National Foundation for Credit Counseling (NFCC)

@NFCC

Founded in 1951, NFCC is the oldest nonprofit financial counseling organization, with a mission to help all Americans gain control of their finances.

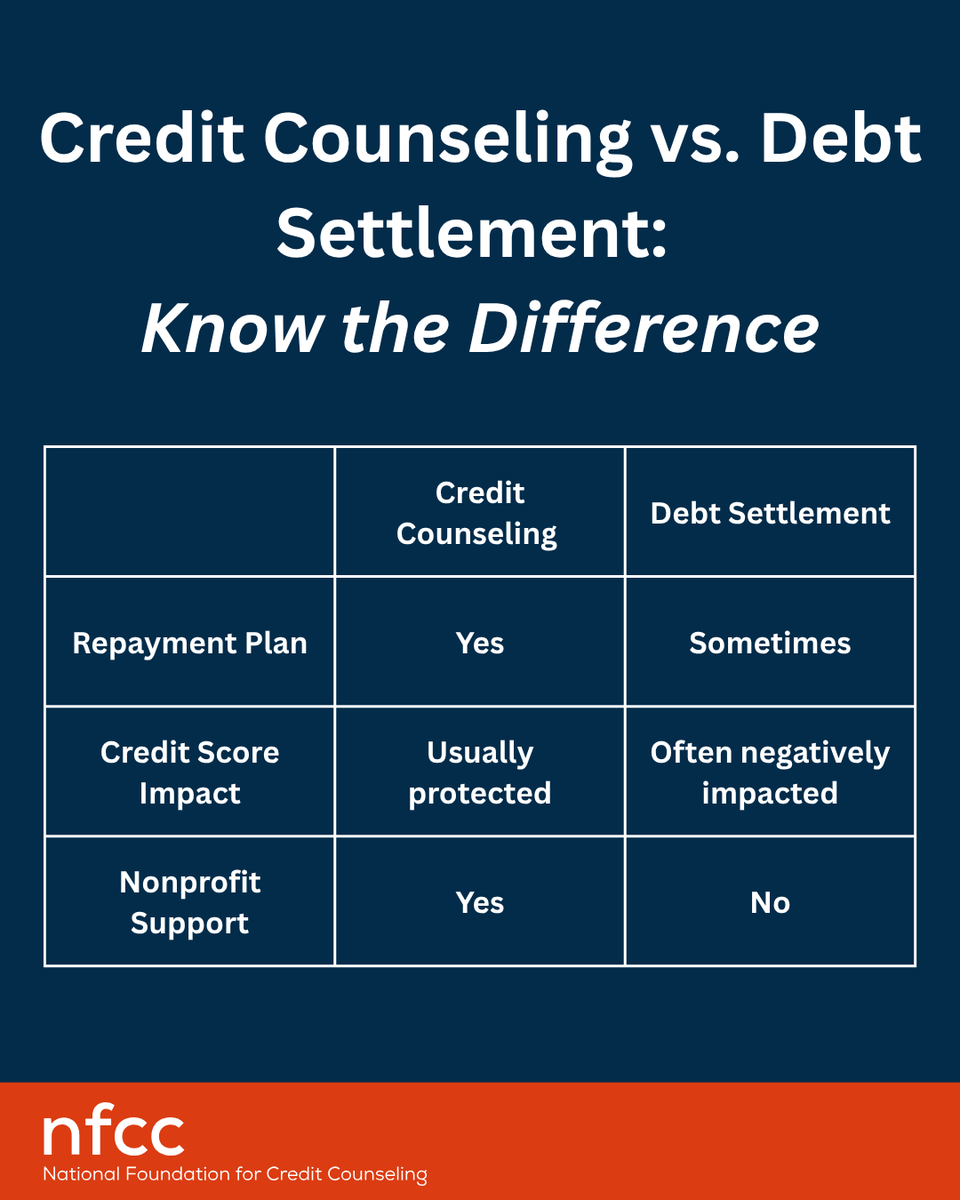

Not all debt solutions are created equal. Credit counseling helps you create a realistic plan to repay debt without taking on new loans or harming your credit Debt settlement often involves stopping payments and negotiating with creditors—potentially hurting your credit score

Take control of your finances today. Connect with a nonprofit counselor and build a stronger financial future. #NFCC #FinancialWellness #CreditCounseling #DebtSolutions #MoneyManagement

Staying on top of your payments can make a big difference. NFCC can help you stay on track. Visit nfcc.org to connect with one of our credit counselors today. #creditcounseling #creditscore #money #NFCC

Debt doesn’t disappear when you ignore it—in fact, it often gets worse. Rising interest rates, credit score damage, and emotional stress are just a few of the hidden costs that can build up over time. #NFCC #DebtHelp #CreditCounseling #FinancialStress #TakeControl #MoneyMatters

David’s story is a powerful reminder of how the right financial guidance can change lives. Through the support of the NFCC, he found a path forward—and he’s not alone. 🔗 Visit nfcc.org to learn how you can take the first step. #NFCC #CreditCounseling

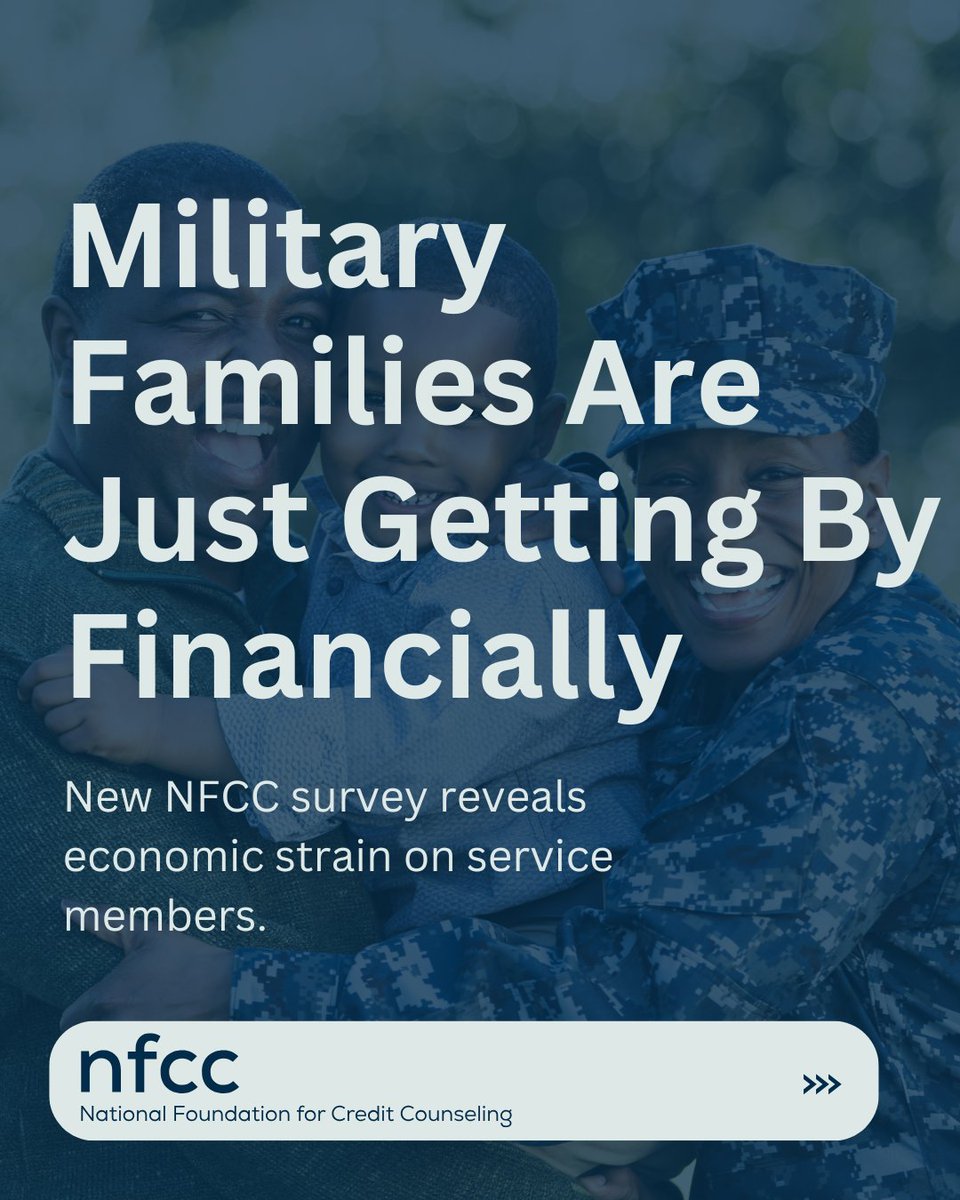

Military families are navigating more than just duty — they’re facing growing financial pressure. New survey data shows that 1 in 2 active-duty service members are just getting by. From rising debt to reliance on risky financial services, the challenges are real. 📞800-388-2227

Worried about a recession? You’re not alone. Economic uncertainty can lead to financial stress—but there are steps you can take to prepare. Connect with us today to find credit counseling services near you -> loom.ly/P1PPTzY #NFCC #FinancialWellness #RecessionPlanning

New survey findings from the NFCC and The Harris Poll reveal growing economic pressure on military families—many of whom are turning to savings, credit cards, or non-traditional services just to cover daily expenses. 🔗 loom.ly/lr-bYtw #NFCC #MilitarySupport #Finances

Our military community faces unique debt challenges, and many encounter risks when navigating today’s complex financial marketplace. NFCC partners with military families to replace uncertainty with confidence through trusted, nonprofit debt relief solutions. 📊 Learn more:

Debt can take a toll on your credit score, financial goals, and even your mental health. Taking action matters, but you don’t have to face it alone. NFCC is here to help you. Call us today at 800-388-2227 for support. #CreditCounseling #DebtSolutions

Financial freedom matters just as much as independence. Happy Fourth of July from your NFCC family! #NFCC #FourthOfJuly #FinancialFreedom #IndependenceDay #CreditCounseling

July is Military Consumer Month—a time to spotlight the unique financial challenges faced by active-duty service members, veterans, and their families. 💻 Learn more and find support: loom.ly/_ZhaduU #MilitaryConsumerMonth #NFCC #FinancialReadiness #SupportOurTroops

Financial freedom isn’t just a dream—it’s a goal you can work toward, one smart step at a time. Whether you’re tackling debt, building savings, or just getting started with a budget, having a plan makes all the difference. 🔗 Visit nfcc.org #NFCC #FinancialFreedom

Big news: NFCC has officially launched the Life Beyond Debt program. This initiative helps people reduce debt and build savings at the same time—because financial wellness is about more than just catching up. 🔗 loom.ly/3SFReho

Looking for simple ways to cut monthly expenses? Start with your energy bill. Changes like switching to LED bulbs, unplugging unused devices and taking advantage of natural light can make a big difference over time. Energy efficiency = financial efficiency. #NFCC #BudgetTips

In his latest article, @BruceMcclary breaks down the challenges Americans face when it comes to housing—and how we can help. 📖 loom.ly/jwnPQ40 #NFCC #NationalHomeownershipMonth #HousingHelp #CreditCounseling #FinancialWellness #HomeownershipSupport

Summer on a budget? Say less 😅 I know the grocery/snack bill is wild and they're probably screaming "I'm bored" every 5 minutes ...but you can keep the kids learning, laughing, and off your last nerve without spending money every day. Swipe for low-cost (and free) ideas by age…

There’s no perfect budget—only the one that works for you. Whether it’s 50/30/20, envelope method, or zero-based budgeting, the key is finding a system that fits your lifestyle and helps you stay consistent. Need help getting started? Call (800) 388-2227 #NFCC #BudgetingTips

When was your last financial check-in? Asking yourself these three questions regularly can help keep your financial goals on track? If not—don’t stress. We can help you take the next step. #NFCC #FinancialCheckIn #BudgetTips #DebtHelp #SmartMoneyHabits

Not sure where to start with your finances? A certified credit counselor can help you understand your debt, build a budget, and create a realistic plan toward financial stability. Find the help you need today. Visit loom.ly/P1PPTzY #NFCC #CreditCounseling #DebtSupport