Noel.hl (theo arc)

@NarwhalTan

GTM @theo_network | Hyperliquid Maxi 👨🍳 @hypurr_co | Ex-GTM @HQ_xyz @p2pvalidator | Tweets are personal views

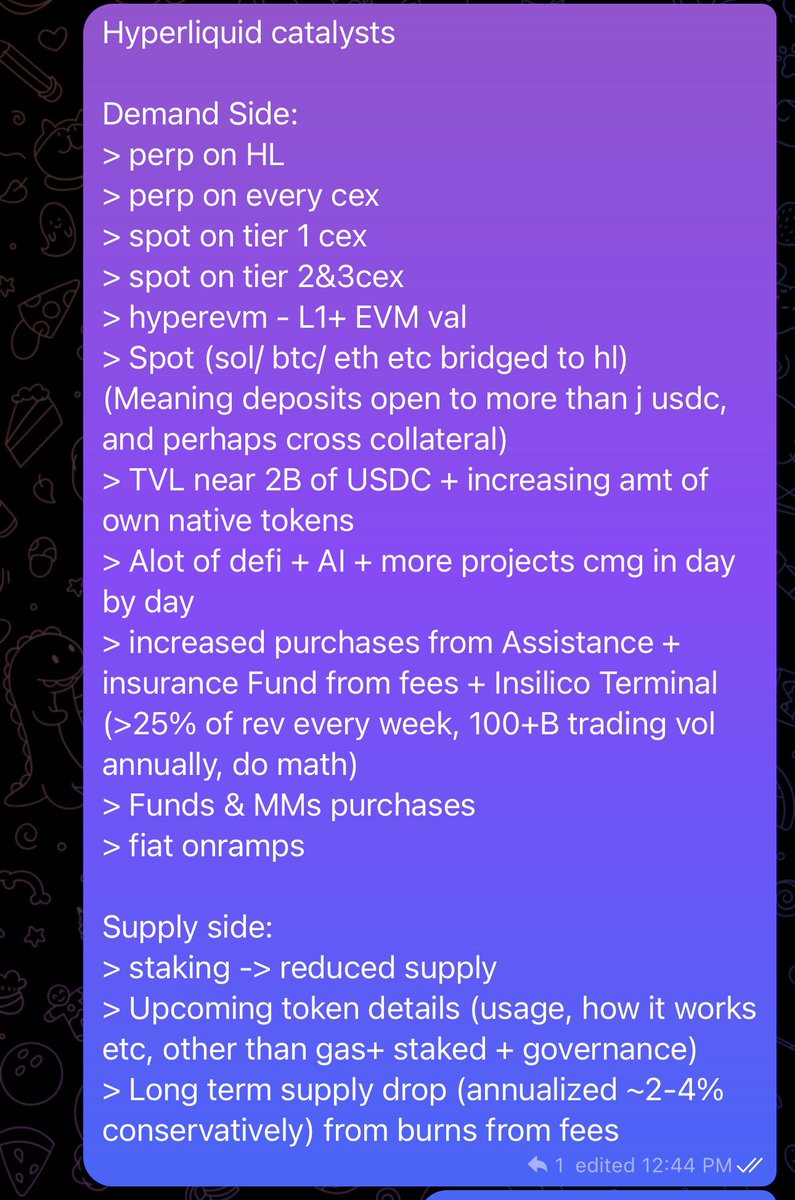

Putting it here My @HyperliquidX catalysts Up only

Particularly excited to have $THBILL go live, and have it roll out across the various chains on @Arbitrum, @Base and @HyperliquidX HyperEVM next week, tapping onto @LayerZero_Core ‘s OFT technology. Lots more to come for Theo.

1/ Introducing thBILL: Theo’s institutional-grade, onchain money market fund built in partnership with Standard Chartered’s Libeara A thread breaking down thBILL’s mechanics and launch sequence as we begin rolling it out across ecosystems 🧵

I’ll hav to thank @yusoffkim for introducing it to me. i’ll hav to thank @chameleon_jeff for the refund during a bad wick and liquidation engine breakdown that made me stay and believe in the team. No CEX would’ve done that. Those 2 points led to alot of conviction using and…

Share a Hyperliquid lore about yourself 🐱

Bond Tokenization Stack The issuance and operation of $thBILL by @Theo_Network involve collaboration among four key partners: 1. Wellington Management: An institutional investment firm managing assets of approximately $1.5 trillion, responsible for constructing and managing…

1/ Introducing thBILL: Theo’s institutional-grade, onchain money market fund built in partnership with Standard Chartered’s Libeara A thread breaking down thBILL’s mechanics and launch sequence as we begin rolling it out across ecosystems 🧵

i feel like theres more coinstore employees than users tf. IDK A SINGLE USER of their 12+M userbase but every time i get a coinstore employee DM 😭

Something I want to dive deeper into is our optimistic RWA minting feature, allowing MMs to mint instantly based on per block quotes that we provide. Means minters have faster fulfillment and clearer price guarantees. Works especially well for non-volatile assets like thBILL bc

1/ Introducing thBILL: Theo’s institutional-grade, onchain money market fund built in partnership with Standard Chartered’s Libeara A thread breaking down thBILL’s mechanics and launch sequence as we begin rolling it out across ecosystems 🧵

1/ Introducing thBILL: Theo’s institutional-grade, onchain money market fund built in partnership with Standard Chartered’s Libeara A thread breaking down thBILL’s mechanics and launch sequence as we begin rolling it out across ecosystems 🧵

Stablecoin adoption is exciting, but still in its infancy What happens when these countries want more than to just hold the dollar? Step 1: Stablecoins solve basic store-of-value needs Step 2: Users demand yield + composability Step 3: Onchain markets rival traditional markets…

State of Stablecoins 2025 🧵

All roads lead to Hyperliquid. Don’t you understand yet?

i am deeply saddened by the implosion of another crypto fund to remedy this i will be raising 200M to launch gainzy capital all funds to be used on a 1B notional 5x long of pumpusd on hyperliquid we mooned ? im a genius we got liq’d ? complex hype airdrop strategy, im genius

Everytime i hop on a call with @degennQuant he makes me wait so he can bullpost something on Hyperliquid. Lesson in there.

Fun fact and reminder, $HYPE used to buy tickers are burnt.

👀 What do you call it, a Hyperliquid? Theo is coming.

blz use my @prjx_hl ref code i need MOAR POIINTSSSS prjx.com/@NARWHALTAN

Listen as @iggyioppe discusses the future of tokenization and real-world assets coming onchain. Thank you @Nasdaq @TradeTalks for having us on!

.@truemarketsco @UpexiTreasury @MetaWealth & @Theo_Network join @JillMalandrino on @Nasdaq #TradeTalks to discuss the broader legislative moment for digital assets and the rise of stablecoins and tokenization of real-world assets. x.com/i/broadcasts/1…