NAR Research

@NAR_Research

Find out what NAR experts are saying about the housing market and economy. Contact us at [email protected] with questions.

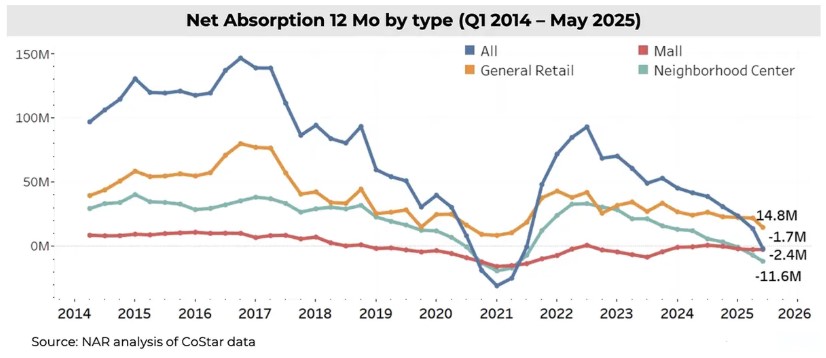

Retail demand has weakened since pre-pandemic highs. Net absorption is negative and annual rent growth slowed to 1.7% as of May 2025. General retail shows positive absorption, while neighborhood centers and malls reduced vacancies by cutting inventory. nar.realtor/research-and-s…

Sales of previously owned homes in June dropped 2.7% from May to 3.93 million units on a seasonally-adjusted, annualized basis, according to the National Association of Realtors. #NAREHS via @CNBC cnbc.com/2025/07/23/jun…

NAR's @JessicaLautz sat with @NPR to discuss the latest happenings in the housing market, as home sales remain slow and home prices continue to grow: npr.org/2025/07/24/nx-…

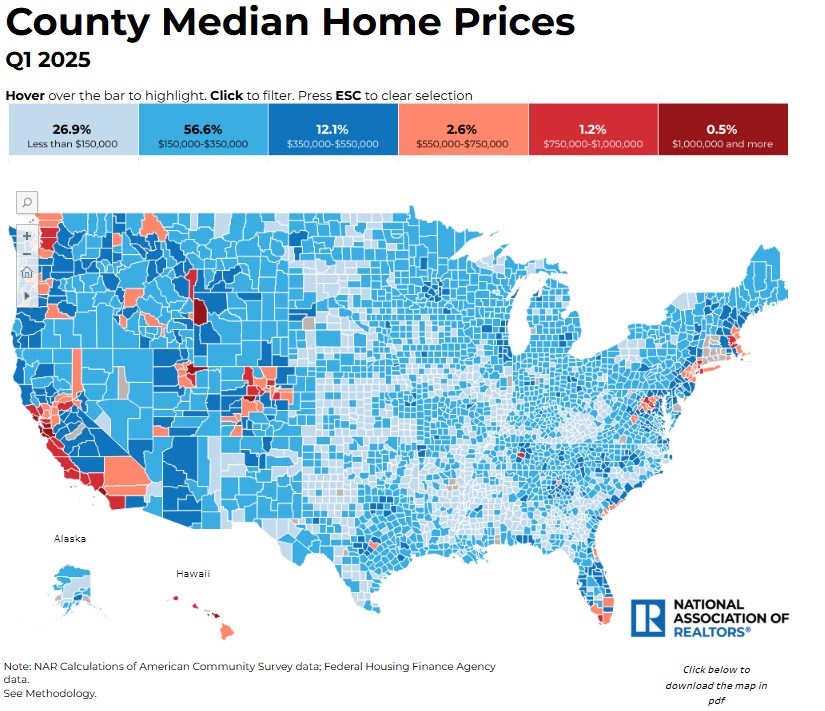

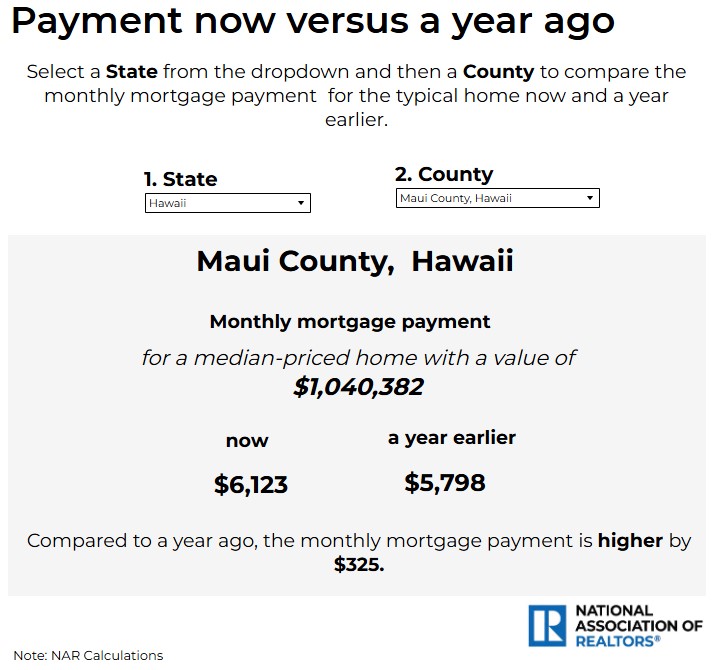

NAR calculated median home values for 3,119 counties and county-equivalents in the United States. Home values represent the value of all homes instead of home sales. Use the interactive tools to find your market's data: nar.realtor/research-and-s…

As of May 2025, the multifamily sector shows early signs of stabilizing, with net absorption up 19% to nearly 528,000 units and new completions down 9%. Vacancy rose to 8.1%. Sun Belt markets see sharper rent declines, while Midwest cities outperform. nar.realtor/research-and-s…

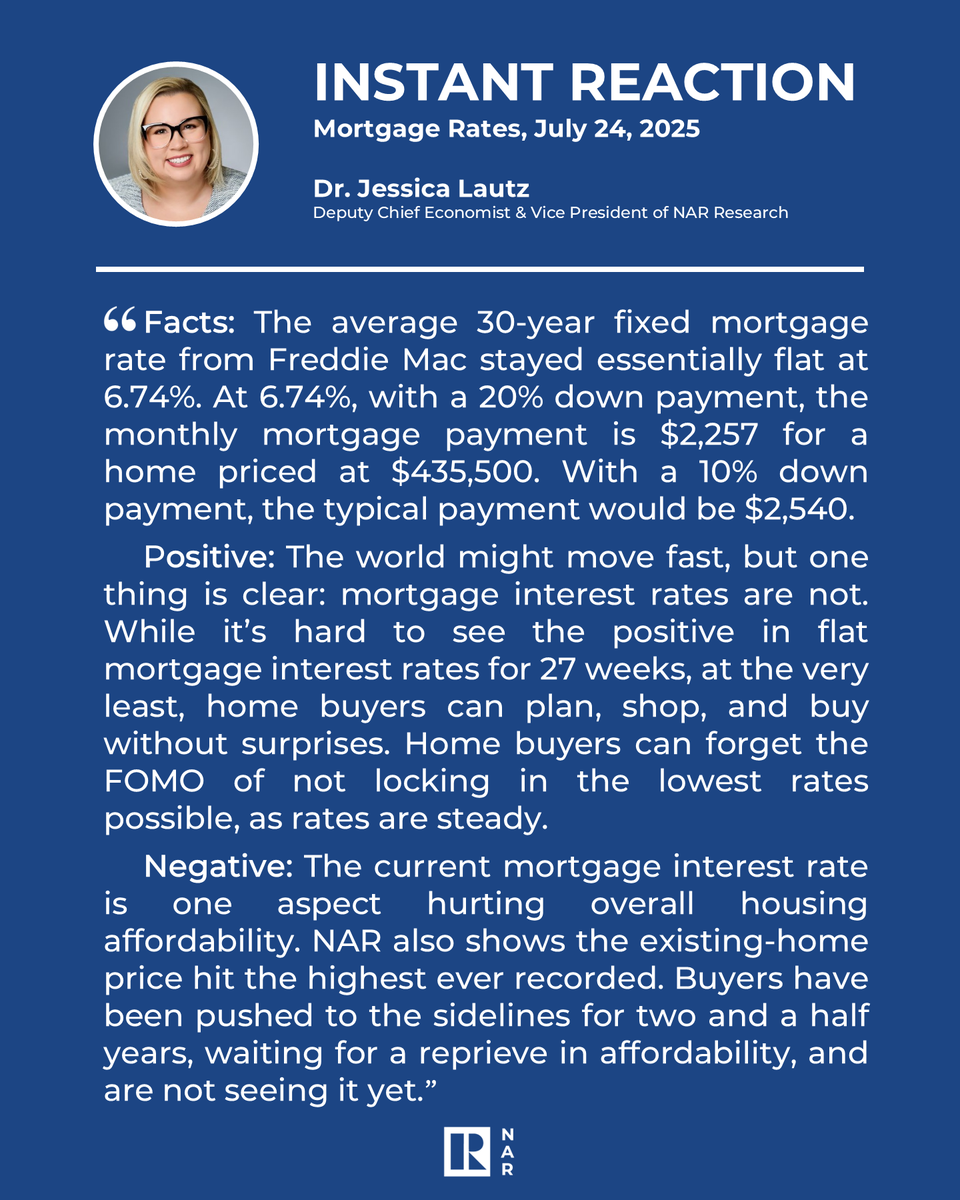

Instant Reaction: Mortgage Rates, July 24, 2025 "While it’s hard to see the positive in flat mortgage interest rates for 27 weeks, at the very least, home buyers can plan, shop, and buy without surprises." nar.realtor/blogs/economis…

With continued slow home sales, all-cash home buyers (29%) continue to show strength in the market. Non-primary residence buyers fell (14%), which is driven by lower investor activity (8%)—lowest share since September 2022 (8%). Find more market insights: nar.realtor/research-and-s…

June 2025 brought 3.93 million in sales, a median sales price of $435,300, and 4.7 months of inventory. The median sales price is up 2.0% year-over-year, and inventory was up 0.7 months from June 2024. #NAREHS nar.realtor/infographics/e…

"The Chinese housing market has been slow to recover following the pandemic, so Chinese buyers see a beneficial opportunity in diversifying their investment portfolios with exposure to stronger U.S. markets," NAR's @MattCResearch told Newsweek. newsweek.com/china-leads-li…

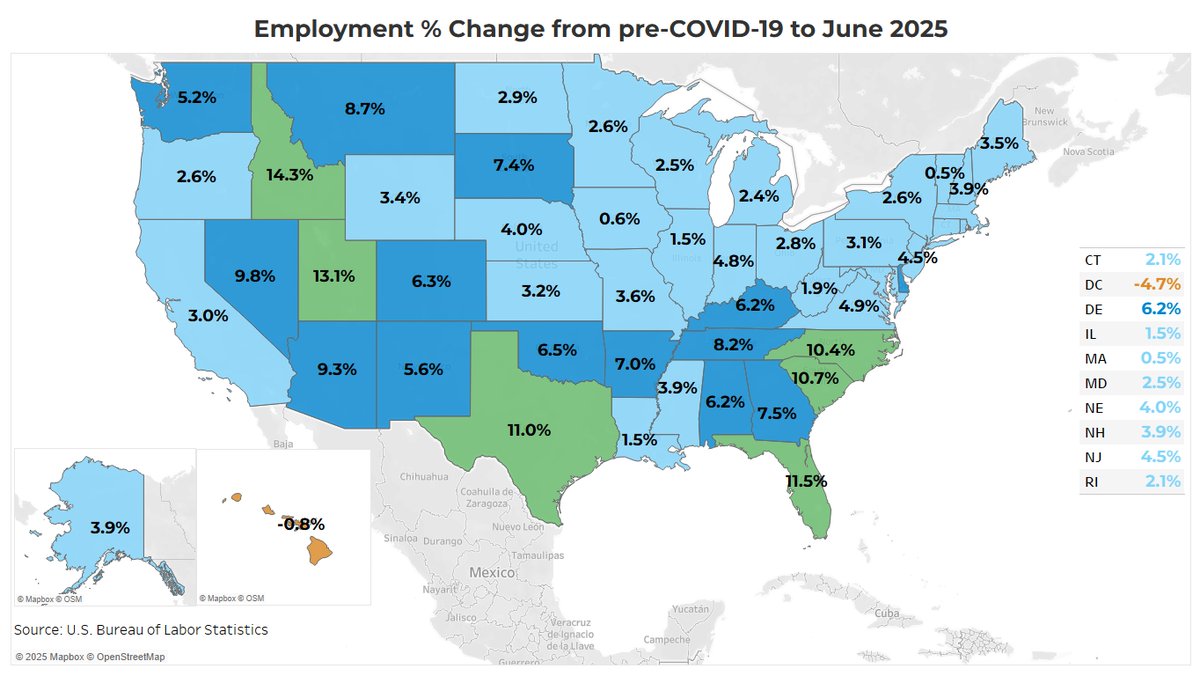

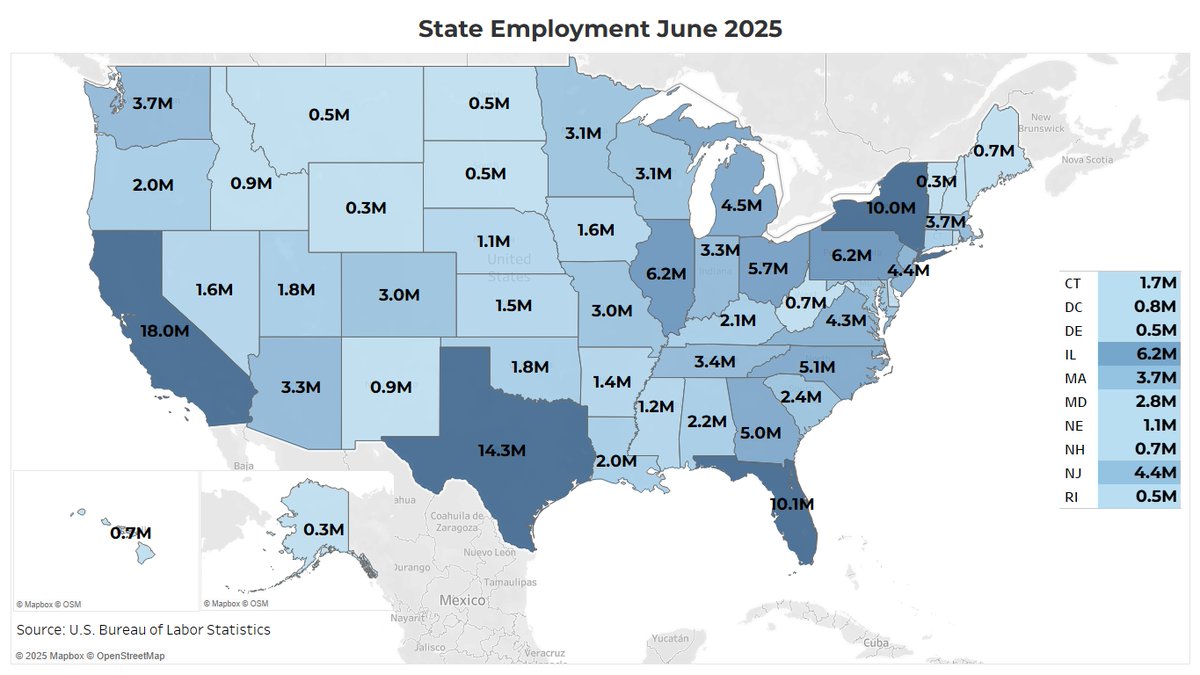

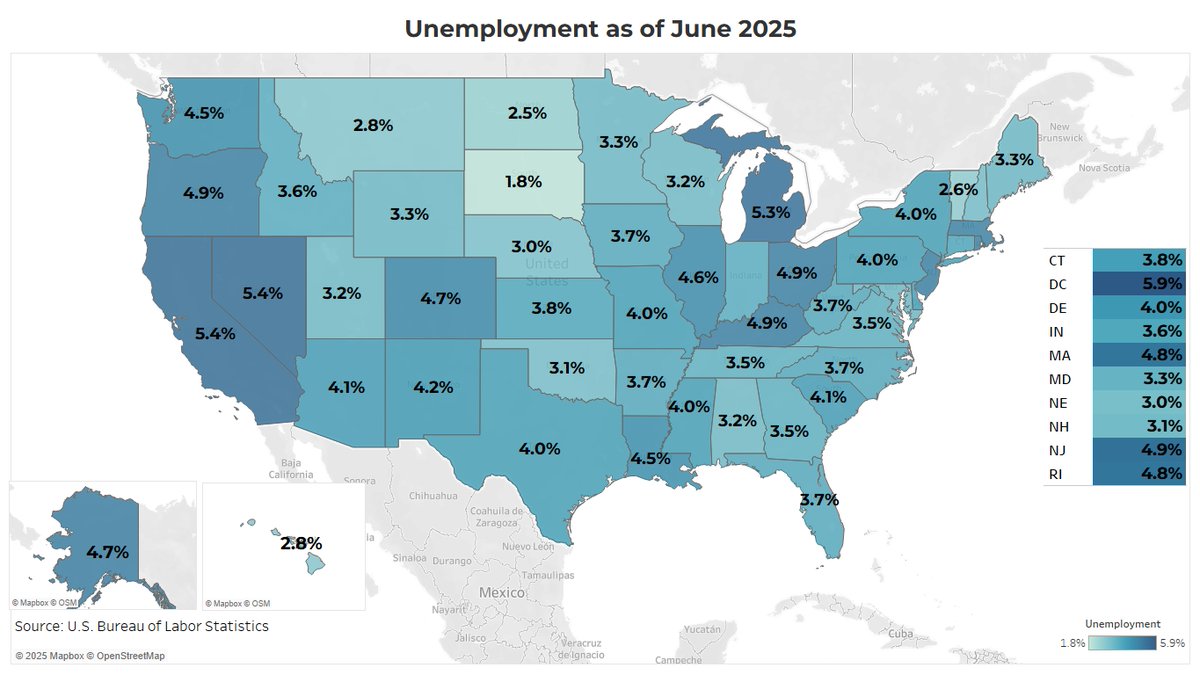

While home sales remain slow due to higher mortgage rates, there are 7M more people working compared to pre-covid. Job gains add to potential housing demand that could be released once mortgage rates fall. Over the past 5 years, the top states are: ID, UT, FL, TX, and SC.

NAR's July 2025 real estate forecast summit provided a midyear update on the economy and housing from Chief Economist Lawrence Yun, Deputy Chief Economist Jessica Lautz, and Economist Anat Nusinovich. Watch the recording: nar.realtor/videos/july-20…