NEOS Investments

@NEOSInvestments

Next Evolution Options Strategies seeking income as the outcome. Disclosures: http://bit.ly/3rvYk84

🎉 A big win for the NEOS Nasdaq-100 High Income ETF (QQQI) — awarded “Best New Active ETF” at the @ETFcom Awards! This honor highlights the Fund's growing adoption, unique characteristics, and cements its role as part of the next evolution of options-based strategies in this…

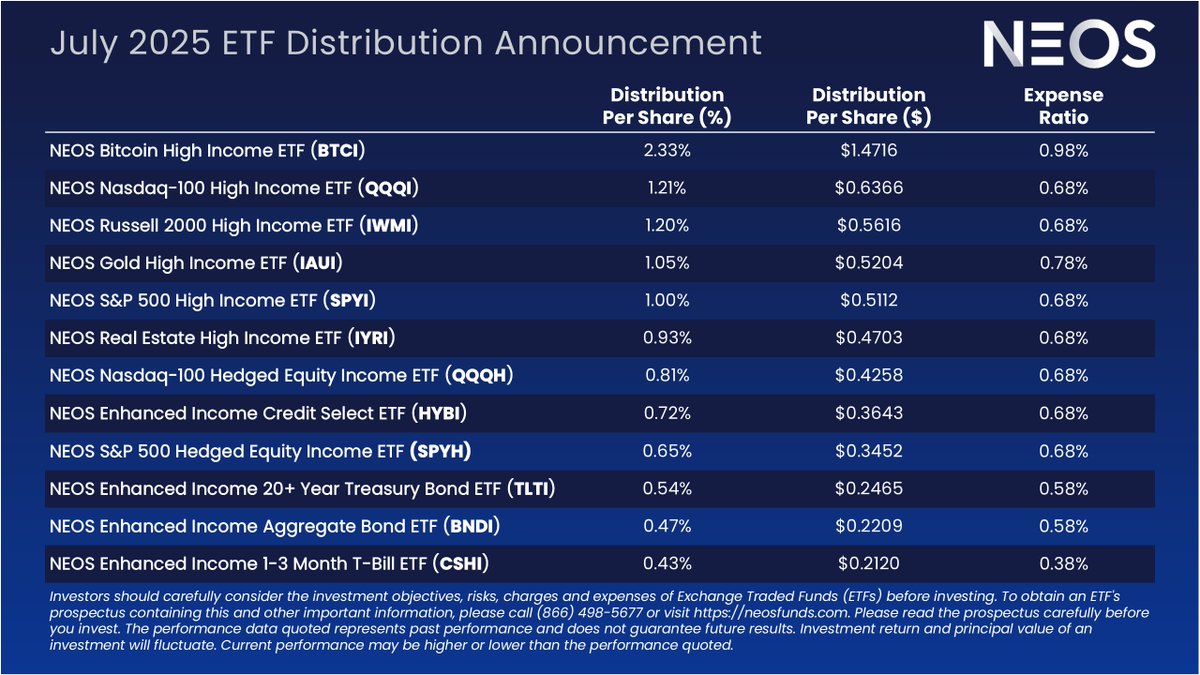

July 2025 Monthly Distribution Information for the NEOS ETF Suite Important Disclosures: Past performance is no guarantee of future results. The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted…

Gold and Bitcoin have both had impressive runs and while they serve different roles in a portfolio, both assets have drawn investor interest amid rising market uncertainty. But neither has historically offered income… NEOS Investments offers two ways to access physical and…

What We Believe Sets NEOS Apart? NEOS Equity High Income ETFs aim to address the common pitfalls of traditional covered call strategies by focusing on three key pillars: High Monthly Income Our options overlays are designed to generate consistent monthly distributions, while…

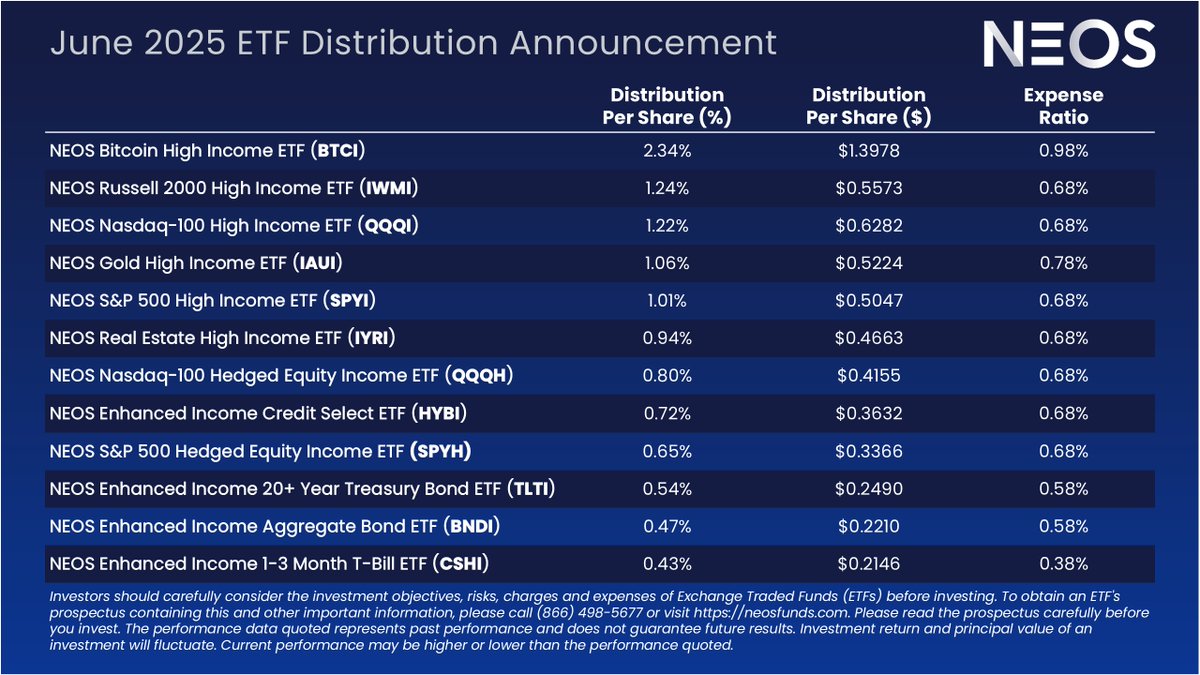

June 2025 Monthly Distribution Information for the NEOS ETF Suite Important Disclosures: Past performance is no guarantee of future results. The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted…

Episode 6: Tyler Ellegard, CFA, of Gradient Investments joins the Monthly Income Podcast. youtu.be/9yTqSw43is4?si… via @YouTube

REITs have faced meaningful headwinds over the past several years, driven largely by a sharp rise in interest rates and tighter financial conditions. Higher borrowing costs have pressured real estate valuations, while reduced access to capital has weighed on expansion and…

Whether rates rise or fall, the income investing landscape can be challenging to navigate. 🔼 Rising rates pressure long-duration bonds and rate-sensitive sectors like REITs and utilities. 🔽 Falling rates may lift prices but reduce forward-looking yields—making it harder to…

IWMI—the NEOS Russell 2000 High Income ETF—may offer a compelling way to harness market volatility to pursue high monthly income in a tax-efficient manner. IWMI invests in the Russell 2000 Index, which represents the small-cap segment of U.S. equities—home to dynamic,…

At NEOS Investments, we’re focused on delivering the Next Evolution of Options-Based Strategies through a growing lineup of ETFs—built to target high monthly income and tax efficiency across core portfolio exposures. Founded by pioneers in the rapidly growing options-based ETF…

May 2025 Monthly Distribution Information for the NEOS ETF Suite Important Disclosures: Past performance is no guarantee of future results. The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted…

In periods of uncertainty, some investors turn to Bitcoin as a potential hedge—whether against inflation, geopolitical instability, or unpredictable central bank policies. But while Bitcoin can offer long-term upside, it’s also known for its high volatility. That’s where…

SPYI—the NEOS S&P 500 High Income ETF—may offer a compelling way to harness market volatility to pursue high monthly income in a tax-efficient manner. In today’s tariff-fueled, volatile environment, that may be more relevant than ever. SPYI invests in the S&P 500 Index and…

We’re thrilled to have teamed up with @CBOE to spotlight the NEOS S&P 500 High Income ETF (SPYI) in the heart of New York City. Thank you to Cboe for the incredible opportunity! #CboeListed Learn more about SPYI at neosfunds.com/spyi/

QQQI—the NEOS Nasdaq-100 High Income ETF—may offer a compelling way to harness market volatility to pursue high monthly income in a tax-efficient manner. QQQI invests in the Nasdaq-100 Index, which includes many of today’s most influential and innovative companies—leaders in…