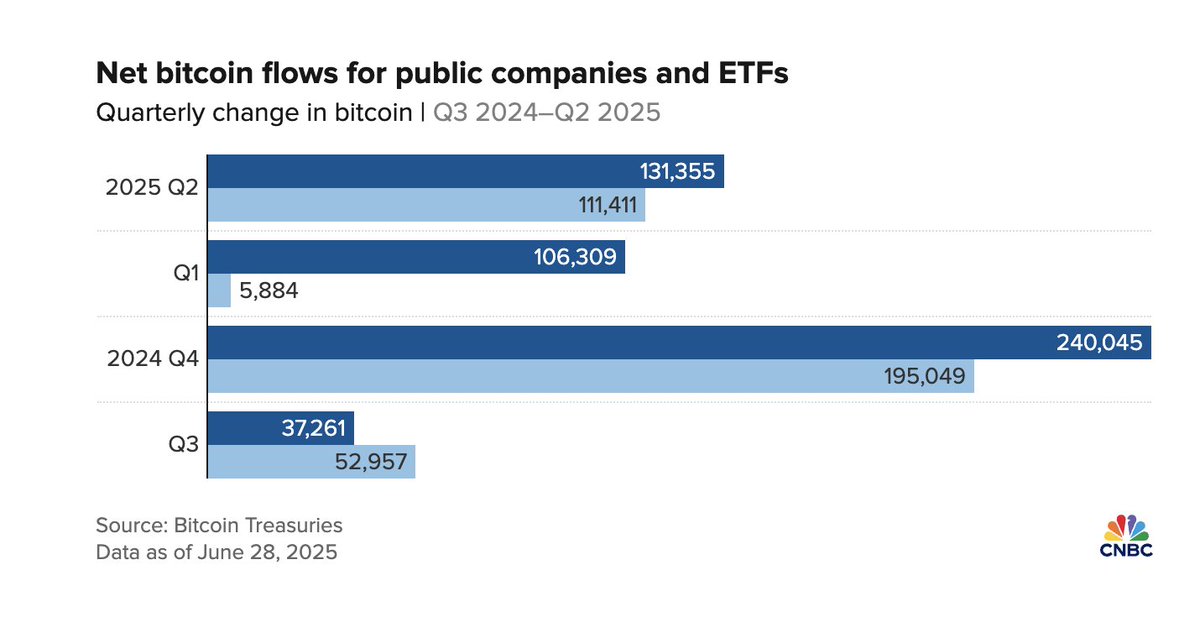

Corporate treasuries are hoarding Bitcoin. We're doing something different. While 140+ companies follow the @MicroStrategy playbook—converting cash to Bitcoin for balance sheet leverage—NexBridge takes the opposite approach. Not just holding Bitcoin. Building real…

2025, the year that Wall Street discovers that Bitcoin ≠ Crypto. It already started in El Salvador. We're just building the bridge. #Bitcoin #LatAm #Tokenization #ElSalvador

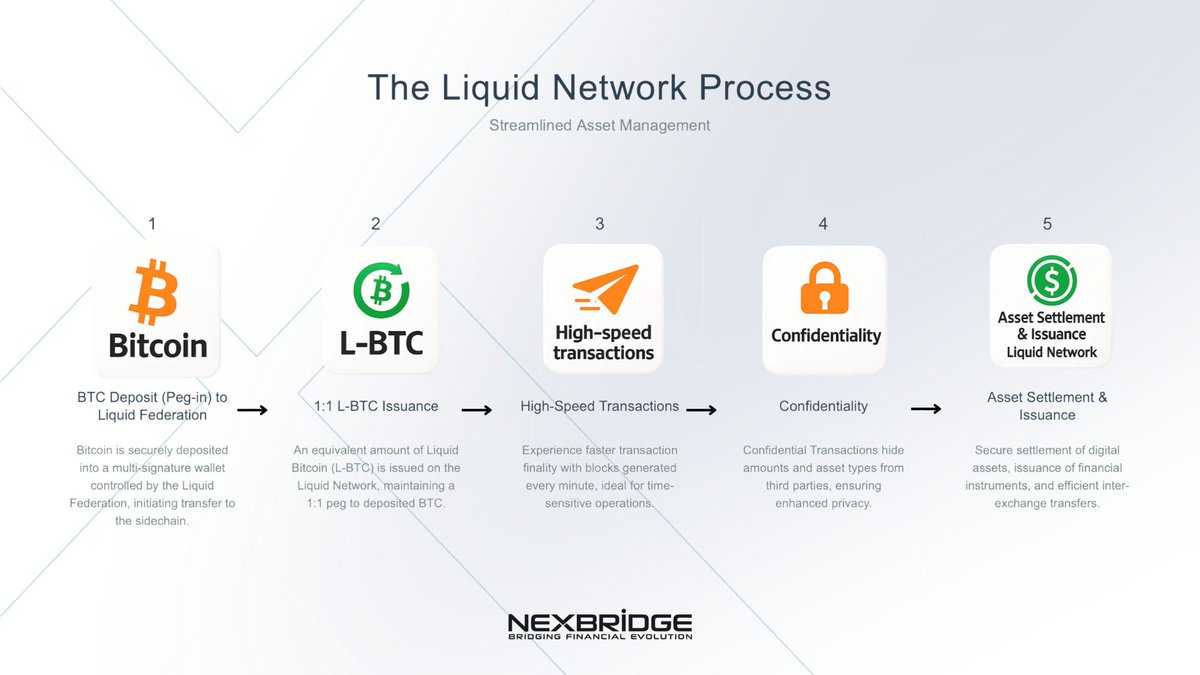

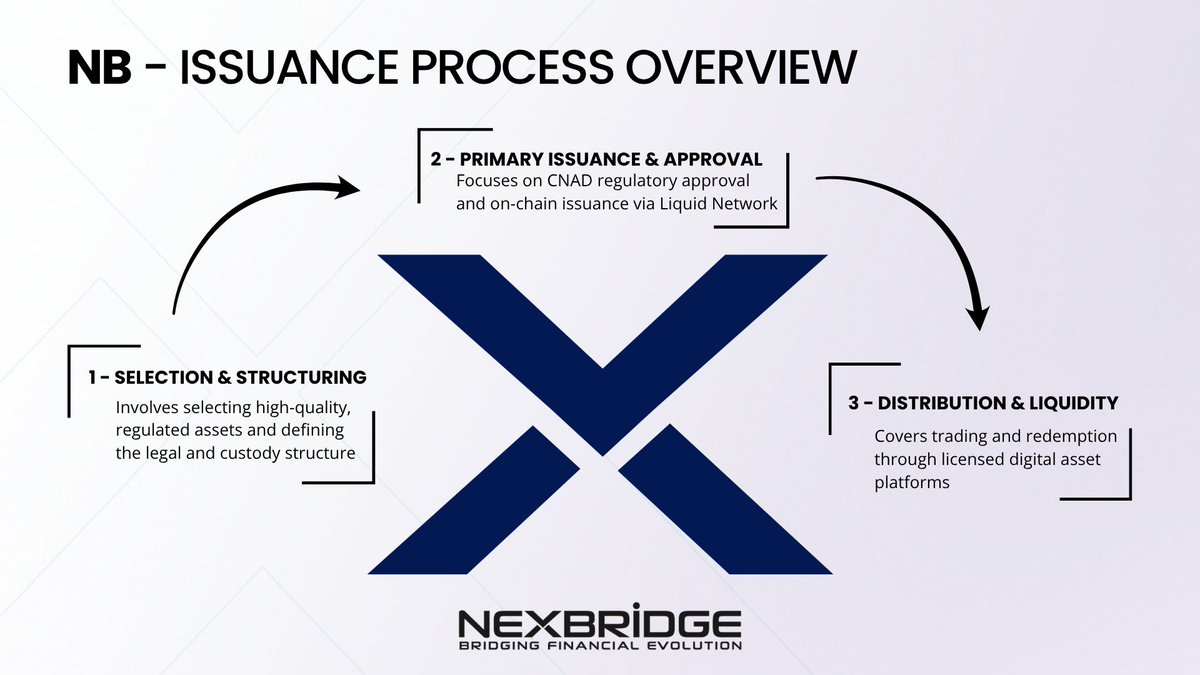

🏗️ How NEXBRIDGE Regulated Issuance Actually Works Most people think tokenization is just "putting assets on blockchain." It's not. Here's our 3-step regulated process: STEP 1 → Selection & Structuring ⦿ Submit the Relevant Information Document (RID) to @cnadsv (CNAD)…

Most Treasury bill tokens go up in price. Others distribute more tokens. But almost none behave like actual bonds. How yield is calculated in tokenized T-Bill products affects much more than returns. It determines their safety, regulatory compatibility, and real adoption. There…

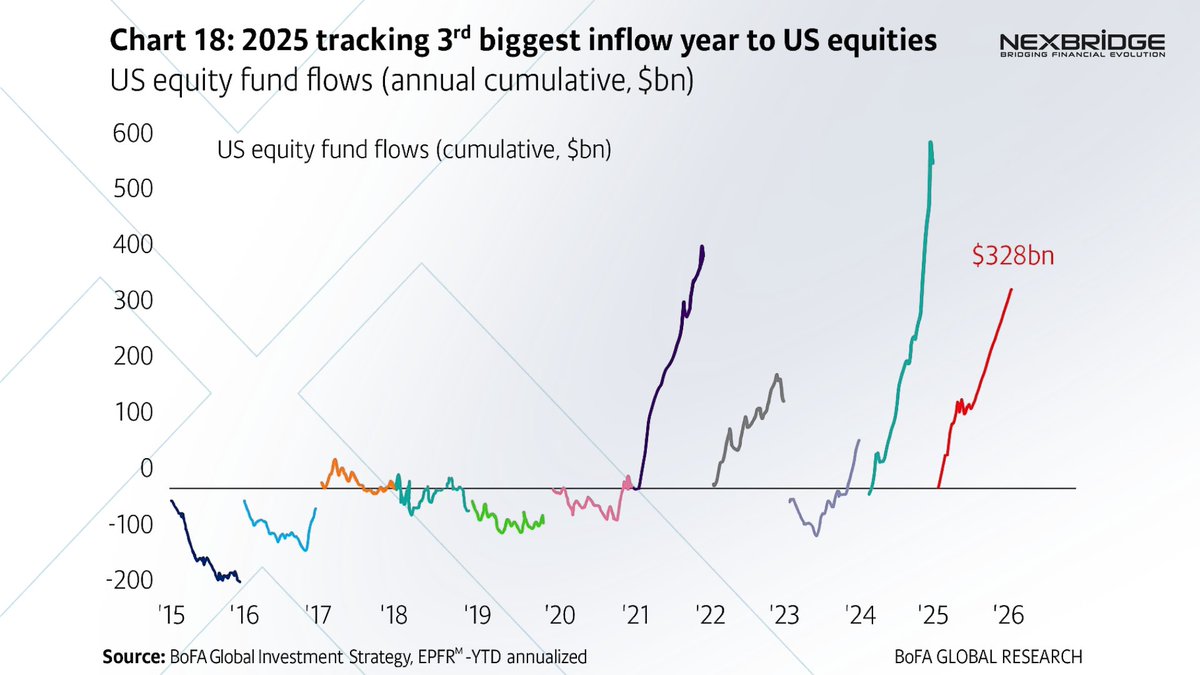

$328B flowing into U.S. equities. The 3rd largest inflow in history. Institutional capital moves fast, but infrastructure still moves slow. We're building the bridge. NEXBRIDGE – Modern rails for institutional finance on Bitcoin.

Asset managers → blockchain. Never the other way around. We’re building the BitcoinFi bridge.

USTBL Update. Token NAV is currently $1.0180. Over $30M in tokenized U.S. Treasury ETF exposure, settled directly on Bitcoin rails. Available on @BFXSecurities. Institutional access meets BitcoinFi infrastructure. Same asset. Better rails. Zero barriers.

Imagine tokenizing U.S. Treasuries… and realizing you can’t redeem them. “The most powerful promise of tokenization —24/7 liquidity— simply didn’t exist when we launched USTBL. We had to build the rules from scratch just to get it listed on an exchange.” ↳ @michelecrivelli,…

Why are U.S. Treasuries being tokenized in El Salvador? In Ep. 261 of Web3 with Sam Kamani, @michelecrivelli of @NexBridgeSV breaks down how they're bridging traditional finance and blockchain through regulated RWA issuance. Here’s what you’ll learn. 🧵

Bitcoin changed everything. But the main network has limitations for institutional volumes. Liquid Network solves this. It's a Bitcoin federated sidechain designed for institutions. Same Bitcoin security, but with specific features for professional finance: – Institutional…